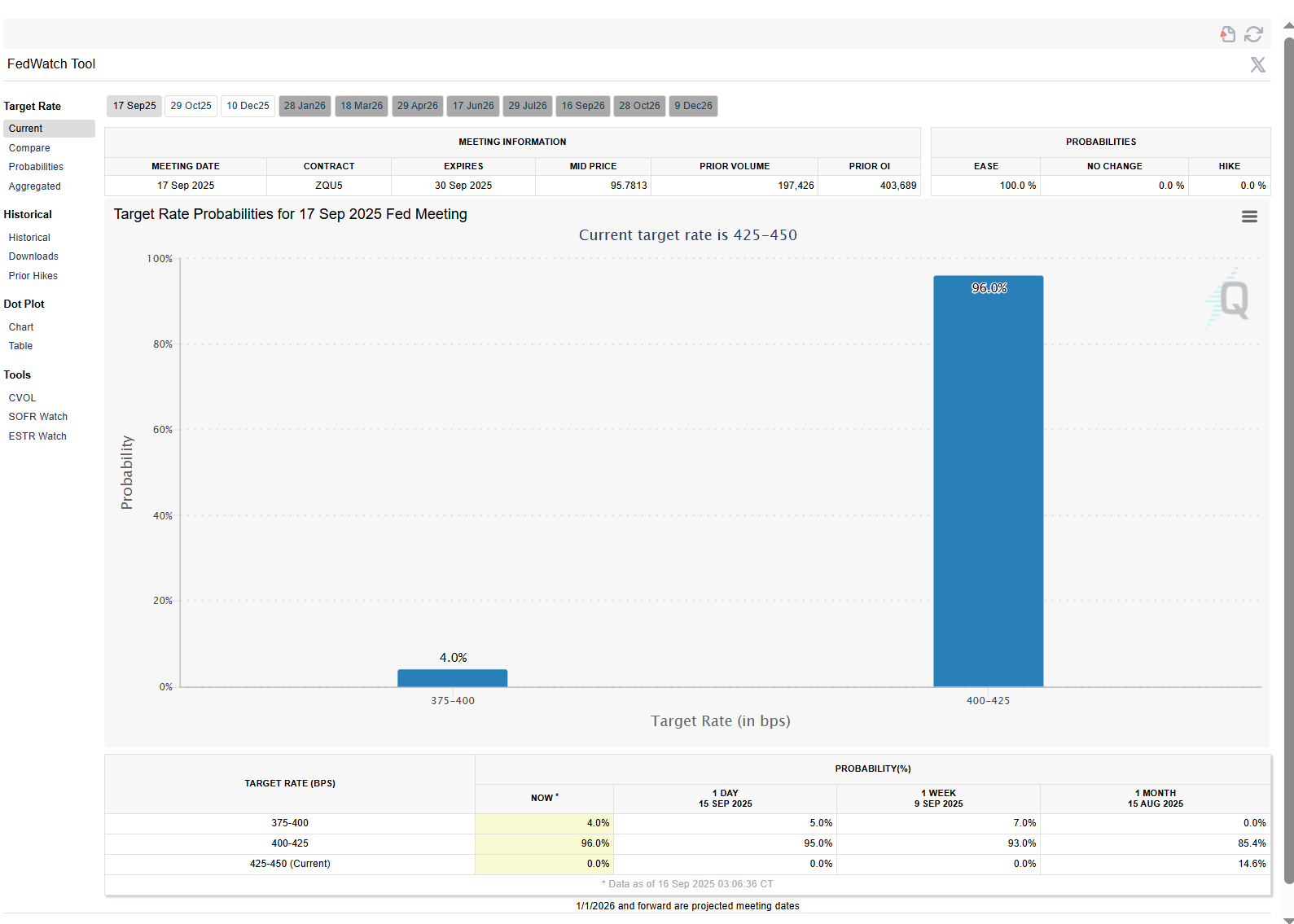

I am of the opinion that rate hikes nuked altcoins. The market believes with 100% confidence that rate reductions are coming.

