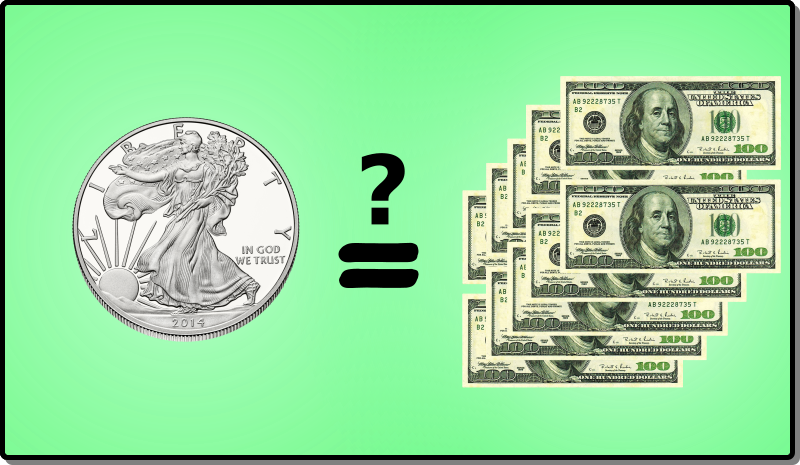

Silver is almost to $50 an ounce, for the second time in record.

The question is, should you buy more silver?

What? You don't have any silver? Then you should definitely buy some silver!

But, what most people want to know who would read an article titled like this is, "should i continue to buy silver, because it is going much, much higher, or should i sit on what i have until the "inevitable crash"?

Is the price fixing over?

Silver and Gold have had their prices manipulated for a long time. So, we assume that if silver prices are allowed to fly free, that silver's price will go much higher. The corollary is that if the manipulation has ended, then we assume the control mechanism got broken. That means the dollar or the COMEX has failed. (It could also mean that the manipulators had a changed of heart. Very doubtful)

Well, it looks like the COMEX is about to have some competition in the silver futures/supply from China and/or Russia. And because the COMEX is out of silver, they need to quickly raise the price to something that might be sustainable, or when these foreign exchanges come online, everyone will try to arbitrage between the two, wiping out the COMEX. This may be what is happening.

Or maybe they have run out of money because D.O.G.E. destroyed their money printers, and so the COMEX manipulators have run out of bullets. Or maybe they are worried about the tsunami of dollars that is heading back to the States.

Either way, the COMEX manipulators will probably try to smash the price down one more time.

Silver used is greater than silver mined

The problem with keeping prices suppressed is that supply doesn't rise to meet demand. And we have had a lot of shell games played to maintain silver supply. Unlike gold, silver is used, and it is only a matter of time before its used up.

There isn't a replacement for silver. And the electronics it is used in, uses a small amount per device, so there is nothing but paying more for silver, and thus more per device.

Until the price of silver gets high enough, no one is going to invest in creating silver mines. (most of the silver we get currently is gotten as a byproduct of mining copper and/or gold.) It is really going to hurt when we run out of the silver stockpile. It will be years before new sources are brought online.

New Technologies

Can you imagine if someone creates a free-energy device, but it needs an ounce of silver. People will pay whatever it takes to get an ounce of silver.

Or, that new wireless internet with needs a special antenna cast out of silver. How much would you pay for internet access anywhere on the planet?

Although these products are coming, i do not know how much silver they will need (if any), nor do i think they will be available while we go through the COMEX collapse.

That said, there are a quite a few very important devices that are coming out now that will need more silver. And which people will pay whatever it takes to get them.

And when they do, you will see vans/tents in front of every grocery store advertising to buy silver at highest rate in town.

So, where is the price of silver going? Well… up.

I expect that we will get over $50 and then there will be a HUGE smackdown. Like to single digits. But there will be no one selling silver for that price. ($5 per ounce, but you will pay a $45 fee). And then we will see silver going up a dollar a day, and then five dollars a day.

We have a long way to go before silver catches up with gold. If we get back to 12 : 1 silver to gold ratio, that is $325 silver, however, most people believe that we will see silver go 1:1 with gold

I know that those people who bought silver at $5 an ounce, then $20 an ounce, then $50 an ounce, then $30, then 20 and back to $30 will think that $50 an ounce is a really high price to pay. But so many indicators say that silver is going to $100s per ounce, maybe $1000s per ounce. On that, continuing to buy silver is a good investment.

However, if it is the end of silver manipulation, than stack dollars, as in real green paper may be a good idea. As, after the riggers lose control, then it isn't long before bank closures/failures. And, at that point, for a while, cash will be king.

I hope that you have already purchased a good stack of silver. And then, all there is, is too wait until people get desperate to buy silver. Silver will be declared a national strategic metal, however it will be hard to confiscate, and there will be a lot of manufacturers who will be buying directly from the people, and so, the govern-cement won't have a good ability to control or regulate silver or its price.

All images in this post are my own original creations.