Another big week in uranium sector prompts some changes in the strategic approach - reduce physical and extend explorers. Took action in marijuana too

Portfolio News

In a week where S&P 500 dropped 0.28% and Europe dropped 0.21%, my pension portfolio rose 1.77%. Not hard to find the clues - uranium and nuclear below

Big movers of the week were DevEx Resources (DEV.AX) (64.9%), GoviEx Uranium (GXU.V) (50%), Dateline Resources (DTR.AX) (46.9%), Cauldron Energy (CXU.AX) (46.1%), ioneer (INR.AX) (38.5%), Cettire (CTT.AX) (36.8%), Westwater Resources (WWR) (36.3%), Genmin (GEN.AX) (35%), American Uranium (AMU.AX) (34.2%), Atha Energy Corp (SASK.V) (33.9%), Peninsula Energy (PEN.AX) (33.7%), Northern Dynasty Minerals (NAK) (30.8%), Evolution Energy Minerals (EV1.AX) (30.8%), 3D Systems Corporation (DDD) (26.9%), St George Mining (SGQ.AX) (26.3%), Elevate Uranium (EL8.AX) (23.1%), Vulcan Energy Resources (VUL.AX) (22.5%), Sun Silver (SS1.AX) (22%), Premier American Uranium (PUR.V) (22%), Elevra Lithium (SYA.AX) (20.7%), Advance Metals (AVM.AX) (20.5%), Elixir Energy (EXR.AX) (19%), American Rare Earths (ARR.AX) (18.5%), Earths Energy (EE1.AX) (16.7%), Lightbridge Corporation (LTBR) (17.4%), Uranium Royalty Corp (UROY) (15.6%), Lynas Rare Earths (LYC.AX) (15.5%), Sigma Lithium Corporation (SGML) (15%), Halliburton Company (HAL) (13.8%), Silex Systems (SLX.AX) (13.5%), CGN Mining (1164.HK) (13%), Ora Banda Mining (OBM.AX) (12.9%), Heavy Minerals (HVY.AX) (12.9%), Azincourt Energy (AAZ.V) (12.5%), Standard Uranium (STND.V) (12.5%), Energy Fuels (UUUU) (12.4%), Metals X (MLX.AX) (12.1%), Forsys Metals Corp (FSY.TO) (11.9%), Halliburton Company (HAL) (11.5%), Terra Critical Minerals (T92.AX) (11.2%), Global Uranium and Enrichment (GUE.AX) (11.1%), Reece (REH.AX) (11.1%), Boss Energy (BOE.AX) (11%), 29Metals (29M.AX) (10.6%), enCore Energy Corp (EU) (10.4%), RocketBoots (ROC.AX) (10%)

46 stocks in he big movers list - just wow in another big week for uranium/nuclear power (20 stocks), rare earths (5 stocks), alternate energy (6 stocks), silver/gold mining (5 stocks) cover the big themes

US markets wanted to go down - often goes like that between earnings seasons - nothing to inspire the buyers and creeping up to quarter end

Crypto Drifts Again

Bitcoin price drifted lower all week finishing the week 2.1% lower than the open with a peak to trough range of 5.3%.

Ethereum price dived lower and then recovered finishing the week 4.7% lower than the open with a peak to trough range of 11.3%. Looks like the Bitminer buying in midweek helped - see below

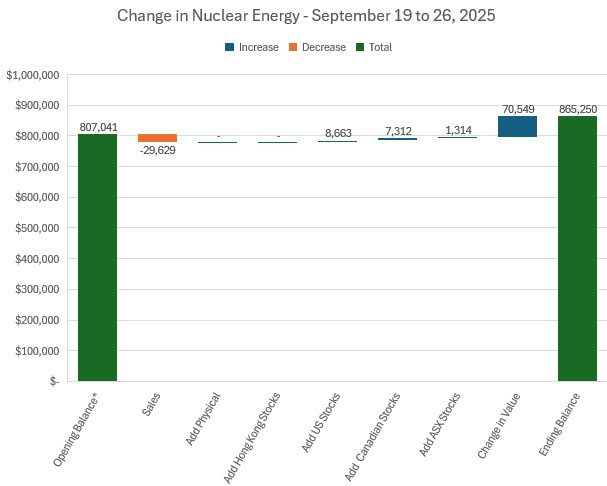

Nuclear Energy Holdings

After last week's selloffs at options expiry a few more sales and some buying further along the development curve. Purchases less than the sales and more telling an 8.7% increase in valuations.