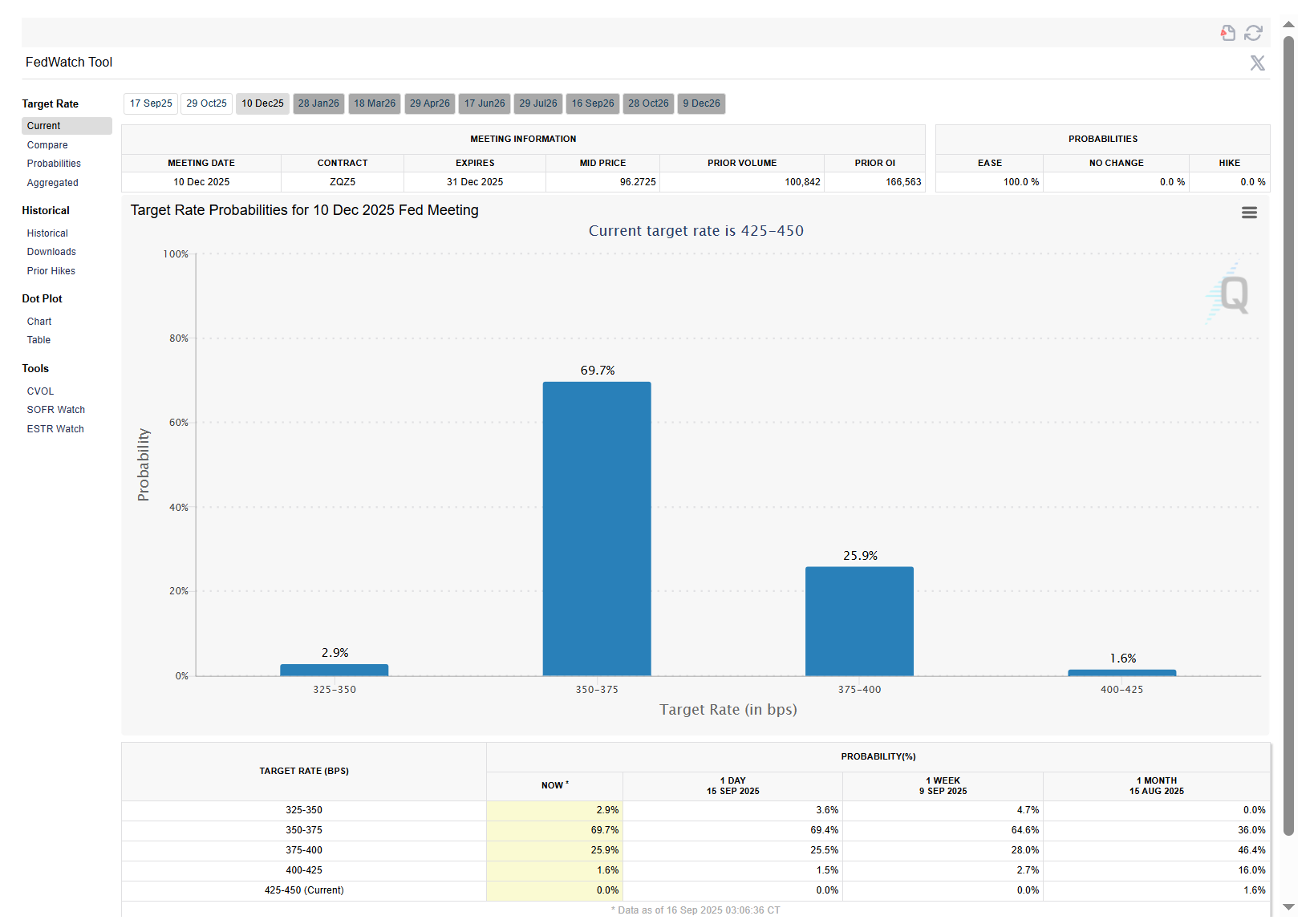

We're not just looking at 1 rate cut though. The market is expecting .75% aka 75 basis points between now and December. By the end of the 2026 the expectation is that rates will be cut by 2%.

It's hard to predict what the centralized fed will do over the next two years, but the market is currently expecting a significant drop.

Why does this matter? Investors have to seek out a return. Investors with large fortunes are probably pretty happy getting 4-5% return on a relatively safe investment like a treasury note. But as that percentage goes down those same investors are less happy and need to figure out a different way to get a return. The higher the interest rate in this country the less they want to invest in other things.

So, when the interest rate falls investors look for returns elsewhere to bring their annual return higher. This is where things like bitcoin come in. BTC is making 100% gains in the year, so even just a 1% allocation can help them achieve their former target. Well 1% of the bond market is a fucking giant number.

So, that's the thesis. I've felt it in my blood that we're doing a full altseason and comeback tour since december of 2023. I didn't think it would take this long, but I think that just means when it finally hits it's going to be bigger.

Anyway, we'll see. Expect volatility, but I'm pretty excited for Q4 of 2025 and pretty much all of 2026.