I performed a rather neutral-toned analysis of the potential revenue mechanisms for @leostrategy in response to the question "Where does the yield come from for SURGE".

I make no significant distinction between the Inleo team and LeoStrategy team given the discernible coordination and overlapping ownership of the relevant tokens. @khaleelkazi has identified himself as a "Board Member" of LeoStrategy.

My analysis apparently was interpreted as harsh criticism of Leostrategy, you may access the post and comment chain here: https://peakd.com/hive-167922/@leostrategy/surge-is-the-nextgen-stable-yield-play-9c3#@alohaed/re-senorcoconut-t3b30c

General response, if you have a token project on Hive with replete with a marketing and hype campaign, anyone can and should (if so inclined) discuss it on chain. Your permission or opinion is irrelevant. One of the primary purposes of Hive is to secure a censorship resistant forum for discussion. Freedom is a habit and strengthened by practice. I would absolutely respect your respective right to down vote that content.

The hype around the tokens, is approaching 2021 DeFi levels of hype, and virtually every prediction or estimate of the value of the associated tokens is "up only". When hype is at a fever pitch, it is likely time to engage in some sober analysis.

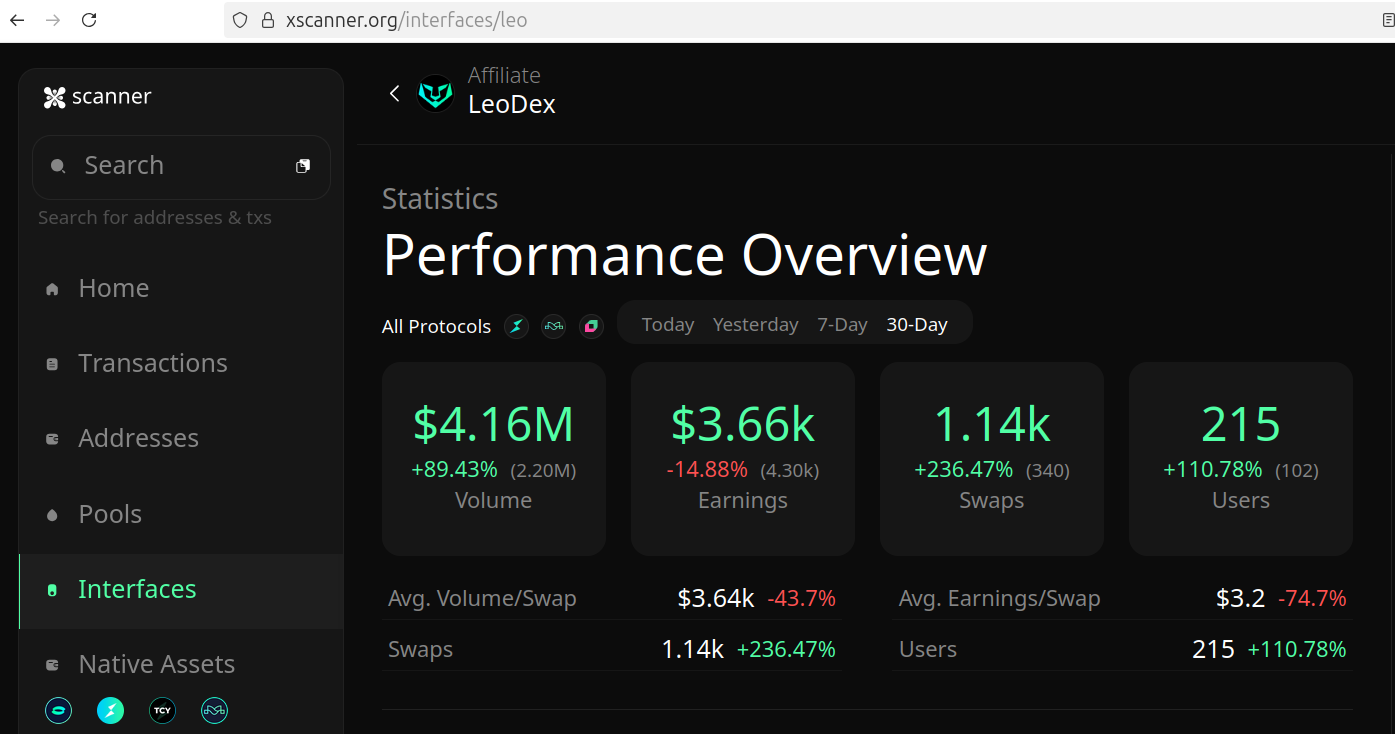

The general premise of LeoStrategy, does have some merits. With LEO now essentially a revenue share token on LeoDex, it has some clear utility. The caveat is that LeoDex is now one of many competitors in the Thorchain/Maya crosschain swap ecosystem. From the available data LeoDex has generated ~$3,600 in earnings from its swap fees. That amount may increase if perpetual futures trading increase platform revenue. It is unclear if the Thorchain ecosystem itself is capable of generating a substantial increase in usage. Leostrategy is a substantial staker of LEO on the LeoDex platform and thus captures a substantial portion of swap fees. It's clear that those swap fees will have to grow substantially to fund the same level of spending on LEO that was generated by the presales of LSTR and SURGE.

In my analysis of the yield source for SURGE, I commented to the person that asked, that at least for the first six months of yield payments, the purchaser is funding their own yield. That is LeoStrategy sequestered a portion of the sales to pay for the yield. There is nothing controversial or disputable about this observation.

The poster responding to me from LeoStrategy concluded "Again, I'd love for you to explain how HP plays any role in this?"

This is relatively simple to answer: 1. LeoStrategy's content is curated with both Hive Power (HP) and Leo Power. 2. LeoStrategy and InLeo related accounts consistently advocate for users to "Feed the SIRP", the SIRP is a mechanism where subscriptions to INLEO premium, and curation revenue is used to purchase LEO with Hive, and distribute it to LEO stakers. LeoStrategy itself identifies the SIRP as an element of achieving its goals.

While it may be an unpopular opinion, given the coordination and synchronized marketing, the distinction between InLeo and LeoStrategy appears to be a polite fiction. I think the project is interesting, and it success likely hinges on driving volume to the LeoDex platform. I also make no apologies for analyzing and commenting on public projects that utilize the Hive Blockchain at least in part.