There is an interesting ongoing experiment in the Hive Blockchain ecosystem.

The LEO token which was previously a layer two token, and incentive token for the Leo Finance/InLeo frontend to Hive, has been reimagined as a revenue share token for the decentralized exchange Leodex

Scarcity of the LEO token is being engineered by a complimentary project that has branded itself as LeoStrategy, and roughly emulates Strategy's Bitcoin acquisition model, but with LEO. LeoStrategy has sold two tokens LSTR and SURGE, and used a portion of the proceeds to purchase LEO from the marketplace on Hive.

LEO still served as a incentive token for the InLeo frontend, but in a somewhat reduced capacity. The Leo team capped the supply of the token at 30,000,000 and sent the remainder of the tokens to the Null Account. The current circulating supply of LEO tokens are 29,649,470; the bridging mechanism from Hive LEO to Arbitrum LEO burns approximately 10.5% of the LEO that is transferred in the process. Some market makers for LEO and related tokens (SURGE and LSTR) are given a discounted bridging rate.

The InLeo team uses site revenue to purchase LEO tokens to fund the rewards pool for holders voting with staked LEO (Leo Power).

The LEO token itself now is classified as a native Arbitrum token (aLEO) and the version on Hive is considered wrapped (hLEO) along with wrapped versions of the token on Polygon (pLeo) and BNB (bLeo).

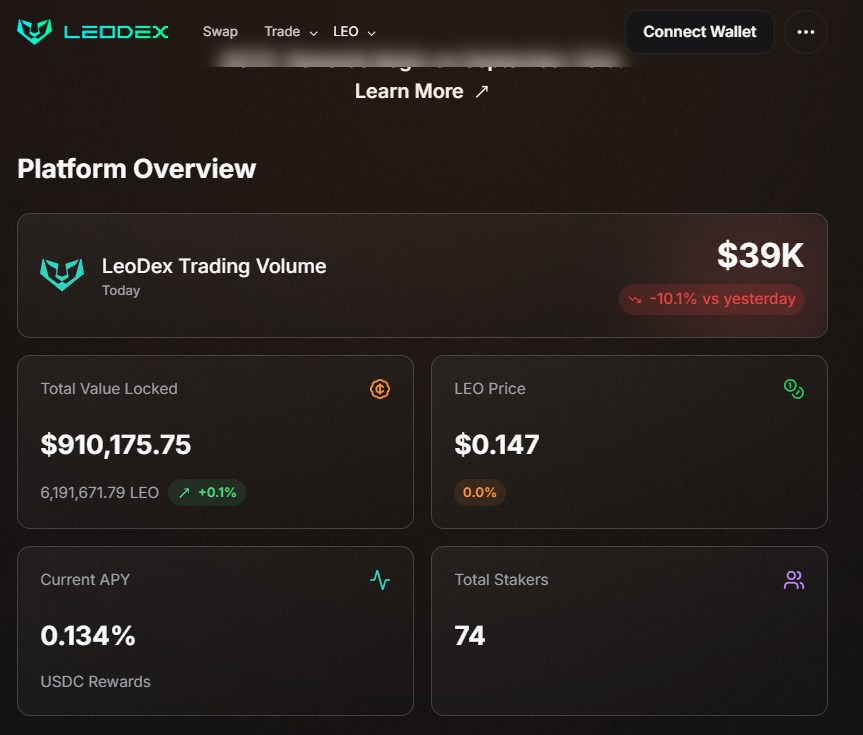

LEO staked on LeoDex is referred to as sLEO, and ~6,191,671 LEO are staked, and the swap fee revenue is split between the stakers. Staked LEO held by LeoDex is referred to as protocol owned liquidity (POL) and the revenue it generates is used to purchase and stake more LEO.

POL is currently 382,617 LEO, or approximately 6.1% of the total LEO staked on LeoDex.

LeoDex is a cross chain swap platform, that functions primarily in the ThorChain/Maya Protocol ecosystem, and leverages perpetual futures trading through Rujira's mechanisms.

LSTR is roughly a share in the LeoStrategy project, though no formal announcement of governance mechanisms or tokenholder rights have been articulated.

On Hive the lstr.alerts account announces when it purchases LEO from the market, and every 24-hours it posts the current balance sheet.

