Hive History

I have recently learned that it is not very easy to track your hive account growth history. There are no publicly available user friendly tools to do that. Thanks to Marky, and @beaker007 we have discovered and used HAF. The Hive Application Framework (HAF) is a technical component designed to address the challenges of accessing and querying large amounts of historical data on the Hive blockchain.

We have accessed the documentation here: https://mahdiyari.gitlab.io/hafsql/, thanks to @mahdiyari

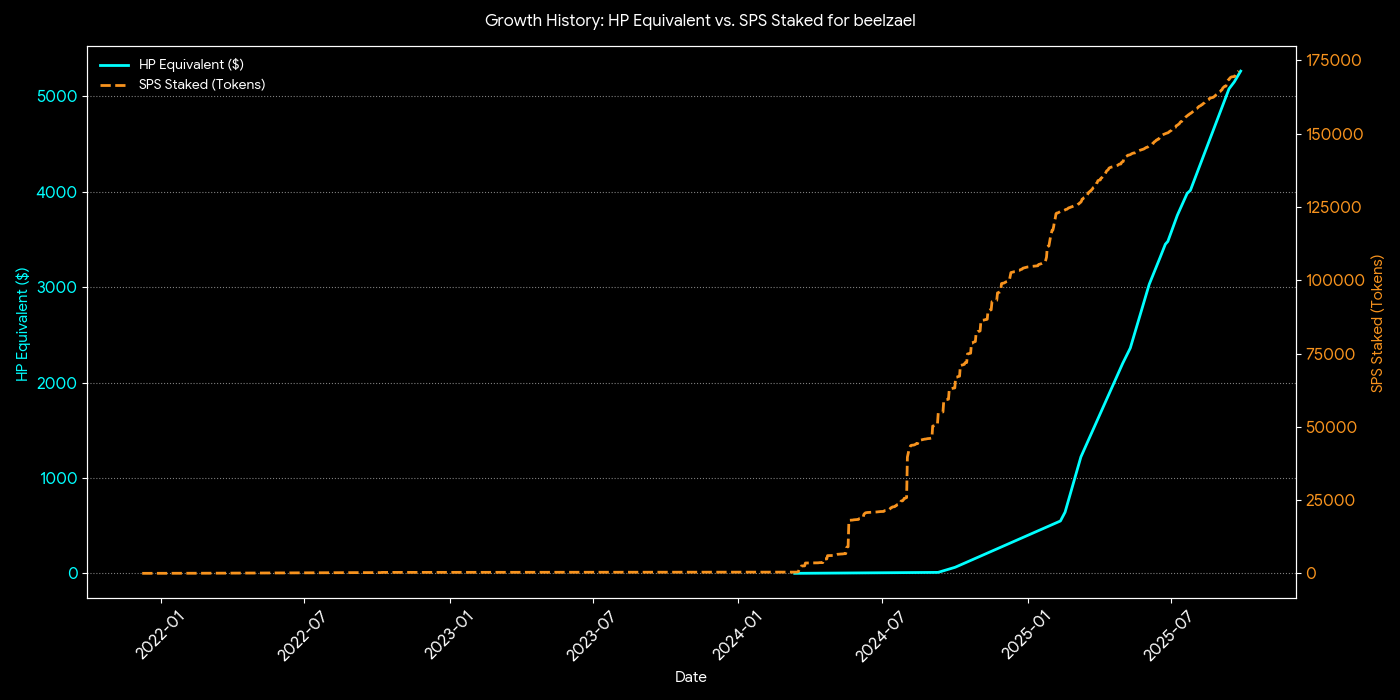

So what I am trying to do with this? In my previous post, I was trying to investigate how a sample group of people grown their SPS stake. I want to know how they have growth their hive stake as well.