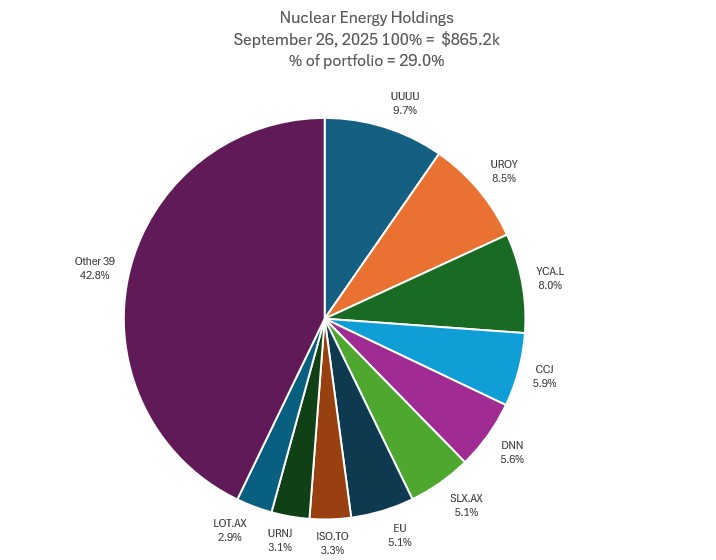

A few changes in the mix of holdings with share of portfolios stepping up over a point to 29%. Uranium Royalty Corp. (UROY) jumps a place into slot 2 - moves made last week pay off. Silex Systems Limited (SLX.AX) jumps a place into slot 6. IsoEnergy Ltd. (ISO.TO) rises two places into slot 8. Sprott Junior Uranium Miners ETF (URNJ) and Lotus Resources Limited (LOT.AX) come into the top 10 in slots 9 and 10. Dropping out of the Top 10 is Sprott Physical Uranium Trust Fund (U-UN.TO) on the sales there. Others goes up one to 39 stocks with one new add.

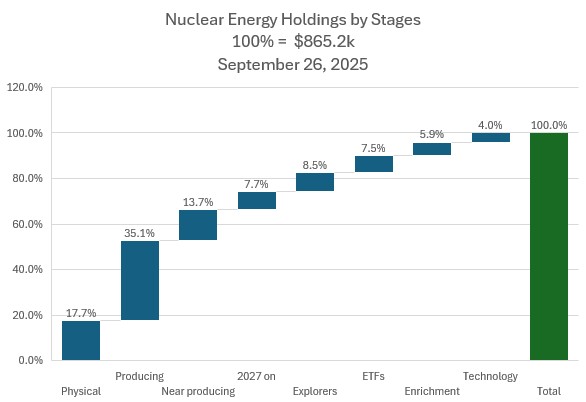

Some key changes in the holdings by Stage. Physical comes down 1.6 points with the sales there. Producing goes up 1.3 points. Explorers shows the big jump up 1.2 points. Technology drops 0.8 points on drop in values there.

