Nuclear and uranium stocks take a pounding - time to average down and go open-ended in a few uranium spots. More like a week for keeping the powder dry

Portfolio News

In a week where S&P 500 dropped 2.41% and Europe dropped 4.58%, my pension portfolio dropped a whopping 4.15% - the amount of the drop was almost equivalent to one full year of pension payments.

Big movers of the week were Tilray Brands (TLRY) (37.6%), Microequities Asset Management Group (MAM.AX) (16%), KEIWA (4251.T) (13.2%), Loop Industries (LOOP) (12.5%), Sarytogan Graphite (SGA.AX) (12.2%), Locksley Resources (LKY.AX) (12%)

With only 6 stocks in the big movers list we know what sort of week that was. AS for the big themes - marijuana and battery materials and rare earths have one stock each.

Might be the time to talk about the big movers down - maybe in sector terms - ASX uranium down 17.6% with Boss Energy (BOE.AX) down 49.8% on quarterly report and US stocks down 13.4% with 18 holdings dropping A$1k or more. Worst was NuScale Power Corp (SMR) down 14%. The 18 made up of nuclear tech (2 stocks and one options trade), uranium (8 stocks), internet services (1 stock), alternate energy (4 stocks and one options trade)

Markets have that overbought feeling. Response to the EU trade deal was muted and then more rumbling about tariffs and then the Fed did not cut rates and then a soft jobs report. Market decided Friday that the Federal Reserve should have cut rates and down she went again.

Crypto Bumbles

Bitcoin price pushed lower finishing the week 3.5% lower than the open with a peak to trough range of 6.2%.

Ethereum price pushed lower finishing the week 6.5% lower than the open with a peak to trough range of 14.2%. The bounce in buying from the lows was quite strong recovering more than half the drop

Something is happening in Litecoin land (LTCBTC) with price popping 17% vs BTC in 3 days.

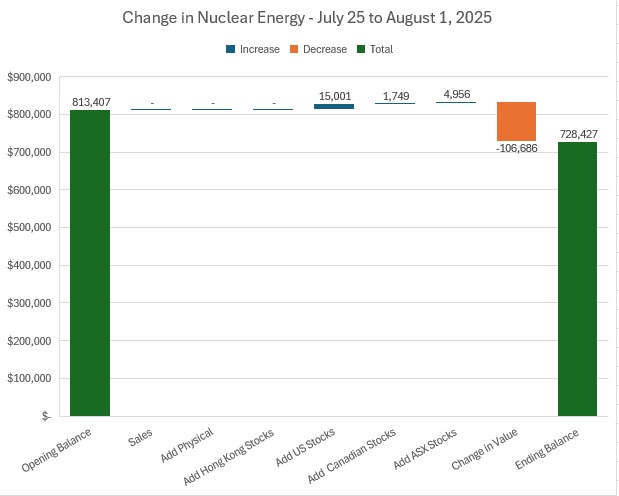

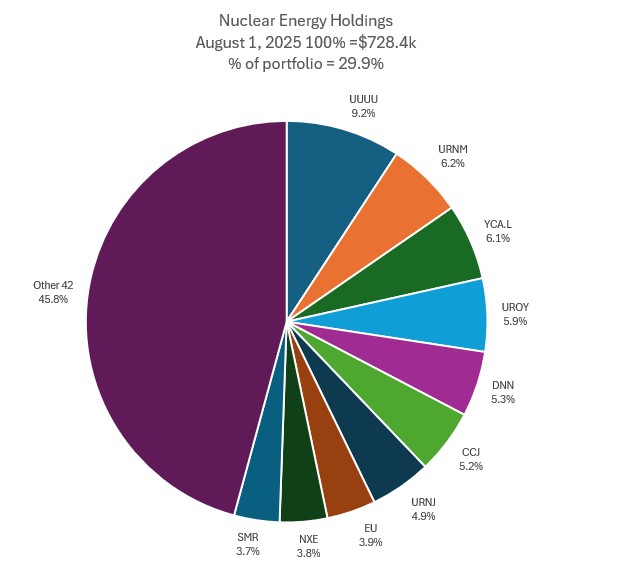

Nuclear Energy Holdings

A few stocks added in uranium sector but more telling is a 13% drop in valuations across 3 portfolios (not including drop in options valuations).