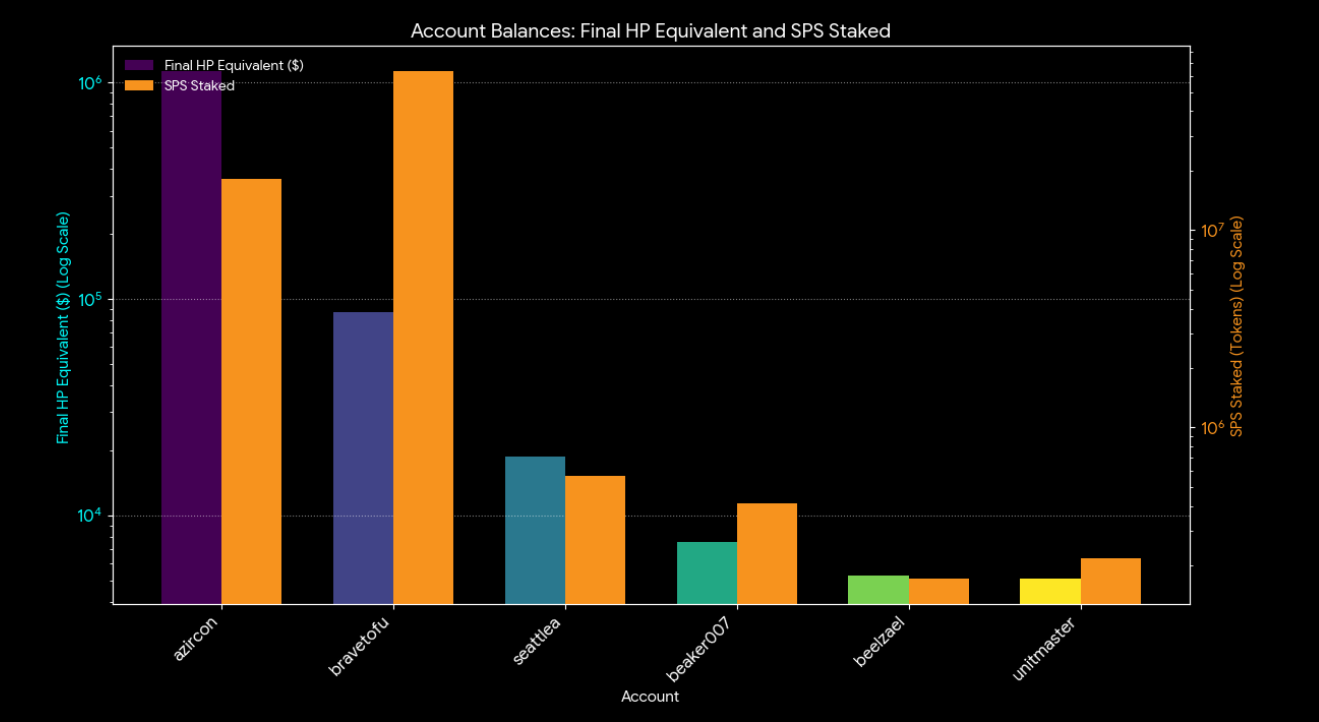

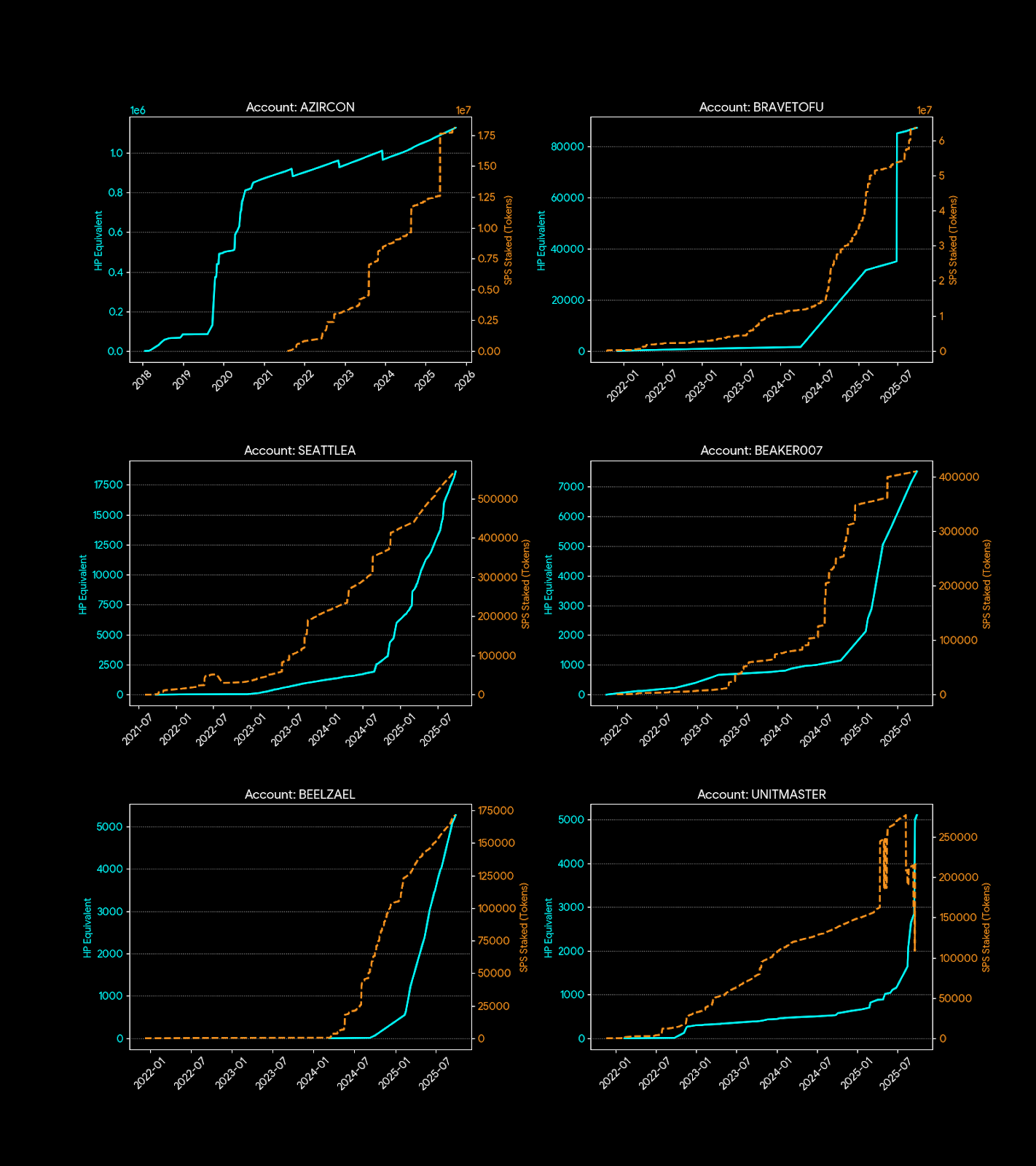

Here are the six accounts in question that I investigated in the last post. Today, I will investigate their hive history of stake. So I colored the SPS stake of these individuals in the same orange color and their current HP in different colors.

Account Balances: HP Equivalent and SPS Staked

| Account | Final HP Equivalent | SPS Staked |

|---|---|---|

| azircon | $\$1,128,124.58$ | $18,114,812.00$ |

| bravetofu | $\$87,347.84$ | $63,654,356.41$ |

| seattlea | $\$18,616.27$ | $569,199.11$ |

| beaker007 | $\$7,506.49$ | $410,219.29$ |

| beelzael | $\$5,265.74$ | $171,377.95$ |

| unitmaster | $\$5,104.15$ | $216,889.69$ |

Whenever, we see and talk about a particular account, the table like above is what we see. This shows their current HP. Now in peakd and hivestats, there is a month or two you can go back and observe how their HP has grown. But I want more. I want see the whole history. That is where HAF helps.

