The Great Reset, Wuhan, COVID, the Federal Reserve, Bill Gates, cashless society, Dark Winter, even Jeffery Epstein, my thoughts.

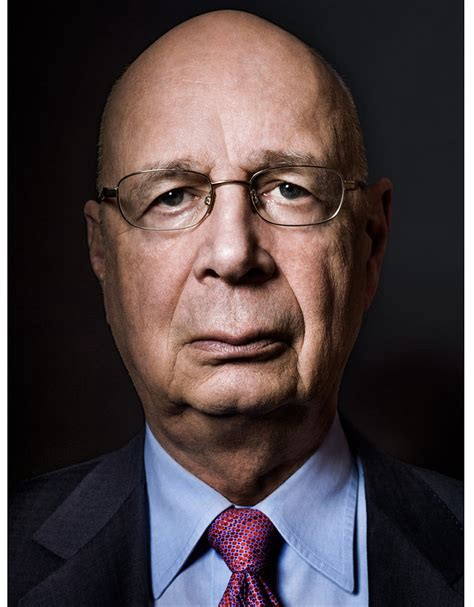

Do you know who this man is? You should.

He is influencing the world in ways you couldn’t even fathom.

He is the architect of the world’s “Great Reset”.

His name is Klaus Schwab.

Klaus Martin Schwab, founder and executive chairman of the World Economic Forum comes from a prestigious background of engineering and economic backgrounds. He has received multiple doctorates in the aforementioned areas of study.

From the years of 1993–1995 Schwab was a member of the United Nations High Level Advisory Board on Sustainable Development and he transitioned into a role from 1996–1998 to Vice Chairman of the UN Committee for Development Planning. As a member of the UN High Level Board for Sustainable Development, Schwab helped develop Agenda 2030, a worldwide plan intended to be a “blueprint to achieve a better and more sustainable future for all.” Sounds lovely.

Schwab has authored books such as the The Fourth Industrial Revolution, Shaping the Fourth Industrial Revolution and COVID 19: The Great Reset. These books hold a common theme of pushing autonomous labor, reorganization of state and individual power, and a trade off of privacy for convenience and social cohesion.

The Fourth Industrial Revolution, written in 2016 is an aptly timed response for the ruling class to transition into the next world of centralized industry, privacy intrusions, erosion of civil liberties and a complete reorganization of global politics through environmental, political, and economic means. This transition is necessary in response to the decaying dollar standard world economy, with more centralization in personal data collection and an ability to transition to AI run economies.

A few notable excerpts from Klaus Schwab’s latest book COVID19: The Great Reset include:

“Acute crises contribute to boosting the power of the state. It’s always been the case and there is no reason why it should be different with the Covid-19 pandemic.” (p.89)

“The Covid-19 pandemic has made government important again. Not just powerful again, but also vital again[…]” (p.89, the author quoting John Micklethwait)

“For the first time […] governments have the upper hand. […] Rather than simply fixing market failures when they arise, they should, as suggested by the economist Mariana Mazzucato: ‘move towards actively shaping and creating markets that deliver sustainable and inclusive growth.’ “ (p.92)

“While in the past the US was always the first to arrive with aid where assistance was needed, this role now belongs to China” (p. 123)

“The containment of the coronavirus pandemic will necessitate a global surveillance network” (p.33)

“We will see how contact tracing has an unequalled capacity and a quasi.-essential place in the armoury needed to combat Covid-19, while at the same time being positioned to become an enabler of mass surveillance.” (p.153)

any digital experience that we have can be turned into a “product” destined to monitor and anticipate our behaviour.” (p.166)

“The possibilities for change and the resulting new order are now unlimited and only bound to our imagination” and “We should take advantage of this unprecedented opportunity to reimagine our world” (p.19)

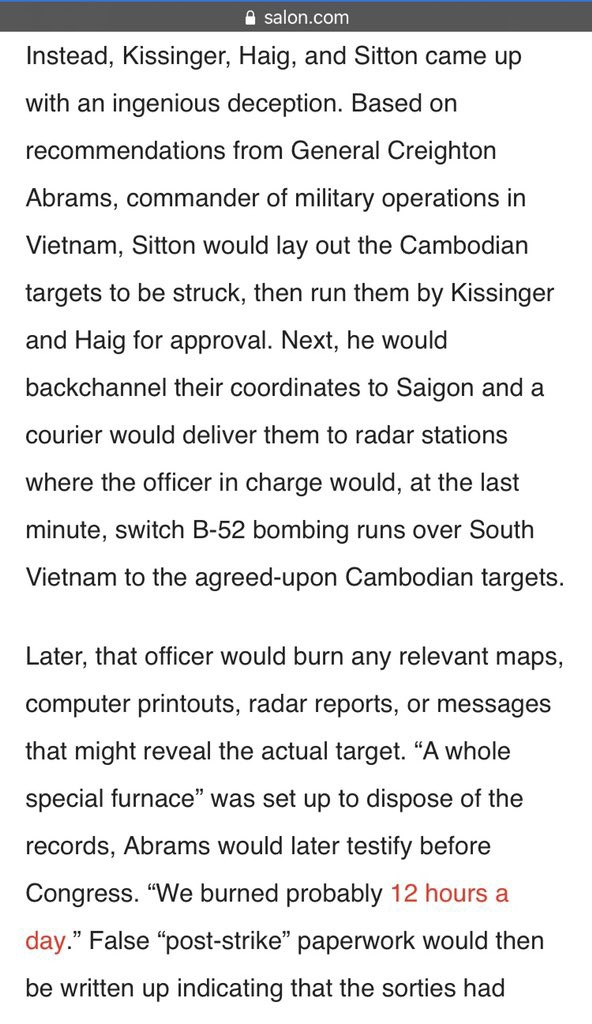

Henry Kissinger, renowned war criminal, is a repeat guest with Klaus Schwab at the World Economic Forum’s annual meeting Davos.

https://www.salon.com/2015/11/10/henry_kissingers_genocidal_legacy_partner/

During the Vietnam War, Kissinger was instrumental in a secretive, deceptive bombing campaign of Cambodia, Laos and Vietnam.