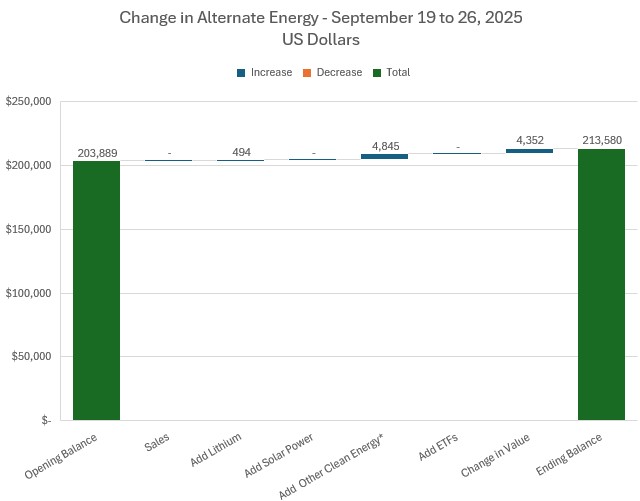

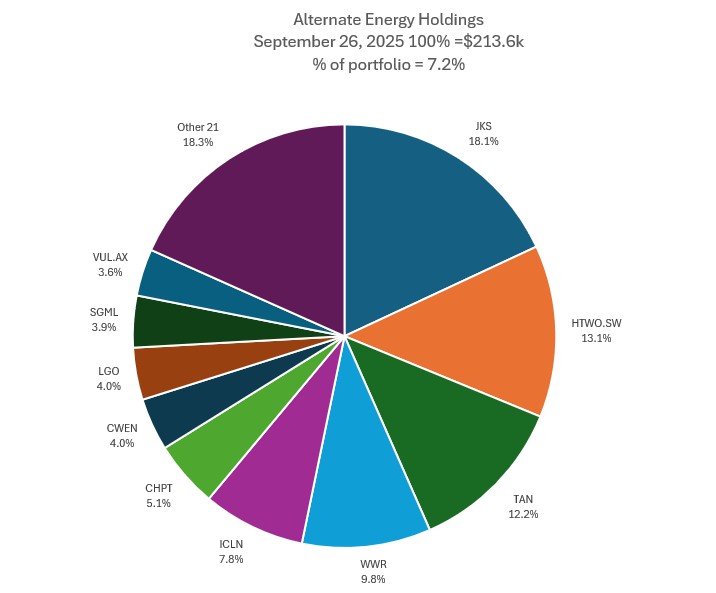

Alternate Energy Holdings

A few minor changes in holdings and 2.1% increase in valuations

No change in the rankings for the top 3 but some key percentage changes - JinkoSolar (JKS) drops 1.5 points. L&G Hydrogen Economy UCITS ETF (HTWO.SW) in slot 2 drops 0.8 points. Invesco Solar ETF (TAN) in slot 3 drops 0.5 points. Westwater Resources, Inc. (WWR) rises one place into slot 4 - all other places in Top 10 stay the same. Share of portfolios rises to 7.2% - nudging higher.

Bought

Deployed some of proceeds from selling Anfield Energy Inc (AEC.V) Canadian listing in other explorers a bit further away from the developer stage.

I did a bunch of purchases based on an instinct and picked explorers some way off developing. It seems clear that uranium market is off to the races - the value is further down the value chain rather than in physical and producing.

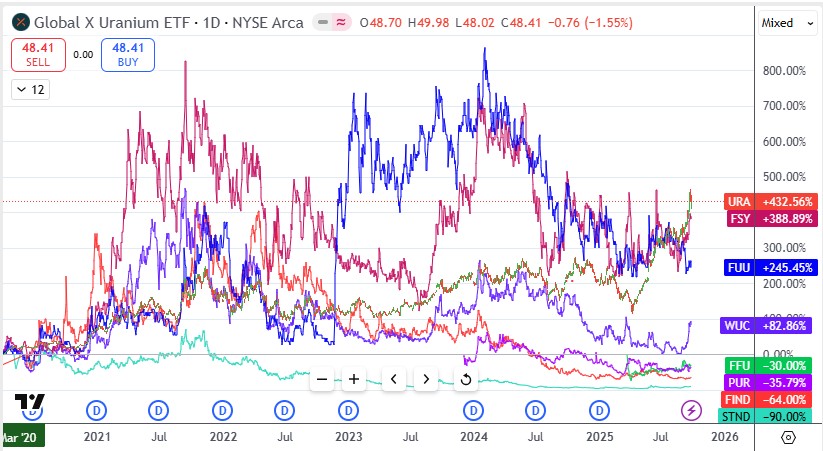

Did the charts afterwards to test the instincts of what I bought to compare them with the Global X Uranium ETF (URA - the bars). The chart goes back to the 2020 cycle low for the ETF. Big lesson one - all are lagging but the range of the lag is massive between -90% and +432%. Of note - none did better than the ETF

