Like most technology, cryptocurrency constantly evolves over time.

Compared to other software though, innovating atop of Bitcoin and other cryptocurrencies is relatively easy thanks to its open-source nature, which allows for a lot of collaboration and experimentation.

Once a particular innovation proves itself workable, it can be plugged into new crypto projects, and the progress compounds. However, when it comes to mature cryptocurrencies, certain aspects are difficult to change, especially after the market cap reaches billions or trillions of dollars.

In this post, we cover the evolution of cryptocurrency inflation models, with a focus on Burn-Mint-Equilibrium (BME), an innovation that many new DePIN projects have been adopting to better balance their token supplies.

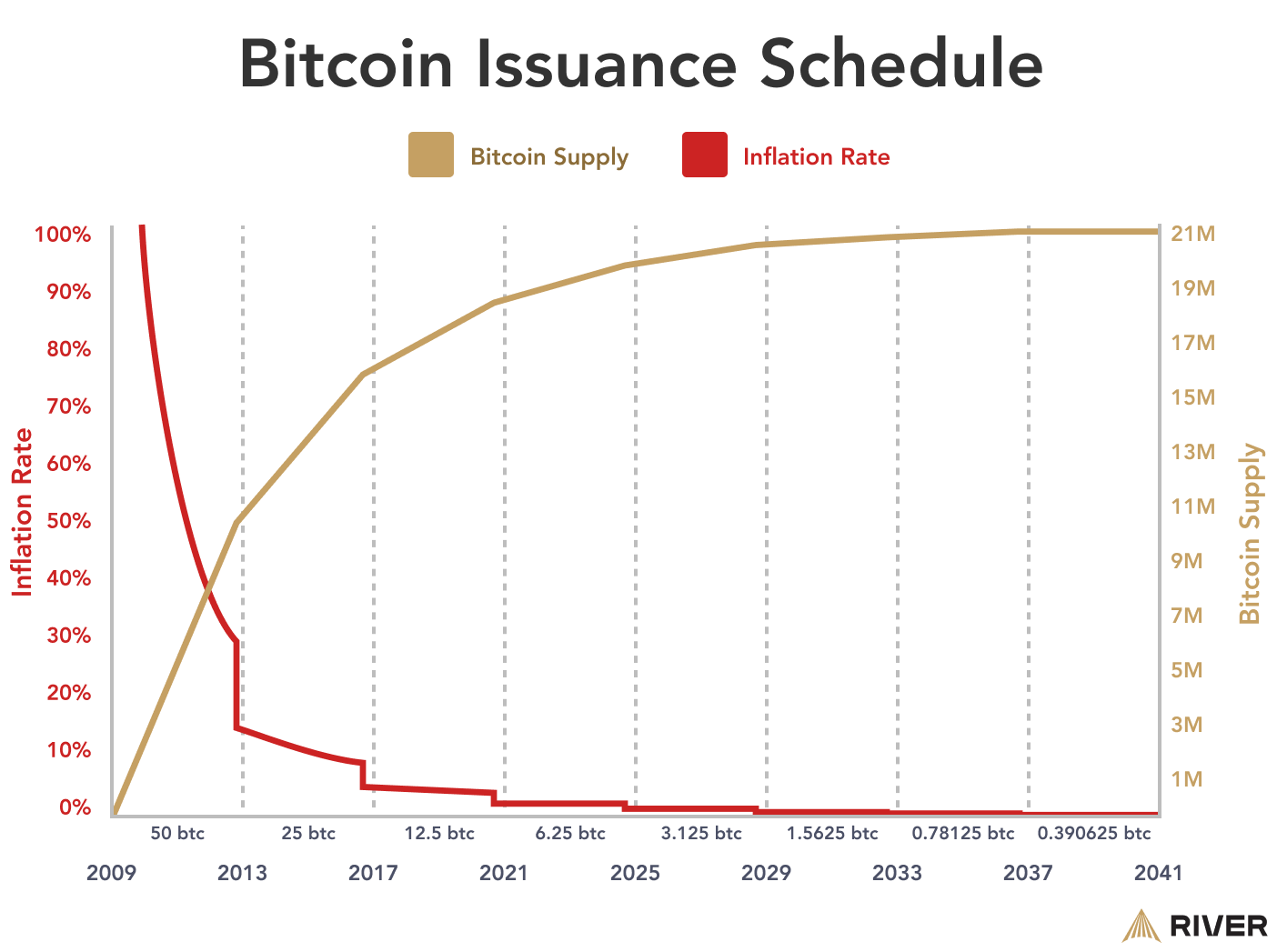

Bitcoin: Predictable and Deflationary by Design

Day in and day out, the Bitcoin network generates new coins (BTC) each time a block is solved by a miner. This happens every 10 minutes on average.

The block reward that miners earn is halved every four years. For example, when Bitcoin first launched in 2009, miners earned 50 BTC for solving a block. In 2025, the reward has dropped to 3.125 BTC per block.

Given this fixed issuance schedule, we can calculate that the maximum supply of Bitcoin will be 21 million.

Similar to Bitcoin, many other cryptocurrencies mint new coins/tokens on a fixed schedule, regardless of network demand and usage. That said, since Ethereum launched in 2015, there have been many innovations that make token issuance more efficient.

Ethereum: From High Inflation to Dynamic Supply

Unlike Bitcoin, Ethereum doesn't have a fixed total supply. Rather, its inflation rate has fluctuated over the years as a result of community-approved network upgrades, as well as the implementation of a token burning mechanism.

Here is a summary of Ethereum's inflation trajectory:

- 2015–2018: High inflation (~10–14% annually) due to 5 ETH block rewards and smaller supply.

- 2018–2021: Moderate inflation (~3–4%) after network upgrades that reduced block rewards.

- 2021–2022: Variable inflation/deflation post EIP-1559 as "base fees" started to be burned proportional to network usage.

- 2022–2025: Low issuance (~0.5–1%) under Proof of Stake, with net supply often deflationary during high activity or slightly inflationary during low activity.

Although difficult to calculate reliably in real-time, you can check the total supply of ETH on a block explorer like Etherscan for a good estimation.

Ethereum wasn't the first cryptocurrency to implement a mechanism that burns tokens to regulate the supply.

