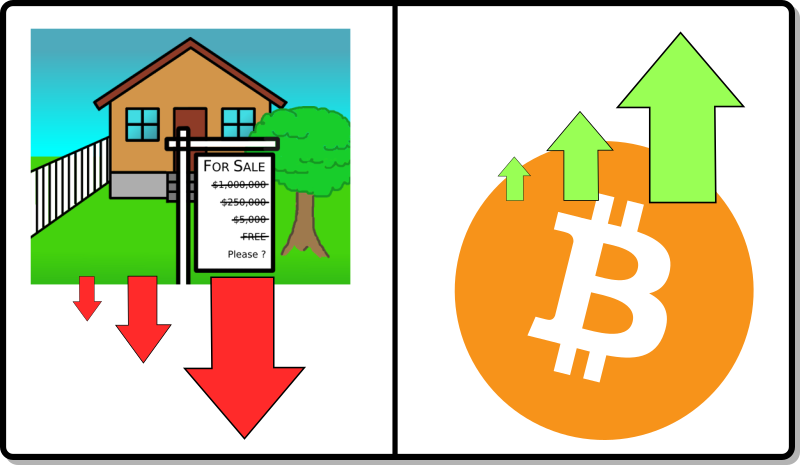

It will be interesting watching how more real estate is dumped on the market as more people realize that bitcoin has a better ROI, with none of the work.

The price of real estate will drop, triggering more investors to dump more real estate on the market. More money in bitcoin will spur even more investment in bitcoin, and then real estate will look like an even worse investment…

There are so many reasons why bitcoin is going to be going up. Billions of reasons. Maybe trillions of reasons soon.

There is 76 million reasons real estate is going to be going down. As baby boomers move into retirement facilities or mortuary plots all of their houses will be dumped on the market. 25% of the houses, and almost 50% of the value in The US.

New York City has even more reasons for landlords to dump their holdings. California too. As the leaders there move things to be even more socialist/communist. California has let cities decide if they want to implement rent controls, meaning that landlords cannot keep rents covering the insurance premiums. Keeping the housing is tantamount to throwing away money. Add to that, that these places will be implementing laws where the non-paying tenants cannot be thrown out, and you have a scenario where, if the investors wait too long, they won't be able to give those houses away.

You add these together and bitcoin goes UP and house prices go DOWN

Investors are dumping their properties

Home owners are trying to hold onto their high home values. They aren't dropping their prices, although they aren't getting any prospective buyers. On the other hand, investors are dropping their prices aggressively to get buyers.

Similarly builders are selling new houses, for less than people are selling a slightly used house for, in the same tract.

If you watch any of the real real estate channels they are all reporting that there isn't any buyers from the middle class. Agents are having open houses with no lookers stopping by.

The investors are doing what everyone should be doing. Drastically slashing the sales price until buyers show up. And the way this usually goes is, at some point, everyone realizes this, and drops the price, causing others to drop the price, causing even more price cuts. When mortgage rates almost doubled, people should have dropped the prices at least 30% so that the monthly payment stayed about the same, but no one did.

Bitcoin is becoming more accepted.

Bitcoin has definitely moved out the wild-speculation camp and has started to move into the solid investment camp.

There is so much quite buying of bitcoin happening right now that bitcoin should be over a quarter million right now, but not many are paying attention. And there is a lot of people who have been holding bitcoin for a while, who are glad to sell at $100k. $100k is life changing wealth for the middle class. However, this group will soon dry up, and then we will see bitcoin's price climb into the sky.

And one of the groups that is deciding to move into bitcoin are real estate investors. Real estate is starting to look like a bad investment. Taxes, insurance, maintenance are all going up. While the laws are getting worse People's wage are stagnant and so they can't afford the increase in rental rates that the investors thought they could get.

Whereas, bitcoin is performing better the real estate has, without any of the work or risk involved in real estate.

However, it may be too late. Real estate investors who saw this all coming, have stated that they should have started selling earlier. Getting rid of the last of their inventory was getting hard. Still, we about to see bitcoin going way up, and real estate become a ticking time bomb. So, the investors will be doing whatever they have to, to get out of the real estate market.

More money is coming to bitcoin. (although, not quite as much as investors would have liked)

And then the real estate market crashes

At current interest rates, housing prices will need to drop 50% before buyers come back into the market. And, by the time the prices are dropped 50%, they will have to be dropped more because of the flood of inventory.

And this will be just the start of baby boomers selling, meaning the late baby boomers will have to lower prices even more.

And this is only one fraction of the houses that will be on the market. * All causes mortality is still climbing, with new, more dangerous diseases looming on the horizon * Immigrants are leaving. Soon, they will be running for the border, leaving many houses empty * People fleeing the cities will leave even more empty houses.

There isn't the population, even if they had money, to buy up all these houses.

At some point, suburban houses become worthless.

With bitcoin going up, and house prices going down, if you want a house, trading crypto for it will get you some motivated sellers.

Just remember, you are trading something that is becoming more valuable, for something that is tanking. However, there is something truly to be said about owning your house free and clear. (if you have a mortgage, you will probably be able to pay off your mortgage with crypto, as more banks start offering custody services and generally start working with crypto.

For a short time, you may be able to use your bitcoin as collateral for a loan, and use that to pay off your mortgage or buy a house. The reason i say for a short time is that a bitcoin loan requires that there be printable fiat, else, usury will quickly show why you cannot lend with interest when you have solid money. (the money to pay for the interest doesn't exist. It will soon be found that more than 21 million bitcoin is owed in interest)

This will be a great time for crypto holders.

All images in this post are my own original creations.