Schwab describes the framework of creation for a “New World Order” and gives thanks to Kissinger for “50 year long mentorship and all the advice you have given me.”

https://twitter.com/i/status/1343249127166115842

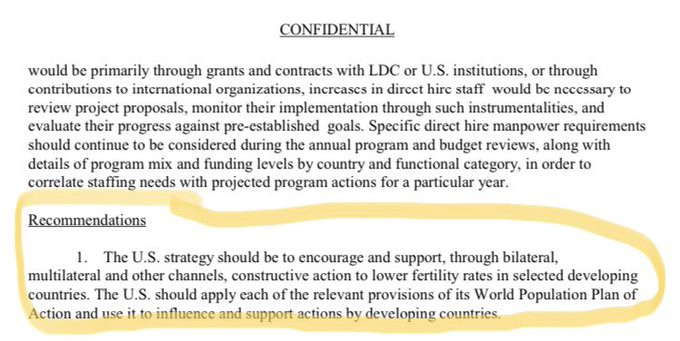

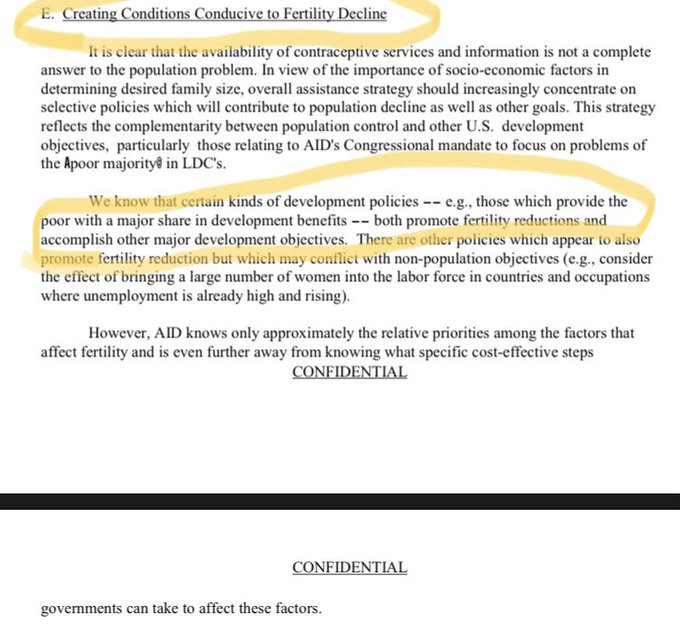

46 years ago “The Kissinger Report” was released by USAID (US Agency for International Development), this report was focused on curbing population growth and “Creating Conditions Conducive to Fertility Decline”.

https://pdf.usaid.gov/pdf_docs/PCAAB500.pdf

https://pdf.usaid.gov/pdf_docs/PCAAB500.pdf

https://pdf.usaid.gov/pdf_docs/PCAAB500.pdf

Kissinger was instrumental in the deaths of hundreds of thousands of civilians through his hand in Operation Menu and Operation Freedom Deal, the two bombing campaigns of Cambodia, Vietnam and Laos. He has advocated for fertility decline and has been a mentor to Klaus Schwab for a period of 50 years. The World Economic Forum was founded by Schwab 49 years ago in Januray of 1971.

Time to look at the economic implications of COVID19.

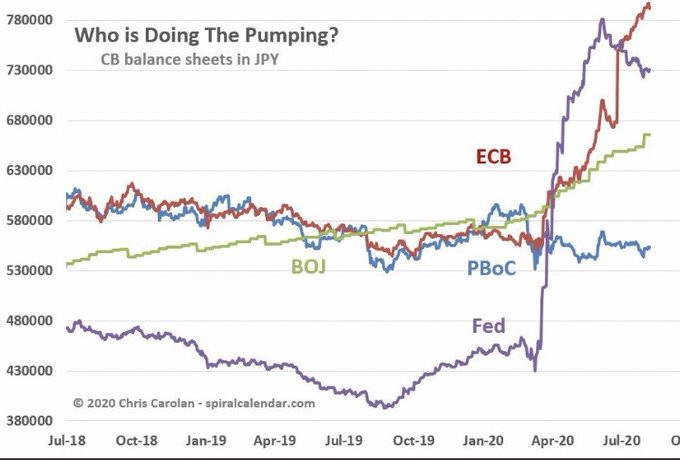

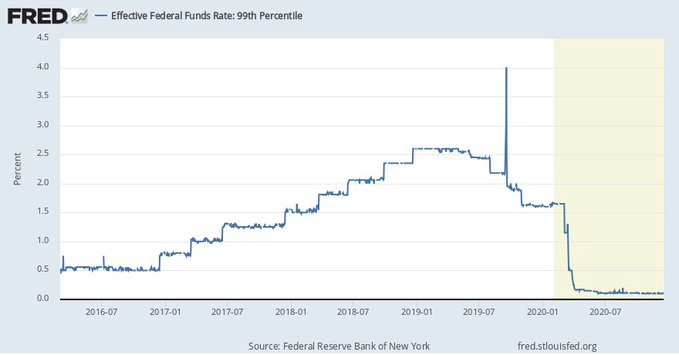

The Great Reset is happening at a time when the monetary policy of the central banks around the world have surpassed unsustainable levels. The level of debt that has been added to the world via money printing has been astronomical, while maintaining zero or even negative interest rates. The economic powers know and see this, a controlled reset is necessary for the power structure to be maintained. A debt jubilee or a complete monetization of all debt is the most likely outcome. It’s not just America, central banks around the world are printing and printing and printing, while interest rates are bottomed out at zero.

The level of wealth transfer from small businesses to major corporations has been staggering since the COVID lockdowns have begun. It has been a two fronted attack on the shuttering of small businesses and the complete backstop of corporate debt.

