Well, You are Mr. Incredible!

Mr. Incredible is a favorite movie around my household (both part 1 and 2). There are several scenes we watch over and over again, and quote often.

Bob Parr: Because I'm formulating, okay! I'm taking in information! I'm processing! I'm doing the math, I'm fixing the boyfriend, and keeping the baby from turning into a flaming monster! How do I do it? By rolling with the punches, baby! I eat thunder and crap lightening, okay? Because I'm Mr. Incredible! Not "Mr. So-So" or "Mr. Mediocre Guy"! Mr. Incredible! [Violet and Dash are silent for a moment after Bob's rant]

Violet Parr: We should call Lucius. Bob Parr: No, I can handle it! There's no way I'm gonna... [yells] Bob Parr: [Jack-Jack goes flying through the walls, catapulting himself towards the pool in the backyard, and Bob runs after him to catch him] Violet Parr: I'm calling Lucius.

That is one of my favorite segment from the movie Incredibles Part II.

Because I'm Mr. Incredible! Not "Mr. So-So" or "Mr. Mediocre Guy"! Mr. Incredible!

Mind you Mr. Incredible is a superhero, and yet, he is struggling with his average parenting identity! I think he is a great dad! But very average, just like me. So why does it hurt to be an average dad?

Why does it hurt if your portfolio returns are market average?

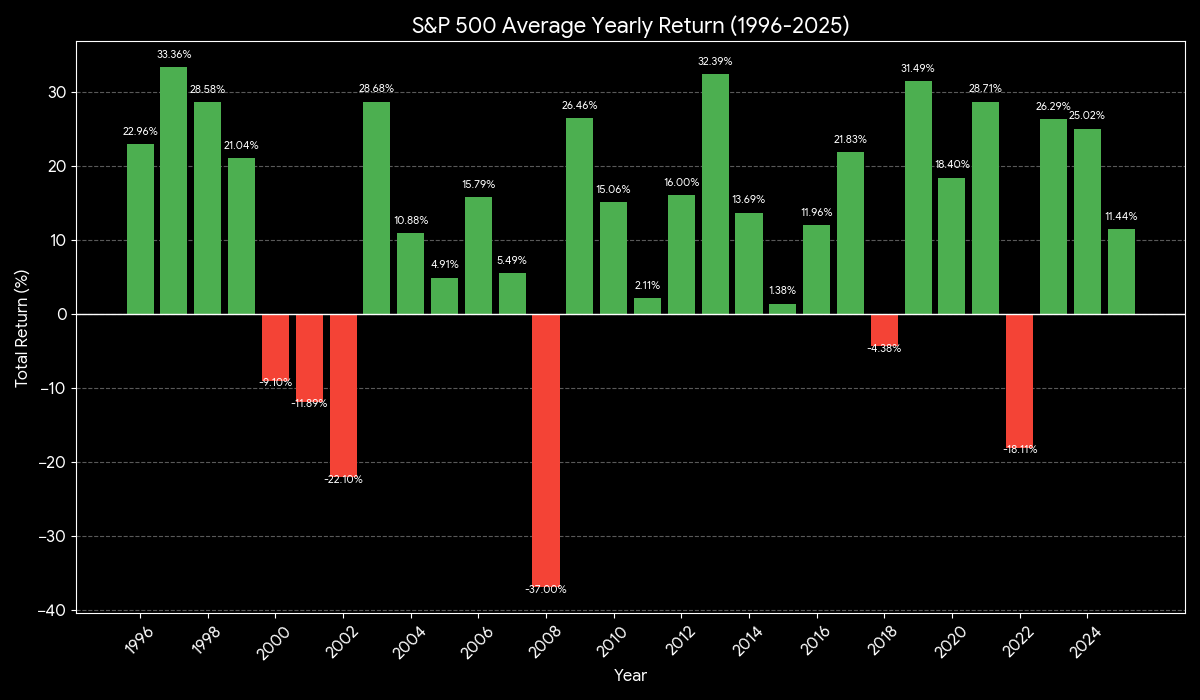

Notice, out of 30 years, there are only 6 years of negative returns. Worst being 37% during the financial crisis, but it was followed by 9 straight years of positive returns.

Over the last 30 years, the average annual return of the S&P 500 has been approximately:

Nominal (including dividends): 10.985% Adjusted for inflation: 8.262%

Wow! 30 year! That is a typically a very long and full working life, right? Just starting with $500 and investing $500 per month compounded while investing total in S&P 500 gives you $1,027,330! Yes, that is the power of compounding. Yes, it did have two of the largest bear markets in the history of modern stock market.

Yet we are not satisfied. We are always looking for the next big thing, to outperform the market..............and failing mostly!

https://www.youtube.com/watch?v=Oommijue01E&t=40s

Here is that clip!

Cultural Narratives of Exceptionalism

From a very young age, we are often surrounded by stories of extraordinary people—geniuses, heroes, disruptors. Media, education, and even corporate culture often glorify being "the best" or "above average." This creates a subtle pressure: if you're not exceptional, you are invisible. Especially if you grow up in SE Asia, China etc, you are told constantly that nobody remembers the second best! The word Tiger Mom didn't just came out of thin air, and also it is not just Chinese, I have seen plenty of tiger moms in India.

Somewhere along the line we have forgotten that being an average dad, an average student, an average investor, an average cook ........... none of these are a 'bad' thing. It is in fact a normal thing.

Social Comparison

We constantly compare ourselves to others, especially in the age of social media, where people showcase their highlights. Internet is full of YouTube videos with 1000% ROI on some hot stock or some secret coin! Have you ever wondered:

-

if they are making 1000% on an token or stock, why are they selling their advice on YouTube for a $200 subscription?

-

why they are always % return? 1000% of what exactly? $1? Why not a dollar amount with dates and time stamps?

You should know the answer. They are fake.

And yet, thousands of people are trapped by these crooks. In fact some our discord servers have these people too. I say always ask them, why are they poor?

Fear of Wasted Potential

Many people feel and want to be exceptional. They think they could be if only they had more time, resources, or motivation. If they had inherited money, or if they bought that good stock at the bottom of the bear market where they were writing "its a bloodbath" on discord. Just buying S&P 500 index fund every month seems:

- very boring

- for the losers

They search for better and better ROI and that Perfect High

What do I tell them? I am going to borrow another quote:

"I'm at the stage in life where I stay out of arguments. Even if you say 1+1=5, you're right. Have fun,"

Because:

It’s always easier to sell them some shit than it is to give them the truth