A week for sitting back. Added a few nuclear power ideas and adjusted a few sold options positions and trades

Portfolio News

In a week where S&P 500 rose 1.57% and Europe rose 1.01%, my pension portfolio rose 1.67%. Heavy lifting done by nuclear tech stocks and options contracts on uranium and a few Canadian commodity stocks (uranium, nickel, gold) and the Japanese stock in the list below.

Big movers of the week were Locksley Resources (LKY.AX) (96%), Fortuna Metals (FUN.AX) (74.6%), Grand Gulf Energy (GGE.AX) (50%), Mandom Corporation (4917.T) (39.7%), Core Nickel Corp (CNCO.V) (33.3%), Standard Uranium (STND.V) (30%), QuantumScape Corporation (QS) (26.9%), Lightning Minerals (L1M.AX) (26.2%), St George Mining (SGQ.AX) (25.4%), Cauldron Energy (CXU.AX) (22.2%), TechGen Metals (TG1.AX) (20%), Oklo Inc (OKLO) (18.5%), Aeris Resources (AIS.AX) (17.2%), Blue Star Helium (BNL.AX) (16.7%), 29Metals (29M.AX) (16%), Premier American Uranium (PUR.V) (13.6%), Cettire (CTT.AX) (13%), Global Atomic Corporation (GLO.TO) (12.7%), Bayhorse Silver (BHS.V) (12.5%), CleanSpark (CLSK) (12%), Atos (ATO.PA) (11.1%), Kaiser Reef (KAU.AX) (11.1%), Elixir Energy Limited (EXR.AX) (10%)

22 stocks in the big movers list - feels like a small number but there are some key things happening in the big themes. From the top - rare earths (3 stocks), alternate energy (3 stocks), uranium/nuclear (5 stocks), gold/silver mining (6 stocks). Notable are to helium stocks in the list. Always good to see stocks in the big movers list after buying them. Little doubt that commodity markets are starting to fire up.

US markets kept pressing the up button with indices taking turns to make new highs - last day of the week was a small pullback ahead of Fed nerves

Crypto Bounces

Bitcoin price pushed higher finishing the week 3.7% higher than the open with a trough to peak range of 5.4%.

Ethereum price pushed higher and then gave almost half away finishing the week 7.2% higher than the open with a trough to peak range of 11.3%.

Binance Coin(BNB) moved up the same way without giving back with a 9.8% pop - following higher in the new week after indicating they are close to closing a DoJ case.

Solana (SOL) pops 25% position itself as a key transactions token

Avax (AVAXBTC) pops 22% vs Bitcoin on talk of being added to the ETF generation

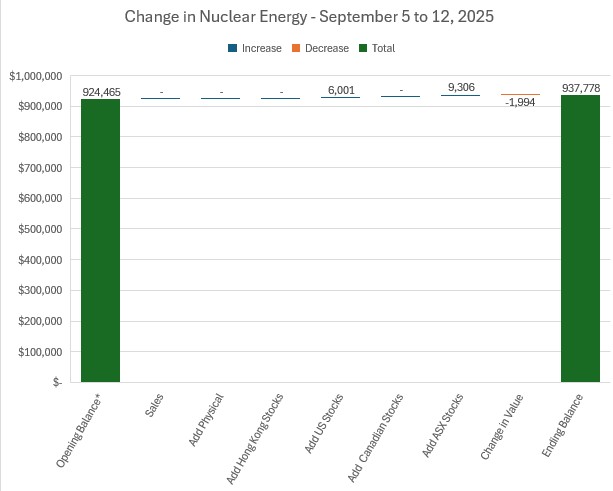

Nuclear Energy Holdings

A few additions in the week and a 0.22% drop in valuations - the big move up in options contracts is not reflected in these numbers.

