Uranium and nuclear stocks made the big moves dragging a swathe of covered calls to assignment - never seen moves like this.

Portfolio News

In a week where S&P 500 rose 0.96% and Europe dropped 0.29%, my pension portfolio rose a staggering 4.45%. The work on asymmetric returns has come - all down to nuclear tech, uranium and gold/silver mining - in that order.

Big movers of the week were Oklo Inc. (OKLO) (63.5%), Silex Systems (SLX.AX) (47.2%), NANO Nuclear Energy (NNE) (40.1%), Peninsula Energy (PEN.AX) (37.9%), QuantumScape Corporation (QS) (34.9%), GoviEx Uranium (GXU.V) (33.3%), Anfield Energy (AEC.V) (31.8%), CleanSpark (CLSK) (31.6%), Lightbridge Corporation (LTBR) (30.7%), NuScale Power Corporation (SMR) (28.7%), St George Mining (SGQ.AX) (28.4%), Vulcan Energy Resources (VUL.AX) (25.9%), enCore Energy Corp (EU) (25.1%), Energy Fuels (UUUU) (24.6%), Dateline Resources (DTR.AX) (23.1%), Locksley Resources (LKY.AX) (21.4%), Gevo (GEVO) (21%), Cauldron Energy (CXU.AX) (18.2%), Uranium Royalty Corp (UROY) (18.1%), Global X Uranium ETF (URA) (17.6%), PZ Cussons (PZC.L) (17.5%), Pilbara Minerals (PLS.AX) (16.7%), Global Atomic Corporation (GLO.TO) (16.1%), Kairos Minerals (KAI.AX) (16%), Aura Energy (AEE.AX) (15.9%), Cettire (CTT.AX) (15.8%), Pantera Lithium (PFE.AX) (15.8%), NexGen Energy (NXE) (15.5%), New Frontier Minerals (NFM.AX) (15.4%), Sprott Junior Uranium Miners ETF (URNJ) (14.8%), Fortuna Metals (FUN.AX) (14.6%), Lotus Resources (LOT.AX) (13.9%), Barrick Mining Corporation (B) (13.6%), Lifeist Wellness (LFST.V) (13.3%), Alligator Energy (AGE.AX) (13%), Ur-Energy (URG) (13%), Denison Mines Corp (DNN) (12.7%), Largo (LGO) (12.7%), IsoEnergy (ISO.TO) (12.5%), Zinc of Ireland (ZMI.AX) (12.5%), ASP Isotopes (ASPI) (12.4%), Coeur Mining (CDE) (12.2%), VanEck Uranium and Nuclear ETF (NLR) (12.2%), Sprott Uranium Miners ETF (URNM) (12.1%), Elevate Uranium (EL8.AX) (12.1%), Atha Energy Corp (SASK.V) (12%), Sigma Lithium Corporation (SGML) (12%), Fiverr International (FVRR) (11.8%), Boss Energy (BOE.AX) (11.7%), Stanmore Resources (SMR.AX) (11.1%), Whitehaven Coal (WHC.AX) (10.8%), AIC Mines (A1M.AX) (10.4%), Cameco Corporation (CCJ) (10.3%)

A monster 53 stocks in the big movers list with a huge swell in commodities. From the top it looks like a nuclear and uranium power up - nuclear/uranium (29 stocks), alternate energy (8 stocks), rare earths (5 stocks), gold/silver mining (3 stocks), marijuana (1 stock). Interesting to see 2 coal stocks in there.

US markets waited nervously for Federal Reserve meeting and then got a little nervous about the rhetoric - maybe not enough cuts. And then in the next two days forgot all about that and made records - even Russell 2000 making a record.

Crypto Drifts

Bitcoin price pushed higher and then fell over finishing the week 2.7% lower than the open with a peak to trough range of 5.2%.

Ethereum price drifted lower to start and tried to recover but failed finishing the week 6.3% lower than the open with a peak to trough range of 8.4%.

Binance Coin (BNB) kept the momentum from last week running with another 20% climb.

