If there’s one thing you’ll often come across in investment advice blogs or articles, it’s the strategy called Dollar-Cost Averaging (DCA). I’m sure you’ve probably heard of it before, I had too. However, when I first read about this strategy, I was a bit doubtful about whether it was actually a good one. The idea of investing a fixed amount of money into an asset, or into a token/coin in the case of crypto, on a regular basis didn’t seem to make much sense to me at first.

But as I continued researching and learning more about this approach, I realized that it’s actually very applicable here on Hive, especially for someone who wants to start their investment journey on the platform.

created using Sora

I’ve found that DCA is a powerful strategy for accumulating or stacking tokens in a consistent, non-aggressive way. Let me show you how it works using the price movement of the $HIVE token over the past three months.

Let’s say you started buying Hive tokens at the beginning of August 2025. A reasonable DCA plan for Hive would be to invest $100 worth of Hive every week.

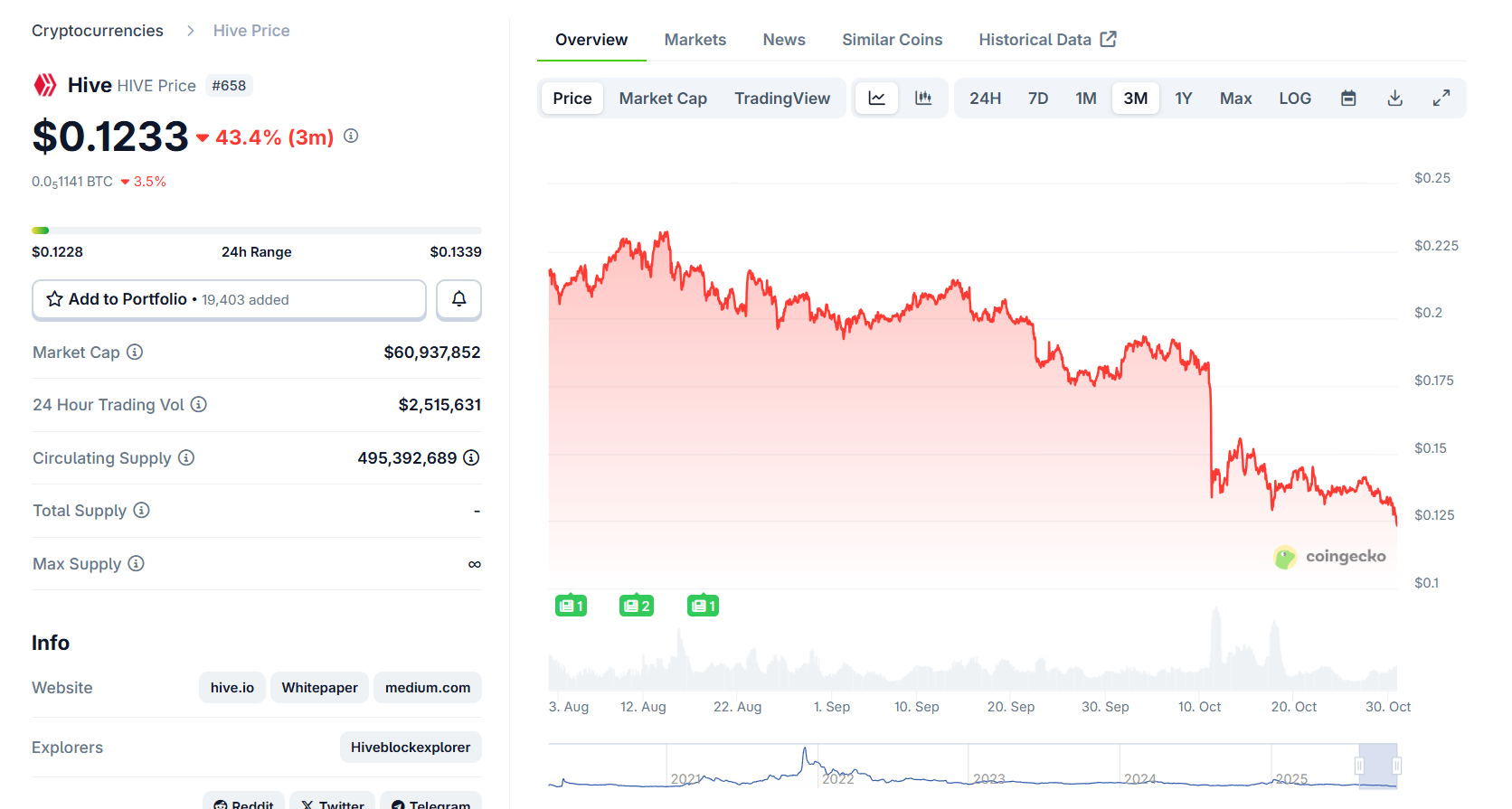

As you can see in the chart, Hive’s price has been quite volatile over the past three months, trending downward overall. Of course, we couldn’t have predicted this movement three months ago, which is why the strategy involves buying regularly, regardless of the token’s price.

In this example, we’re buying $100 worth of Hive every week from August 1, 2025, to October 30, 2025.

So, let’s break it down:

3-month price picture

- Trend: steady downtrend with lower highs/lows.

-

Rough ranges by month (from the chart):

-

Aug ≈ $0.20–0.22 (avg ~$0.205)

- Sep ≈ $0.17–0.20 (avg ~$0.185)

- Oct ≈ $0.12–0.15 after the dump (avg ~$0.135)

- Current price on your screenshot: $0.1233. Bias: still weak, bounces likely to stall under $0.15–0.16 unless demand improves.

If you invested $100 every week for ~3 months (13 weeks)

I approximated weekly prices by month (4 weeks Aug @ $0.205, 4 weeks Sep @ $0.185, 5 weeks Oct @ $0.135).

- Total invested: $1,300

-

Estimated HIVE accumulated:

-