Mix changes sees Uranium Royalty Corp (UROY) drop two places into slot 4. Cameco Corporation (CCJ) rises 3 places into slot 6 pushing a few down a slot each. Share of portfolios drops just over a point to 29.9%

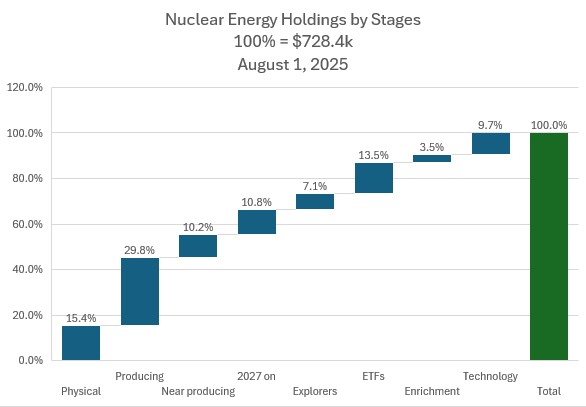

Small changes in the holdings by stage with the largest 0.6 points increase in Producing and 0.4 points increase in Explorers based on the additions in each stage.

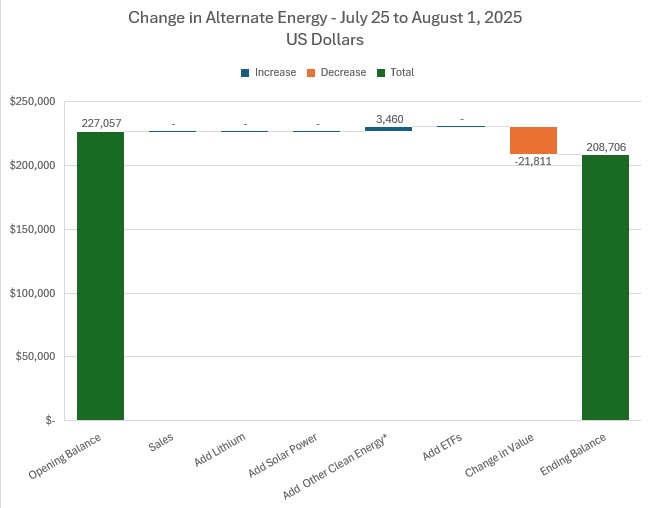

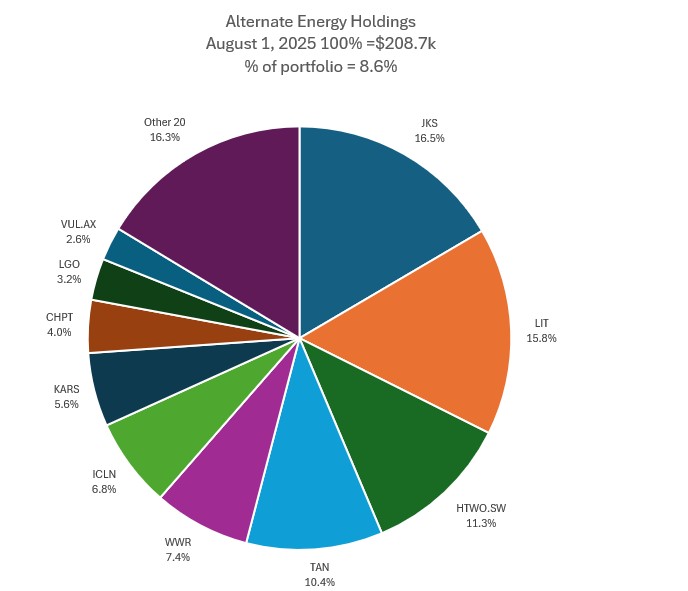

Alternate Energy Holdings

One modest add in other category and a bothersome 9.6% drop in valuations - a lot of that in the stock that was added.