Solana (SOL) did much the same with a 20% rise but giving most away in the first days of the new week

Avax (AVAXBTC) kept building momentum on its new treasury build rising 23% on the week and bouncing back higher after a selloff

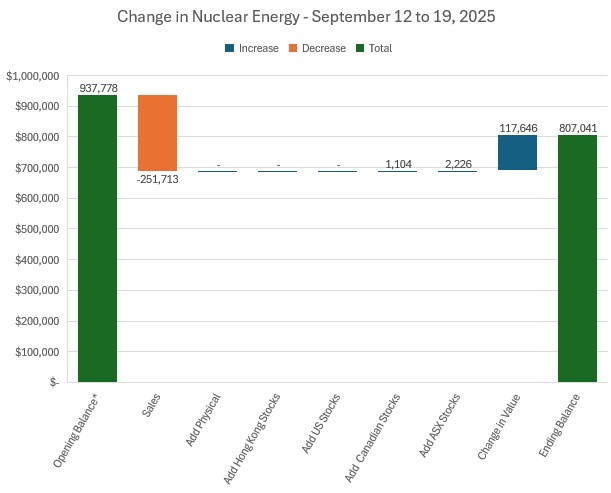

Nuclear Energy Holdings

A massive week through options expiry with $250k assigned and a 12.6% jump in valuations. Got to say I was never planning on holdings in uranium reaching $1 million but it did.

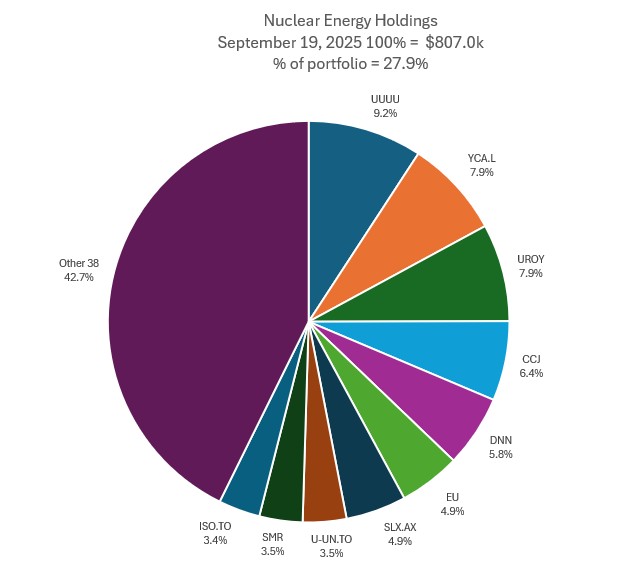

Big changes in the mix of holdings with share of portfolios dropping 7 points to 27.9%. Cameco Corporation (CCJ) drops a place to slot 4. The two Sprott Uranium mining ETFs (URNM and URNJ) and Centrus Energy (LEU) drop out with the sales there. encore Energy rises 4 places into slot 6. 4 new entrants to top 10 with Silex Systems (SLX.AX) in slot 7, Sprott Physical Uranium Trust Fund (U-U.TO) in slot 8, NuScale Power Corporation (SMR) in slot 9 and IsoEnergy Ltd. (ISO.TO) in slot 10. Share of holdings drops to 27.9% - more in line with planned 25% target. Number of Others drops 5 to 38 with a share of 42.7%. The plan going forward to get this looking more like an ETF with the Top 15 accounting for around 85%.

