The Coinbase chain, Base has gained traction in the last year, emerging as one of the top L2 on Ethereum. I’m not even sure should it be called L2, as from my perception it’s more of an L3 than L2. Coinbase wants to give its users more toys to play with and onboard the users of the exchange to the Base chain. Instead of users using Coinbase to buy crypto and then transfer it to another chain where they do all the defi, NFTs and other stuff, keep them in the ecosystem by offering them this company chain.

The chain itself is opensource, built with the Optimism technology. However, from my understanding Coinbase is running the chain by themselves, meaning one validator/block producer. I’m not totally sure how exactly this works and if there more validators, or options for other to support the chain, but in both cases it’s a single entity show. What this means is that basically if they want, they can censor transactions, freeze funds etc. without any consent from other parties. They can be subject to regulation and government control as a US based company.

However, for now the show continues and the chain has gained traction. It is global and international, and everyone can use it. A while back they even introduced zero fees for USDC transactions on Base, making payments with USDC on Base attractive.

Let’s take a look at the data on the Base network and see what has been happening in the last period.

The data presented here is mainly from base scan, DeFi Lama and Dune Analytics.

We will be looking at: - Total Value Locked TVL - Number of Addresses - Active Addresses - Daily Transactions - Fees - Contracts

The data here is gathered from sources like Basescan.org, Dune Analytics and DeFiLama.