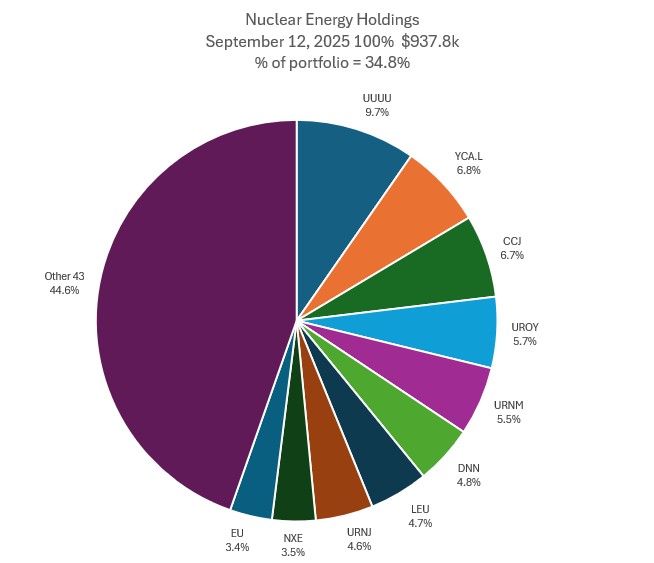

Only one change in the mix of holdings with Centrus Energy (LEU) swapping places with Sprott Junior Uranium Miners ETF (URNJ) in slots 7 and 8. Share of portfolios pops up 0.4 points to 34.8%

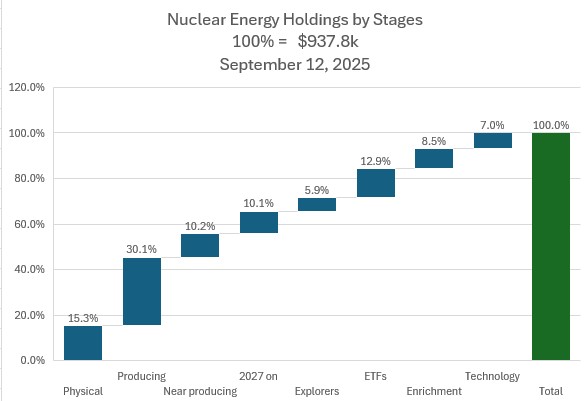

Holdings by Stage is changed by the additions with Enrichment going up 1.2 points and ETFs going up 0.4 points. Increase in Technology valuations sees it go up 0.4 points also.

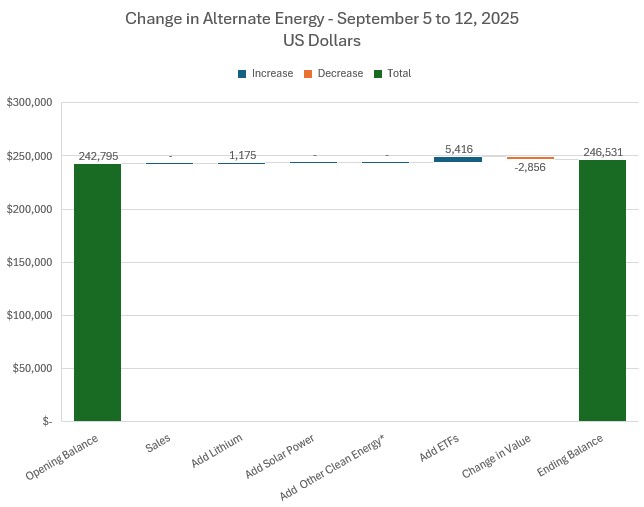

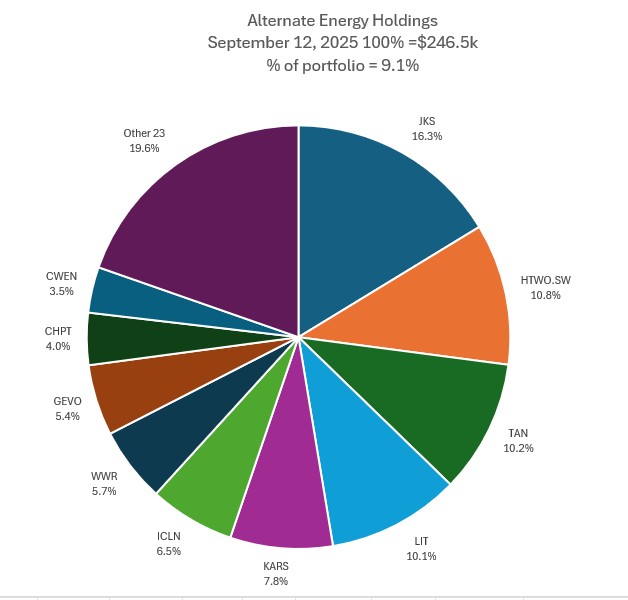

Alternate Energy Holdings

Two changes in alternate energy portfolio and 1.2% drop in valuations.