One more chart to compare the other two explorer purchases

Both have been positive over the cycle but only Anfield Energy (AEC.V) has been lagging. That suggests the purchase of Alligator Energy (AGE.AX) may have already missed the boat - that said there is a range of +600% to 2500 percent in the time frame - might be all good if +2500 comes back into play.

F3 Uranium Corp (FUU.V): Uranium. Scaled into holding in small managed portfolio to average down entry price. Doing this as ticker is low for a small portfolio.

**Forsys Metals Corp. (FSY.TO): Uranium. Scaled into holding in managed portfolio

Premier American Uranium (PUR.V): Uranium. Market did not react well to the completion of the Nuclear Fuels purchase - made my purchase in pension portfolio the week before look a bit sick - averaged down buying another parcel 15% lower. This is part of a process of scaling into uranium stocks that are not as far down the path to producing and with solid management teams.

Uranium Royalty Corp (UROY): Uranium. With price opening at $3.90 (Sep 22) and racing higher put in place a January 2027 5/7.5 call spread. With net premium of $0.50 this offers maximum profit potential of 400% for 92% price move. That feels like a big ask but it is 15 months away and price moved 17% on trade day.

Let's look at the chart which shows the bought call (5) and breakeven as orange rays and the sold call (7.5) as a yellow ray with the expiry date the dotted green line on the right margin (top right corner). This trade is a blue sky trade above all the others - why do it? The orange arrow is a clone of the run in 2021. Current price move is actually running more steeply. This trade is positioning for just such a run. Note that there was no sold put action - that can be put in later to reduce the net premium. This portfolio has one unpaired sold put expiring in October - it is doing some of the funding.

Canopy Growth Corporation (WEED.TO): Marijuana. Scaled into holding in managed portfolio to average down entry price. Plan is to write covered calls until market finds an exit - then end the sorry investment saga. Wrote covered call for 3.6% premium with 4.4% price coverage - a bit tight but only for one week.

Cronos Group Inc (CRON): Marijuana. Scaled into holding in managed portfolio to average down entry price. Plan is to write covered calls until market finds an exit - same plan. Wrote covered call for 3.8% premium with 14.7% price coverage.

Tilray Brands (TLRY): Marijuana. Scaled into holding in personal portfolio to average down entry price. Plan is to write covered calls until market finds an exit - same plan. Wrote covered call for 4.1% premium with 61% price coverage.

Société BIC SA (BB.PA): Europe Consumer Products. Scaled into holding in managed portfolio to average down entry price. Struggling to write covered calls at a breakeven price - one way to do that is reduce breakeven price. Wrote covered call for 0.3% premium with 6.3% price coverage.

Loop Industries (LOOP): Specialty Chemicals. Scaled into holding in managed portfolio to average down entry price.

Glencore plc (GLEN.L): Base Metals. Rounded up holding in managed portfolio to get round up an odd lot for writing covered calls. Wrote covered call for 0.3% premium with 13.1% price coverage.

ChargePoint Holdings (CHPT): Electric Vehicles. Rounded up holding in managed portfolio to round up an odd lot for writing covered calls. Wrote covered call for 3.17% premium with 21.2% price coverage. Scaled up holding in personal portfolio.

Halliburton Company (HAL): Oil Services. Averaged down entry price in personal portfolio to improve breakeven pricing for covered calls. Wrote covered call for 1.3% premium with 8.8% price coverage.

Sigma Lithium Corporation (SGML): Lithium. Improving lithium carbonate pricing suggests the bottom may be in. Averaged down entry price in personal portfolio. Wrote covered call for 1.97% premium with 30.8% price coverage - wide enough to cover the higher priced holdings too.