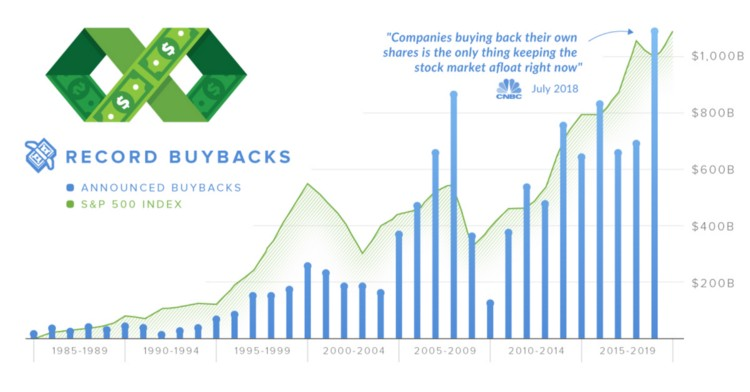

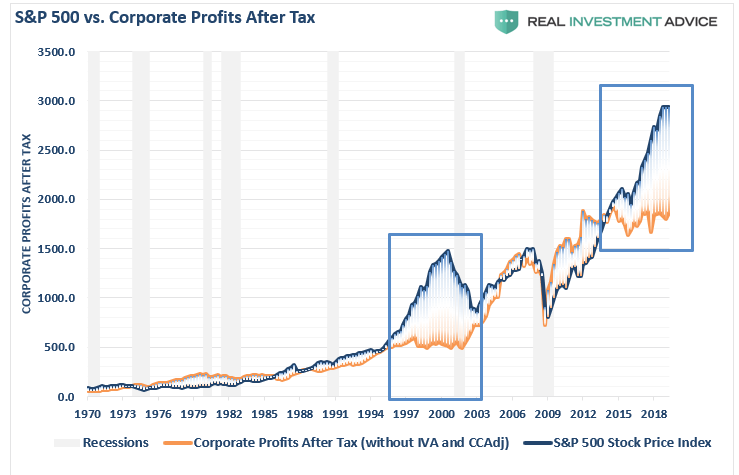

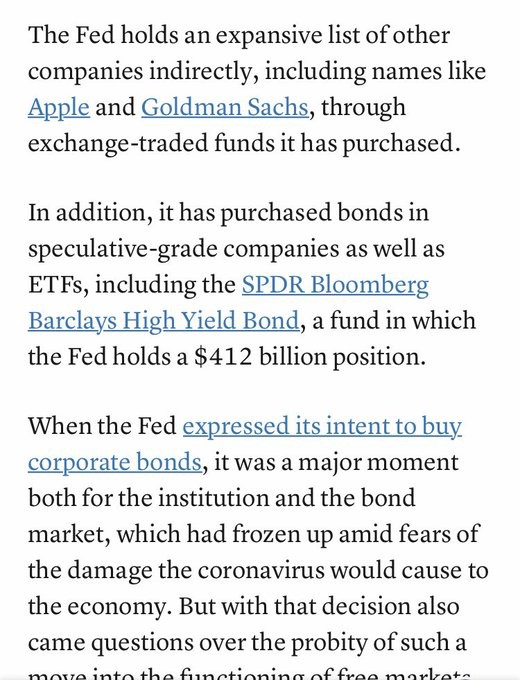

The Fed has printed dollars into existence out of nothing, using it to buy corporate bonds of some of the largest companies. The debt being bought by the fed often is the same money that was borrowed in the last 9 years of near zero % interest rates and used to buy back stock, enriching the shareholders. These shareholders are enriched by the low interest rate debt used to buy free floating stock, these profits are not driven by fundamentals, just debt.

How did this wealth transfer happen? It was by printing money. The oldest most reliable play in the fed’s playbook. But how much did it print? 35% of all dollars in existence as of this December 2020, were created since January 1st. 35% PERCENT. Below is Federal Reserve chairman, Jerome Powell.

https://twitter.com/i/status/1341079733933645830

But that 35% is denominated in dollars, not even printed pieces of paper, but just numbers typed on a computer.

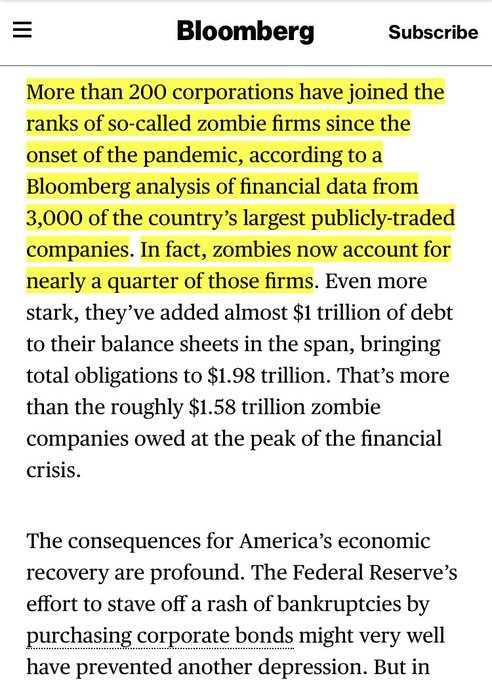

These digitally printed dollars flow into the economy by way of the stock market. The newly minted dollars are used to service zombie corporations, companies that can’t even pay there monthly debt payments. These companies now comprise 527 of the 3000 companies in the Russell 3000, an index of the 3000 largest publicly traded companies in America, which composes 98% of US companies that are publicly traded.

The gut reaction to this economic environment is of assistance to job creating corporations to assist them in staying in business and preserving jobs. But as with most governmental programs the result is wildly different than the original intention.

By continuously injecting debt fueled monetary stimulus into these zombie companies we are “kicking the can down the road” to a constantly growing day of economic reckoning. These centralized actions also entrench the corporate class in power by not allowing failing corporations to declare bankruptcy and allow productive assets to live on and unproductive assets to be restructured.