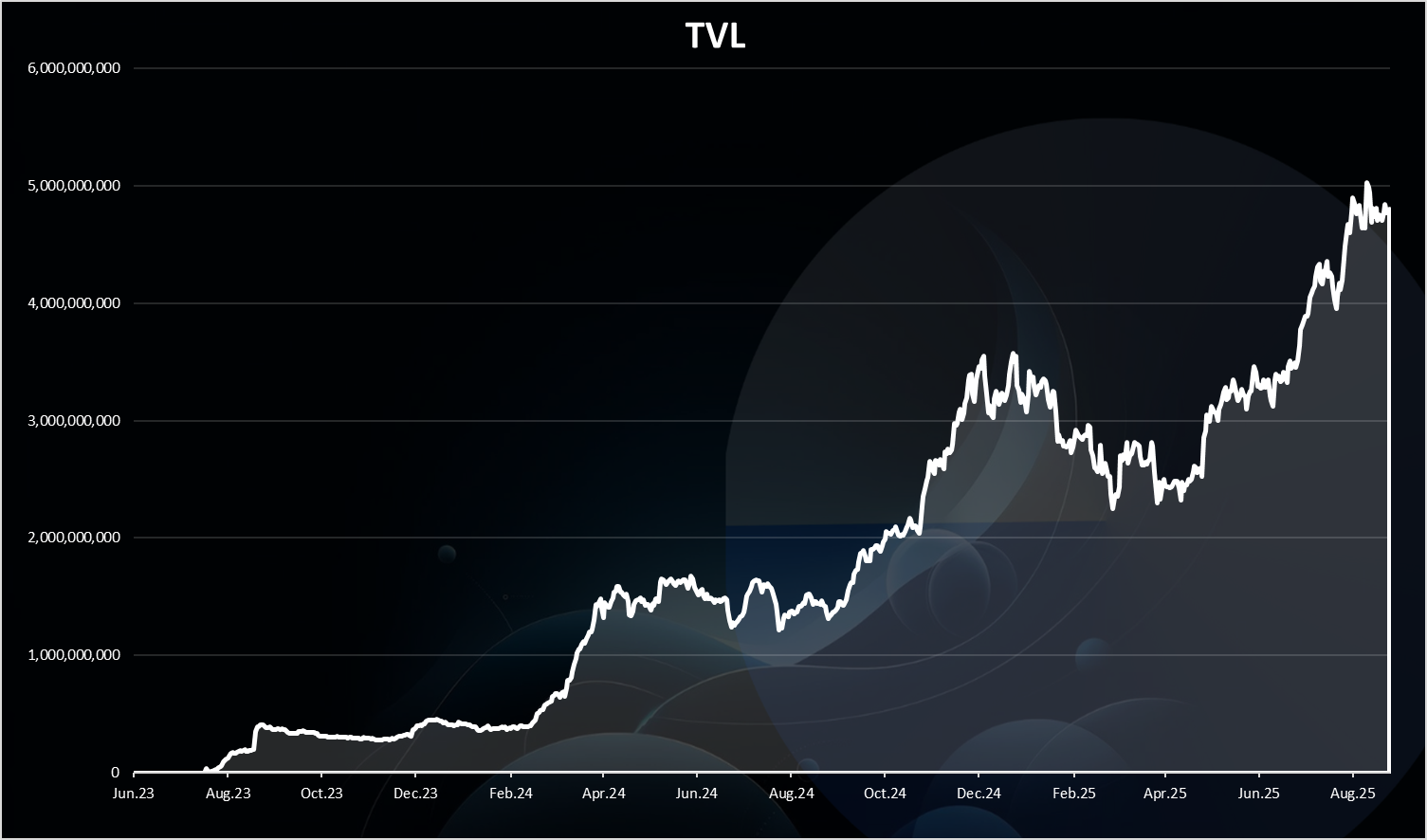

Total Value Locked

This represents how much value has been bridged to the Base chain where it seats and is being used in DeFi and other use cases. Here is the chart:

As we can see for the first time funds started being bridged on Base back In August 2023, when the TVL reached 400M USD. Then a period of stagnation up to February 2024, when the TVL started growing aggressively and it reached 1.5B, went sideways for a while and then later in 2024 grew aggressively again and reached ATH of 4B in TVL. It dropped in the first half of 2025 under 3B, and since May 2025 it has been growing almost constantly reaching a new ATH of 5B just recently.

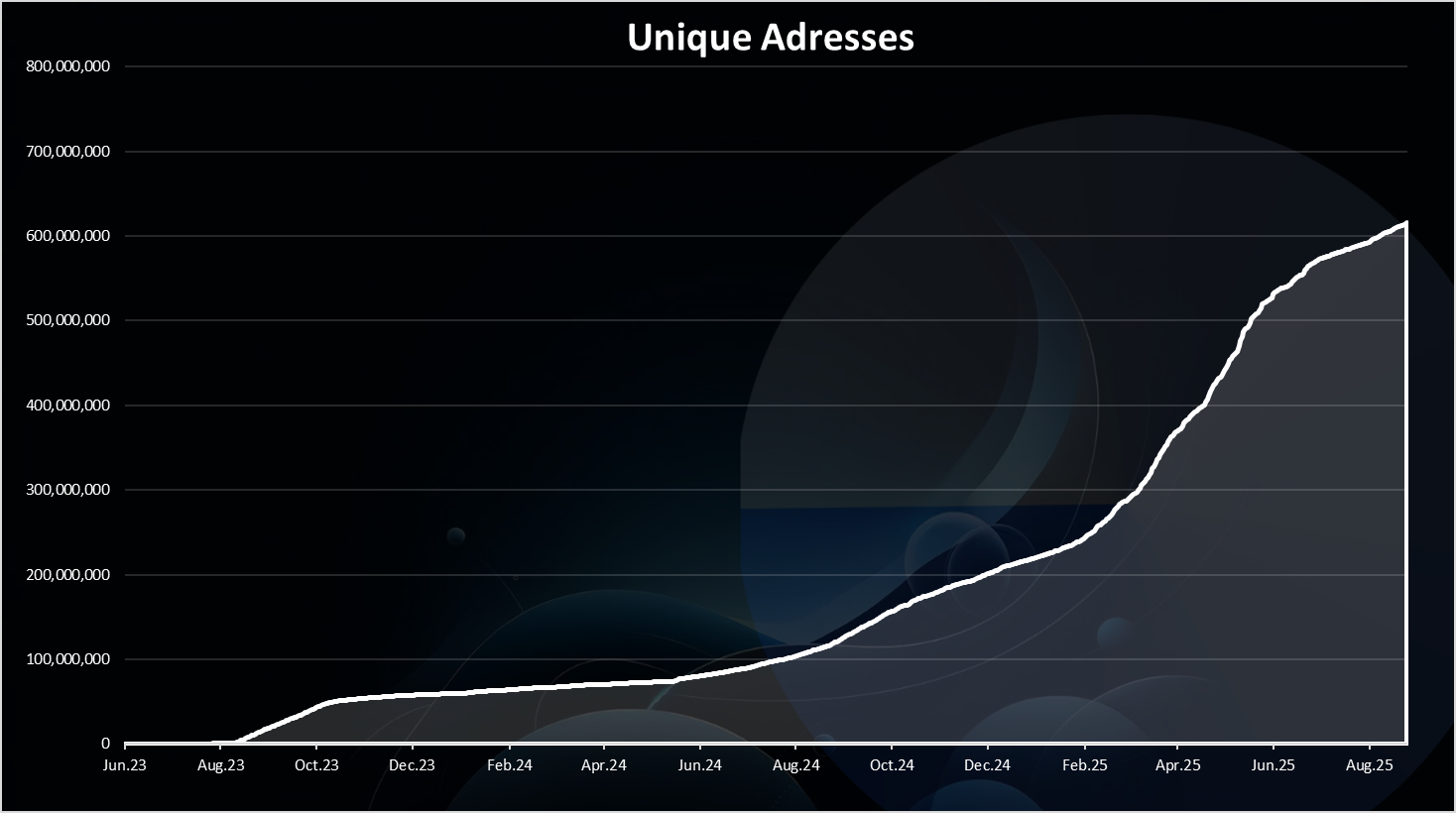

Number of Addresses

One of the key metrics for crypto projects is the number of wallets.

