Checked stocks in France - picked a few targets there. Added one more rare earths play. And a better week in nuclear and alternate energy

Portfolio News

In a week where S&P 500 rose 2.49% and Europe rose 3.15%, my pension portfolio rose 2.27%. Largest single drag was stock holding and call options on NuScale Power Corp (SMR) down 11.4%

Big movers of the week were AdAlta (1AD.AX) (50%), Curaleaf Holdings (CURA.TO) (42.8%), Coeur Mining (CDE) (34.2%), Blue Star Helium (BNL.AX) (33.3%), Locksley Resources (LKY.AX) (32.1%), Solis Minerals (SLM.AX) (29.3%), SSR Mining (SSRM) (25.8%), Azincourt Energy (AAZ.V) (25%), Panther Metals (PNT.AX) (25%), Northern Dynasty Minerals (NAK) (20.3%), Sun Silver (SS1.AX) (19.7%), Stroud Resources (SDR.V) (18.7%), Pan American Silver (PAAS) (18.2%), Sayona Mining (SYA.AX) (18.2%), Northern Star Resources (NST.AX) (18.2%), Cronos Group (CRON) (17.9%), Canopy Growth Corporation (WEED.TO) (17.8%), American Rare Earths (ARR.AX) (17.5%), Uranium Energy Corp (UEC) (17.4%), ChargePoint Holdings (CHPT) (16.8%), Lynas Rare Earths (LYC.AX) (16.7%), Titan Minerals (TTM.AX) (16.7%), Pilbara Minerals (PLS.AX)(15.6%), Iluka Resources (ILU.AX) (15.4%), Tilray Brands (TLRY) (14.1%), Mineral Resources (MIN.AX) (13.8%), Snow Lake Resources (LITM) (13.6%), Kairos Minerals (KAI.AX) (13%), IsoEnergy (ISO.TO) (12.8%), Stanmore Resources (SMR.AX) (12.7%), Healius (HLS.AX) (11.9%), Arafura Rare Earths (ARU.AX) (11.4%), 3D Systems Corporation (DDD) (11.2%), Beach Energy (BPT.AX) (11%), Cettire (CTT.AX) (10.9%), VanEck Gold Miners ETF (GDX)(10.7%)

36 stocks in the big movers week - a rebound after the messy week the week before. There are some threads emerging in the big themes - rebound and recovery. From the top - marijuana (4 stocks), silver/gold mining (9 stocks), rare earths (4 stocks), alternate energy - mostly materials (6 stocks), uranium (4 stocks). What is clear is commodity markets are moving.

Statements like this from Donald Trump moves markets - 4 stocks in the big movers list

Markets wanted to move higher on solid earnings but did get jittery on poor services report mid-week and then reached for records

Crypto booms

While we are on the topics of "statements like this" - this one for crypt0 markets

Bitcoin price sagged a bit and then pushed higher hard finishing the week 6.2% higher than the open with a trough to peak range of 8.3%.

Ethereum price pushed higher finishing the week 21.7% higher than the open with a trough to peak range of 22.5% (see green label on right for code ETHUSDT)