Apple, not a zombie corporation by any means, but they still received federal reserve support in the form of debt buying. The third most valuable company on planet earth, behind Saudi Aramco and Microsoft.

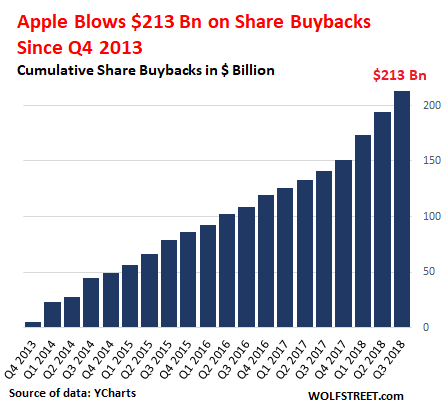

Apple has $192.8 billion in free cash on their companies balance sheet, and between 2013 and 2018 has spent $213 billion on stock buybacks, which enriches shareholders, specifically hedge funds and Warren Buffet, who’s Berkshire Hathaway owns 5.45% of Apple.

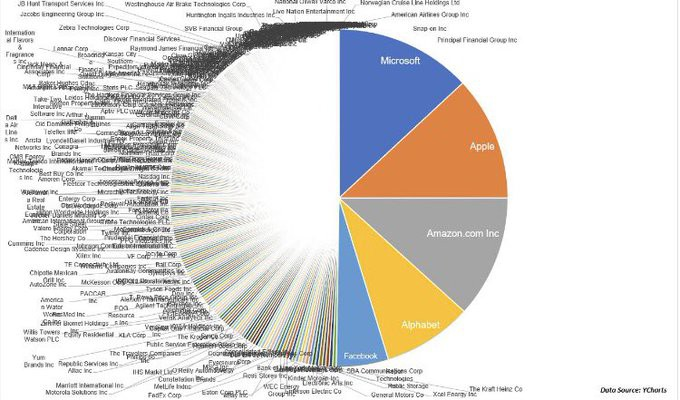

But the federal reserve has bought $25.5 million of Apple’s corporate debt. Which seems minuscule, but the “backstopping” of their debt, and the implication of doing it more if necessary, is more valuable than the $25.5 million of federal reserve paper dollars which was printed out of thin air and essentially given to the company. The concentration of the tech sector of the overall SP500 has reached levels of utter by dominance by the tech behemoths.

Such concentration leads to fragility of the overall market. Forcing the Federal Reserve to provide massive liquidity injections into the riskiest of markets.

CNBC

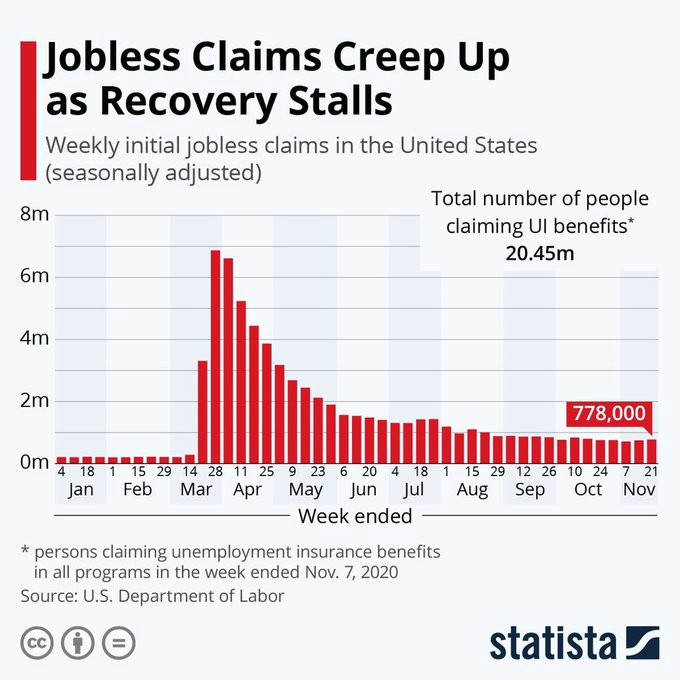

This is all the while small businesses are failing in beyond record breaking numbers. But weren’t there programs to help these failing small businesses? Weren’t the programs put in place to maintain jobs?

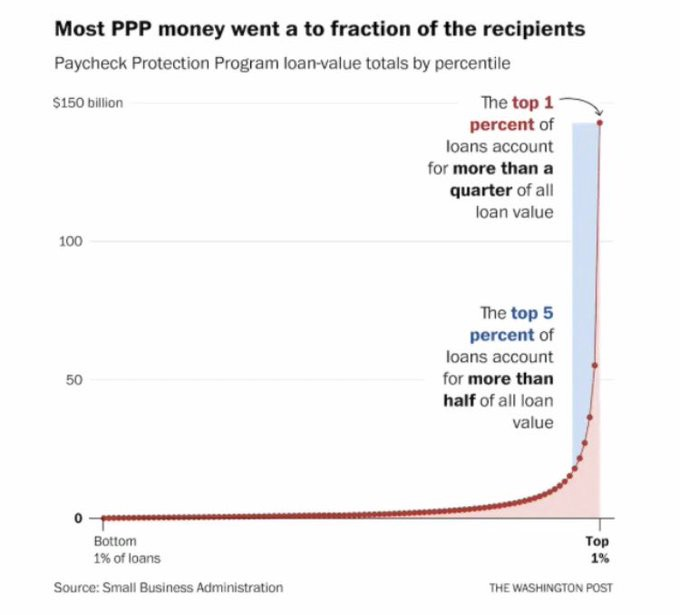

Who did the printing of currency actually help?

Where did all the stimulus meant for the average worker go?

Companies such as Microsoft, Goldman Sachs, Visa and Home Depot have been the beneficiaries of the Federal Reserve’s printing of currency and debt buying programs, while you received $1200 in March and another upcoming $2000, maybe.

