My journey in the LEO economy is long-term. I just love the level and drive of innovation here despite being a young crypto project. This Leostrategy's thread I just read, talking about sLEO Collateralized Lending by Leostrategy, will be a game-changer, further cementing my love for this community.

As a new user, I have been stuck in the dilemma of either staking LEO and delegating to lstr.voter to get daily returns like I presently have or staking LEO on LEODEX as sLEO for USDC rewards. Meanwhile, LSTR and SURGE are so appealing to be held, among many other wealth-building options available. Stumbling upon LeoStrategy’s lending dashboard teaser has left me startled at the future about to be unveiled. To think that the idea about sLEO lending is piloted by the strategy firm makes it more interesting,

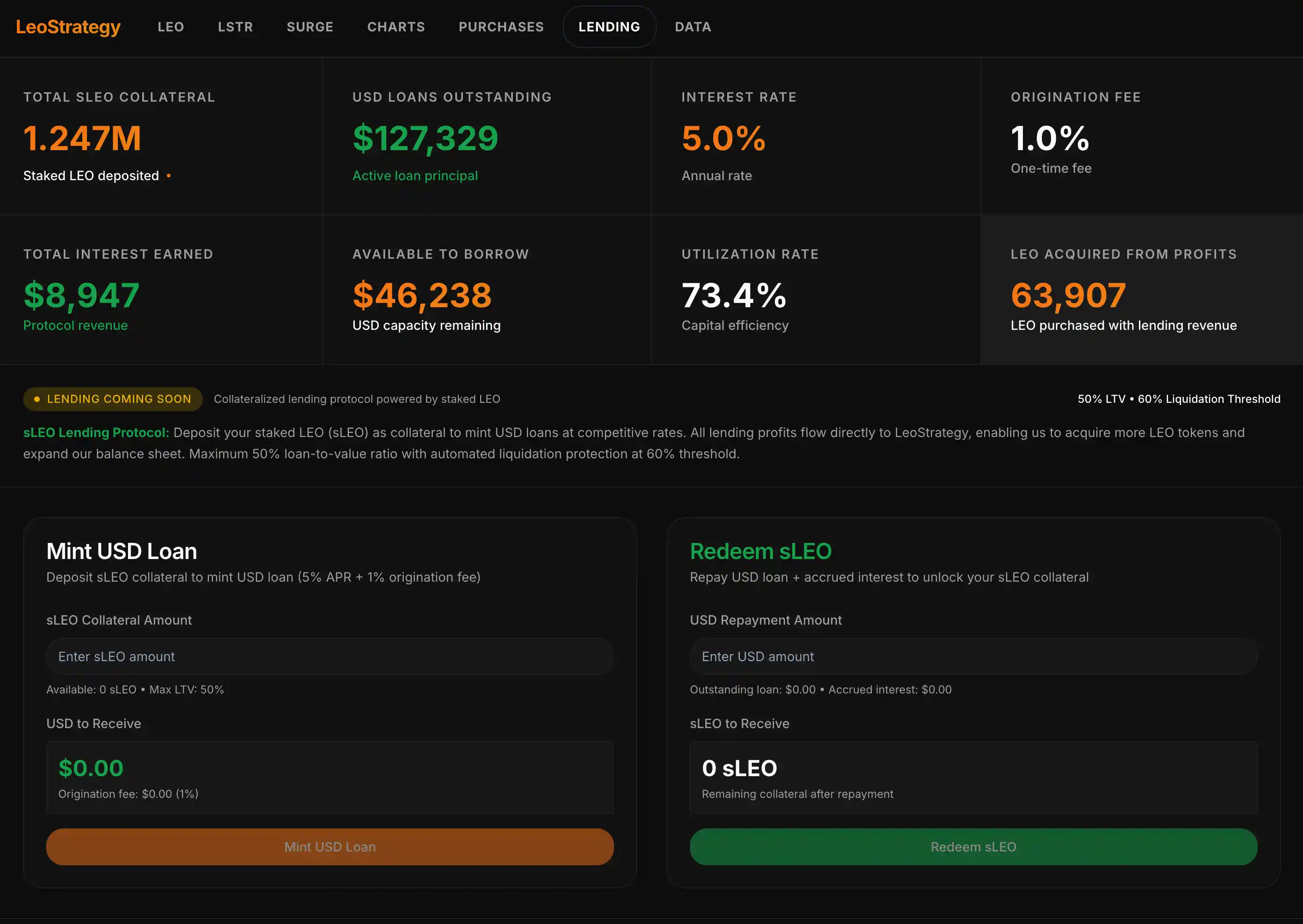

The idea, staking LEO as sLEO, which becomes collateral to mint USDC loans at a low interest rate of 5% as teased in the dashboard. What really caught my attention was not the loans themselves; it was what the protocol does with the interest. Instead of hoarding profits, LeoStrategy recycles them back into the economy by buying more LEO

The lending profits are to flow into Leostrategy to help the company buy more LEO and stake them permanently. This is an interesting and creative way to grow the value of the LEO token and make more users find it interesting, while the strategy can generate more revenue to buy more LEO towards its 10 million target.

This is where the flywheel we once talked about begins to spin in real time. Collateral produces liquidity, liquidity generates revenue, revenue buys more LEO, and more LEO strengthens the base for the next round. In essence, the community’s stake is not just locked; it is working, multiplying, and reinforcing the very ground it stands on.

I find this incredibly refreshing. Most of the financial systems I’ve seen extract value from users. Here, the design is tilted the other way. Profits continuously flow back into the ecosystem to strengthen the asset itself. It is a loop that grows stronger with participation.

The mechanics are straightforward enough: deposit sLEO as collateral, mint a USD loan worth up to 50% of its value, and pay a 5% annual interest plus a 1% origination fee. Repay the loan, and you get your sLEO back. If the market dips and your loan-to-value crosses 60%, the system has safeguards to liquidate to stay healthy. It is the kind of balance between freedom and protection that gives both users and builders confidence.

But beyond the numbers and formulas, what excites me most is what this says about LeoStrategy’s role in the LEO economy. They are not just providing tools; they are laying down the rails for an entire ecosystem where LEO can be more than a token. It becomes money, collateral, and growth capital - all at once.

For me, discovering this as a new participant feels like stepping into a city and suddenly realizing there’s a whole underground metro system running beneath your feet. It is hidden infrastructure, quietly making everything above ground possible.

In LeoStrategy’s world, collateral is no longer just about locking value; it is about unlocking confidence. The vitality of the LEO economy is not in avoiding volatility but in transforming it into momentum. And perhaps, just perhaps, this is what true financial innovation should feel like.

I'm buying more SURGE, LSTR, LEO, and I am in for the long term because value keeps building up.

Image from LeoStrategy's Thread

Image from LeoStrategy's Thread

I am your Blockchain and Technology Journalist.

DiaryOfABlockchainTourist

Posted Using INLEO