Cost of a Home!

I was having a discussion with a couple of folks yesterday about housing market at various places. This is a highly complicated discussion even within various parts of the United States, let alone in other parts of the world. I don't consider myself an expert in real estate in any meaningful way, but I do own my primary residence, and also own multiple rental rental properties over 20+ years. I bought my first home when I was in graduate school with a graduate student salary (and mostly Apple stock to be honest!). Anyways, I digress.

When I decided to lookup national data, I was a bit shocked. I have been taught the 28/36 rule a while back, and I am glad to see that people still use it, but my goodness, US have become completely unaffordable for most people!

The 28/36 rule is a guideline that helps people determine how much they can afford to borrow for a mortgage. It suggests that:

Your total housing costs (including mortgage principal, interest, property taxes, and insurance) should not exceed 28% of your gross monthly income. This is known as the front-end ratio.

Your total debt payments (including housing costs and other debts like car loans and credit card debt) should not exceed 36% of your gross monthly income. This is known as the back-end ratio or debt-to-income ratio (DTI)

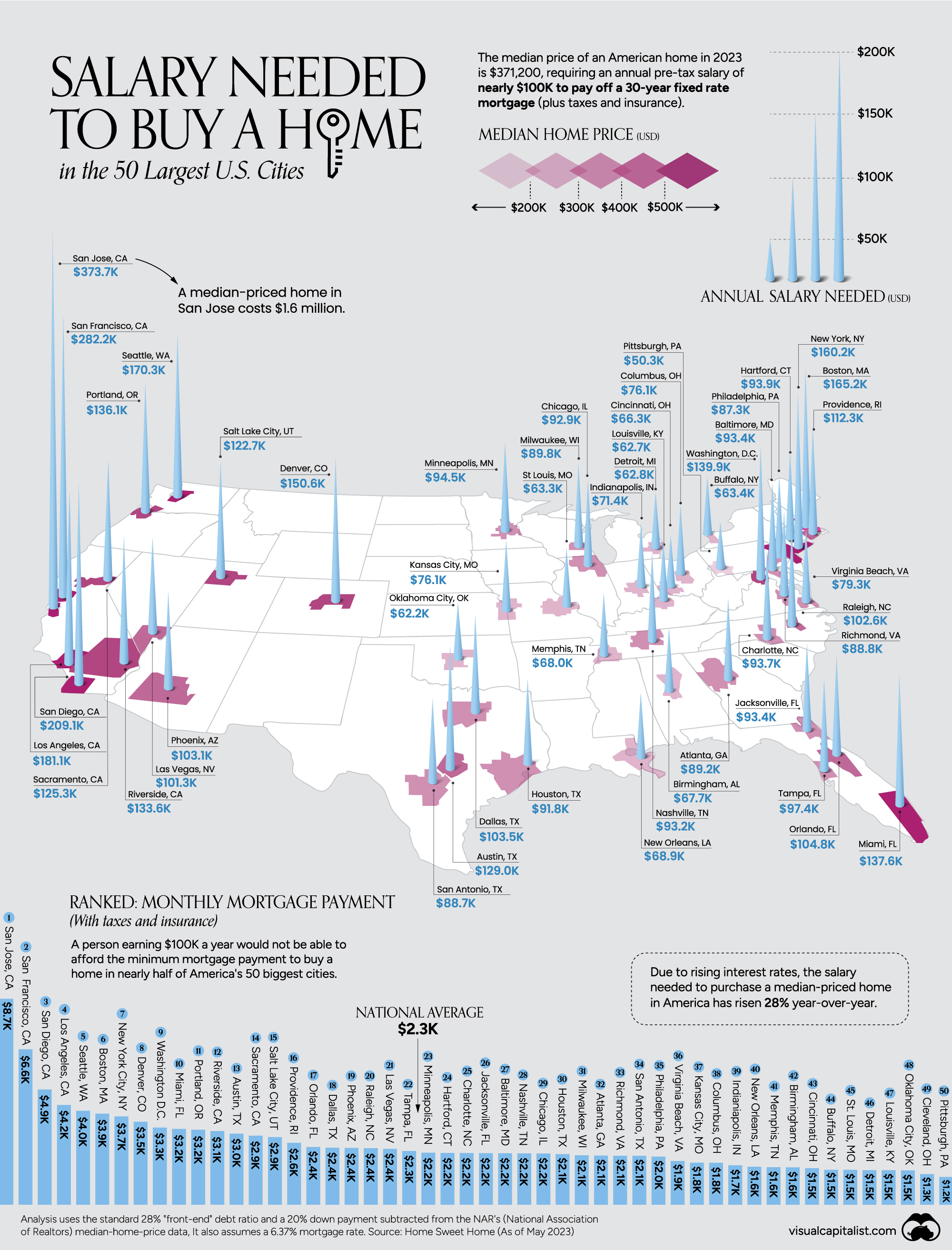

So if we follow the 28/36 rule; and we know the median single family home price (public data) at various cities (I am mostly considering urban areas in the US), we can calculate how much salary one needs to afford a single family home. The infographic below does a good job in idenfying those.

