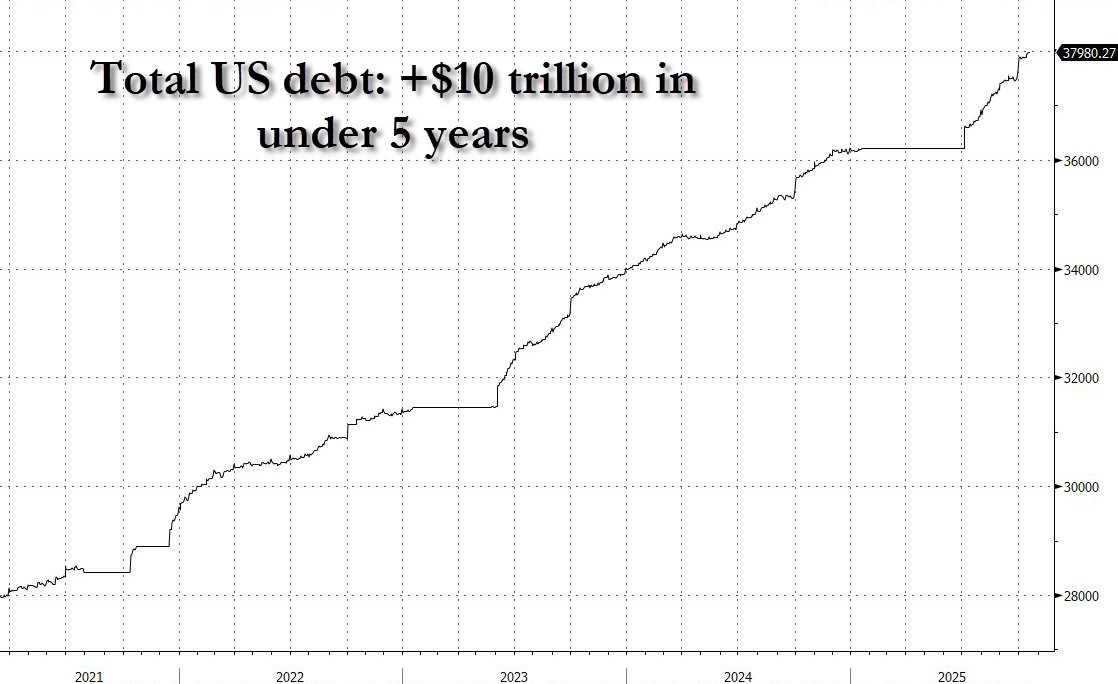

As the cryptocurrency market continues its steep sell-off, and Crypto Twitter loses its shit on X, US national debt casually surpassed the $38 trillion dollar mark.

There's no denying that it's been a tough year for crypto investors. In fact, it's been the exact opposite of the bull-run we expected to unfold in 2025.

Valuations continue to plunge, even after the greatest liquidation event in crypto history, and some people are seriously considering giving up at this point:

These relentless market dips are indeed painful, and may cause you to question your commitment to the industry. However, when prices crash, it's important to zoom out and gain some perspective.

Accelerating Debt

In just the past five years alone, $10 trillion was added to the US national debt, pushing it past the $38 trillion dollar mark.

Sovereign debt has been growing both exponentially, and unsustainably. That is probably why digital IDs (in the UK, for example) and CBDCs (in the Eurozone) are being pushed now more than ever, as a replacement to the current system.

Cryptocurrency is the most peaceful defense we have against draconian digital IDs and Central Bank Digital Currencies (CBDCs).

Skyrocketing Gold

Setting aside the volatility of crypto for a moment, take a look at the price of gold for a second, which has soared from $2000 to $4000 per ounce in just the past two years.

Even gold's volatility is starting to resemble that of a memecoin these days, and indicative there are serious problems afoot in the financial system.