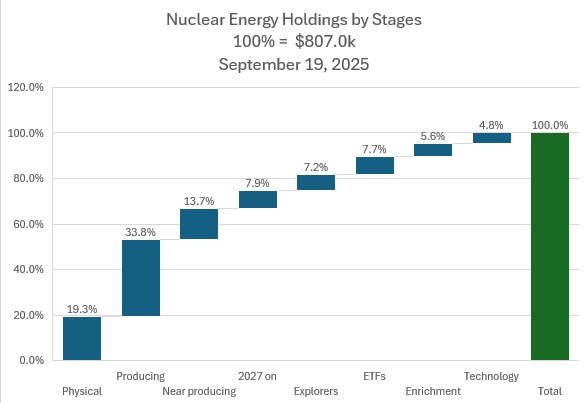

The big changes in holdings by Stage - 4 point jump in Physical, 2.7 point jump in Producing despite the sales there, 3.5 point jump in Near Producing, 2.3 point drop in 2027 on with the sale of NexGen (NXE), 1.3 point jump in Explorers mostly on value changes, over 5 points drop in ETF's with the sales there, 2.9 point drop in Enrichment and 2.2 point drop in Technology. A lot of those drops are more than made up for increase in options values - not shown in these charts.

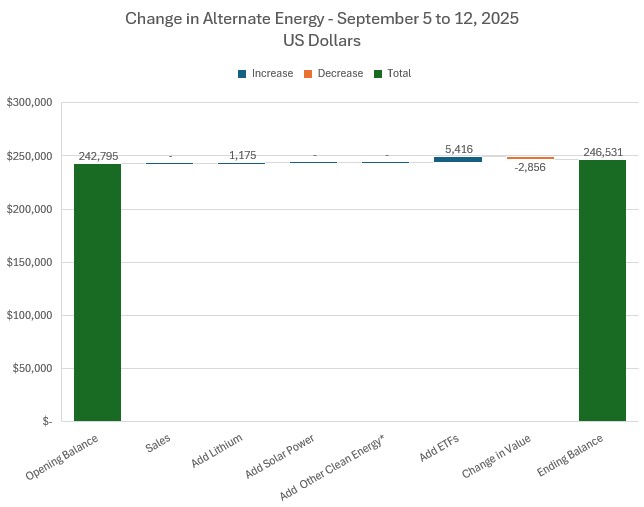

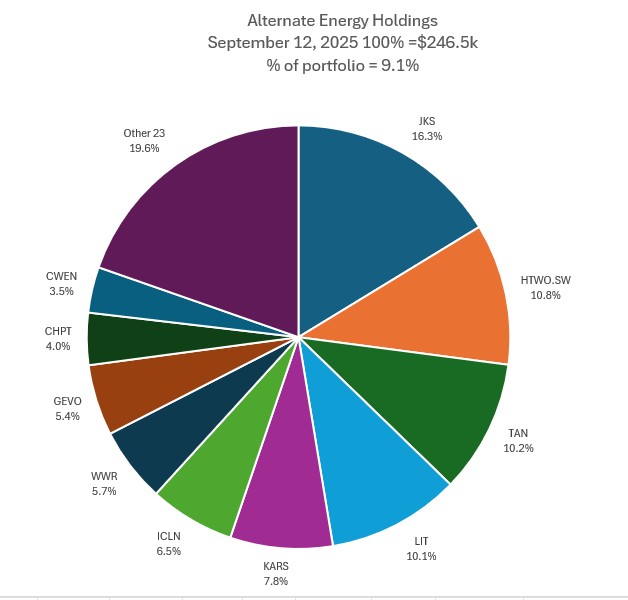

Alternate Energy Holdings

A few sales in lithium and electric vehicles with one replacement purchase - and a change in valuation of 6%

Share of portfolios drops 2 points to 7%. Mix of holdings changes with the two ETF's sold below dropping out of the Top 10 moving all below that up two places. iShares Clean Energy ETF (ICLN) jumps two places into slot 4. ChargePoint Holdings, Inc. (CHPT) and Clearway Energy, Inc. (CWEN) move up 3 places each into slots 6 and 7. Largo (LGO) and Sigma Lithium Corporation (SGML) and Vulcan Energy Resources Limited (VUL.AX) come into Top 10 in slots 8, 9, and 10. Number of Others drops 2 to 21 with a share of only 18.2%.