One anomalous change in the mix of holdings with Leo Lithium (LLL.AX) coming into the Top 10 - stock remains suspended - stays at same value while the market falls. Share of portfolios drops half a point to 8.6%

Bought

Denison Mines Corp (DNN): Uranium. With price opening at $2.21 (Jul 28) put in place a January 2026/October 2025 2.5/2 diagonal ratio risk reversal. The ratio sold puts fully fund the call premium and offers breakeven of $2.45 on the call and $1.95 on the put with 10.5% price coverage should either side go to assignment. See the analysis of the same trade in TIB769

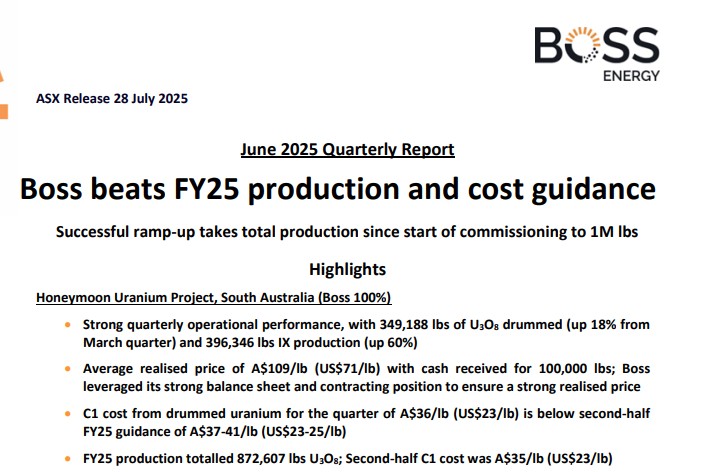

Boss Energy Limited (BOE.AX): Uranium.

Boss presented quarterly activities report - Honeymoon exceeds FY25 Guidance (production up, cost per lb down) - should be good for stock price

One paragraph in the quarterly presentation spooked markets

Now that Boss has been able to analyse the initial 12 months of actual performance and design for wellfields B1 to B5, and assess recent delineation drill results for wellfield development at East Kalkaroo (B6 to B9), Boss has identified potential challenges that may arise in achieving nameplate capacity as previously outlined in the EFS. This is largely due to the potential for less continuity of mineralisation and leachability.

My sense is the market over-reacted with a 40% drop - bought a few parcels to work the rebound - yes there is a potential drop in LOM lbs but the scale and cost of addressing that is uncertain. Markets hate uncertainty.

GoviEx Uranium Inc (GXU.V): Uranium. Pending order below market taken up in pension portfolio - pullback driven by Boss Energy (BOE.AX) story gives good openings to scale in or average down. Developing Muntanga project in Zambia with production expected from 2026.

SonicShares Global Shipping ETF (BOAT): Shipping. With agreement on EU-US trade deal figured that shipping rates could improve. Will get a jump once the China deal is done. Averaged down entry price in pension portfolio.

QuantumScape Corporation (QS): Battery Technology. Share price has been something of a rocket ship the past few weeks - then it all fell over. Am exposed to sold puts - currently 26% under water. Step one of the recovery plan - buy a parcel of stock to be able to average down should the sold puts go to assignment. Wrote covered call for 1.5% premium with 38.8% price coverage - written at strike stock will be assigned in at. This purchase appreciably higher than the tax loss sale in June.

Went digging - the chart shows a few things. Earnings released on July 23 were mildly positive - no downside surprises. Did find two articles. One is the questioning about the bubble - normal stuff. The other one is a note about insider stock sales by directors. That is what spooked the markets. Business has yet to show a profit.

