We went for a team lunch and the conversation went for the investments. Everyone was talking about their investments and what they are currently investing in. One guy talked about only investing in the small funds, why because it is giving more than 20% returns in the last 10 years.

PC: Pixabay.com

PC: Pixabay.com

Now looking at the return, it seems like a great return but when you see the year to year basis, small cap funds are the most volatile. In one year they give 70% returns whereas in some year -50% returns. Bit overall in the long term it gives somewhat good returns.

Now I asked the collegue that what he will do if he needs the fund in say 5 years down the line. He said he will take out the money because it will easily fetch 20% returns in those 5 years. But he was wrong and I corrected it. Small cap funds will not give 20% every year, it might give negative returns for 2 to 3 years and might give extra ordinary returns in 1 years.

Now for example, if you want the money in the next 5 years. And if the small cap funds gave negative returns in those 5 years then you will lose a lot of money if you want to withdraw.

And that's why we should not invest a lot in the small cap fund. We should diversify and along with that the small cap fund should be only invested if the time horizon is for more than 10 years. I have told this to my colleague and now I feel he will rethink his investment decision and he will make his portfolio better in the years to come. And that's why people should try to go through their portolfio with advisors to see if they are doing something wrong or not.

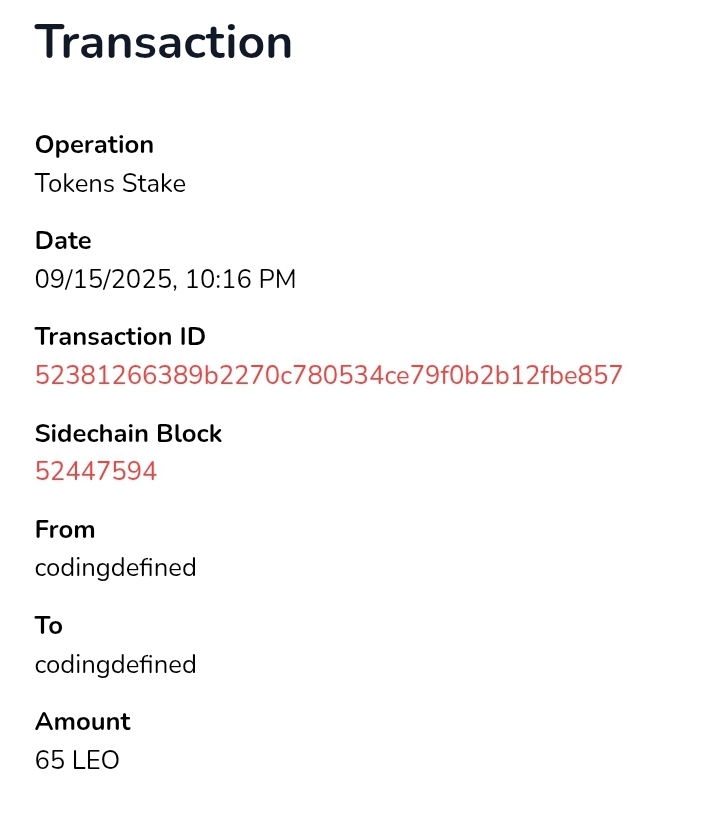

As part of LPUD, I have also powered up 65 Leo.

Posted Using INLEO