Bought

Tesla, Inc (TSLA): Electric Vehicles. Price started moving ahead of the weekend on news of Elon Musk buying more shares opening at $423.13 (Sep 15) and then trading lower in the first hour. Rather than do another credit spread (the one 310/300 expiring this week has offered a tidy 36% return for one month's work) put in place a January 2027/December 2025 420/520/400 call spread risk reversal. With a net premium of $30.64 this offers maximum profit potential of 226% for 22.9% price move. The sold put (400) fully funds the call spread premium with 5.5% price coverage. Breakeven should the sold put get assigned is $393.53. Now the obvious question is "why bother with 226% return over 16months when one could get 36% a month doing credit spreads?" It has to do with the fully funded bit - it is a free trade provided price stays above the sold put at expiry

Let's look at the chart which shows the bought call (420) as blue ray and the sold call (520) as a red ray and the sold put (400) as a dotted red ray with the expiry dates the dotted green lines on the right margin. This is something of a blue sky trade as price has not reached the sold call level (520) - closest is $480. Taking the left hand blue arrow price scenario (not the biggest possible move we have seen) and applying that after another 0.786 Fibonacci retracement, suggests this trade will not make the sold call (520) before expiry. The trade could possibly drop below the sold put (400) before its expiry. My sense is this run is bigger than the blue arrow price scenario - add in a bit more. That pulls the trade above the sold put at its expiry.

With Elon Musk buying $1 billion worth of stock, I do not mind buying 100 shares at the price he paid - i.e., below the current price.

enCore Energy Corp (EU): Uranium. Personal portfolio is a bit underinvested in options trades on uranium. With price opening at $2.55 (Sep 16) put in place an April 2026/January 2026 3/4/2 call spread risk reversal. With net premium of $0.23 this offers maximum profit potential of 338% for 56.9% price move. The sold put (2) partly funds the call spread premium with 21.6% price coverage and levers up profit potential to 1529%. Breakeven will be $2.07 if sold put gets assigned. Plan will be to roll out the sold put around expiry time to match the call expiry.

F3 Uranium Corp (FUU.V): Uranium. Deployed spare cash in small managed portfolio into this uranium explorer. A nibble for the very long run to average down (at half the price of the previous nibble). This portfolio is only $2k in size and all invested in uranium and alternate energy.

AXP Energy (AXP.AX): US Oil. Doubled position in pension portfolio. Business is developing oil properties in US (Colorado and Oklahoma) and has been through a few iterations and name changes and business model changes. Noted the spudding of a new well in Oklahoma - maybe this time

Combining our gas to power generation model with our JVA partners, we are planning to grow our footprint in this area over the coming months

During February 2025, the Company completed a successful Gas To Power trial under a Joint Venture Agreement with USA-based, Blackhart Technologies Inc. During the trial, gas powered generators were used to operate 530 ASIC miners connected to the internet using Starlink. The trial demonstrated the business model allowing recommencement of oil production and further revenue from the Gas to Power agreement with Blackhart.

Cobalt Blue Holdings (COB.AX): Base Metals. Doubled position in pension portfolio. Cobalt Blue recently completed placement which gives funding to get to FID on their Kwinana Cobalt Refinery project - they got land approvals for that too.

Holding in Cobalt Blue goes back a while with the first tranche bought not long after listing in 2017. Made a partial exit of half the holding around the peak in 2018. And then the wheels fell off with price dropping below the first entry level - recovering quite strongly and then falling over again. Made a top up in the 2nd falling over. Looking for this latest top up to spike and exit - the world needs cobalt especially from reliable supplies.

Carrefour SA (CA.PA): Europe Supermarkets. Scaled into holding in pension portfolio to average down entry price a little. Wrote covered call for 1.1% premium with 3.9% price coverage. Also added sold put for 1.03% return with 4.4% price coverage

Premier American Uranium (PUR.V): Uranium. Scaled into holding in pension portfolio on news of yet another merger deal reaching conclusion - this time with Nuclear Fuels.

Premier American Uranium expands and enhances one of the strongest exploration portfolios in the United States, anchored by the Kaycee and Cyclone exploration projects in Wyoming, representing the largest combined ongoing drilling program in the State

Market reaction was less than friendly the day after the trade. We shall see - it is time to kick around the explorers a bit more fully.