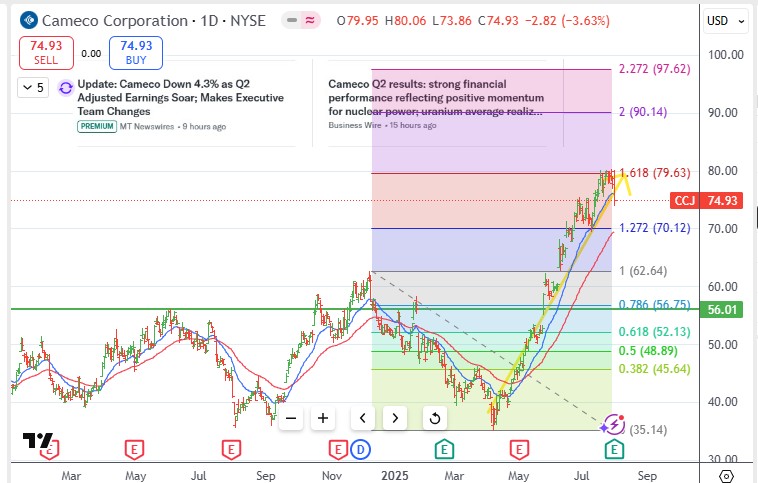

Cameco Corporation (CCJ): Uranium. Pending order hit in pension portfolio with price correcting after earnings. Had forgotten to close out the pending order when I set up a 75 strike sold put.

Analysts forecast Cameco would earn $0.52 per share in Canadian dollars in Q2, but the company actually earned C$0.71 -- more than five times last year's Q2 profit

Earnings were ahead of estimates - expectations for the rest of 2025 are solid too. order book is pricing better than spot market and spot market appears t have found support. What is wrong? Maybe go ahead of itself on valuations.

The chart would seem to support that with price reaching a key Fibonacci extension and with PE at 75 times. Have also overlaid a yellow arrow you might recall from previous charts - the size of the move in Centrus Energy (LEU) price

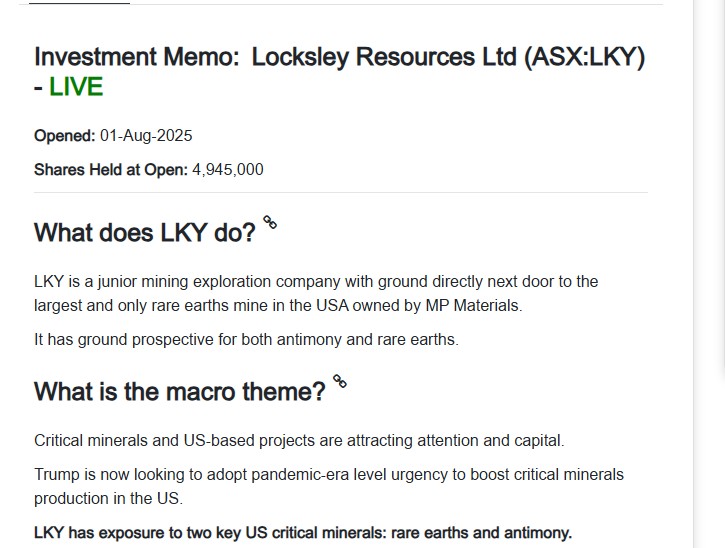

Locksley Resources (LKY.AX): Rare Earths. Next Investors idea to take a stake in this rare earths stock - exploring tenements close to MP Materials Corp (MP) tenements.

Stake idea is to ride the coattails of the DoD investment in MP. here is a quick summary I found about the stock

Now for a comparison chart with MP Materials (MP - the dark blue line) which goes back to the cycle low for MP. This shows that price has run somewhat in line with MP until trade time (the blue ray - 40 points ahead then) and surged after trade time. Feels like a good place to be at 53% up already.

