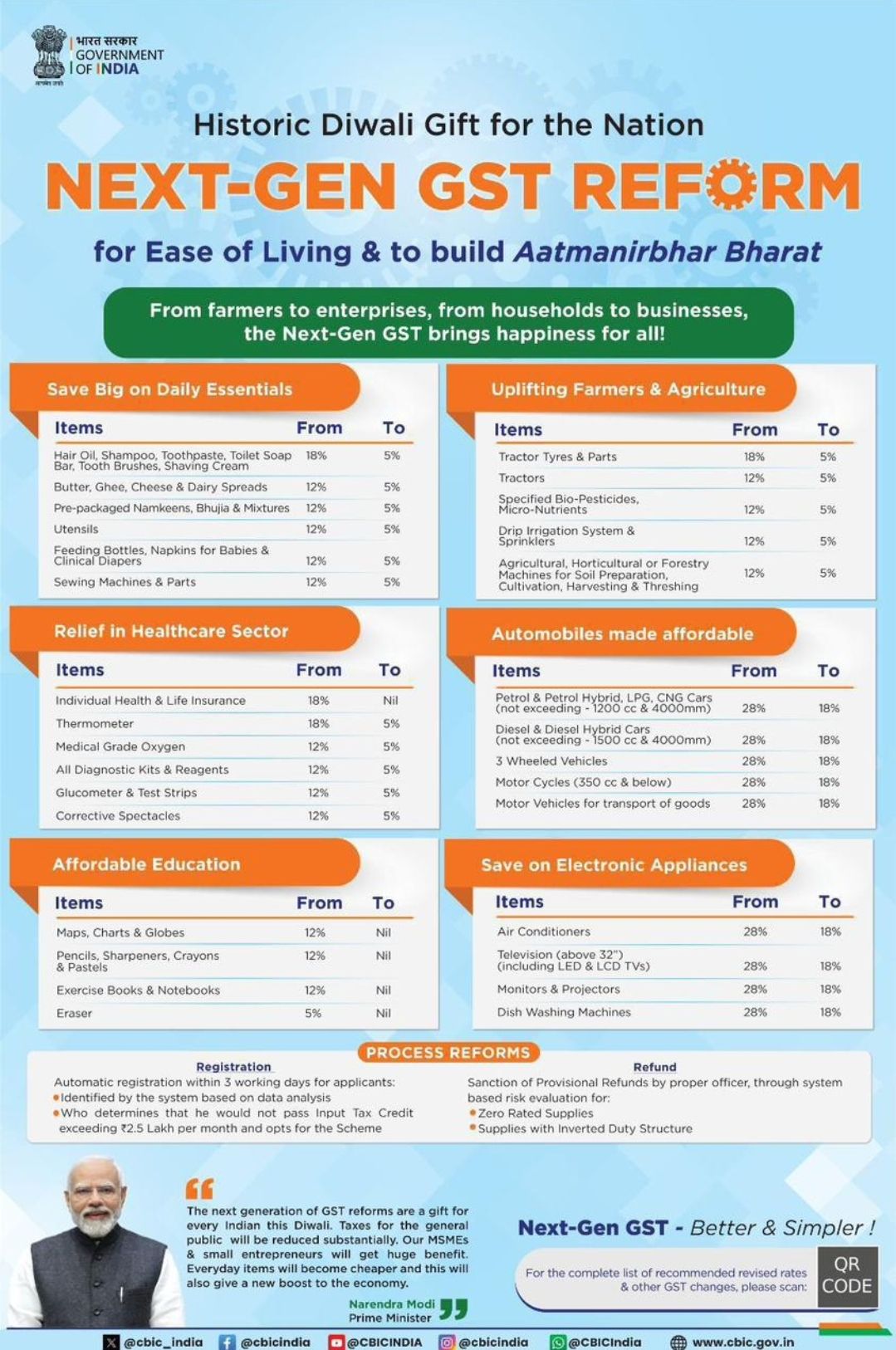

GST or Goods and Services Tax is a indirect tax which is the tax you have to pay for all the goods for services you are consuming. So we used to have different slabs like 5%, 12%, 18%, 28% etc for the GST. And now we have only 2 slabs, 5% and 18%. The below is the photo of the GST tax rate which was done yesterday.

PC: Google.com

PC: Google.com

The best thing was Health and Life Insurance. Previously the health and life insurance was around 18% GST but now it is 0%. So it's a big relied for people because 18% could be saved. I am saying could be because you never know if the companies will pass down the rate cut to the consumers or not. But if they will then it's a huge boost. People having the insurance will pay less and along with that seeing low price people will take the insurance. Similarly other Healthcare items GST were also reduced helping everyone.

Now the thing is I am not happy with the 2 rates too, it should be one rate and thus everything should comes under that. But I know that doesn't work like that because people who is rich should pay more whereas poor or middle class should pay less. And that's why luxury items attract more tax than the normal items. And that's why you can see cars which are less than 1200cc are 18% whereas more than that will attract 28%.

Similarly for bike too. So it's a welcome change and hopefully in future we will have much streamlined GST rates. Also there is a special rate which is too high and that is on Gutkha and Pan Masala that means Government wants people to stop eating it bit let's see how much effect it will happen.

Posted Using INLEO