Current circulating LSTR is 100,000 tokens, with a nominal maximum supply of 1,000,000 - as currently configured on the Hive Blockchain. LPS or LEO Per Share of LSTR was reported as 30.56

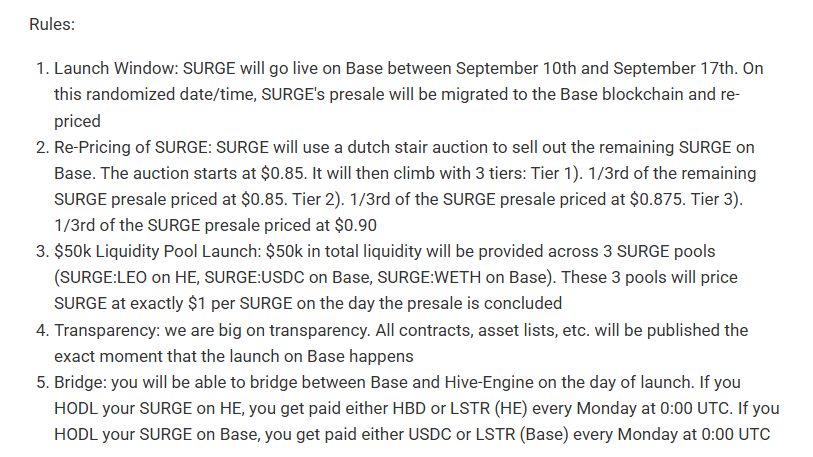

The SURGE token is roughly billed as a perpetual yield token. LeoStrategy offers SURGE holders 15% APY, paid weekly in proportion, at a permanent valuation of $1.00 per SURGE.

500,000 SURGE tokens were placed for sale on the Hive Engine marketplace at a price of 4.0 Hive per SURGE. LeoStrategy is reserving a portion of the presale to fund six (6) months of yield payments, or approximately $37,500. The remainder of the proceeds will be used to purchase Hive from the market. LeoStrategy claims that the LEO purchased from the market will be permanently staked and removed from the market. LeoStrategy is currently the largest staker on the LeoDex exchange.

After the six (6) months of runway, LeoStrategy will need to generate approximately $210 in revenue per day to fund it's yield obligations (assuming no additional SURGE is sold).

LeoStrategy claims that if the protocol is dissolved that shares of SURGE will be redeemable for $1.00 per share.

Currently no liquidity pools existing for open trading of SURGE. In early August of 2025, LeoStrategy announced that liquidity pools for SURGE would go live on Base "between September 10th and 17th." When the self announced window had lapsed, the LeoStrategy account announced liquidity pools would be delayed until LeoStrategy's crosschain market makers were functional.

https://peakd.com/hive-167922/@leostrategy/surge-and-lstr-on-base-the-details-you-need-to-know-966

Swap fee revenue from LeoDex.io appear to be a primary source of revenue for LeoStrategy along with arbitrage bots (market makers) operated by LeoStrategy. Both streams are essentially dependent on awareness of LEO and LeoDex.

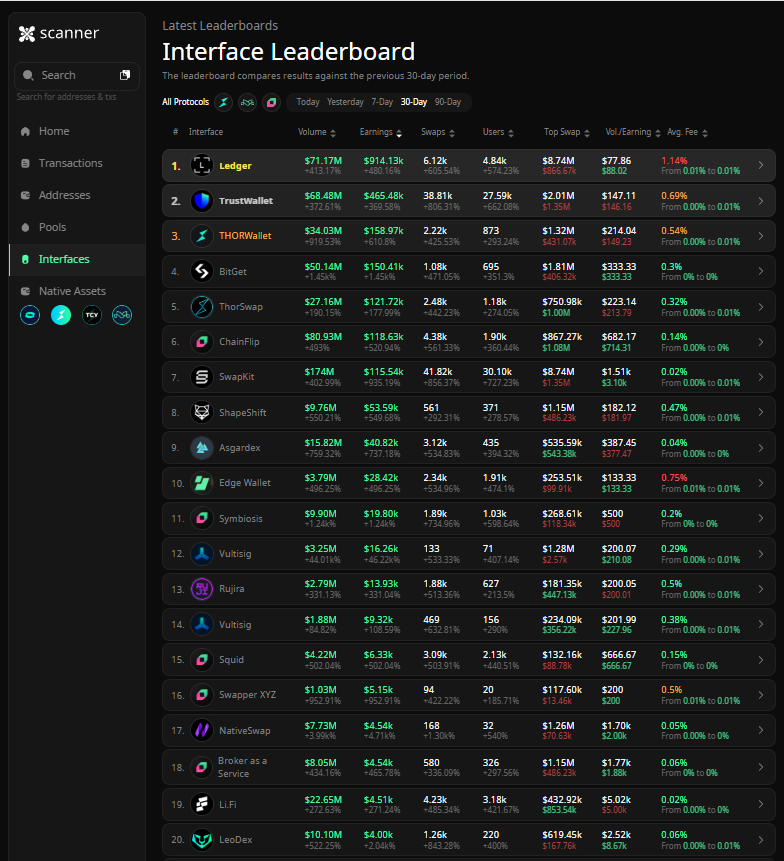

The ThorChain/Maya Protocol ecosystem appears to be competitive with a low fee structure. LeoDex statistics can be viewed on xscanner

