Since May 2024, Eric Semler, owning 7.6% of Semler Scientific (SMLR) shares, has adopted a Bitcoin treasury strategy inspired by Michael Saylor. On May 28, 2024, SMLR announced its “Bitcoin Standard”, accumulating 5'022 BTC for approximately $475 million at an average price of $92'385 per Bitcoin.

Acquisition Breakdown

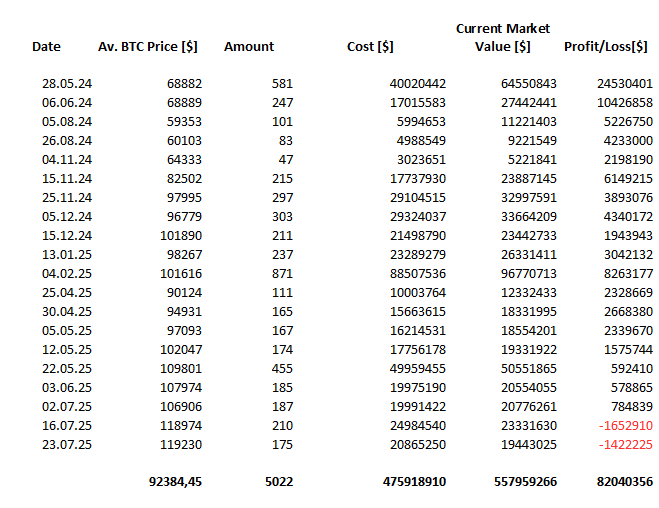

SMLR’s Bitcoin purchases, following MicroStrategy’s approach, are detailed below:

| Year | 2024 | 2025 |

|---|---|---|

| Funds Deployed ($M) | 168,7 | 307,2 |

| Funds Deployed (%) | 35,5 | 64,6 |

| BTC Acquired (%) | 41,5 | 53,8 |

Bitcoin Goals

On June 19, 2025, SMLR announced (press release) its Bitcoin targets: - 10,000 BTC by the end of 2025 - 105,000 BTC by the end of 2027

Market Value of Holdings

As of September 9, 2025, with Bitcoin priced at $111,103, SMLR’s holdings are valued at $558 million, reflecting an unrealized gain of $82 million and 17,2% profit.

SMLR owns 0,02% of all BTC, or 0,03% of still accessible BTC (What Happens to Lost Bitcoin? .

Sources: - Eric Semler on X.com - SMLR financials: Semler Scientific Investor Relations for 8-K, 10-K, and 10-Q reports - SMLR Investor Relations: Purchases - BTC price: CoinGecko

Notes: - Funds Deployed: Funds allocated during a period compared to total investments in an asset. - BTC Acquired: Amount of Bitcoin acquired in a period compared to the total held. - Totals from the IR page slightly deviate from these calculations. Could be due to rounding errors. - Nr. BTC reported 5'021 but is 5'022 - (Error: -0,02%) - Av Cost reported 94'772 but is 92'384 - (Error: + 2,6%) - Acqusition Cost reported 475'836'000 but is 475'918'910 - (Error: - 0,02%)

Vote for my witness: @blue-witness