The government shutdown has forced the Bureau of Labor Statistics (BLS) to close its doors, delaying the release of September’s closely watched jobs report at a moment when the U.S. economy faces growing uncertainty. Normally published today and on the first Friday of each month, the report offers a snapshot of employment trends that guides businesses, investors, and policymakers. With more than 2,000 BLS employees furloughed, the report remains locked away, depriving the Federal Reserve of a critical data point as it considers its next move on interest rates. This directly impacts the premise for a trade I started last week and will likely mean I'm about to loose a lot of money...

Unemployment has edged higher this year, rising from 4% in January to 4.3% in August. Meanwhile, payroll firm ADP reported an unexpected net loss of 32,000 private-sector jobs in September, compared with forecasts for a 45,000 gain. Without the official BLS data, economists are left piecing together the labor market’s direction from less comprehensive private indicators. Fed Chair Jerome Powell has already warned that the economy is behaving in unusual ways, with inflation and a weakening labor market moving out of sync. The central bank cut rates in September but faces another decision later this month, but potentially without the benefit of the jobs report, and possibly without upcoming inflation gauges if the shutdown drags into mid-October we could see the decision impacted.

Looking at history, past shutdowns show the ripple effects can extend even after the government reopens. In 2013, the BLS took four days to release delayed jobs data and over a week to publish inflation figures, leaving the Fed flying half-blind at its policy meeting. While most economists expect the shutdown’s direct economic damage to be small and temporary, the lack of data injects fresh uncertainty into an already murky outlook.

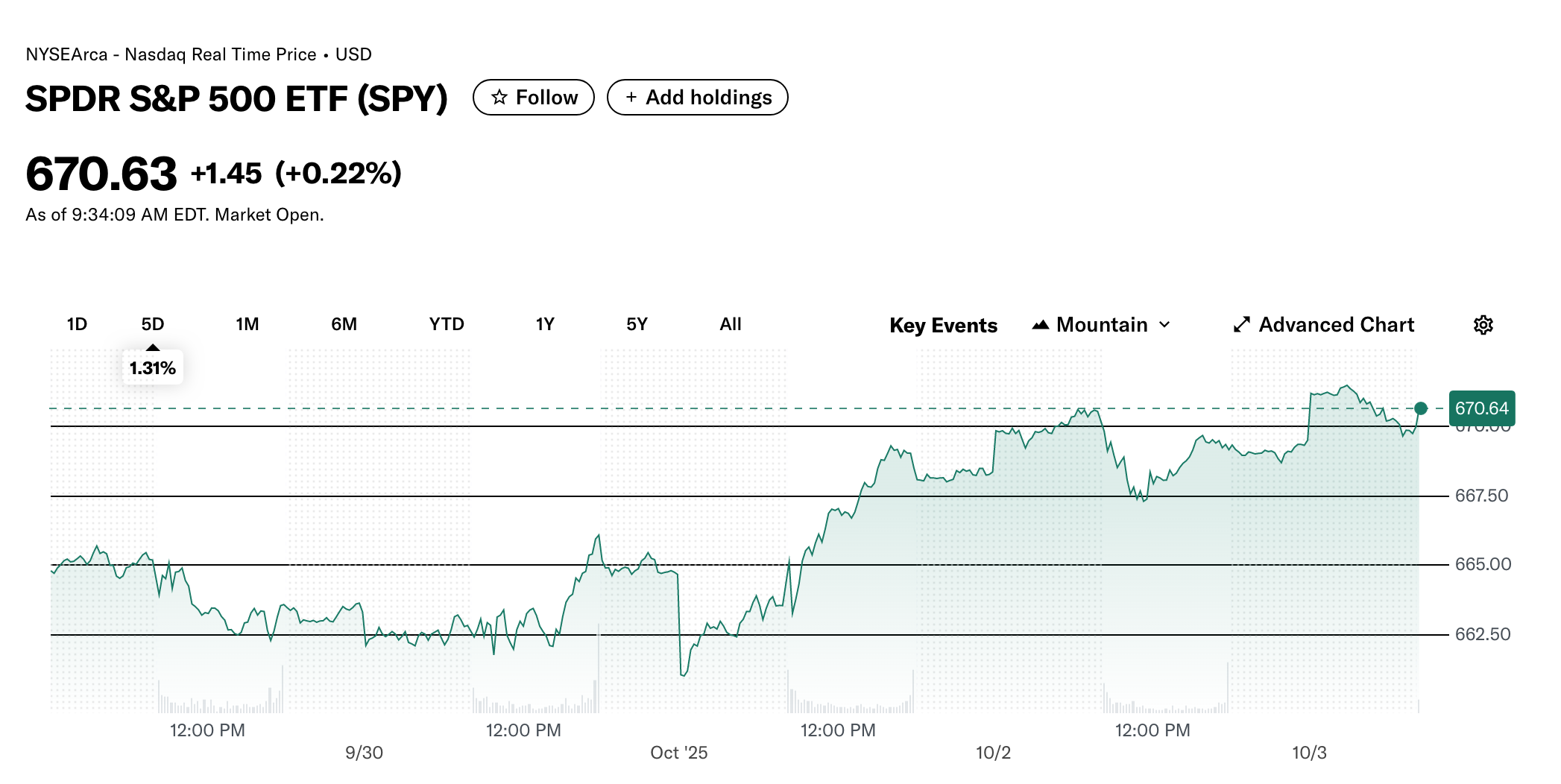

However, as I have been saying markets are tricky and today's open makes me thing that the bull market is just too strong and comparing the economy to stocks is misguided and will loose you money like what's happening to me!