When most people think of blockchain, they think of speculation. I've been thinking that way too for long until recently joining this new blockchain family - INLEO on Hive where money is defined from first principle, crypto is defined from a standpoint of value and real maths are applied to tokenomics.

True that tokens swing wildly in price, fortunes are made and lost overnight, and projects rise and collapse in rapid succession. In a swift turn, I've discovered that blockchain is capable of much more than speculation. It can also deliver predictable, transparent, and sustainable financial instruments. SURGE, connected to the Leostrategy initiative, is a prime example of this - a project that takes the time-tested idea of fixed income and reimagines it on-chain.

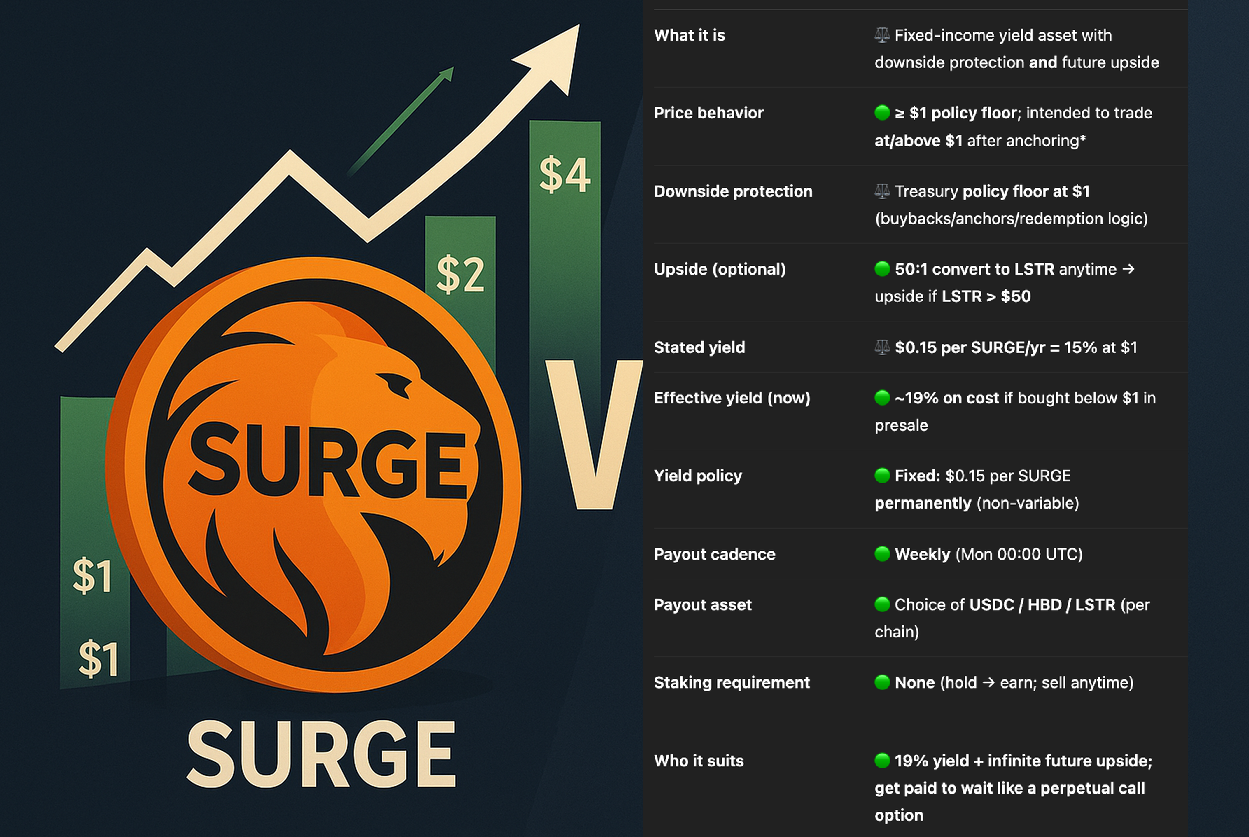

In traditional finance, fixed-income instruments such as bonds are crucial for stability. They provide investors with predictable returns, lower risk, and serve as foundational building blocks for larger economies. DeFi has experimented with yield-bearing products, but many of them are volatile, dependent on governance votes, or linked to unsustainable practices. SURGE steps into this gap with a clear and innovative design, offering a fixed payout of $0.15 per SURGE per year, supported by a treasury policy floor.

This structure alone would make SURGE notable, but its role in the ecosystem goes further. By being tied to Leostrategy, SURGE does not just provide yield; it contributes directly to ecosystem growth. Leostrategy uses proceeds from SURGE and LSTR sales to purchase LEO tokens daily, permanently staking them into the system. This creates a dual benefit for investors and the entire community of LEO. Investors enjoy reliable payouts, and the broader community benefits from a more robust token economy.

The real innovation lies in how SURGE merges the concept of fixed-income stability with the dynamic opportunities of blockchain ecosystems. Holders have the safety of downside protection (via the $1 policy floor) while also having an optional upside linked to LSTR conversions. In effect, SURGE is not just a static income product; it is a hybrid instrument that can participate in future growth without sacrificing its baseline security.

Furthermore, SURGE demonstrates how blockchain projects can solve one of DeFi’s biggest challenges, which is, aligning individual incentives with community sustainability. Too often, yield products drain value from ecosystems rather than adding to them. SURGE flips this model. Every payout and every holder indirectly strengthens the LEO economy, turning personal income into a tool for collective advancement.

This kind of innovation is what will move blockchain finance forward. It is not about creating the flashiest speculative token; it is about designing products that are useful, sustainable, and aligned. SURGE provides weekly payouts, flexible payout options (HBD, USDC, or LSTR), and no staking lockup. It blends user convenience with structural integrity.

SURGE offers a model for how decentralized projects can design financial instruments that mirror and improve upon traditional tools. Imagine a future where entire communities are supported not just by speculative growth but by predictable, community-aligned yield products like SURGE. It is a reminder that blockchain innovation is not only about breaking old systems, but also about rebuilding them in better, fairer, and more transparent ways.

I am buying more SURGE because it feels safer to do so.

I am your Blockchain and Technology Journalist.

DiaryOfABlockchainTourist

Posted Using INLEO