Sold

No sales

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

Boss Energy Limited (BOE.AX): Uranium. Bent the rules for this portfolio and added a holding here without a signal - a holding for the very long run.

Top Ups

Helloworld Travel Ltd (HLO.AX): Travel Services. Dividend yield 9.58%. Helloworld operates primarily as a RV rental business in New Zealand but does have operations in Australia. Because of that NZ focus I had invested only half a position size.

Chart shows price collapsing on the earnings announcement after that first entry (the blue ray) and popping higher on forward guidance from the company (the text boxes). The double bottom off support from way back helps the trade confidence. I not also the shareholding in Webjet (WEB) which this portfolio also holds. Might dump this stock at breakeven and rely on Webjet.

Sold

Vanguard MSCI Index International Shares ETF (VGS.AX): International Index. Closed half the holding at 52 week high for 19.1% blended profit over first 4 trades in auto-invest from February 2024.

Income Trades

Covered Calls

A quiet week for writing covered calls with four only all US in two portfolios.

Naked Puts

No adds to the naked puts list other than the one for Denison above and the credit spreads below.

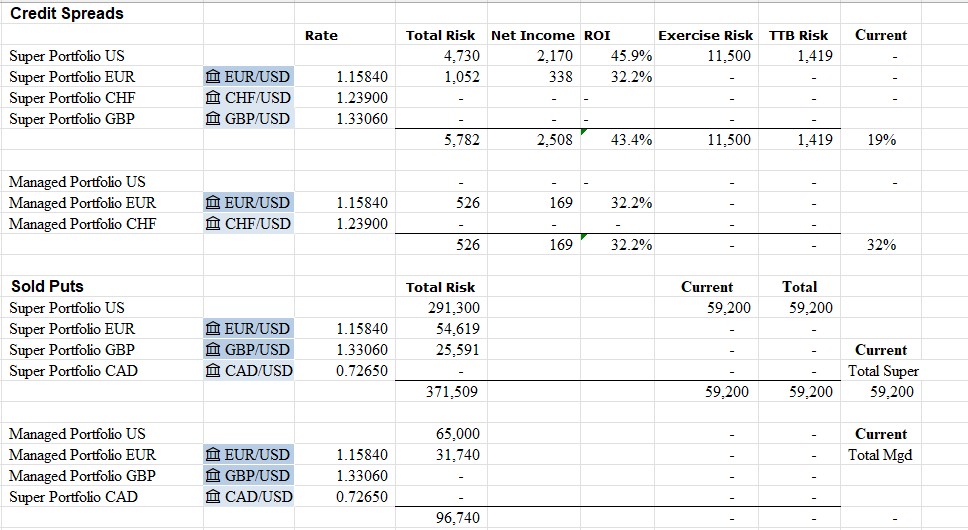

Credit Spreads

- VanEck Uranium and Nuclear ETF (NLR): Uranium. ROI 47.1% Coverage 3% - September expiry

- Alerian MLP ETF (AMLP): US Oil. ROI 17.6% Coverage 3.7%

- Dutch Bros Inc. (BROS): US Restaurants. ROI 30.9% Coverage 6%

- GE Vernova (GEV): Alternate Energy. ROI 53.8% Coverage 1.9% - a bit tight with a big ticker size.

