This is the first time I am checking out the US Debt Clock. So I thought I will share the link and my learning with you.

This is the link: https://www.usdebtclock.org/index.html.

The U.S. Debt Clock

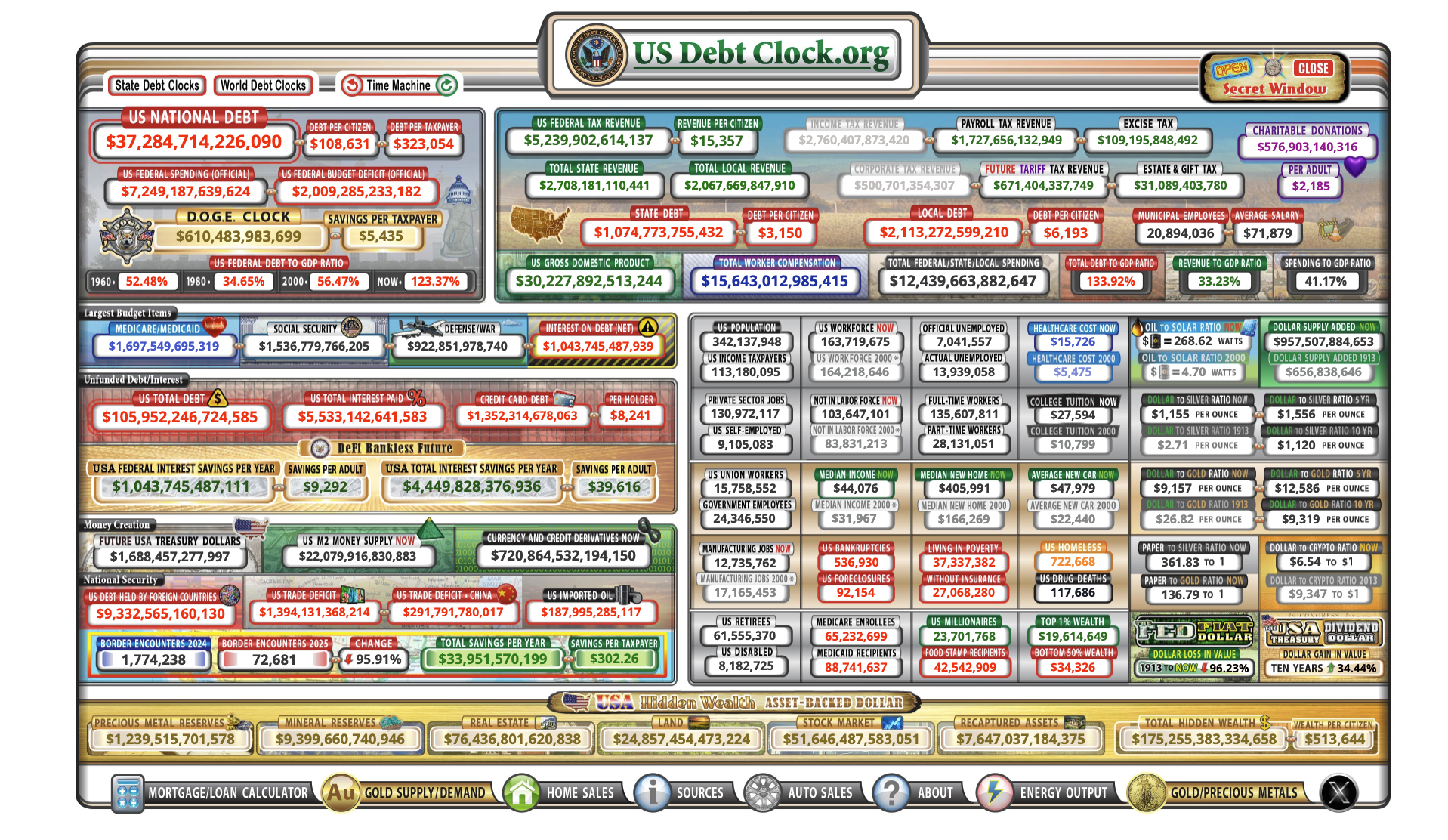

The U.S. Debt Clock is a real-time online tool that tracks the United States’ national debt and many related financial statistics. It’s often displayed as a fast-moving digital board, where the numbers climb second by second, reflecting how much money the government owes.

What It Shows

- National Debt: Total money the U.S. government has borrowed and not yet repaid.

- Debt per Citizen / per Taxpayer: The share of debt per person or per taxpayer.

- Federal Spending & Revenue: Running totals of government spending vs. tax collections.

- Unfunded Liabilities: Future obligations (Medicare, Social Security) not fully funded.

- Other Indicators: Population, workforce participation, inflation, trade balance, state debts.

Why It Matters

The U.S. Debt Clock is often used as a visual reminder of the growing scale of debt.

It raises questions about:

- Fiscal responsibility and sustainability of spending.

- Burdens on future generations.

- Risks of inflation, higher taxes, or reduced services.

- Trade-offs between borrowing for growth and long-term repayment challenges.

Some takeaways:

The annual growth rate of U.S. national debt is approximately 5.3% over that 12-month span.

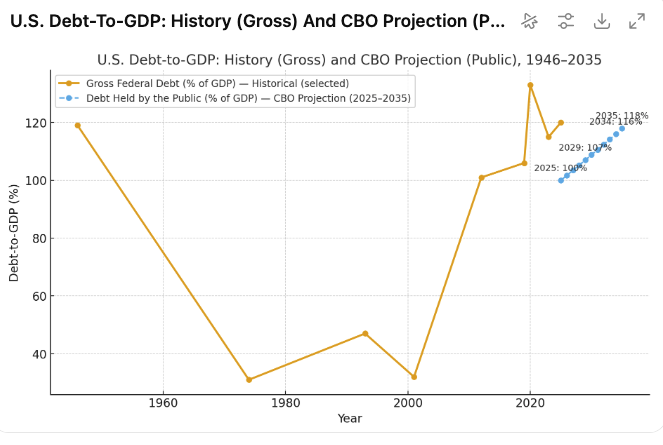

It is important to note that governments aren’t like households. They can refinance debt indefinitely if trusted. So the US is likely to refinance it. However, debt levels should be viewed relative to GDP, not just in absolute terms.

[Source: ChatGPT]

[Source: ChatGPT]

Besides, the U.S. dollar’s role as the global reserve currency provides unique borrowing power.

At best, the U.S. Debt Clock is both a warning symbol and an educational tool, showing in dramatic fashion how quickly debt rises. Its meaning, however, depends on broader economic context, fiscal policy, and global confidence in the U.S. economy.

Posted Using INLEO