Some big moves in altcoins - Aave (AAVE) the lending protocol up 24%

Chainlink (LINK) popping 41%

And Avax (AVAX) up 15% against BTC making that a move over 20%

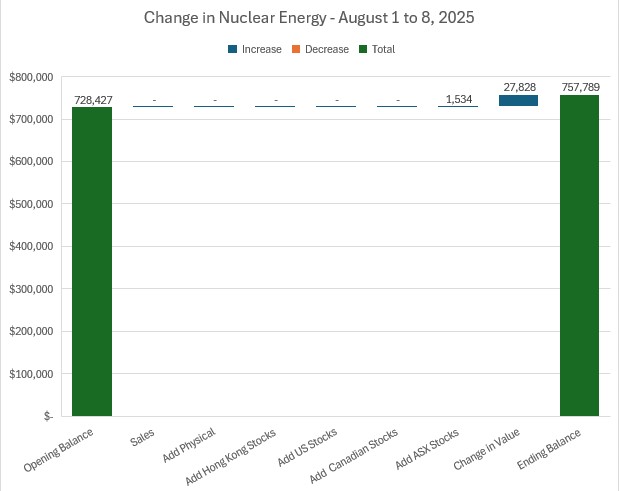

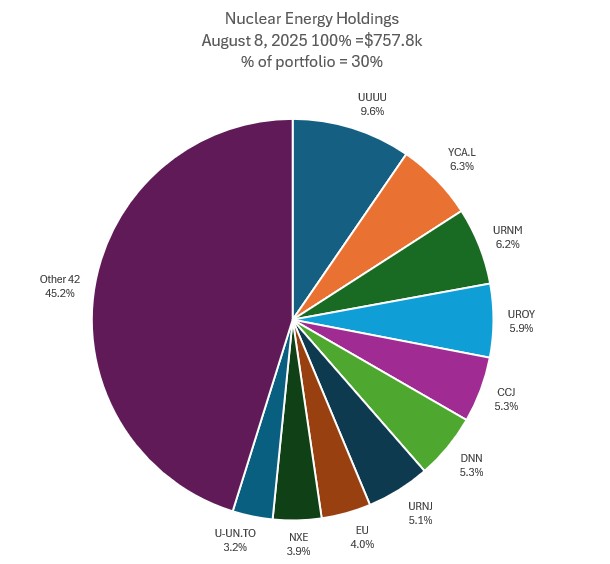

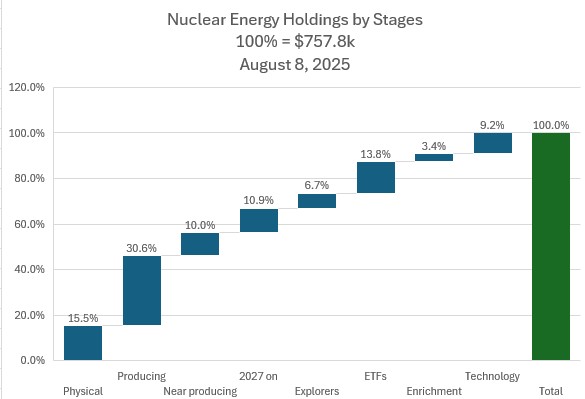

Nuclear Energy Holdings

One stock add plus auto-invest in a quiet week with a recovering 3.8% increase in valuations.

A few changes in the mix of holdings Yellow Cake plc (YCA.L) moves up one place into slot 2. Sprott Physical Uranium Trust Fund (U-UN.TO) moves into the Top 10 displacing NuScale Power Corp (SMR). Cameco Corporation (CCJ) and Denison Mines Corp. (DNN) swap places in the middle. Share of portfolios edges up to touch 30%

Biggest change in holdings by stage is 0.8 points jump in Producing - this feels like the sweet spot in a sideways spot market.

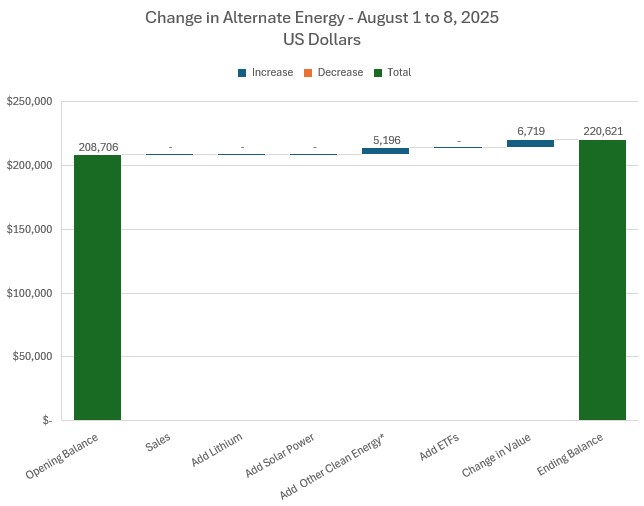

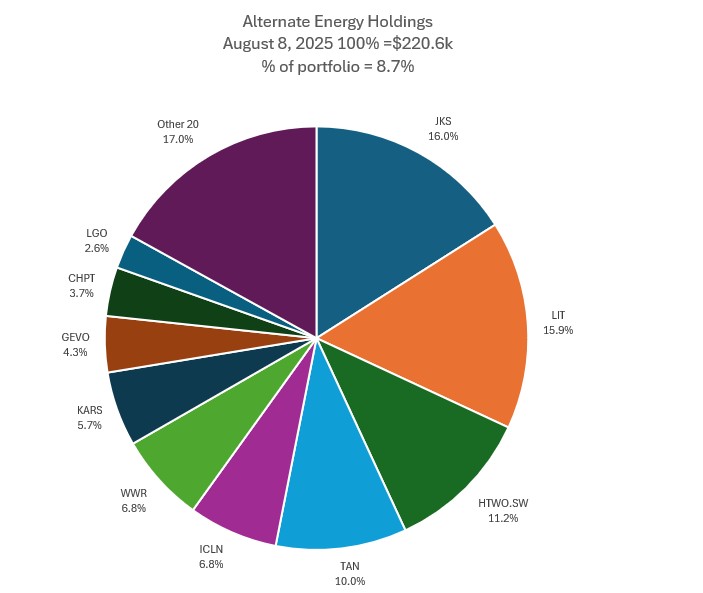

Alternate Energy Holdings

One addition to holdings and a 3.2% jump in valuations

The addition sees Gevo Inc (GEVO) come into Top 10 in slot 8. iShares Global Clean Energy ETF (ICLN) and Westwater Resources, Inc. (WWR) swap places in the middle. Largo (LGO) drops a place and Vulcan Resources (VUL.AX) drops out the Top 10. Share of portfolios goes up a little to 8.7%

