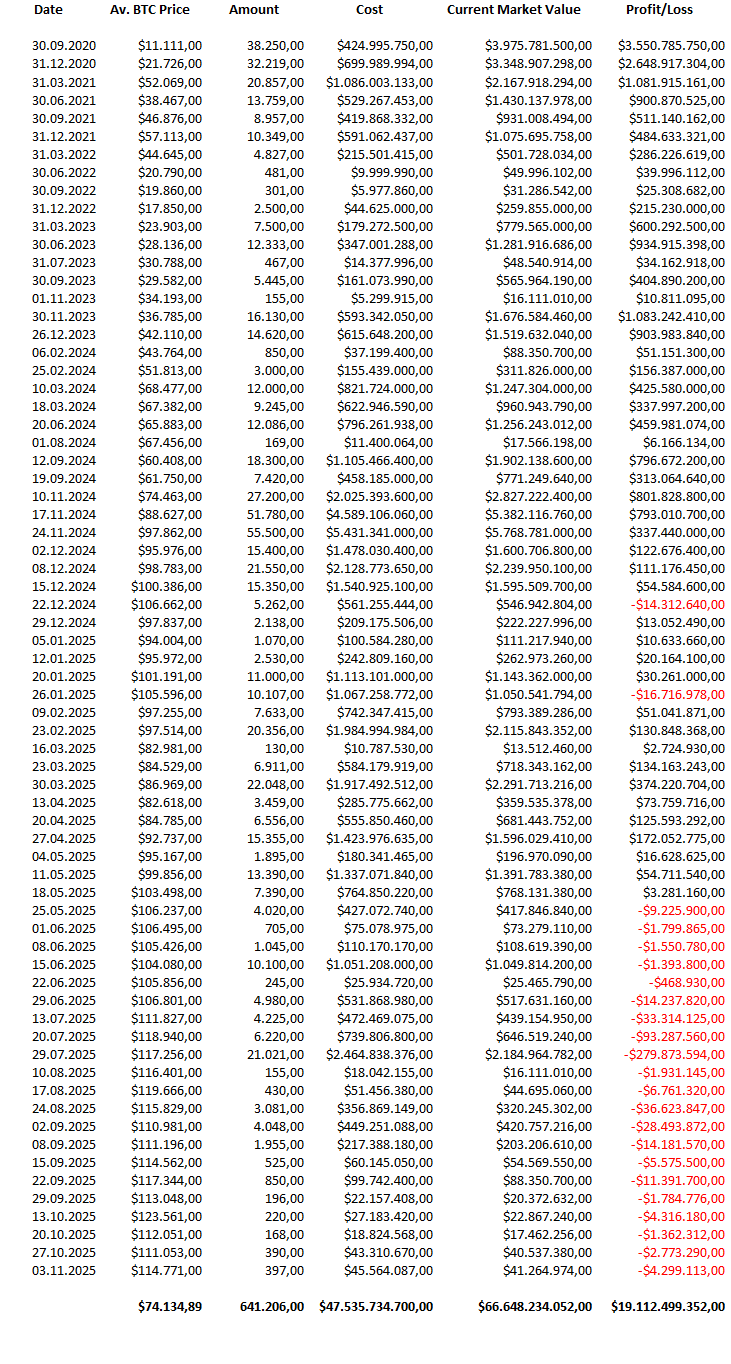

Since August 2020, the company has accumulated a whopping 641'206 BTC, investing approximately $47,5 billion at an average price of $74,1k per Bitcoin.