The Federal reserve in addition to bailing out the largest and most rewarded corporations of the past decade, have been considering a central bank backed “federal cryptocurrency” referred to as many as Fedcoin. This is done in response to the decentralized Bitcoin, Powell has stated. This is also happening at a time of widespread adoption of cryptocurrency, specifically bitcoin by many mainstream investors.

https://blockchain.news/news/us-fed-chair-jerome-powell-grilled-over-fedcoin-digital-currency-progress

The Federal Reserve’s interest in a digital currency coincides not only with growing adoption of decentralized crypto like Bitcoin and Ethereum, but at a time when there are calls for dirty, germ infested cash to be phased out.

https://www.ft.com/partnercontent/comarch/covid-19-the-viral-spread-of-cashless-society.html

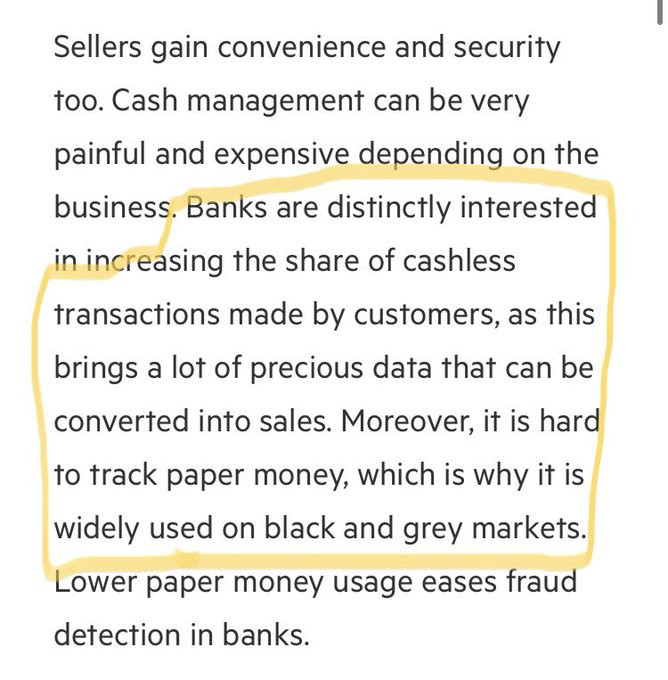

The goal is to track, trace and tax everything you do. This is beneficial not only to the “too big to fail” banks but also for the governement.

https://www.ft.com/partnercontent/comarch/covid-19-the-viral-spread-of-cashless-society.html

“brings a lot of precious data that can be converted into sales”

Precious data. Converted into sales. By the banks.

The justifications for this move to digital currency will be primarily transmission of virus and a crackdown on the “black market”. Implementation of this digital currency will most likely be a governement mandate for businesses to open up post COVID lockdowns.

It is not just the central banks of the world that are trying to digitize our currency. Some tech behemoths are attempting to digitally monetize the systems of your body. Specifically Bill Gates’ Microsoft.

https://patentscope2.wipo.int/search/en/detail.jsf?docId=WO2020060606

Unbelievably the patent number for Microsoft’s cryptocurrency is essentially “2020 666” just with some extra zeroes.

Is this a joke? It’s not funny.

Coincidence? Hell of a coincidence.

Or could it be something more dystopian?

https://patentscope2.wipo.int/search/en/detail.jsf?docId=WO2020060606

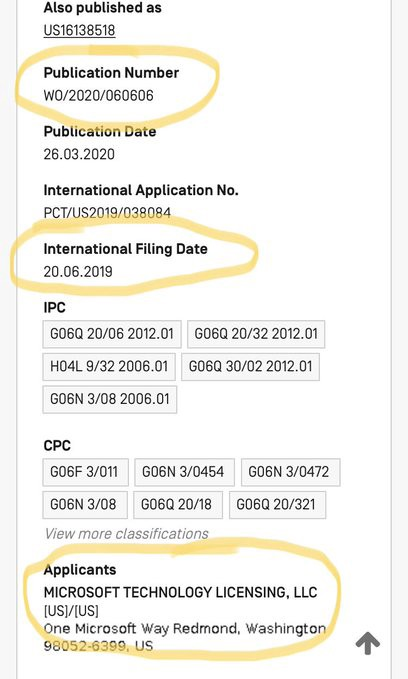

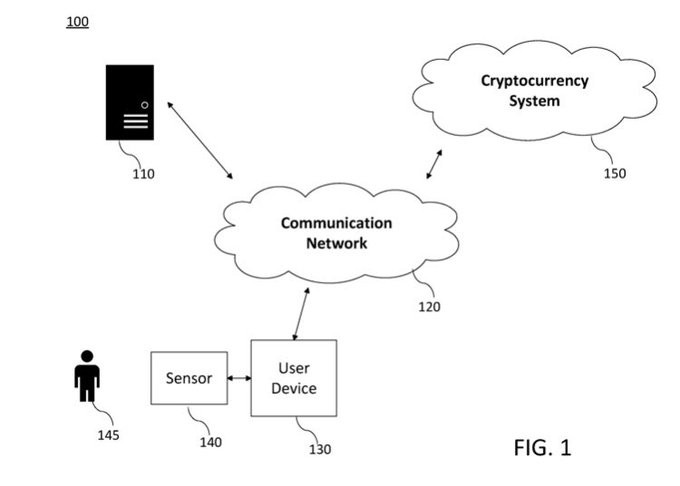

Microsoft’s W02020060606 patent involves technology that tracks your biometric data at a time such as when you’re viewing an advertisement and how your body reacts to that.

https://patentscope2.wipo.int/search/en/detail.jsf?docId=WO2020060606

The depth of intrusion of this technology is frightening.