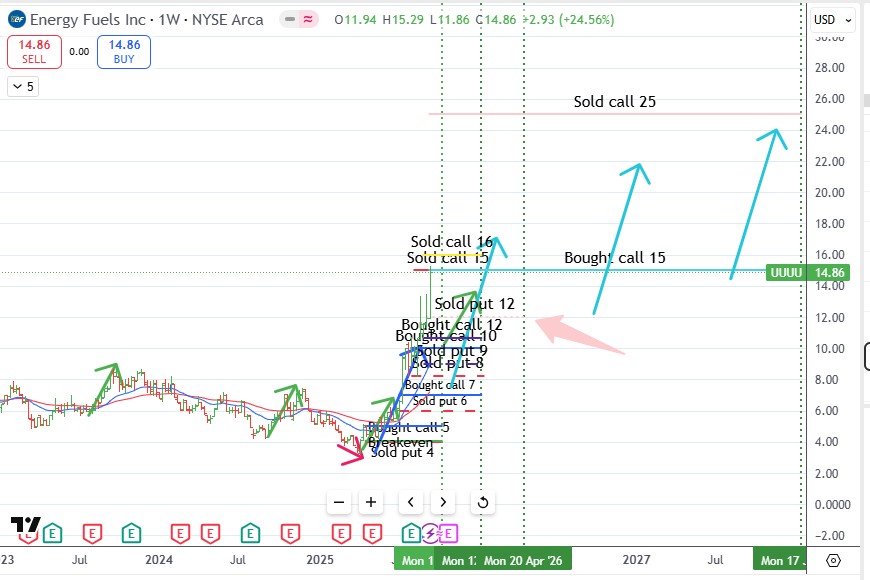

Energy Fuels Inc (UUUU): Uranium. With price opening at $14.10 (Sep 19) put in place a January 2028/April 2026 15/25/12 call spread risk reversal. This offers maximum profit potential of 483% for 77.3% price move. The sold put (12) fully funds the call spread premium with 14.9% price coverage.

Let's look at the chart which shows the bought call (15) as a light blue ray and the sold call (25) as a light pink ray and the sold put (12) as a dotted light pink ray with the expiry dates the two dotted green lines on the right margin - look up and right into blue sky.

Excuse the mess on the chart as it contains a few shorter dated trades all of which are close to being overtaken by the strong price move - it is clear that the current price move is at least as big as the light blue arrow price scenario. Going to need two of those for this trade to reach the maximum - pretty confident that we will not see the sold put (12) come into play (the big pink arrow) - but there are 7 months to go.

Peninsula Energy (PEN.AX): Uranium. Took up SPP allocation in personal portfolio. Was not able to get allocations done for other two portfolios. Rights were allocated on Friday Sep 12 with closing date Sep 16. Broker was not allowing allocations as they needed two days and there was a weekend - disappointing with offer price of $0.30 and stock ending this week at $0.40 (Sep 19).

Assignment on sold puts - just a few this cycle.

Commerzbank AG (CBK.DE): German Bank. In personal portfolio and managed portfolio. Breakeven since last assignment (Jan 2025) €30.37 vs €32.25 close (Sep 19). Income trades have made investing in the recovery very effective. Wrote covered call for 1.02% premium with 7% price coverage vs breakeven.

DHL Group (DPWA.DU): Europe Logistics. In pension portfolio. Breakeven over life of the holdings €36.18 vs €37.68 close (Sep 19). Initial stock screen idea which fell foul of US tariffs. Been running income trades to recover and am now back in a profitable situation.

ENGIE SA (ENGI.PA): French Utility. In pension portfolio. Breakeven over life of the holdings €17.77 vs €17.88 close (Sep 19). Recently went back to writing puts across all portfolios on this stock as is has quite low volatility - income trades have done the heavy lifting to keep this profitable. Dividend yield 8.28%

Builders FirstSource (BLDR): Building Products. In pension portfolio. Breakeven over 3 sold put cycles since previous assignment $119.27 vs $124.15 close (Sep 19). Share price has bounced around with the speculation about Federal Reserve rates cuts and hikes - now the next cut has come along, price should build.