Mix of holdings sees L&G Hydrogen Economy UCITS ETF (HTWO.SW) and Invesco Solar ETF (TAN) swap places in slots 2 and 3. KraneShares Electric Vehicles and Future Mobility Index ETF (KARS) rises two places on the addition there into slot 5. Everything else ranks the same. Share of portfolios drops a little to 9.1% (rounding drop)

Bought

Core Nickel Corp (CNCO.V): Base Metals. Partial fills on pending order with stock making big movers list last week.

Silex Systems (SLX.AX): Uranium Enrichment. Took up allocation in SPP - got a VWAP price just below offer price of $3.90.

TechGen Metals (TG1.AX): Gold Mining. Took up allocation in SPP - a big move between record date and SPP closing date - tidy profit bankable and options available too at a strike only 20% above $0.03 close (Sep 9)

KraneShares Electric Vehicles and Future Mobility Index ETF (KARS): Electric Vehicles. With Tesla (TSLA) recovering after a sell off added to holding in this ETF - replacing a portion of holindg taht could be assigned on a covered call.

Snow Lake Resources (LITM): Lithium/Uranium. Snow Lake completed acquisition of tranche in GTI Energy (now called American Uranium) - averaged down entry price in sp.

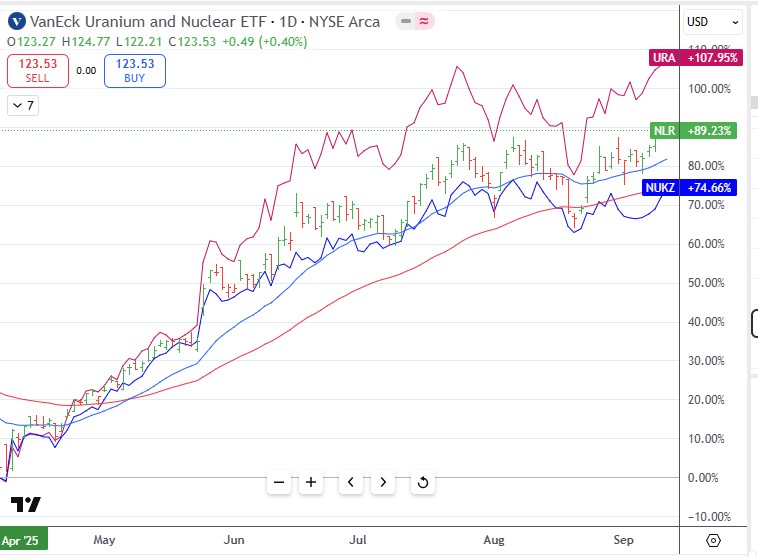

Range Nuclear Renaissance ETF (NUKZ): Nuclear Power. Likely that holding in VanEck Uranium and Nuclear ETF (NLR) will get assigned on a covered call. Bought a replacement parcel of this ETF - it is lagging.

NexGen Energy (NXE): Uranium. With price opening at $7.88 (Sep 10), there is a chance covered call will go to assignment on this long held stock. The pricing momentum suggests it is time to look for a longer dated options idea. Put in place a January 27/March 26 10/15/7 call spread risk reversal. With a net premium of $0.87 the 10/15 call spread offers maximum profit potential of 477% for a 90% price move. Can the stock move 90% in 15 months? Get approvals for Arrow development and it will do 4 times that - not a prediction. The sold put (7) with a closer in expiry partly funds the spread premium and levers up maximum profit potnetials to 3077% with 11.2% price coverage. Breakeven should to sold put go to assignment is $7.17.