First the overall number of wallets.

There was massive growth during the whole period and even faster acceleration in the las year. The number of wallets on Base is now close to above 600M. For comparison Ethereum has close to 350M wallets, so Base has surpassed it now, and it is close to being number one from all chains, in close competition with the Binance Smart Chain.

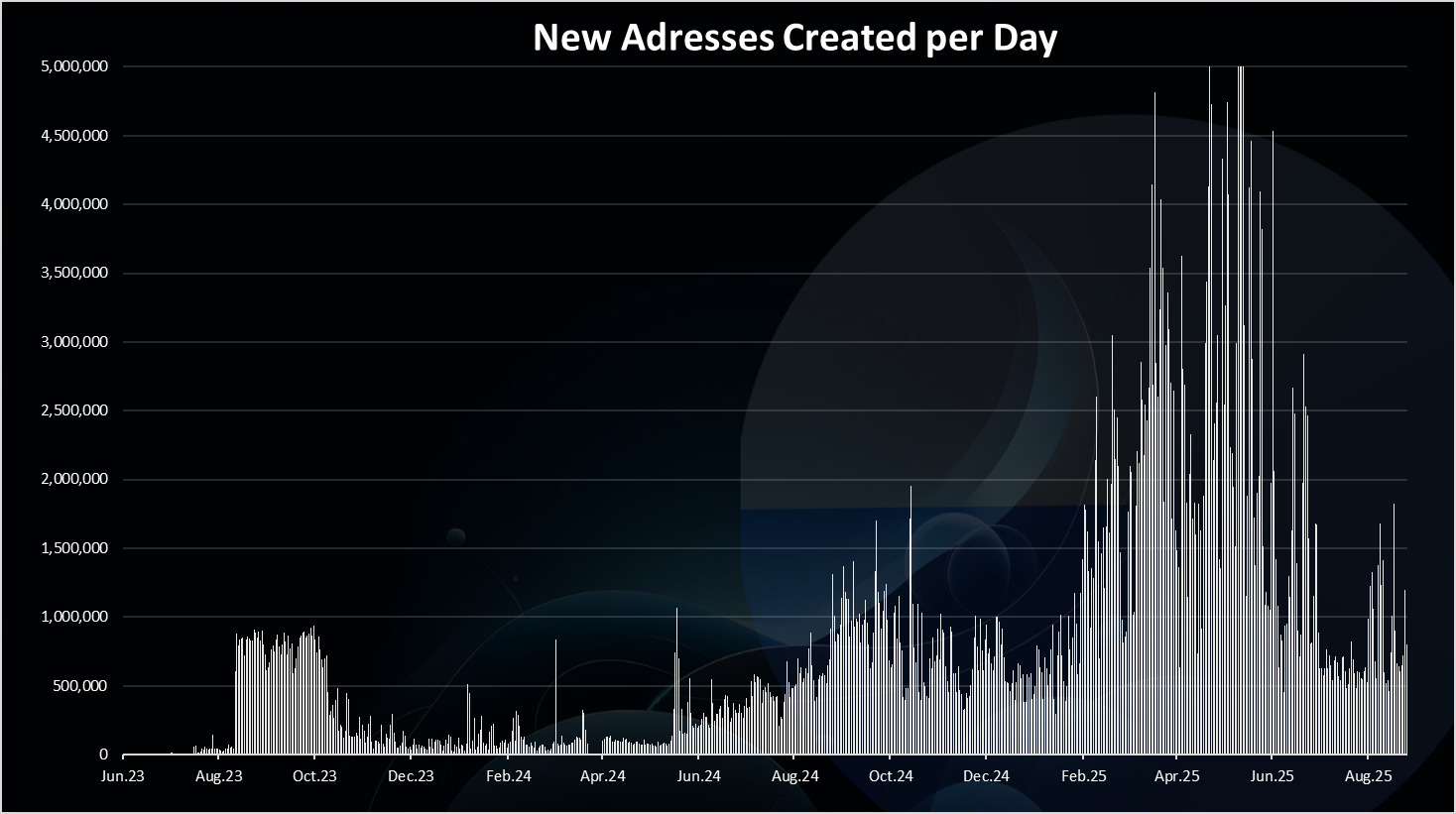

If we take a look at the new daily wallets we get this.