Bought

Dateline Resources (DTR.AX): Rare Earths. After getting the Next Investors for Locksley Resources Limited (LKY.AX) put in a pending order for this stock - there tenements are closely located

The Company owns 100% of the Colosseum Gold-REE Project. The Colosseum Mine is in the Walker Lane Trend in East San Bernardino County, California. Situated less than 10km north of the Mountain Pass Mine, USA’s only operating rare earth mine, owned by MP Materials.

https://www.datelineresources.com.au/

The charts look a bit similar - also outperforming MP materials (MP) whose Mountain Pass mine is already producing. This trade went in below the market same day as the other - had to wait out the weekend to get hit. More like an options trade than an investment in USA critical materials. See TIB770 for the Locksley Resources (LKY.AX) chart

Saw a tweet suggesting a few French stocks trading well below other European peers. Have listed the current valuation stats behind each stock chosen. For context my stock screens look for price to sales (P/S) below 2, price to book (P/B) below 1 and price to earnings (PE) below 10. Both stocks are below. They have not made screens as they are not showing one month highs = so these trades could be a bit early. I am figuring a US trade deal has to drag French stocks up.

Carrefour SA (CA.PA): French Supermarket. Dividend yield 7.40%. PE 7.42 P/S 0.09 P/B 0.85 Wrote covered call for 1.2% premium with 5.8% price coverage.

Business has been plagued with under-performing assets in Italy and Brazil. Earnings reported on July 25 include sale of Italy business - maybe better times ahead. Chart shows 50% profit possible to get back to 2023 highs. One more comparison chart

Added in iShares France ETF (EWQ - blue line) and one UK supermarket, Tesco (TSCO - purple line). Get back halfway and an easy 35% profit target hit.

Note: I chose to ignore Casino-Guichard (CO.PA) - looks like a basket case.

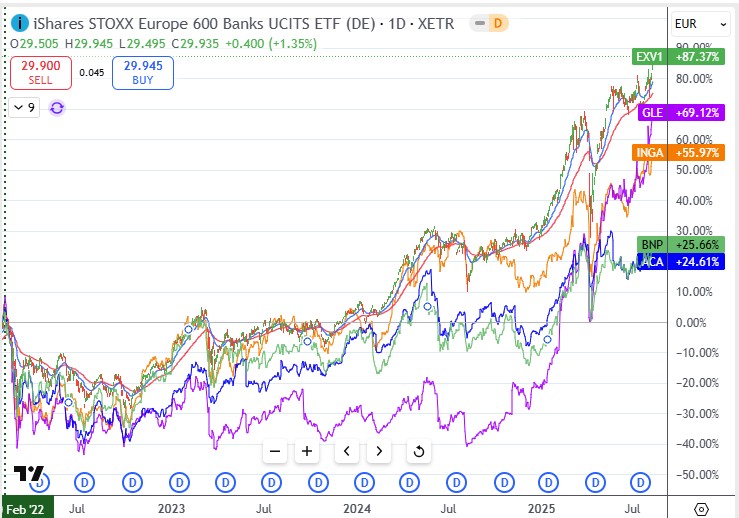

Credit Agricole (ACA.PA): French Bank. Dividend yield 6.76%. PE 7.04 P/S 1.77 P/B 0.65. Had a look at the relatives for two banks and picked this one as it was trading the furthest from 52 week high. Wrote covered call for 0.9% premium with 4.7% price coverage.

Did the relative chart work afterwards to confirm the instinct - the two banks that were on the suggested list are the laggards (blue line and green line) compared with European banking ETF (EV1.DE - the bars). Added in also Ing Groep (INGA.AS - the orange line) which I hold.

Ultragenyx Pharmaceutical (RARE): US Pharmaceuticals. Price has been hammered over the last few months - added a parcel to pension portfolio - already hold this in one other portfolio as a TSP covered call idea. Earnings were solid

What struck me was a broker overweight rating and a target price cut from $112 to $105 - even if they are 50% wrong stock will make a better than 50% return.

Wrote covered call for 0.89% premium with 7.6% price coverage - not bad for just over a week to expiry.