https://patentscope2.wipo.int/search/en/detail.jsf?docId=WO2020060606

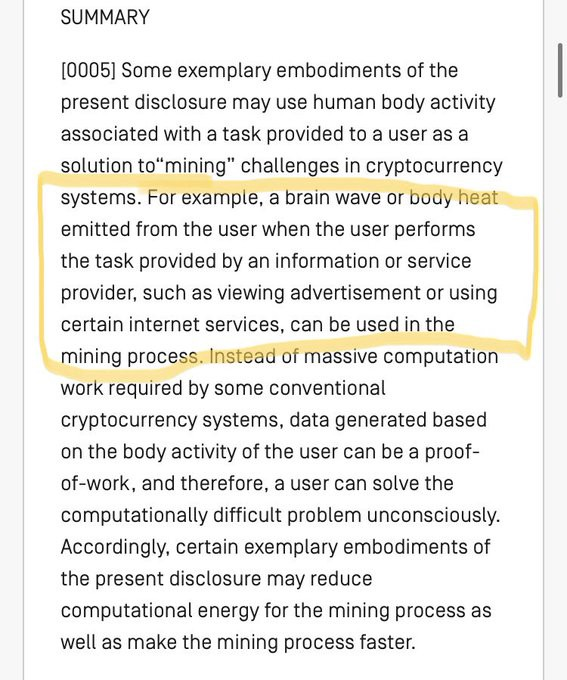

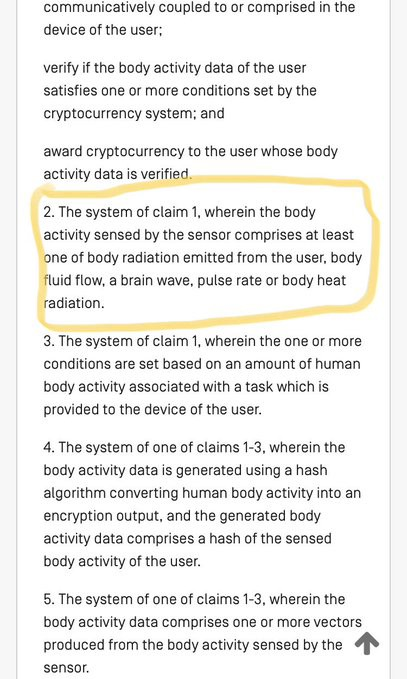

To be clear there is no mention of a microchip in this patent. But to quote the abstract:

“A sensor communicatively coupled to or comprised in the device of the user may sense body activity of the user.”

The following is the figure of the patent described in the abstract.

https://patentscope2.wipo.int/search/en/detail.jsf?docId=WO2020060606&tab=PCTBIBLIO

The historical response to government overreach and monetary inflation is to transfer wealth from fiat currency to precious metals such as gold and silver. These forms of wealth provide an untraceable format of wealth preservation.

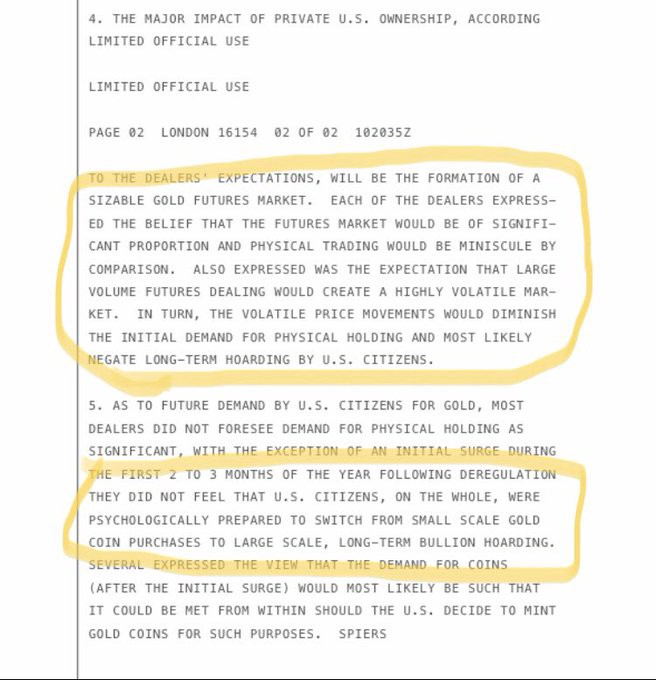

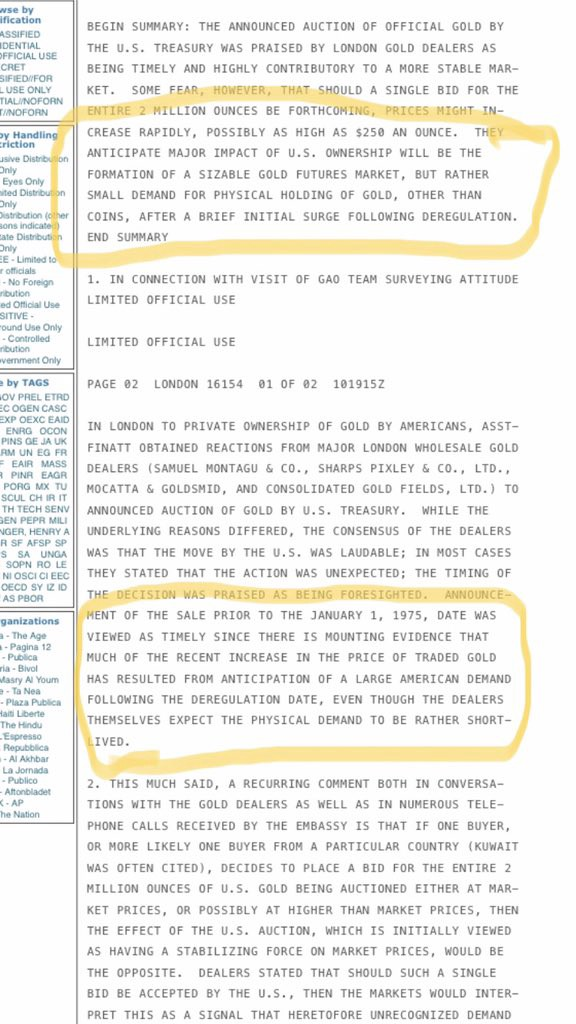

In 1974 the Department of the Treasury wrote a document outlining the creation of a volatile gold futures market that would dwarf the physical trading of metal which in turn disincetivizes long term holding of gold. It has since been released by Wikileaks, the whistleblowing outlet founded by now imprisoned Julian Assange. Wikileaks has a pristine publishing record, never having to retract a single document.

https://wikileaks.org/plusd/cables/1974LONDON16154_b.html

On December 10th, 1974, the day the following document was written, gold was priced at $178. Today it is priced at $1882. A 1057% return.