4×$100 / 0.205 ≈ 1,951 HIVE

- 4×$100 / 0.185 ≈ 2,162 HIVE

- 5×$100 / 0.135 ≈ 3,704 HIVE

- Total ≈ 7,817 HIVE

- Average cost per HIVE (cost basis): ~$0.166

- Value today at $0.1233: ~$964

- Unrealized P/L: ~–$336 (–26%)

What price do you need to break even?

- About $0.166 (your average cost).

Quick “what-if” value of your ~7,817 HIVE

- At $0.15 → ~$1,173

- At $0.18 → ~$1,407

- At $0.20 → ~$1,563

So, now what?

Of course, at the current price, there’s no point in selling at a loss, and it’s frustrating to just let your tokens sit idle on an exchange or in a wallet doing nothing, right? So, let’s think of a way to make them grow. The most obvious approach is to stake them, convert them into Hive Power, and use that for curation.

Let’s say you’re able to maintain daily curation activity and consistently use your full voting power, 10 votes at 100 percent, on good content.

On average, you can expect around 8% APR from curation rewards, plus an additional 3% from staking rewards. Now, if you decide to take a long-term approach and continue curating consistently for the next four years, let’s calculate how much your stake could grow over that period.

Awesome... adding the extra 3% staking to your 8% curation makes the APR ≈11%.

Using your starting balance ~7,817 HP (from $100/week for ~13 weeks), and compounding rewards back into HP:

-

Compounding weekly (realistic):

-

End Yr 1: ~8,725 HP

- End Yr 2: ~9,738 HP

- End Yr 3: ~10,869 HP

- End Yr 4: ~12,132 HP

(For reference: annual compounding ≈ 11,867 HP; continuous ≈ 12,138 HP. Weekly is essentially the same as continuous.)

So after 4 years at ~11% APR, your Hive Power would grow from ~7,817 → ~12.1k HP — about +55% more HP.

In the end, Dollar-Cost Averaging isn’t just about timing the market, but about building discipline and consistency over time. By combining DCA with staking and active curation, you can steadily grow your Hive Power while supporting the community. It’s a simple, sustainable strategy that rewards patience and long-term commitment... the real keys to success in crypto investing.

click here ⏩ City Life Explore TikTok Page 🎦