Silex Systems (SLX.AX): Uranium Enrichment. Announced a placement and share purchase plan which tanked price around 15% down toward placement price. Bought a parcel of stock in pension portfolio to scale in at a price just below placement price. Not sure my broker for the existing holding will process the Share Purchase Plan entitlement - need to check.

Gevo, Inc (GEVO): Specialty Chemicals. Assigned on sold put at expiry. Timing could be poor with earnings due August 11. Breakeven $1.30 vs $1.18 close (Aug 8). Overall trades in the stock remain profitable despite this gap - there are sold puts still open at a lower strike. Have not taken those into the calculations.

Sold

No sales

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

Top Ups

Endeavour Group Limited (EDV.AX): Beverages. Dividend yield 4.90%

Price popped stock onto screens on news of Chairman resigning. Gives a chance to average down and hope for a recovery. Chart shows price trying a few times to break up and failing each time - maybe this 4th time will be the one. Beverages business is facing tough times with inflation steering patrons away from pubs.

Grange Resources Limited (GRR.AX): Base Metals. Dividend yield 2.60%

Chart shows price in a steady decline after the first entry (blue ray) with two attempts to reverse and then forming a double bottom. Rising commodity sentiment is needed.

AutoInvest

$600 spread across 4 uranium stocks, one gold ETF and two index ETFs

Uranium

- Silex Systems Limited (SLX.AX): Uranium.

- Global X Uranium ETF AUD (ATOM.AX): Uranium.

- Deep Yellow Limited: Uranium.

- Elevate Uranium (ELV.AX): Uranium.

- Terra Uranium (T92.AX): Uranium.

Indexes

- VanEck Gold Miners ETF (GDX): Gold Mining. Yield 0.93%

- Vanguard Australian Shares Index ETF (VAS.AX): Australian Index. Yield 3.21%

- Vanguard MSCI Index International Shares ETF (VGS.AX): International Index. Yield 3.26%

Income Trades

Covered Calls

Four covered calls written - all in pension portfolio (Europe 2 US 2).

Naked Puts

A few sold puts on stocks happy to own at lower prices

- Crédit Agricole S.A. (ACA.PA): French Bank. Return 0.96% Coverage 5.1%

- Gevo, Inc. (GEVO): Specialty Chemicals. Return 2.5% Coverage 16.5%

Kicked the can down the road on one sold put to preserve capital

- Builders FirstSource (BLDR): Building Products. 47.8% profit on buyback. 1.9% cash negative - down a strike.

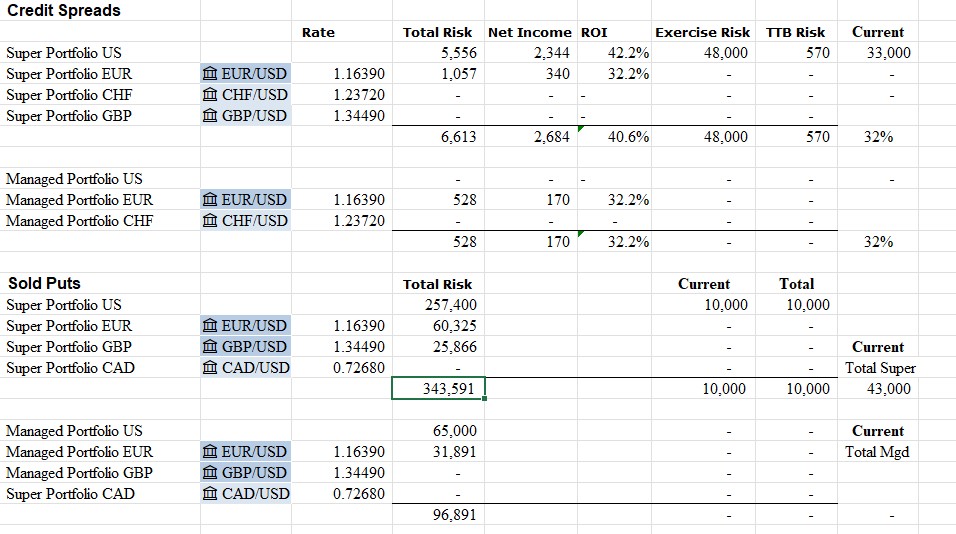

Credit Spreads

Two credit spreads expired out-the-money (i.e., in profit)

- The TJX Companies (TJX): US Retail. ROI 34.7%

- iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. ROI 51.1%

Of the remaining August expiry spreads in pension portfolio, one is trading in-the-money but close to sold strike and one through the bottom.

Exercise risk is well within the cash margins - will let the two big ones go to assignment s they are stocks I am happy to hold. You will see those inthe next report.

Resources

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

August 4-8, 2025