Every user has a desire to go in that direction where they get more profit. In the same way it is also in the Hive ecosystem. Users always try to earn as much profit as possible. If a user gives value to the platform along with profit then that user is considered more successful. It is absolute that every users desire is to earn from this platform. Its in human nature that they always follow the path where there is more profit.

ArcadeColony is a gaming platform where users can play 4 different games. This project has its own tokens called #Colony and #Script. While staying in the game you can earn from these tokens in the form of staking or rewards.

In the same way you can also earn from these tokens through the liquidity pool. For example, if you put swap.hive:colony or swap.hive:script tokens in the liquidity pool then you will keep getting APR profit on every transaction. I have already given a brief post about this where everything is explained. So I will not discuss more about this topic.

My main topic is whether we can earn more from “Colony” and “Script” through in-game staking or by investing in the liquidity pool? As mentioned above every user wants to earn more profit. So there is nothing wrong in choosing the way that gives the best profit. Also its the right of every user to choose the investment he wants for.

WHAT IS MORE PROFITABLE? INGAME STAKING OR LIQUIDITY POOL?

This is an important question and many users are surely searching for the best answer. Today I will tell according to my knowledge and my own investment experience. I have both of these investments and I am getting APR from both sides.

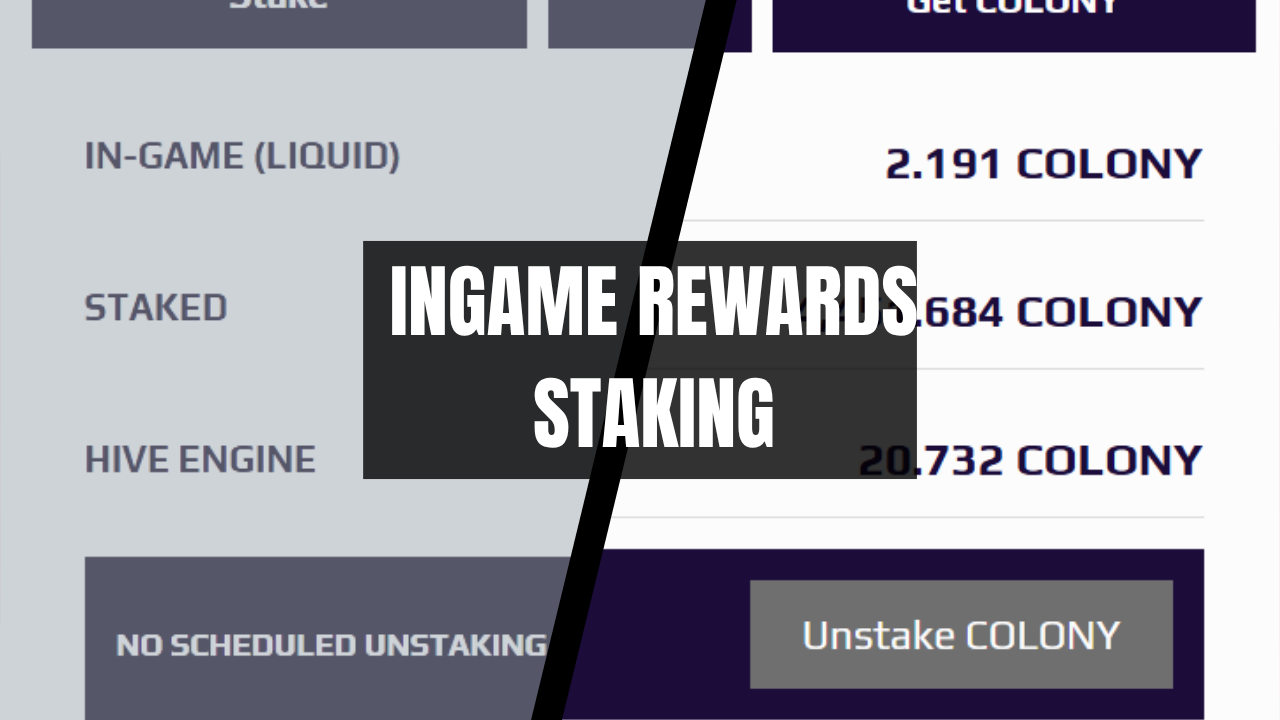

First lets understand in-game staking. In #ArcadeColony you can earn APR profit by staking #Colony and #Script tokens. But here it is not possible to earn only by staking. You also have to play the games. For example by staking the Script token you can generate HOTSAUCE which helps you play games and win #Colony rewards.

In the same way, in the #MoonKarts game you can generate fuel with the help of these two tokens which helps you in the race. On every game win you get rewards. That means if you love gaming then staking here is best for you because by playing games you can win good rewards and increase your APR.

In-game staking has very low risk because there is no danger of impermanent loss. It is easy to manage and gives consistent rewards. But the thing is that the APR here is lower than in the liquidity pool. Another drawback is that your funds stay locked which reduces flexibility.

That means if you regularly play games and keep your tokens staked you can earn up to 10–15% APR, which in my opinion is not bad. Sometimes your APR can increase if you play more games. However it also depends on your initial investment. If you invest more you can play more games and your rewards will also increase.

Now, if I talk about the liquidity pool then the profit rate here is higher. In LP you have to choose a pair like swap.hive:colony or swap.hive:script then create liquidity and your amount will be invested. According to the returns I am seeing till now these pairs give more than 20% APR.

Here your amount is not locked. You can withdraw anytime. The APR here is higher than staking but the risk is also higher. There is a danger of impermanent loss because you have invested by making a pair of two tokens.

Another big benefit in the liquidity pool is that you do not need to work. You just invest, hold and keep earning passive income daily. Your profit keeps changing according to market conditions.

CONCLUSION (STAKING OR LIQUDITY POOL?)

Now let’s come to the conclusion... which opne is more profitable?

If you want steady and safe income then staking is better.

But if you want higher and more volatile income then liquidity pool is better.

MY VIEW

According to my view it is better to invest in both markets. Keep 50% of your amount in in-game staking to get stable yield and invest 50% in the pool for higher APR exposure. By doing this your risk will stay diversified.

I hope you guys will like this post and is interesting as well. If you find it informative then dont forget to give me a support. Share you reviews in the comment section below. Those who will interact will get my 100% upvotes. My staking is increasing. Thank you all for your time reading the content.

TWITTER TELEGRAM HIVE WHATSAPP DISCORD

IMAGES AND GIF TAKEN FROM CANVA, EDITED IN CANVA 1 2

REMEMBER: We should prepare for the unexpected and hope for the best. Life may not be easy, but you must do your best and leave the rest to God.

Posted Using INLEO