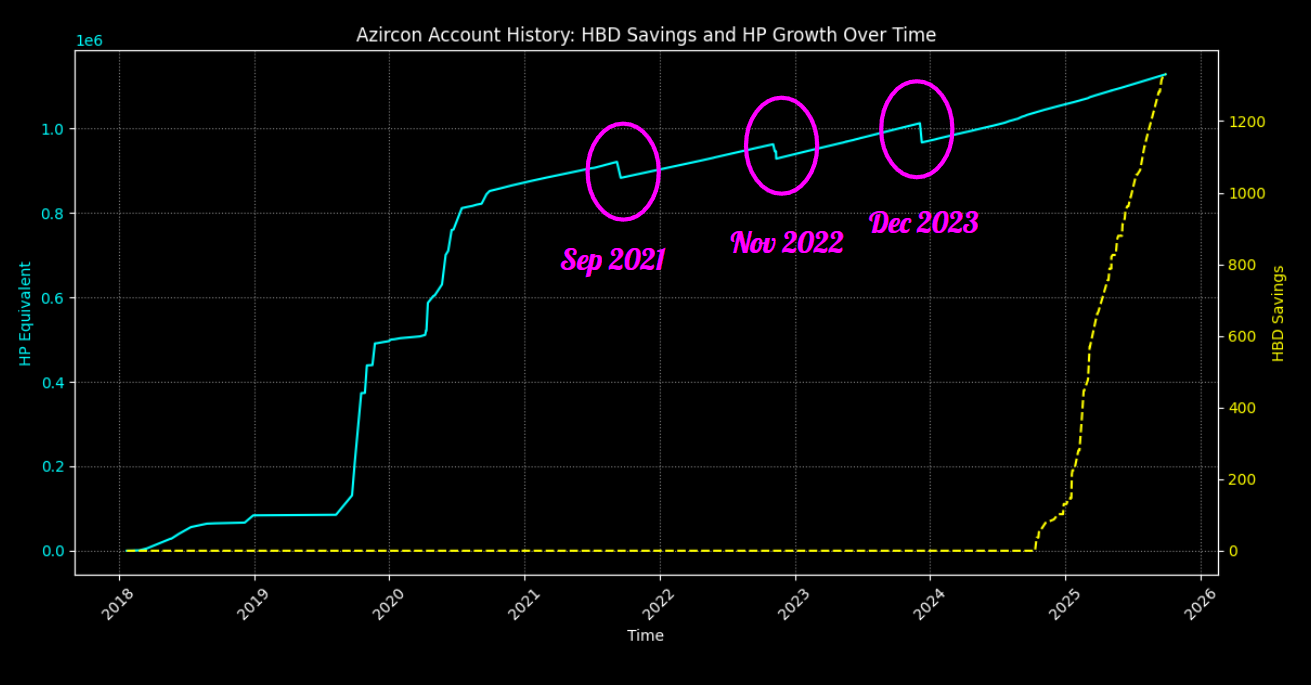

In blue is the HP growth over time for my account. You can clearly see the 3 powerdowns I have done in the past. They are at progressively higher HPs, as hive keeps on giving!. Sep 2021 powerdown was to put Solar Panel on my roof. I wanted to show my wife that hive means something physical, and this money is just not a scam but can actually do something meaningful. In future hive survives or not (it will, I am full confidence), I will have the solar panel on my roof. Nov 2022 was the Riftwatcher sale in Splinterlands, I remember it well, I converted the powerdown hive to Splinterlands cards. Dec 2023 was the Hall of Legends promos, I remember going heavily into them with that powerdown. Even with those powerdown my HP kept on climbing and I am planning to buy some Hive soon. I am expecting VSC DEX will launch soon enough!

Also on note, that I didn't really believed in HDB for a very long time. Even today I have a tiny amount of HBD for the size of account that I have. I believe in it now, and will add to my position as the VSC DEX will get launched.