Let's look at the chart which shows the bought call (10) as a blue ray and the sold call (15) as a red ray and the sold put (7) as a dotted red ray with the expiry dates the dotted green lines on the right margin. Price had almost retraced back to the 2024 lows - so am using the Elliot curve formed then (the zig zag) and cloned that across to the current move. This will get the trade close to in-the-money but could run out of steam. Let's say it does that - and corrects in the same way as we saw in late 2024 - have placed the blue arrow price scenario at a similar 0.618 Fibonacci retracement level. This suggests that trade needs a bigger move to go in-the-money but should stay comfortably above the sold put. Will be selling another put around the March expiry to make the call spread a free trade.

News flow for that NexGen announced a significant uranium discovery at the Patterson Corridor East. The company has discovered intense, high-grade uranium at a depth of just 454.5 meters, marking the shallowest intersection. Still years away from production - maybe 2031.

[Means: Call Spread Risk Reversal. Buy a bull call spread and fund the premium by selling an out-the-money put option below the strikes for the call spread]

Sold

Mandom Corporation (4917.T): Japan Consumer Products. Price popped on announcement of management buyout by Kalon Holdings, a Vietnamese entity. Have learned over time to take the exits when these come along. Partial fill on sell order for 44.6% profit since February 2024. Stock screen idea.

https://www.mandom.co.jp/en/release/pdf/2025091001_en.pdf

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

Sold

NRW Holdings (NWH.AX): Mining Services. Closed above profit target for 46% profit since June 2025. Price had moved fast - had my eye off setting up the sell order just short of 52 week high.

Shorts

Pfizer Inc (PFE): US Pharmaceuticals. Pressure is building from US Health Secretary on the vaccine producers. Scaled into November 23/21 ratio put spread. Ratio was not quite enough to cover the cost of bought put. Still 6.7% to go from the $24.55 open (Sep 9) to go in-the-money. Ever hopeful.

Income Trades

Covered Calls

Only 2 covered calls written in two portfolios - both US. Was a week for sold puts.

Loop Industries (LOOP): Specialty Chemicals. Finger trouble trade - sold 124 contracts instead of 24. Could be ugly with price jumping 10% to $2.06 close - still 21% away with 9 days to go

Naked Puts

Sold puts on stocks likely to be assigned on covered calls: - KraneShares Electric Vehicles and Future Mobility Index ETF (KARS): Electric Vehicles. Return 0.8% Coverage 10.6% - Dutch Bros Inc. (BROS): US Restaurants. Return 2.9% Coverage 9.4% - Clearway Energy, Inc. (CWEN): Alternate Energy. Return 0.48% Coverage 14.9% - Barrick Mining Corporation (B): Gold Mining. Return 1.55% Coverage 1.7% - Cameco Corporation (CCJ): Uranium. Return 1.2% Coverage 13.5% - VanEck Uranium and Nuclear ETF (NLR): Nuclear Power. Return 3.08% Coverage 2.9% - Coeur Mining, Inc. (CDE): Silver Mining. Return 3.27% Coverage 2.5% - iShares MSCI Emerging Markets ex China ETF (EMXC): Emerging Markets. Return 0.69% Coverage 2.3% - Range Nuclear Renaissance ETF (NUKZ): Nuclear Power. Return 2.07% Coverage 4.4%

Sold puts on stock happy to own at lower prices - October expiry - Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Return 0.7% Coverage 10% - enCore Energy Corp. (EU): Uranium. Return 3% Coverage 17%

Kicked the can down the road on sold put to preserve capital - Invesco Solar ETF (TAN): Solar Power. 74% loss on the buy back. 33% cash positive

Credit Spreads

Advanced Micro Devices (AMD): US Semiconductors. With price opening at $152.04 (Sep 9), 160/155 credit spread has traded TTB. My sense is market had over-reacted to Trump threats about chip manufacturing in US - interested to keep the sold put running. Sold the bought put (155) for 30% profit and kicked the can down the road on the sold put (160). Did look at going down a strike - chose not to. Incurs 47% loss on buy back and 36% cash positive on the new sale.