Surging Bitcoin

Meanwhile, over the course of the past three years, Bitcoin has climbed from $15,000 to $107,000, another sign that the dollar may be in serious trouble.

I continue to believe that the capital that has been allocated to Bitcoin via ETFs will eventually flow into fundamentally sound projects that provide more utility in a new, crypto-based economy.

Crypto Fundamentals

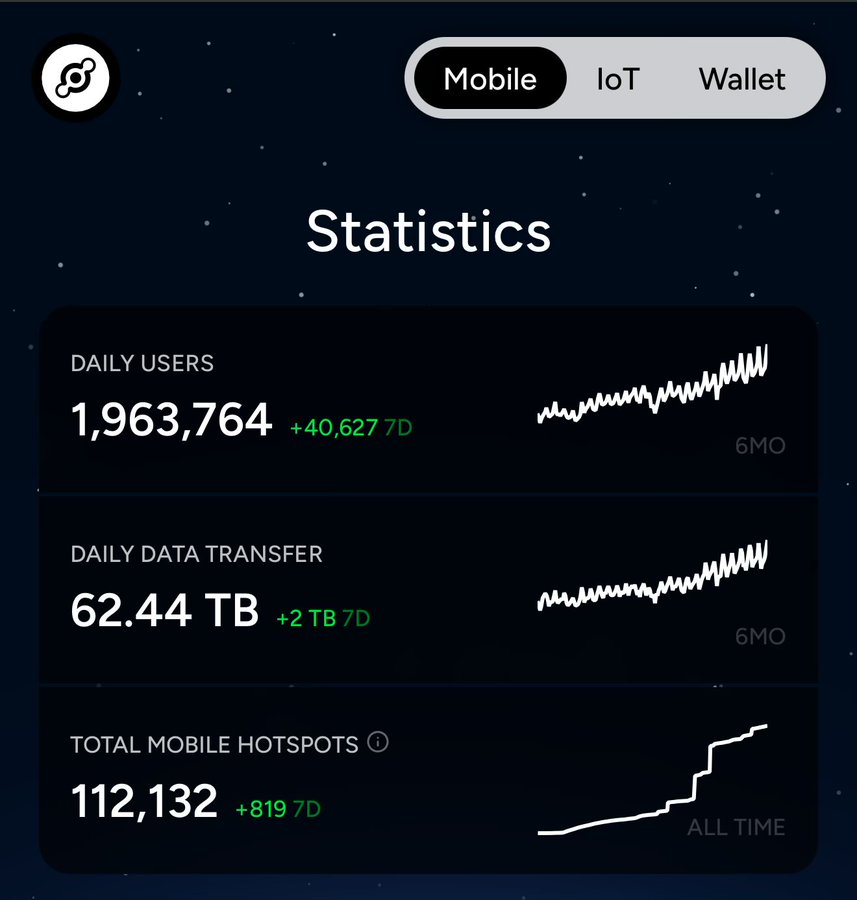

Despite the dire market conditions, many teams continue working long hours innovating, testing, iterating, and improving their products.

For example, Helium continues to increase its wireless subscribers on a daily basis, and this is just one of many DePIN projects that are rolling out community-owned infrastructure that could power the future economy.

Why Quit Now?

Imagine losing your focus now, just as we are approaching the finale of the Great Reset, in which Bitcoin, gold, and debt levels reach absurd levels.

Yes, you could give up on cryptocurrencies, and go slave away for fiat. But the dollars you earn would afford you less and less goods and services with each week that passes.

Instead, you may want to remain steadfast, focused on the dollar's long-term replacement (crypto and tokenization), despite its short-term volatility.

Until next time...

If you found this article interesting, be sure to check out my other posts on crypto and finance here on the Hive blockchain. You can also follow me on InLeo for more frequent updates.

Further Reading

- Who Does The World Owe $315 Trillion Dollars To? - Will Bitcoin Or Other Digital Assets Be More Valuable In The Future?

Posted Using INLEO