## TOKENIZATION OF REAL ESTATE, A POSITIVE OR TRIVIAL APPLICATION?

Today @creativeblue has a pleasure to introduce amazing piece of work by @ulqu3 related to topic which we found very important: tokenization of property market. | [source](https://www.inman.com/2018/05/29/the-essential-guide-blockchain-cryptocurrency-and-real-estate/)

---|---

If there's anything the bear market has shown us, it's that a lot of cryptocurrency projects are not ready to be feasible alternatives to the conventional/fiat way of doing things.

Too many *white elephant* projects have left the market saturated and ultimately resulted in the decline of investor confidence. Throw in some ego and infighting and you are left with a devastating domino effect that has seen the entire crypto ecosystem shed about 83% of its value in less than a year!

Naturally, the most prevalent question in the minds of all crypto-faithful is *HOW DO WE STOP THIS?*

Many options have been put on the table

- **Ban Crypto Altogether!**

- **Regulation**

- **Security Token Offerings**

I think we will all pass on option 1. Crypto is here to stay and even though it's not perfect(*yet*), it has many advantages over fiat that are simply too important to ignore.

Regulation aims to protect the interests of investors but at the great cost of decentralization.

Security Tokens do offer a bridge between regulation and decentralization. While some compromise is expected it does make the climate safer for the investor and protects them from fraudulent projects. The downside of **STOs** is that it somehow limits crypto to only *securities* or digital certificates representing a certain monetary value.

**The blockchain can do so much more than that.**

## In this world of modernization, a new use for the blockchain has emerged. **TOKENIZATION OF ASSETS**

I would like us to discuss that.

Remember *Cryptokitties*? Digital pets that could be trained, nurtured, evolved and traded? The process of interacting with these pets is done via little transactions. Now if we can represent pets with cryptocurrency, why can't we tokenize things like toys, or cars, or houses?

Using Proof of Asset (**PoA**) Protocol, it is possible to digitize assets of value (such as a car, a farm, a house) and trade them on the Ethereum blockchain or any other blockchain that is compatible.

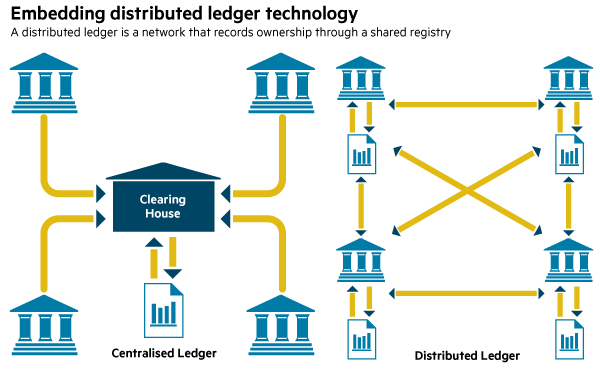

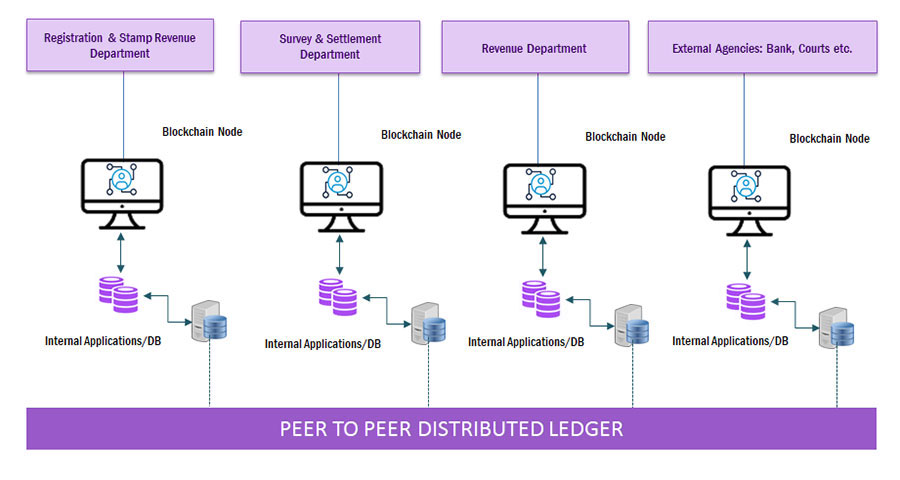

Remember that blockchains are in a nutshell, distributed databases, allowing us to store information in a way that is secure and publicly accessible. | [source](https://banknxt.com/wp-content/uploads/2015/07/Santander-image.png)

---|---

This is a step up from the conventional system of everything going through a central clearing house.

