At first glance, it would seem that Bitcoin and Ethereum are the two winners in the cryptocurrency space. Valued at roughly $2.5 trillion and $500 billion respectively, they are far ahead of the alternatives, at least in dollar terms.

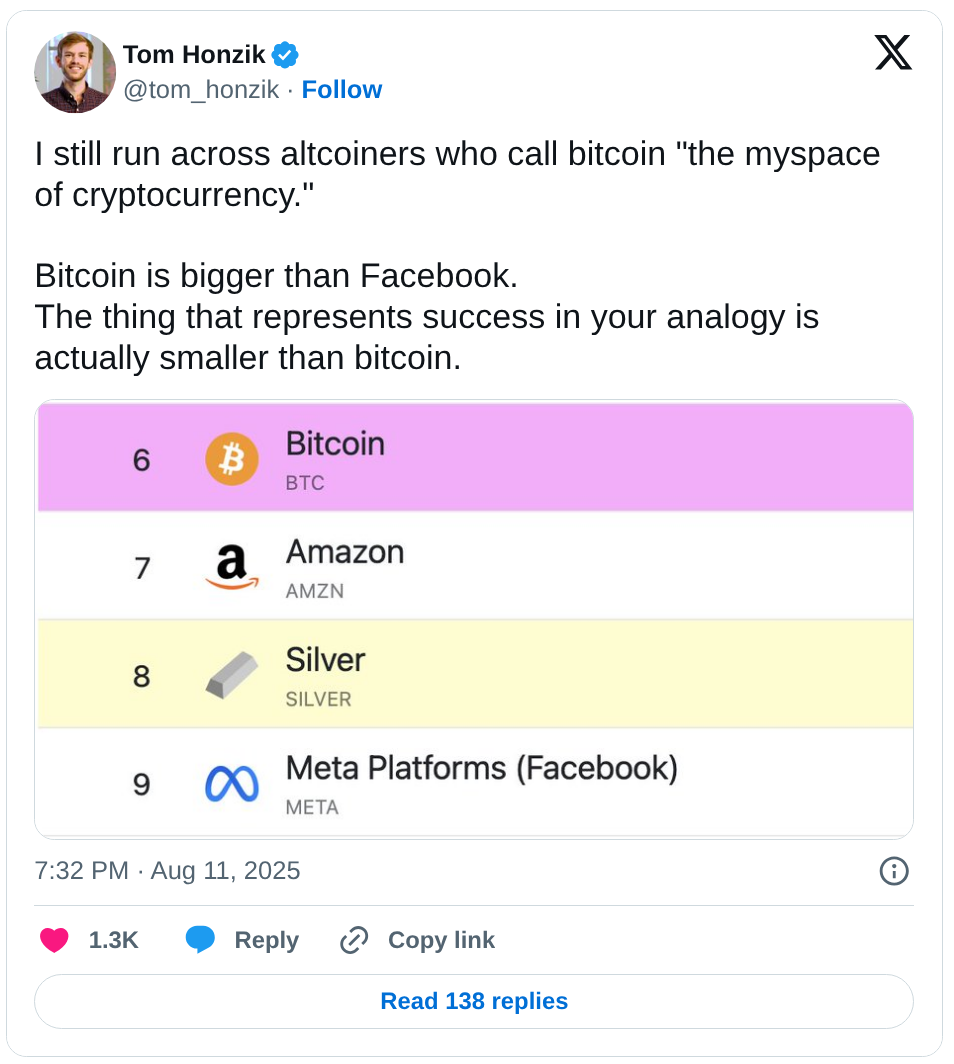

When challenged, Maxis often point out that BTC and ETH have these higher market capitalizations, and are therefore superior to alternative cryptocurrencies (or even companies).

Let's think about this rationally.

Why is Bitcoin superior to Litecoin, for example? Both allow you to permissionlessly send value to anyone, anywhere in the world. While Bitcoin does have the first-mover advantage, Litecoin does it much faster (with 2.5 minute confirmations) and cheaper, especially when the Bitcoin network is loaded with NFT/ordinal traffic.

People may argue that altcoiners are coping, pulling reasons out of their ass as to why other cryptocurrencies may have an advantage over Bitcoin and Ethereum, but the truth is there have been important innovations in privacy, scalability, consensus algorithms, and more since Bitcoin was launched in 2009.