Helium: Burn-Mint-Equilibrium

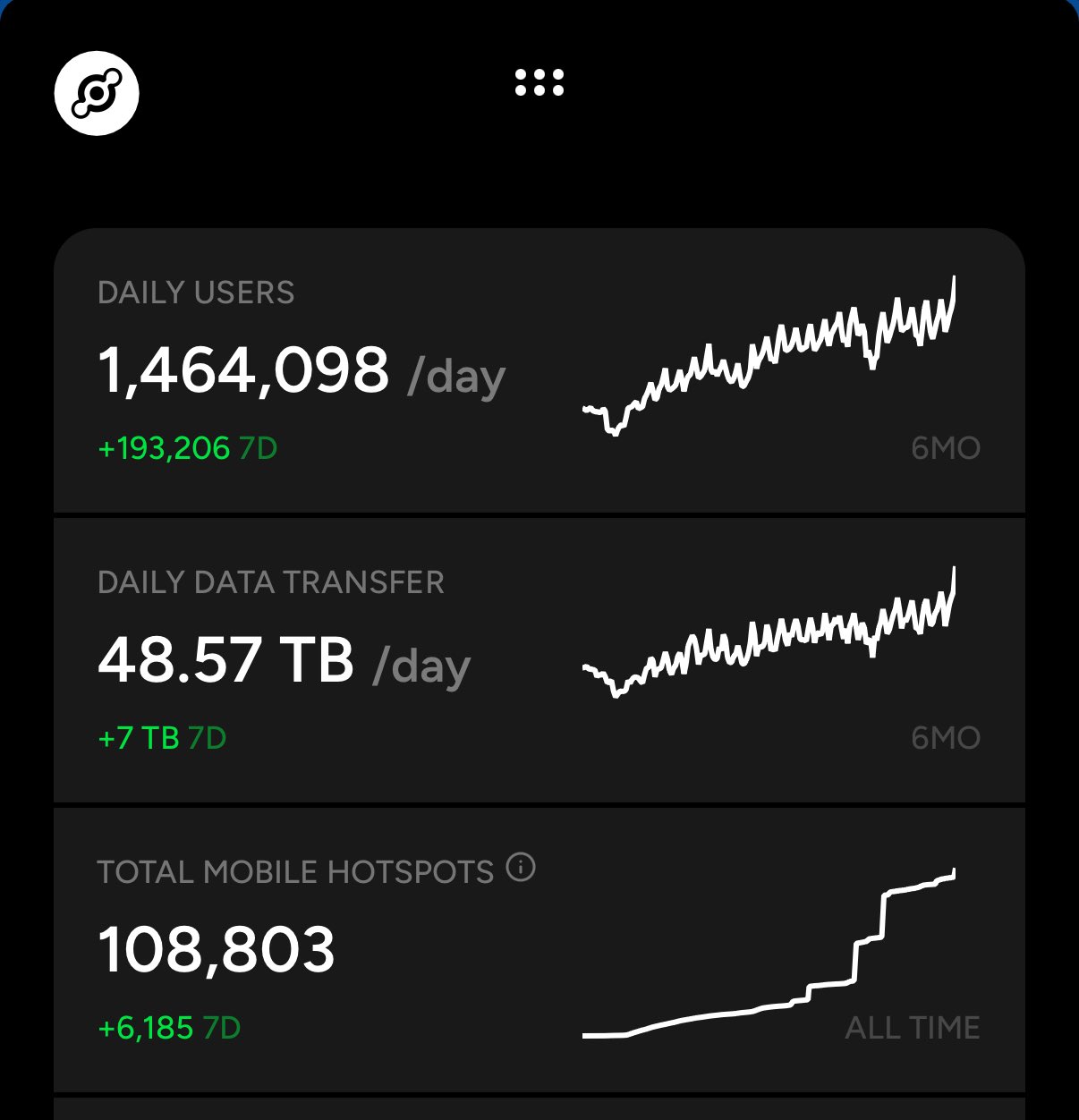

Helium is a very practical use-case of blockchain technology. It harnesses token incentives to roll-out and sustain a decentralized network of wireless hotspots (first LoRaWAN, then 5G). Helium's token HNT resides on the Solana blockchain.

To better align their token supply with actual economic activity on the network, Helium implemented Burn-Mint-Equilibrium (BME), a model pioneered by Factom, with dynamic burning and regulated minting (rMdB). How does it work?

Similar to Bitcoin, the amount of HNT minted to reward the providers (wireless access point operators) remains constant and regulated, halving every two years.

Unlike Bitcoin however, HNT tokens are burned dynamically to generate data credits (required to use the network), which controls inflation as demand rises.

Despite HNT's stagnant price, the number of wireless subscribers, data offload, and hotspots on the Helium network all continue to grow:

Other DePIN projects have also adopted the BME model, including one called NodeOps, a decentralized compute project that has embraced dynamic mint and dynamic burn (dMdB), ensuring that the $NODE supply only expands when backed by economic activity.

Could practical cryptocurrencies that implement this more efficient BME inflation model eventually supersede those that emit new tokens regardless of network demand and usage? Only time will tell.

Until next time...

Bitcoin has a fixed inflation rate, which one could argue is better for the "hard money" it strives to be. Meanwhile, many DePIN projects have adopted a Burn-Mint-Equilibrium model, which burns tokens in proportion to economic activity, regulating inflation.

It would be short-sighted to assume that Bitcoin will be the only form of digital money in the future, or that Ethereum won't have a fair share of competition from alternative smart contract platforms with innovative inflation models.

Which digital tokens will we be using to exchange goods and pay for services in the future? Will it be BTC, ETH, DePIN tokens, or something else? In any case, cryptocurrencies that succeed long-term will need to adopt an inflation model that suits their specific use-case.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the Hive blockchain. You can also follow me on InLeo for more frequent updates.

Sources

Bitcoin Issuance Chart [1] NodeOps Mint and Burn Strategies [2] Heilum Network Growth Image [3]

Posted Using INLEO