Imagine working for a company for 25 years seeing your pay slip each month highlighting your pension contributions only to find out these were never paid.

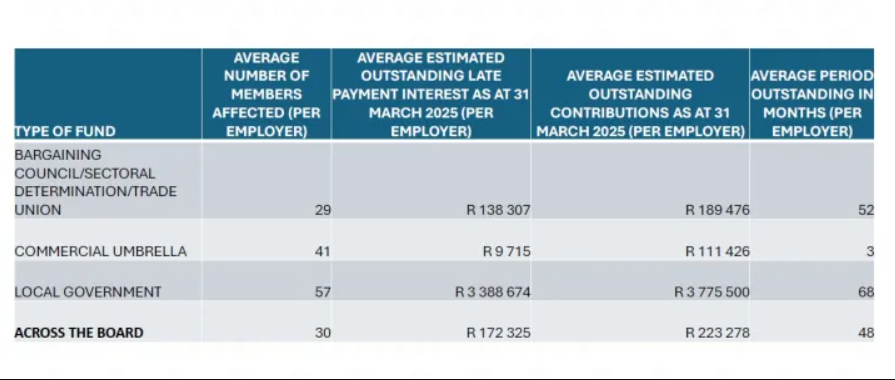

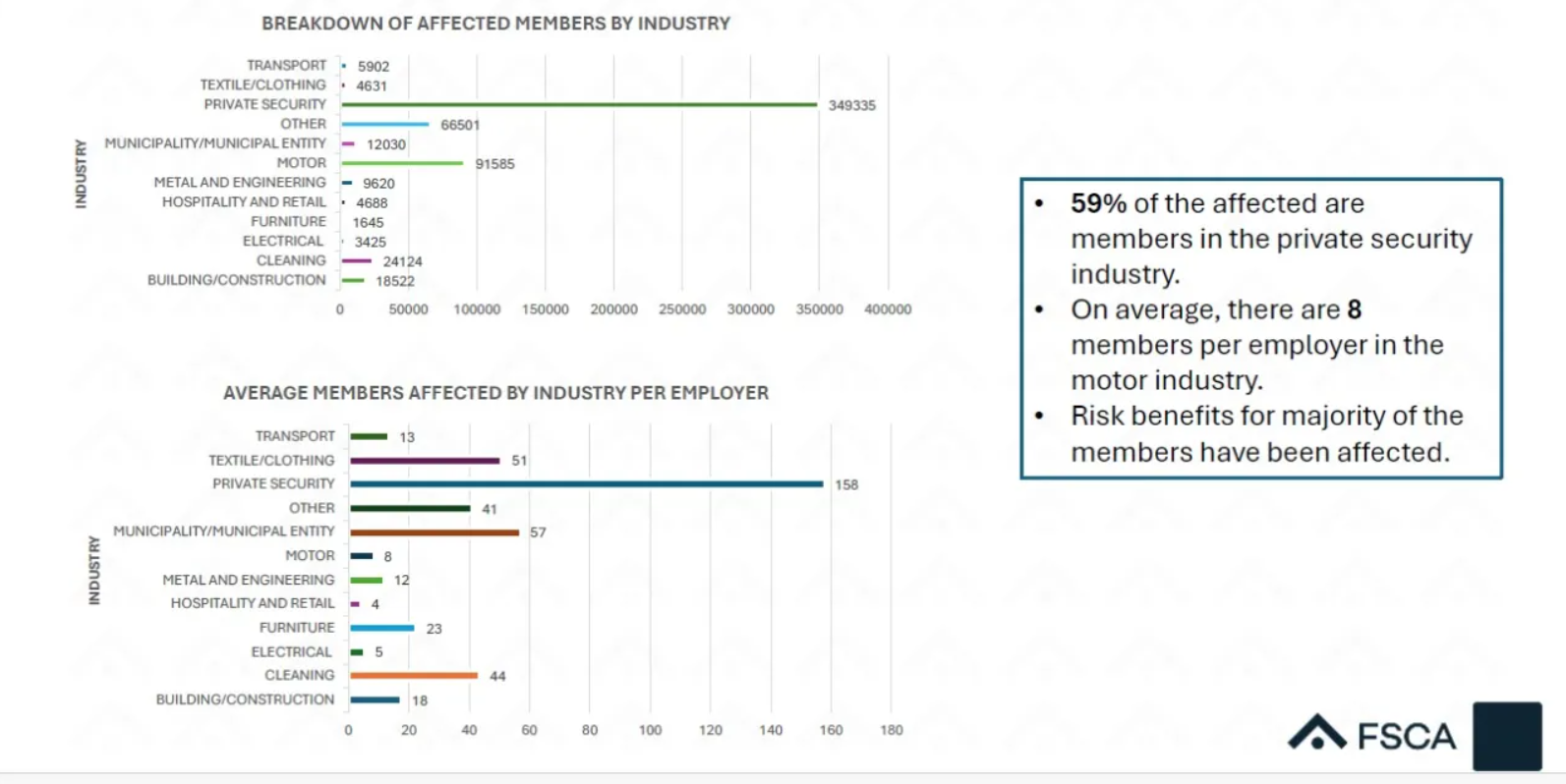

A financial report from the Financial Sector Conduct Authority (FSCA) stated that there was wide spread noncompliance by employers with regard to the pension Funds Act. The figures are alarming with more than 15 500 employers owing more than 600 000 workers R7.3 billion in unpaid pension contributions.

Surely this is no different from theft as your salary package would include a pension that should be paid by your employer. How bad is it you might be asking and this apparently goes back as far as 25 years so some employees actually don't have the pension they thought they had. This in my mind is criminal and total neglect by those running the companies and the poor workers are the ones who are being robbed.

The report published a list naming the most severe companies involved and that list was 5400 long and these are the companies that go back many years. Over the last two years the non compliance by companies has increased by more than 50%. The R7.3 billion in non payments is also made up of R2.3 billion in late payments that have incurred interest. The problem is even when the employers top up the outstanding amount owed there would be a shortfall due to not paying the interest. The pensions being paid out to the employees could be as much as 30% less due to settling the areas and not including the interest part that the fund would have generated over that time period.

The average time line of employers letting things slide is 4 years ranging from decades toa few months but still 4 years is still a chunk of change that would effect employees when they are going on retirement. The government cannot complain and make a fuss about this as the average government department is 6 years on non payments with the worst companies at 304 months.

The big issue is where have those funds gone to as when you have your pension deducted from your salary it should be sent o the pension fund and this has not happened. Knowing how corrupt South Africa is you can think the worst and you are probably correct in your assumptions. That money has been diverted and is long gone and there is fraud involved.

The only reason this has been bought to light is because of the idiotic two pot pension scheme the government introduced recently. This scheme allows employees to tap into their pension funds early by accessing up to 50% leaving 50% behind as their pension. Some employees requested a payment up front and there was no funds available which would have been a great shock, but at least they know this before hitting pension age.

Questions have to be asked how under the watch of the Financial Sector Conduct Authority this could even happen and especially when we are talking about timelines of 25 years. Apparently they are bringing in a new regulation that companies will have to comply with within the next 18 months, but that is still 18 months away.

This is seriously irresponsible and reckless and you have to wonder are these companies even able to afford to pay back the outstanding amounts owed knowing how bad the economy is. My gut feel tells me all those workers are screwed especially those owed for the 25 years especially if one of these companies closes it's doors. These funds are not just lying around and would have been found by accounting firms doing their audits and my guess is these funds have been re routed elsewhere never to be seen again.

Posted Using INLEO