This is all happening while the largest banks in the US have been caught manipulating precious metals markets, an individual safe haven during times of uncertainty and monetary inflation.

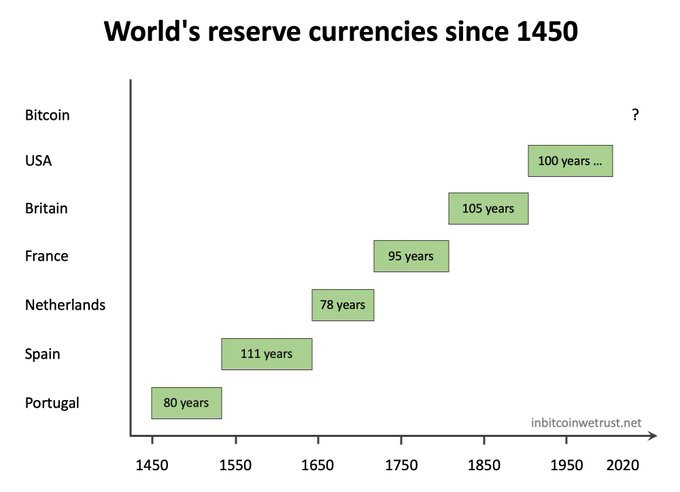

Precious metals provide a mechanism to move wealth outside of any taxable or traceable system. In order to keep the status quo of the economy together the engineers at the Federal Reserve, must keep inflation rates low, precious metal prices low, and control interest rates — which to this point they’ve done a surprisingly good job. However the US dollar global reserve currency is on it’s last legs. Right on schedule.

This global reset brought on by the COVID19 pandemic was timed perfectly for the growing economic reality and social reality of countries around the world when a wave of nationalism, or put another way, “decentralized political rule” started occurring. The decentralization of power between countries is the last thing the New World Order and global financial authorities would want.

So COVID19 was started from a mutated bat disease that was eaten by a guy in a Wuhan wet market and shutdown the world economy 4 months later, right? Well..

Interestingly, Anthony Fauci, ya know, America’s favorite doctor, was Director of NIAID, National Institute of Allergy and Infectious Disease.

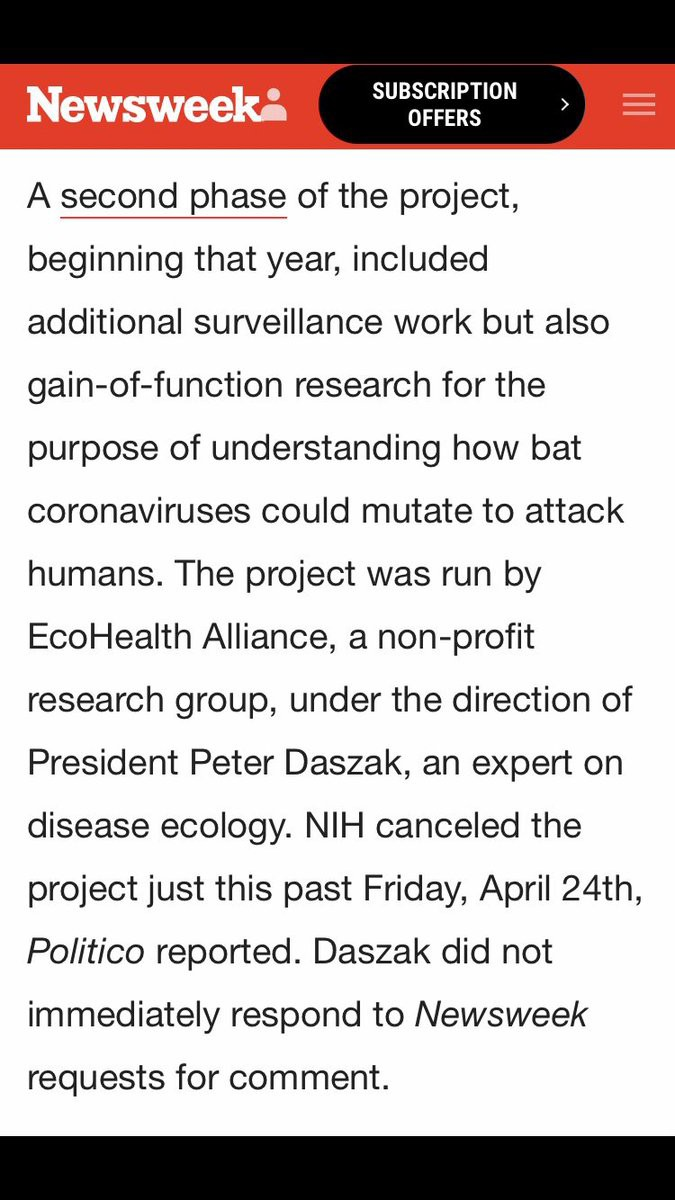

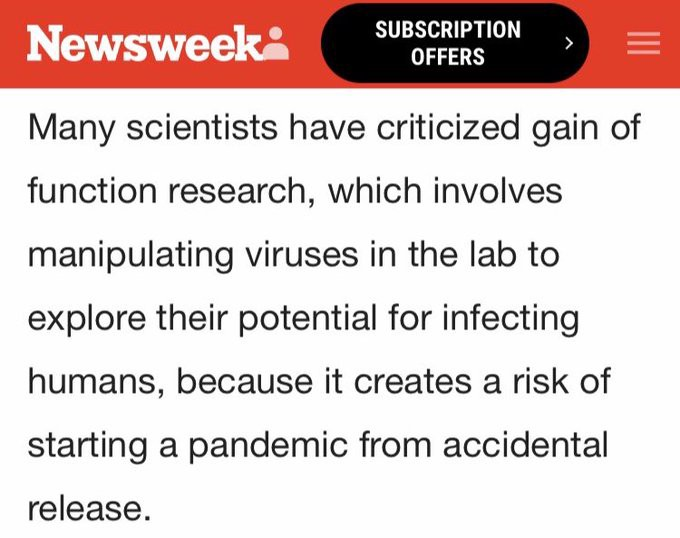

The NIAID was a funder of bat coronavirus “gain of function” research to the tune of $3.7 million officially, over 5 years, starting in 2014 and renewed in 2019 for a total of $7.4 million.