Here as well we can see the growth back in August and September 2023 when there was close to 1M wallets created daily. This lasted up to October 2023 and then dropped to less than 100k new wallets daily.

A growth again in the summer of 2024 and increasing in the last months reaching 4M new daily wallets on a few occasions. In 2025 the number of new wallets grew even more aggressively.

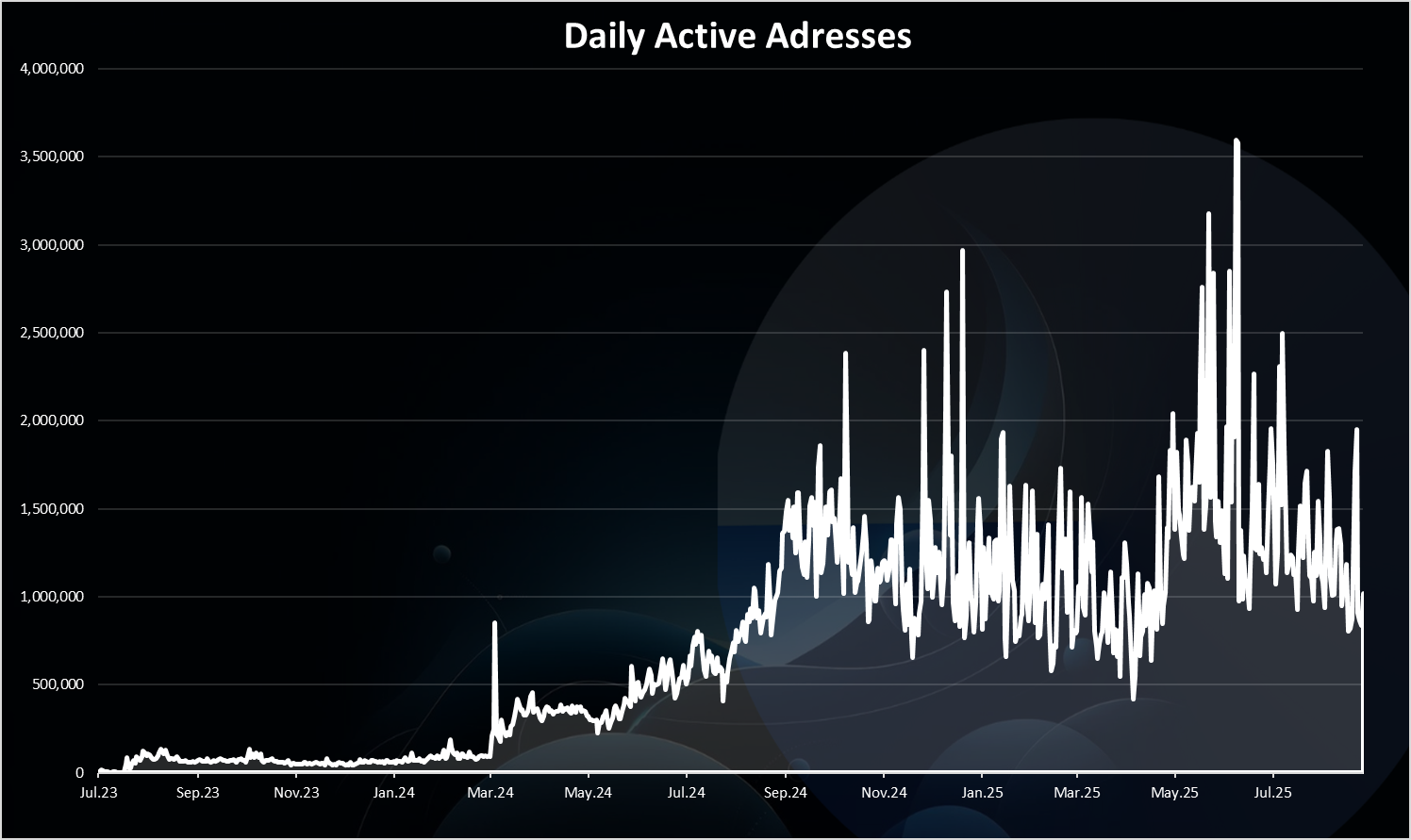

Active Addresses

How many of the wallets created are active? Here is the chart.

