More and more people are looking into stablecoins as the key driver for crypto’s mass adoption. Although the older generation finds it difficult to integrate their finances into this digital economy, the younger generation is taking the leap, moving their fiat through on-ramp solutions and saving their money on-chain as stablecoins. Personally, I believe this will be the use case that creates a snowball effect leading to major mass adoption.

Created using Sora

Created using Sora

I see myself making this move in the near future, especially once my city starts implementing crypto as a common form of digital payment. I actually shared about this on Snaps a few weeks ago, when I came across a news article saying that around 24,000 merchants citywide will soon accept crypto as a payment method. That kind of news makes me very bullish about the crypto space. Here in my city, I rarely use cash anymore. Most of my transactions are already done digitally through systems like NETS, EZ-Link, PayNow, PayLah, and other platforms depending on the merchant. Basically, all my spending is digital, it’s fast, convenient, and helps me manage my finances efficiently.

Imagining a World of Crypto Payments

Now I’m imagining a world where crypto can be used everywhere for payments, and I’m hopeful that HBD will be among the options. Of course, this is already happening in other countries, and even here in my city, thanks to SpendHBD by Distriator.

I recently checked their website to see if any merchants in Singapore have started accepting HBD payments through SpendHBD. To my surprise, there’s already one, Hangry Hamster, a store that specializes in art items and hamster figurines. It’s exciting to know we already have a SpendHBD merchant in the city, although I haven’t visited yet since I don’t collect their products.

I hope more merchants will adopt the SpendHBD payment system soon, allowing more Hive users to use their HBD here in the city.

My wishlist includes restaurants, grocery stores, clothing shops, and stationery stores. Ideally, basic goods retailers would be the first to adopt it, after all, Hive and HBD are perfect for micropayments.

Why Hive Was Built for Mass Adoption

Hive’s design was on point from the very beginning. It’s made for mass adoption, fast, efficient, and with almost zero fees. While most people in other blockchains worry about gas fees, Hive users have already been enjoying gas-free transactions. If more people learned about Hive, I’m confident they’d be drawn to participate and invest in the ecosystem as well.

Real Use Cases, The Hive Cuba Community

Earlier today, I saw a Snaps post from a member of the Hive Cuba community doing e-commerce using HBD as payment. I’m not sure how it started, but it seems they’ve already established a peer-to-peer (P2P) system. Members are buying and selling goods, and even exchanging Hive tokens for fiat through their own P2P network.

This made me realize that Hive use cases don’t have to rely on dApps or external platforms. The Hive blockchain itself is already a platform where people can make trustless transactions, because it’s built for humans, and everything on it is human-readable. Our usernames, reputations, and profiles are all transparent and verifiable.

A well-engaged Hive user with a high reputation is likely to be trusted in a P2P transaction, especially within the same community. That’s what’s happening in the Hive Cuba community, once you join, you’re motivated to maintain a good reputation because it enables future business opportunities.

The Need for Escrow on Hive

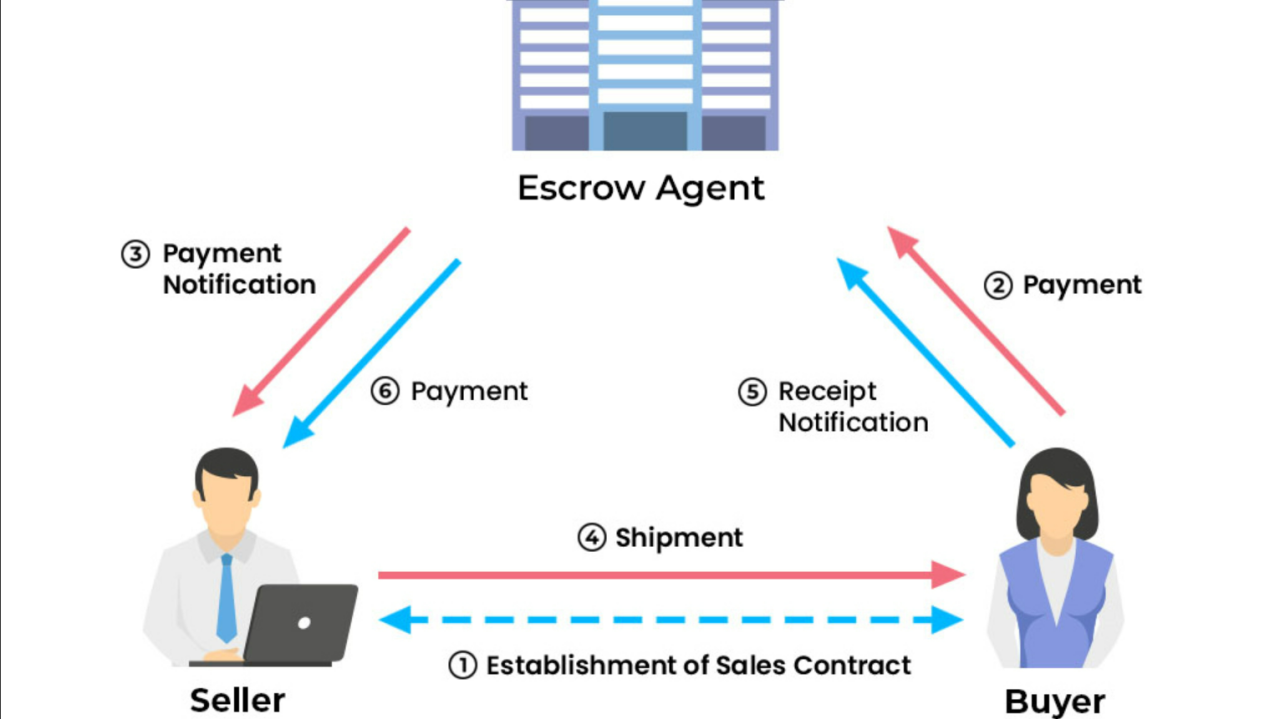

Of course, scalability in P2P systems remains a challenge, but this could be solved through Escrow integration. I’ve heard one of Hive’s core developers mention this feature.

After reading that post, I realized that an Escrow system is one of the key financial tools Hive still needs. It would strengthen our trustless ecosystem even further. Once Escrow is implemented, Hive could evolve into a global marketplace where users can conduct P2P transactions confidently, not just within trusted communities, but worldwide.

Here’s how it would work, both parties would agree on an agent (a neutral party) to facilitate the transaction, including any dispute resolution if needed. This system would eliminate trust barriers and allow people around the world to transact securely, knowing their exchange is protected and likely to succeed.

In the end, Hive and HBD embody the future of everyday digital finance, combining accessibility, speed, and trustless innovation. As more people and merchants begin to embrace crypto payments, we move closer to a world where blockchain seamlessly integrates into daily life. With tools like SpendHBD and Escrow on the horizon, Hive stands ready to lead the next wave of global crypto adoption.

click here ⏩ City Life Explore TikTok Page 🎦