Gain of function research is when a pathogen is artificially enhanced in lethality and in transmission for research purposes. This is claimed to be used for biodefense purposes.

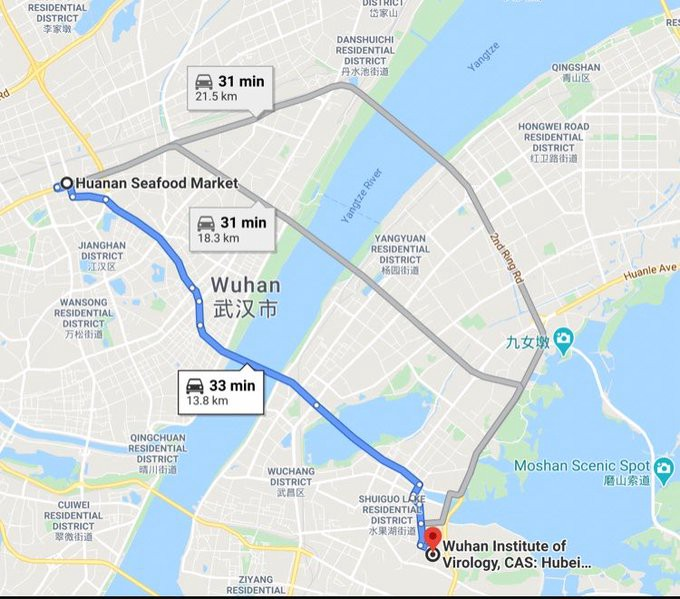

Those millions of dollars were directed to the Wuhan Institute of Virology, which is just a 30 minute drive away from — the wet market that we were told the virus originally spread at. The Wuhan Institute of Virology is what is known as a Level 4 bioweapons facility, the only of it’s kind in China. This is the highest rank of labs that can work with the most dangerous pathogens. Air, water and waste is all treated and filtered within the facility and workers must take extreme precautions leaving and entering the facility. The building is even rated to withstand a 7.0 magnitude earthquake.

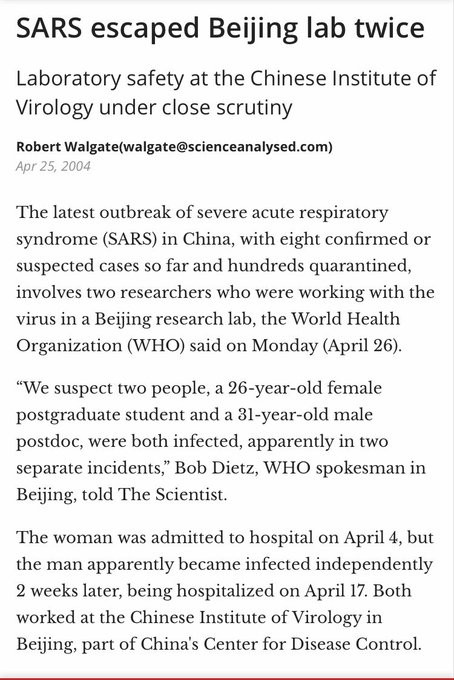

It wouldn’t be the first time a deadly virus escaped from a Chinese lab. The SARS virus has been known to escape from supposedly secured labs before.

https://www.the-scientist.com/news-analysis/sars-escaped-beijing-lab-twice-50137

So just to be straight, there was a lab in Wuhan, China that was funded by an organization headed by Anthony Fauci, which was experimenting with artificially strengthened bat coronaviruses that affect humans which was less than a 30 minute drive to the wet market where the virus supposedly started and spread.

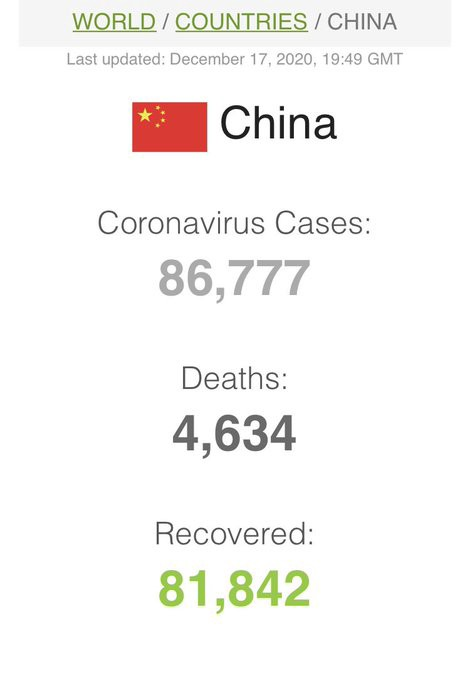

The most surprising thing that has come from china is their virus statistics

Their 1.44 billion population comprise 18.5% of the world’s 7.8 billion population.

China’s stated case count of 86,777 cases (12/17/2020) comprises .14% of worldwide cases.

https://www.worldometers.info/coronavirus/

You really gotta hand it China, huh? Most populous country on the planet but they rank… 80th on worldwide COVID19 rankings.

https://www.worldometers.info/coronavirus/

Bahrain, with it’s population of 1.57 million people (compared to China’s 1.44 billion) has more total cases than China,