Could it be that the best strategy all along was to simply hold Bitcoin/Ethereum, while ignoring the innovations happening in the ever-expanding cryptocurrency industry?

Why does a higher fiat valuation not equal superiority?

TradFi Adopts Crypto

Instead of building a new economy based on cryptocurrency, we have been trying to fit (and regulate) crypto into the traditional financial (TradFi) system. This is like trying to push a square block into a round hole.

The prices of Bitcoin and Ethereum have increased in large part due to the approval of ETFs by the SEC. Now traditional investors, who don't want to deal with seed phrases and private keys, can simply buy paper versions of these coins via an ETF through their bank.

Of course this has made the "number go up" crowd happy, as their hopes of retiring early in the TradFi world increase. But those of us who actually want freedom from central banks, draconian governments, and other financial institutions aren't so thrilled.

We sometimes forget the reason Bitcoin gained any value in the first place was because of its uncensorable payments, and peer-to-peer network. If wallets could have been censored or suspended from the beginning, Bitcoin never would have caught on.

While not happening at the momeent, crypto ETF accounts could easily be censored, suspended or confiscated with a key stroke for reasons ranging from wealth redistribution to refusing wokeness, mass migration, or experimental drugs.

Stuck In The Fiat Mindset

Consider how, many moons ago, we used to pay for goods and services directly with gold. Back then, debt-based fiat wasn't even a thing. Do you think it's possible that, in the future we might be able to pay for things directly with crypto, without first measuring it in dollars, euros, or yen?

Diverging from their original purpose, Bitcoin and Ethereum have transitioned into speculative assets that represent fiat wealth in a system nearly on the verge of collapse, rather than freedom money that could be used in a parallel economy.

What might cause Bitcoin and Ethereum's market dominance to drop relative to other cryptocurrencies?

When Fiat Fails

Despite an increasing number of bank accounts being frozen, cash withdrawals being denied, and rising inflation, the traditional financial system still continues to work, at least for now.

That said, as our sovereign, corporate and individual debts continue to expand exponentially to unsustainable levels, the powers that be have been working on a replacement.

Consider what would happen if we were faced with another financial crisis (incidental or intentional) triggered by unsustainable debt, a cyber attack, or a "climate emergency"? The long-awaited financial reset would finally be executed, bank credits converted to CBDCs, and spending restrictions would come into effect.

At that point, investors would probably want to start using their Bitcoin for its original intended purpose (uncensorable peer-to-peer cash) to buy things like plane tickets, gasoline, red meat, and other items that may end up being limited or restricted in the new system.

However, at that stage of the game, getting your Bitcoin out of an ETF (or centralized exchange) and into self-custody could prove difficult.

Even if you could take ownership of your BTC, at only 7 transactions per second (TPS), the Bitcoin network would quickly reach capacity. (Yes, the lightning network exists, but it's not user-friendly for non-technical people, and loading a wallet can sometimes take hours before all confirmations complete.)

In such a scenario, people may resort to alternative cryptocurrencies like Bitcoin Cash, DASH, Digibyte, etc, that support much higher TPS. People may also start using DePIN tokens in a parallel economy to directly pay for services like WiFi, 5G, compute power, solar energy, storage, and more.

The Fate of Altcoins

These days, investors have become more focused on Bitcoin's fiat value, rather than its actual utility, and have been using that as the basis for declaring its superiority over the alternatives.

I believe we are still early in this game, and all the winners have yet to be discovered by the market.

Another speculative alt-coin run could very well be in the cards, sending everything (including memecoins) to the moon. But eventually the coins and tokens that actually power real economic activity will achieve dominance as the unsustainable fiat system is rendered irrelevant.

Bitcoin and Ethereum will likely remain dominant so long as the fiat system has legs. In fact, alternative cryptocurrencies may not become widely adopted until the traditional financial system falls apart and their utility becomes apparent.

Consider too how altcoins may be considered a rebellious alternative to the draconian replacement being planned by the overlords.

Until next time...

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the Hive blockchain. You can also follow me on InLeo for more frequent updates.

Sources

Square peg into round hole image [1] Tweet that inspired the post [2]

Posted Using INLEO