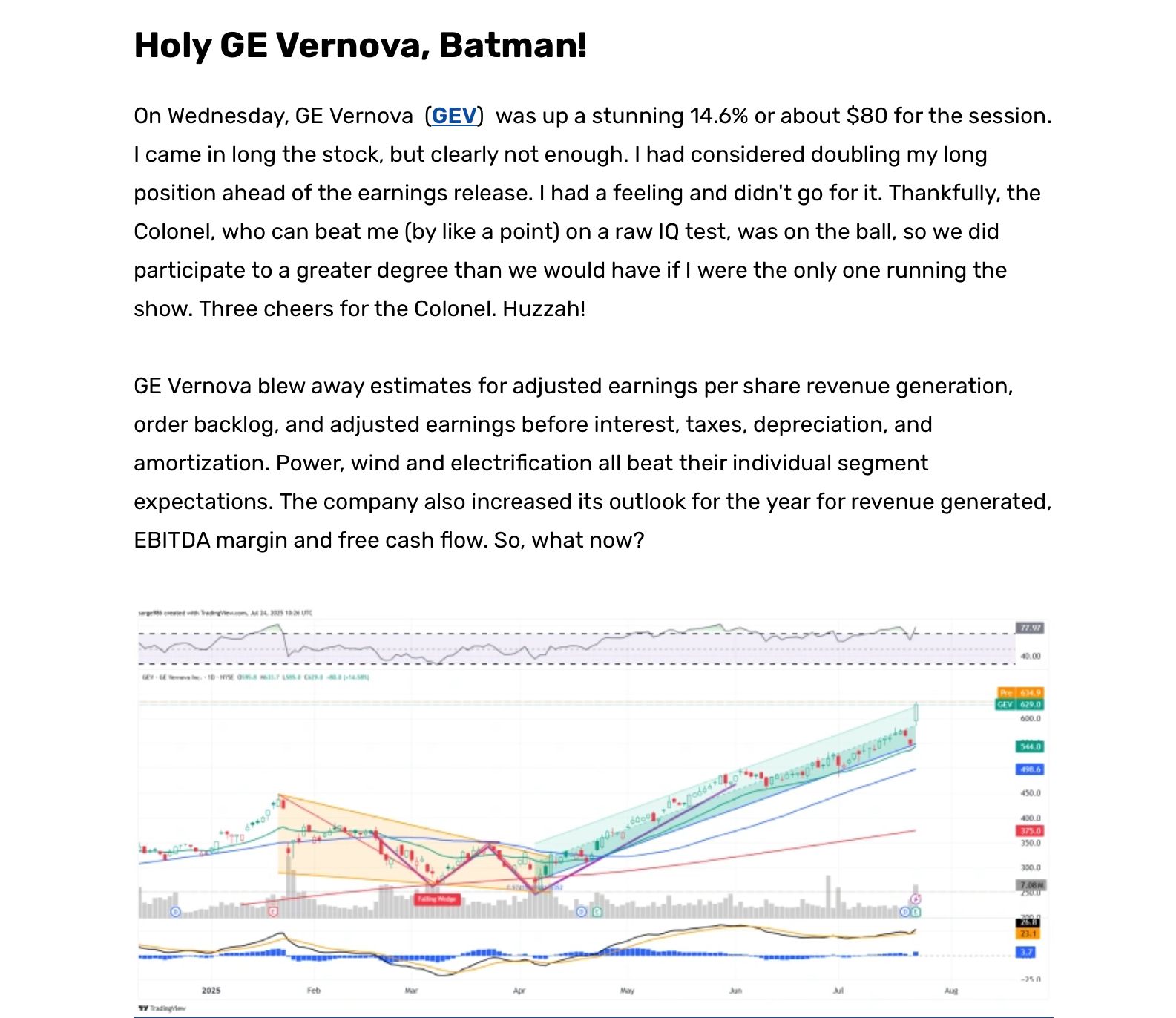

GE Vernova (GEV): Alternate Energy. Saw this article about price performance - that got me thinking

Because ticker price is a bit high to buy 100 shares to write covered calls have been using options trades to drive profits. Since September 2024, have done a few options trades, mostly credit spreads, and have generated 66% profits on capital deployed. Had I bought the stock on the first day profits would have been 189%. The key to doing this the credit spreads is to do them every month while one has conviction - did not do that (did 4 months out of the possible 11)

Exercise risk on the portfolios is well within cash margins though total risk on sold puts is looking a bit uncomfortable. Looking for a market bounce on August 4 to cheer that up a bit.

Resources

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

July 28 - August 1, 2025