During my research, I came across a project called [Brickblock](brickblock.io). Basically, they are an Infrastructural Development project aiming to merge institutional real estate investment management with the benefits of blockchain technology.

In *laymen* terms, they will use software(blockchain) and legal framework to digitally represent real estate via tokens.

Now these aren't your normal hashed or mined tokens. these are one-time minted **Non-Fungible Tokens**. The term Non-fungible Token (*NFT*) means a token that represents something unique. NFTs are not interchangeable.

When applying tokenization to Real Estate, the NFTs will each represent a particular house/piece of land or property and only hold the value the owner has decided to place on them. Non-Fungible Tokens fall under the Ethereum Standard **ERC-721**.

## WHAT ARE THE BENEFITS OF TOKENISING REAL ESTATE?

Disputes over land and property are not news to any of us. In fact, great wars have even been fought over land. The blockchain offers **immutable** and transparent record and evidence of true ownership.

The blockchain will increase the ease of access for different classes of investors and transparency in global real estate markets.

### Imagine being able to buy a piece of land in Tokyo from the comfort of your Manhattan Apartment.

No more long paperwork, no more land settlements with hostile locals, no more government officials to act as middlemen and charge you fees. | [source](https://www.emudhra.com/assets/img/blockchain-land-records.jpg)

---|---

The tokenization of real estate can lead to a whole new era of investment. For example, with [Brickblock](brickblock.io), you invest in tokenized real estate assets with Ether (ETH). When the asset is fully funded, the smart contract issues investors Proof-of-Asset (PoA) tokens proportionate to the amount they invested. [source](https://blog.brickblock.io/faq-tokenized-real-estate-assets-24674ee47543)

This means you can be a part-owner of a building or structure as well. Imagine being the part owner of a prestigious Stadium or a Skyscraper or even the Eiffel Tower. This is called a **CROWD INVESTMENT** as even strangers can collectively fund an investment. However, if the asset isn’t fully funded by the end of the funding period, the funds are returned to investors’ Ethereum wallets.

## How do Proof-of-Asset (PoA) tokens work?

Every asset will be sold through a smart contract platform that will issue its own unique Proof-of-Asset (PoA) token. PoA tokens will be sold during an asset’s funding period and represent all the economic benefits of legal ownership. That means PoA token holders will be legally entitled to the profits of the underlying asset. The profits will be regularly paid out to investors’ Ethereum wallets. [source](https://blog.brickblock.io/faq-tokenized-real-estate-assets-24674ee47543)

One thing that remains unclear is how the legal framework will be integrated into the Real Estate investment. Also, the scope of "investment" would differ from project to project. While some may offer outright ownership, others may offer the opportunity to "invest" and collect profits from the use of the property. I'm not quite sure you can just buy properties in other countries without the government of that country having a say.

One must keep in mind that depending on your geographical region/jurisdiction, there may be taxes involved after converting the profit(to fiat).

## SHARE YOUR OPINION

- What do you think about the tokenization of Real Estate?

- Do you think it is something that the government would support?

- How do you think tokenizing a piece of land you own would benefit/hinder you?

- What Use Cases can you see that may have been overlooked?

Author: @ulqu3

IS FUTURE TOKENIZATION OF PROPERTY MARKET something we should all be aware of?

@creativeblue

· 2019-02-16 03:18

· blockchain

#blockchain

#crypto

#cryptocurrency

#tokenization

#sto

Payout: 0.000 HBD

Votes: 59

More interactions (upvote, reblog, reply) coming soon.