Anfield Energy Inc (AEC): Uranium. Added first tranche of US listing in managed portfolio and pension portfolio. Sure hoping their plan is to list options as well.

Western Uranium & Vanadium Corp (WUC.CN): Uranium. Interactive Brokers now opened access to PURE listings in Canada. Added first tranche in pension portfolio - been waiting for this time for a while on this stock. Developing US mine.

F4 Uranium Corp (FFU.V): Uranium. Added parcel in pension portfolio to average down entry price and scale in. Exploring Athabasca Basin

Baselode Energy Corp (FIND.V): Uranium. Exploring Athabasca Basin

Standard Uranium Ltd (STND.V): Uranium. Exploring Athabasca Basin

Alligator Energy (AGE.AX): Uranium. In personal portfolio - saw a tweet about relative under valuation of Australian developers - added this - already holding in other portfolios. Exploring Northern Territory, Australia in known uranium zone.

Volkswagen A (VOW.DE): Europe Automotive. Dividend yield 6.65%. Wrote covered call for 0.6% premium with 6.9% price coverage. Announced delays in Porsche EV rollout - price gets whacked - buying back in at 6.5% lower than last exit.

Elastic N.V. (ESTC): AI Software. Been doing this as credit spreads. Price pulled back a bit - time to buy some shares. TSP idea. Wrote covered call for 1.14% premium with 14% price coverage.

Star Bulk Carriers Corp (SBLK): Shipping. Been selling puts on this stock for a while. Read a tweet about the moves in bulk shipping rates - time to get back on an old horse with a stock purchase. Tariff wars evolve with more clarity and shipping begins to flow again.

Sold

Anfield Energy Inc (AEC.V): Uranium. Closed out holding of Canadian listing in managed portfolio for 67.2% blended profit since June/July 2024/February/August 2025. Plan is to switch to US listing to be able to write covered calls.

F3 Uranium Corp (FUU.V): Uranium. Finger trouble - closed a parcel instead of buying a parcel creating a 47% blended loss since April/May/June 2024. I think I got mixed up between F3 (FUU.V) and F4 (FFU.V) - did have a pending order open to sell F4 at 52 week high - have since chosen to cancel that. Will buy back. Did do that buy back for a small loss - bought fewer shares to cover that. Will look like a tax loss sale for now.

Sprott Physical Uranium Trust Fund (U-UN.TO): Uranium. Closed out in managed portfolio at 52 week high for a modest 2.1% blended profit since October 2023/February/March/October 2024 and 1.6% blended profit in personal portfolio since April/June/October 2024. One tranche in each portfolio was sold at a loss. Part of the plan to move away from what I believe is a flawed model open only to carry trade type speculation. Sprott is only ever on one side of the uranium trade - buying. When uranium supply shortage hits they will not be able to sell to reap the profits. As it happens I did move up sell price in pension portfolio - forgot about these other two.

Of note is Canadian Dollar declined versus Australian Dollar in a range from 5.3% to plus 0.6% over that time - so on average a losing trade in both portfolios. Red line on chart is the exit AUDCAD price - green lines are purchase dates for stock - only one purchase above the exit line. Decline against Euro (reference currency for the managed portfolio) was 12%. Uranium Insider idea - they never talked about the currency risk or the model flaws

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

Aurelia Metals (AMI.AX): Gold Mining. Always happy to add a gold or silver miner in current markets.

Chart shows a clear reversal on earnings - two broker targets are higher with one better than previous highs. There is 35% target possible below those highs - just above the lower broker target.

Top Ups

Grange Resources Limited (GRR.AX): Base Metals. Been ignoring this signal - but it does average down the entry price quite a bit.