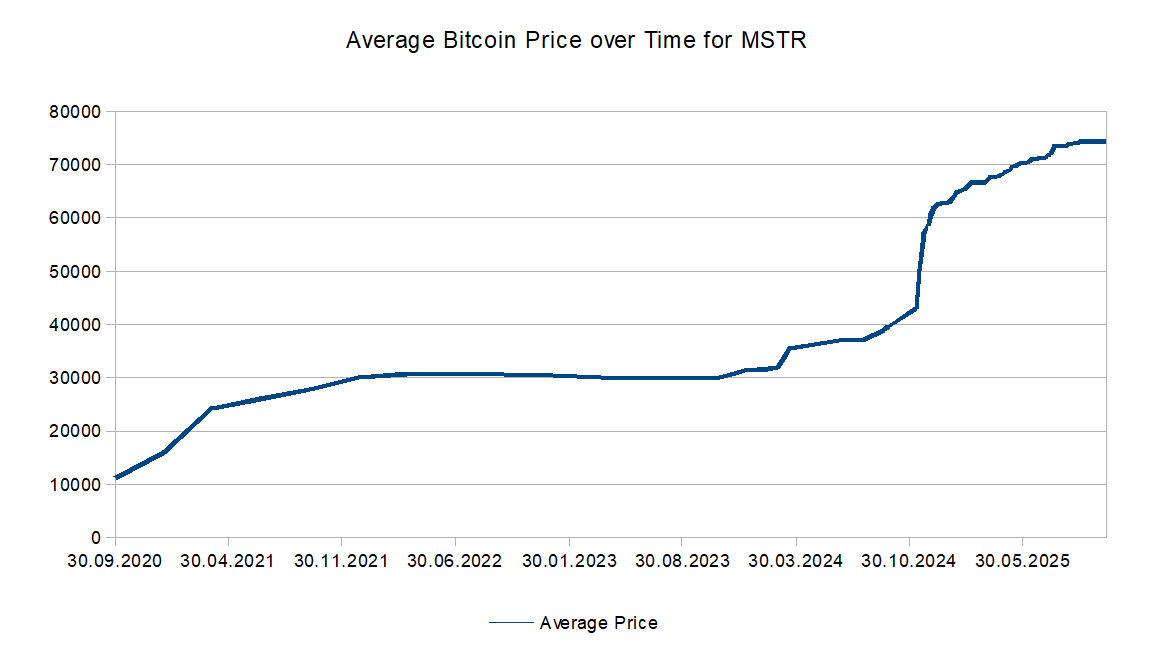

Average Bitcon Price

The development of the average BTC price in the Strategy treasury.

Acquisition Breakdown

MicroStrategy’s CEO, Michael Saylor, has aggressively pursued Bitcoin acquisitions, with a significant portion of purchases occurring in 2025: | Year | 2020| 2021 | 2022 | 2023 | 2024 | 2025 | |----------------|---------|---|---------|--------|---------|---| | Funds Deployed (%) | 2,7| 6,2 | 0,7 | 4,5 | 51,8 | 41,3 | | Funds Deployed ($ b) | 1,1 | 2,6 | 0,3 | 1,9 | 21,9 | 19,2 | | BTC Acquired (%) | 11,8 | 9,3 | 1,3 | 9,5 | 43,1 | 30,4 | In 2025 alone, MicroStrategy deployed $19,6 billion in Bitcoin. This immense expenditure was made possible by the premium at which MSTR shares trade above the market value of the BTC owned and a few (innovative) debt instruments.

Market Value of Holdings

As of today, with Bitcoin trading at $103'942, the market value of MicroStrategy’s holdings has surged to $66 billion. This reflects an unrealized gain of $19,1 billion, with the company’s total Bitcoin position being 40,2% in profit.

Microstrategy owns 3,05% of all BTC, or 3,47% of still accessible BTC (What Happens to Lost Bitcoin? .

Sources: + Michael Saylor on X.com + Microstrategy financials: MicroStrategy investor relations page for 8-K, 10-K and 10-Q reports.

-

MicroStrategy stock market data: finance.yahoo.com

-

MSTR shares outstanding: ycharts.com

-

MSTR insider transactions: openinsider.com

+ BTC price: coingecko.com

Notes: + Funds deployed: funds allocated during a certain period in comparison with overall investments in a particular asset + Nr. BTC acquired: amount Bitcoin acquired during a certain period in comparison with the total amount on the books

Vote for my witness: @blue-witness