Sold

Mandom Corporation (4917.T): Japan Consumer Products. Checked the sell from last week - had not applied the whole tranche. Added in a 2nd sell order which was hit at a higher price for 51% profit since May 2024.

In that time the Australian Dollar has dropped 4% against the Yen - levers up the profit a bit too.

American Uranium formerly GTI Energy (AMU.AX): Uranium. Price spiked - took out what my broker was reporting as profits in personal portfolio. Broker reports average price - FIFO sale would be an ugly loss. LIFO sale would be a big profit after a deeply discounted SPP in July. Booking an average profit of 10.9% since August/November 2023/May/June/September 2024/January/July 2025. Company is developing Lo Herma ISR project in Wyoming. Seems like taking profits was a good move with price dropping 10% on release of Lo Herma Hydrogeology Testing and Resource Expansion Drilling (Sep 18). Seems the market did not like the indications that the Mineral Resource Estimate (MRE) and Scoping Study would only be updated in Q1 CY2026

Silex Systems (SLX.AX): Uranium Enrichment. Price spike when GLE released results of the large scale enrichment demonstration testing - indications were better than market expected.

Sold a parcel of shares to scale down position size and lock in 34% profits from the recent SPP. Not bad work for a week's holding. Needless to say not all tranches held could have been sold profitably - FIFO sale would only be 1.9% profit since September/November 2024/January 2025. There is a price for being early on an idea and an edge averaging down along the way.

KraneShares Electric Vehicles and Future Mobility Index ETF (KARS): Electric Vehicles. Assigned early on covered call for 10.1% blended profit since June/December 2023/July/December 2024 - first tranche was not profitable. Averaging down and scaling in helped. Did replace some of the stock last week.

A swag of assignments on covered calls across all 4 portfolios

iShares MSCI China Small-Cap ETF (ECNS): China Small-Cap Index. 41.5% profit since May 2024 in personal portfolio.

Centrus Energy Corp (LEU): Uranium Enrichment. 150% profit in personal portfolio since August 2025 - stock from a call option trade

NexGen Energy Ltd (NXE): Uranium. 8.8% blended profit in personal portfolio since November 2024/January/February 2025 and 13.9% blended profit in pension portfolio since February/March/May/September/ 2024/January/February 2025. Patient building game paid off. Have been writing the covered calls with wide strikes - surprised to get taken out. Call options added another 73% profits and put options another 61%. Always good to see solid profits on a uranium stock that is unlikely to be producing before 2031.

Sprott Junior Uranium Miners ETF (URNJ): Uranium. 12.5% blended profit in personal portfolio since May 2024/February/May/June 2025 - first tranche was a loss. 4.7% blended profit in managed portfolio since May/August 2024/February 2025. Early tranches were losses too. In managed portfolio, income trades covered the profits another 2.75 times.

Sprott Uranium Miners ETF (URNM): Uranium. 24.7% blended profit in personal portfolio since January/March 2025. 4% profit in managed portfolio since July 2024 - those early entries demanded some patience - now being rewarded. In managed portfolio, options trades outweighed the capital profits by 6.86 times.

Denison Mines Corp (DNN): Uranium. 32.2% profit in small managed portfolio since December 2024 and 11.4% blended profit in managed portfolio since November/December 2024. In managed portfolio options trades since switching to holding US listing outweighed capital profits by 9.23 times - pretty neat considering the stock traded a lot of that time below $2. In small managed portfolio the weighting is 1.2 times added profit. Trading costs are a big factor in this portfolio as it trades in 100 and 200 share lots only.

Global X Lithium ETF (LIT): Lithium. Assigned in managed portfolio for 11.4% blended profit since April/May/June 2025. This has not been a happy investing journey with the collapse of lithium process - this trade suggests we may have seen the bottom - in aggregate across the portfolios this remains a loser. In managed portfol