The bull market in Precious Metals has been gaining steam over the last several years and often historically it is Gold that leads the charge while Silver can lag a bit behind. However once the bull market really gets going Silver can tend to catch fire and take over as the star performer. I like both of course, but I typically prefer Gold because it’s a bit less volatile and harder to manipulate / control supply. That said, Silver is really catching my eye at the moment and I am wondering if we might be reaching that point in the cycle where Silver catches up and even takes over from Gold…

I could go back further but I think 10 years is enough for the purpose of this post. The above chart shows the Gold to Silver Ratio (GSR) which historically likes to fluctuate around 60 to 80, however in recent years it has been holding a lot higher. You can see big spikes in early 2020 when Covid hit and other peaks in mid 2022 and again earlier this year (2025) but for the last few months it has been dropping at a decent rate. The GSR is now almost back to 80 so it looks like Silver has started catching up.

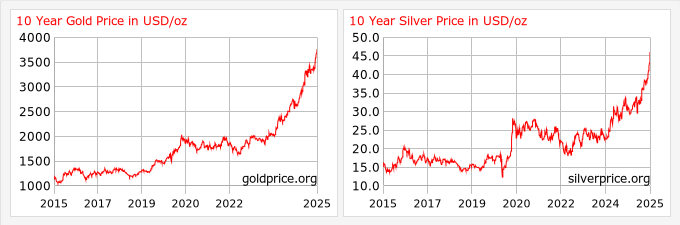

If you have a look at the comparison chart of the last 10 years you can see the shape of the Gold and Silver charts are pretty similar. Silver looks a bit “hairy” as it’s more volatile but both are starting to make that “hockey stick” type of move so far in 2025. If this bull market in Precious Metals is going to continue then it’s a pretty fair bet to say that Silver may be outperforming Gold from here on out.

Of course I have some Silver in my stack, but my paper investments are currently very Gold (and Crypto) centric. I’m starting to think it might be time to do some re-balancing of my portfolio. There is still a decent risk that the metals complex will correct sharply and if it does then Silver will come down hard, but I do think overall the fundamentals are good for Precious Metals so a further diversification into Silver might be a really good option for me.

DISCLAIMER – This is not financial advice