Sold

Terra Critical Minerals Ltd (T92.AX): Uranium. Closed portion at 52 week high profit target (and to release funds for next auto-invest) for 42.4% blended profit on monthly purchases from June 2024 to March 2025. First two tranches had small losses - interesting what a $60 a month auto-invest can do on the right stocks or theme. Also paid the next 12 months monthly subscription

Hedging Trades

UBS ETRACS Silver Shares Covered Call ETN (SLVO): Silver. Deployed part of proceeds of silver sales in personal portfolio on this covered call ETN. Distribution yield is higher than I can achieve writing covered calls on iShares Silver Trust (SLV)

Hecla Mining Company (HL): Silver Mining. Been invested in two silver miners through this cycle - had a feeling that Hecla Mining (HL) was lagging - added a parcel in pension portfolio.

Did the charts after the event - well it is lagging the stock just sold Coeur Mining (CDE) but ahead of Pan American Siler (PAAS). Lesson: Do the chart first - good news is the covered call ETN is lagging too.

Advance Metals (AVM.AX): Silver Mining. Next Investors idea - added a small parcel in managed portfolio

Cryptocurrency

Bitmine Immersion Technologies (BMNR): Ethereum Mining. Bitmine have been actively building their Ethereum treasury as a cornerstone of a mining strategy. Wrote covered call for 3.8% premium with 35% price coverage. A controversial idea.

Tom Lee's thesis on ETH potentially doing 100x centers on it entering a macro super cycle. The Fundstrat co-founder and BitMine Chairman identified Wall Street adoption, AI integration, and BitMine's status as a compliant, yield-generating blockchain as key drivers.

He sees a chance of ETH flipping Bitcoin's market cap, with near-term targets of $4,000 to $15,000 by 2025. Lee anticipates up to $20,000 or more for the longer-term upside based on historical ratios and institutional buying.

Not everyone agrees - one way to find out - take a punt on the days Ethereum price pulls back

Kang labeled the analysis as one of the most retarded combinations of financially illiterate arguments he has seen from a high-profile market voice.

https://finance.yahoo.com/news/tom-lee-ethereum-thesis-dismantled-152235428.html

With price opening at $55.30 (Sep 24) put in place a November expiry 55/65/40 call spread risk reversal. This offers maximum profit potential of 238% for 17.5% price move. The sold put (40) fully funds the call spread premium with 27.7% price coverage - not a lot of risk there

Let's look at the chart which shows the bought call (55) as a blue ray and the sold call (65) as a red ray and the sold put (40) as a dotted red ray with the expiry date the dotted green line on the right margin. What stands out history may not be a good guide. However the sold put (40) is below the previous lows and the sold call (65) is below the last highs. All price has to do is repeat the blue arrow price scenario (same size as the last move up)

Income Trades

Covered Calls

2 covered calls expired written one week away in one portfolio (1 US 1 Canada) - easy cash.

Subdued start to options cycle with 49 covered calls written across 4 portfolios (UK 5 Europe 8 US 34 Canada 2)

Global X Russell 2000 Covered Call ETF (RYLD): Small Caps Index. Russell 2000 index makes a new all time high - time to add to the covered call ETN - always good yields when prices drop away from the highs - yield 10.30%

Naked Puts

Sold puts on stocks happy to own at lower prices - duplicates across different portfolios - Cameco Corporation (CCJ): Uranium. Return 1.23% Coverage 15.1% - one week - Coty Inc. (COTY): Consumer Products. Return 3.25% Coverage 0.8% - Halliburton Company (HAL): Oil Services. Return 1.95% Coverage 7.7% - JinkoSolar Holding Co: Solar. (JKS) Return 3.02% Coverage 12.2% - Aurora Cannabis Inc. (ACB.TO): Marijuana. Return 5.7% Coverage 7.5% - enCore Energy Corp. (EU): Uranium. Return 0.75% Coverage 100% - Halliburton Company (HAL): Oil Services. Return 3.06% Coverage 3.3% - Sprott Uranium Miners ETF (URNM): Uranium. Return 1.35% Coverage 11.3% - 3D Systems Corporation (DDD): 3D Printing. Return 5% Coverage 40.5% - enCore Energy Corp. (EU): Uranium. Return 6.77% Coverage 42% - Centrus Energy Corp. (LEU): Uranium E