This data is from 2023, and you can call it a bit dated, but still I think it does give the 'trend' and you can add 5-10% uplift as you see fit in your local area for 2024-25. I like this infographic a lot because you can visually compare different areas of US. Also please be mindful, those salaries are minimum salaries. Chances are if you earn that much in the respective cities, you can't really afford the Median priced home! Why?

Let me give you a real example:

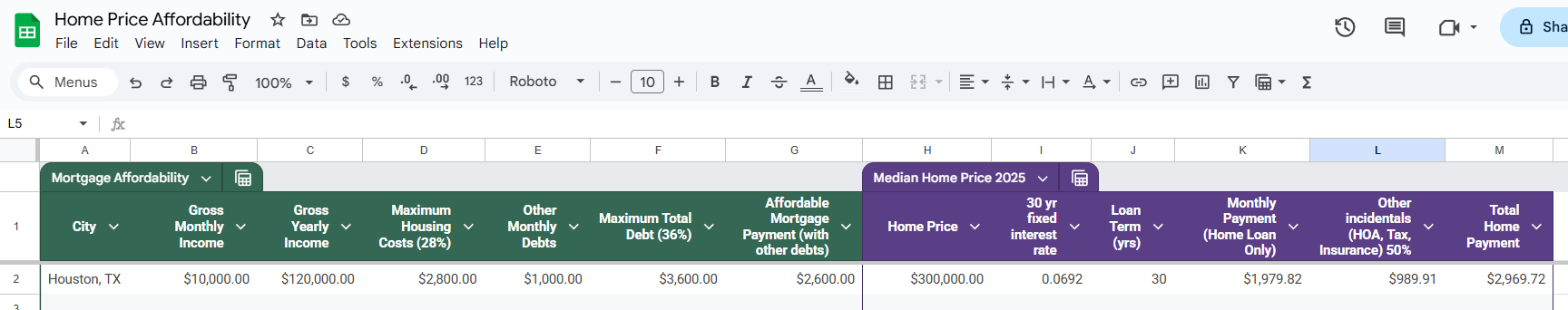

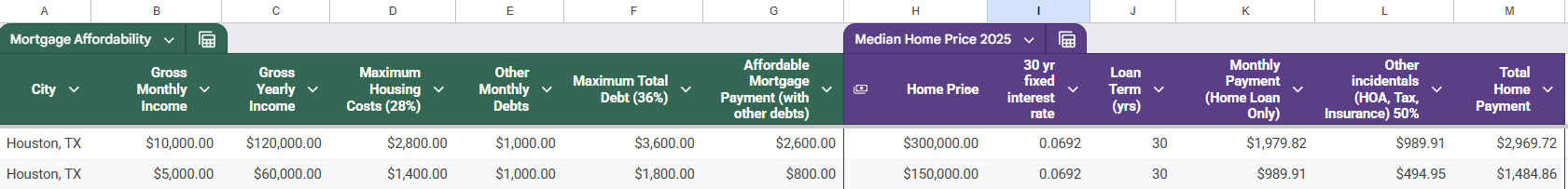

This is a simple google sheet that I made just now.

- Left is the Mortgage affordibility based on salary and 28/36 rule

- Right is the median single family home price today with todays 30 yeat fixed mortgage

So the way to read this table is as follow:

- Lets say you earn $120K in Houston/yr, you can only afford a mortgage payment $2800

- Trouble is to buy a median home, with current interest rate today you pay $2970

- For the record, $120K is much higher than median salary in Houston

- Median salary of Houston is $57K - $63K based on most estimate

So you can only afford half the house!

Something gotta give!

- You look for a less than median price home

- You look for the same home, but somehow manage a cheaper mortgage

- You increase your income or lower other debts

For most people, doing the last two in the short term is very hard, so most people do the first one. They look for a cheaper home. However, that is not easy either. So people typically move to perhaps a less desirable area, a lesser school district, or move to deeper suburbs and commute.

How does the rental work?

Well, once you own a home, you might want to look for a rental property to generate income. Trouble is in high interest rate environment, that is not easy either. Typically in my area, we follow a simple rule of thumb like 28/36 rule.

For a rental to be profitable, it must follow the 1% rule

Meaning, you must be able to rent a single family home for a monthly rent that is 1% of the total price of the home. If you can do that, then the property is cash flow positive on day 1. Trouble is, Houston, which is one of the cheaper market historically, has gotten expensive lately! I blame the migration of tech people from the West! So it is impossible to find a "1% Property" in Houston for ages. I can potentially live with a 0.8% property as well, but then the margins are not good. I rather wait and let the market come down to me. I have been waiting for 8-10 years!

PS. I am posting this on the new financial community. Do check it out!

https://peakd.com/c/hive-180505/created

https://media.giphy.com/media/v1.Y2lkPTc5MGI3NjExaDBldXhqODk4emZrcnNsMWFkZWhwbnc0OHI3OGxjcTdrdnJsc2hzeSZlcD12MV9pbnRlcm5hbF9naWZfYnlfaWQmY3Q9Zw/35pTQFiy14OeA/giphy.gif

https://files.peakd.com/file/peakd-hive/zord189/Zcxlm2md-azircon.gif