https://xscanner.org/interfaces/leo

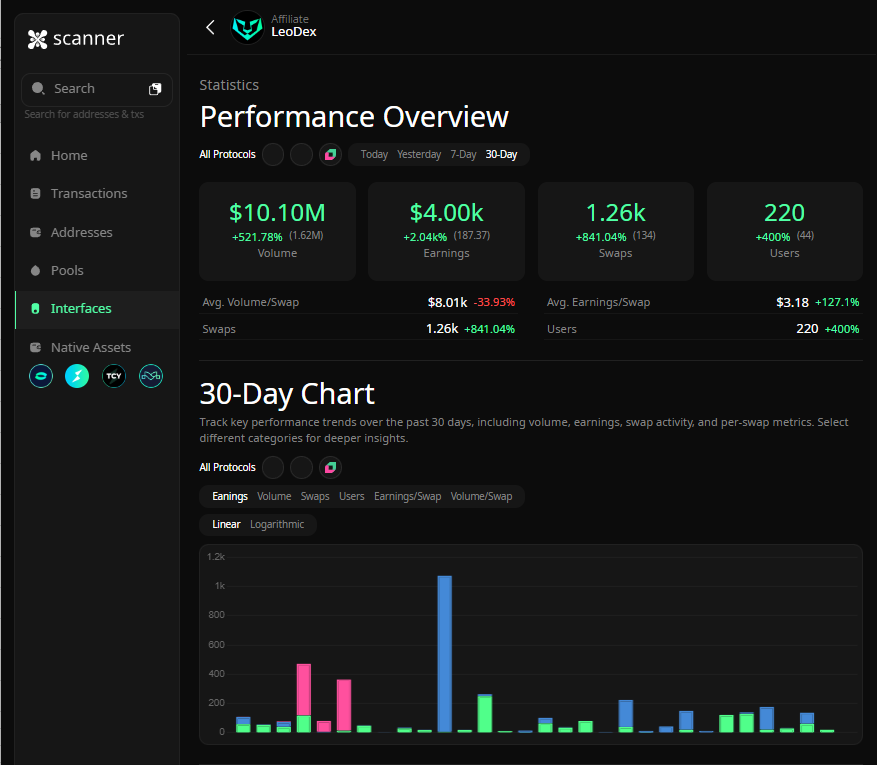

From inspection LeoDex has averaged ~$133 in trading fee revenue per day, over the past 30-days, and ~$112 per day over the past week.

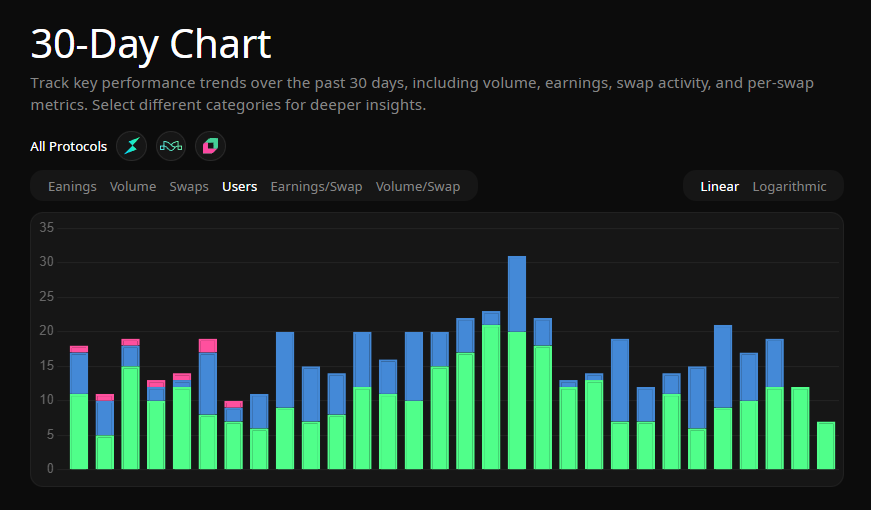

Over the past 30-day period on LeoDex daily unique addresses performing trades have ranged from a low of ~9 to a high of ~31 (from xscanner).

Discoverability seems to be the primary challenge for LeoDex, Leo, and LeoStrategy. In the past 30-days LeoDex is ranked #20 for earnings in the exchanges tracked by xscanner (ThorChain, Maya, Chainflip).

https://xscanner.org/interfaces

LEO token holders and the InLEO platform users seem uncomfortable or reluctant to engage on traditional social media to generate discovery points. Discussion on the InLEO threads may generate rewards for the posters and commenters but is substantially invisible to the wider market for cryptocurrency speculators.