The Rest of them

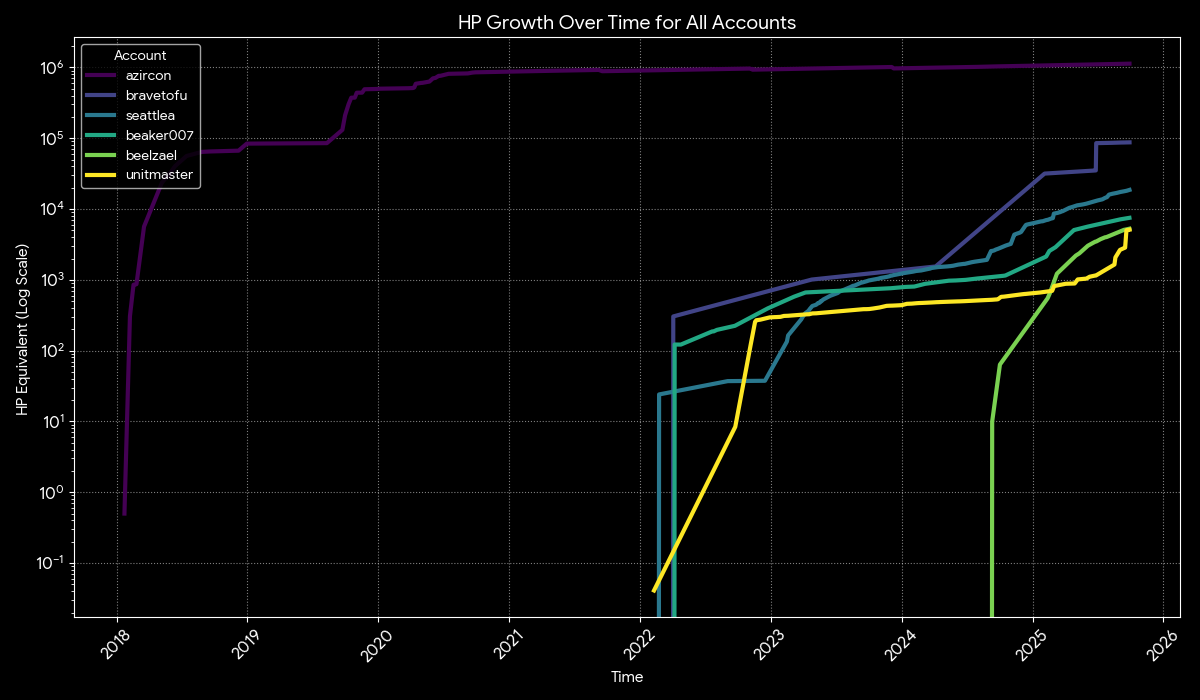

All the sample accounts grown their SPS and staked growing their HP.

A bunch of them started in early 2022, while @beelzael is the latest adaptor, started posting in late 2024. But he is picking up rather quickly.

Based on their staking behavior in Hive Power (HP) and SPS (Splintershards), all six accounts demonstrate a fundamental long-term growth mindset, as staking these assets requires locking up capital (HP takes 13 weeks to power down; SPS has withdrawal/unstaking periods).

The differences lie in the scale, timing, and strategic focus of their commitment, which reveals three distinct growth philosophies.

-

The Strategic Dominators (High-Impact Stakers)

-

The Balanced & Consistent Builders (Methodical Stakers)

-

The Gradual and New Contributors (Developing Stakers)

| Investor Profile | Accounts | Key Mindset & Strategy |

|---|---|---|

| Strategic Dominators | azircon, bravetofu |

- Highly Aggressive & Calculated: Deploys massive capital, often synchronized with market cycles (e.g., 2025 spike). - Dominance Focus: Aims to maximize influence/returns by holding dominant stakes in both core governance (HP) and DApp utility (SPS). |

| Balanced & Consistent Builders | seattlea, beaker007 |

- Disciplined & Methodical: Follows a stable, long-term strategy of consistent reinvestment and linear capital growth since the earliest days (2021). - Ecosystem Balance: Shows sustained, equal commitment to the fundamental health of the Hive chain and the Splinterlands DApp. |

| Gradual and New Contributors | beelzael, unitmaster |

- Developing Conviction: Growth is smaller-scale and often passive (rewards-driven) or shows a conviction that grew later (e.g., HP stake starting in 2023). - Lower Risk Exposure: Belief is present, but capital deployment is measured, cautious, or constrained, showing a willingness to participate without deep financial commitment. |

This is a small sample, and I have good knowledge of all these individual. I used their account as a test case. I need to increase the sample size to see, if more investor profile shows up, or if this subcategories collapses. Stay tuned.

I think there is a lot to learn from people's behavior and long term thinking from charts and plots reflecting their long term investment. Public hive wallet and publicly available historical data let us investigate and research that. It is critical to look at these and reflect. Imagine if we can do it, everyone can do it. Hive provides and will always provide, this is not my prediction, but my expectation.

PS: As I finished writing this post, beaker already delivered!

https://beebalanced.streamlit.app/balance_history_page