At first the number of active wallets increased to around 100k DAUs, where it stayed for a while, and then a continuous growth in 2024, starting back from March 2024 reaching an 2M DAUs in December 2024. A drop in the first months of 2025, and growth again in May 2025 with a new ATH of 3.5M. Since then, a pull back again in the range of 1M to 1.5M DAUs.

For reference the number of active wallets on ETH is around 500k.

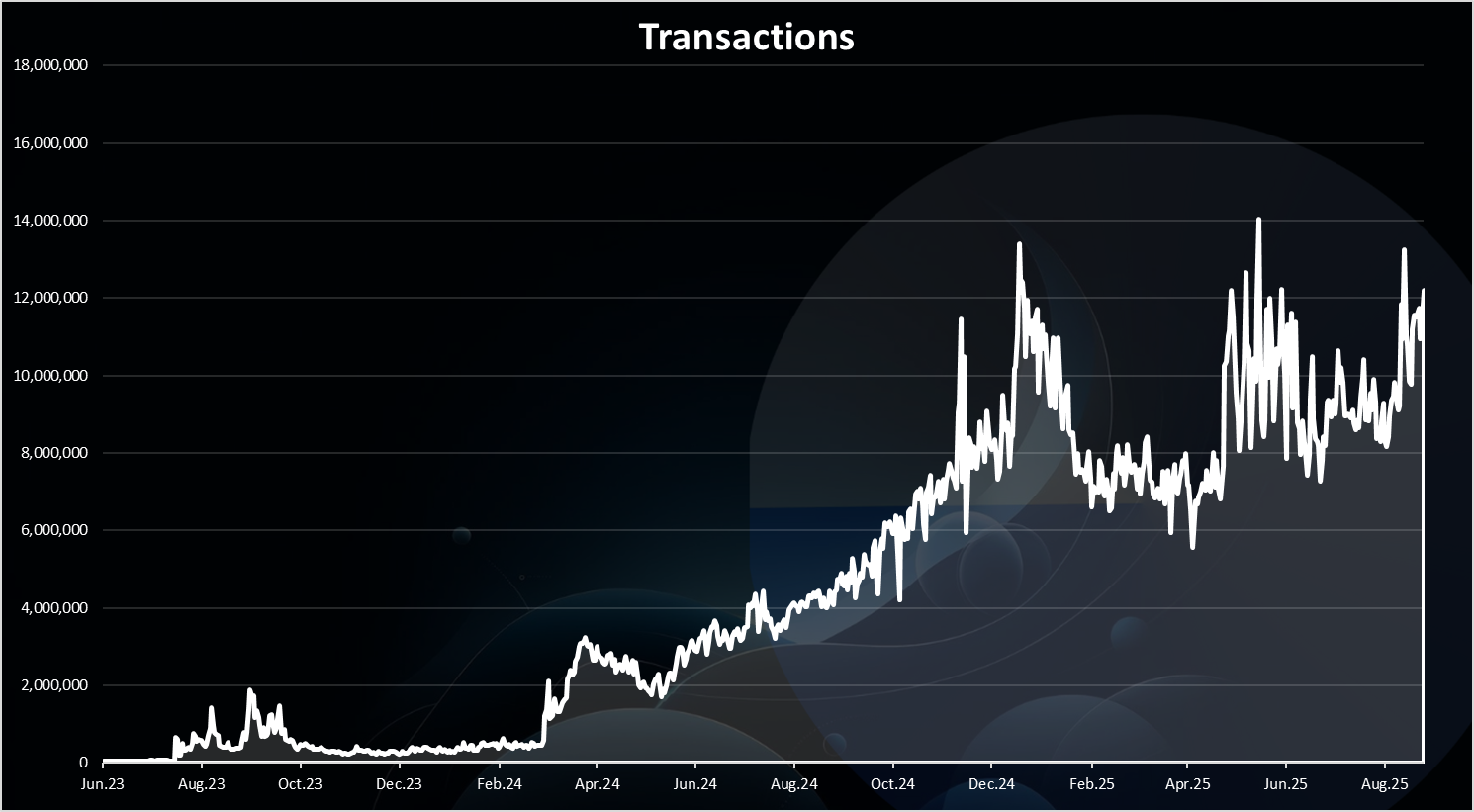

Daily Transactions

The activity on the network is mostly represented by the number of daily transactions.

On the transactions side we can see a constant growth in 2024, that started back in March. An ATH in number of active wallets on Base was reached at the end of 2024 and the beginning of 2025 with an amazing 13M transactions. A lot of bots probably in here because of the cheap fees. However there is still a big growth.

Some ups and down in the last period with the numbers around 10M.

On Ethereum the number of transactions per day is around the 1M mark.

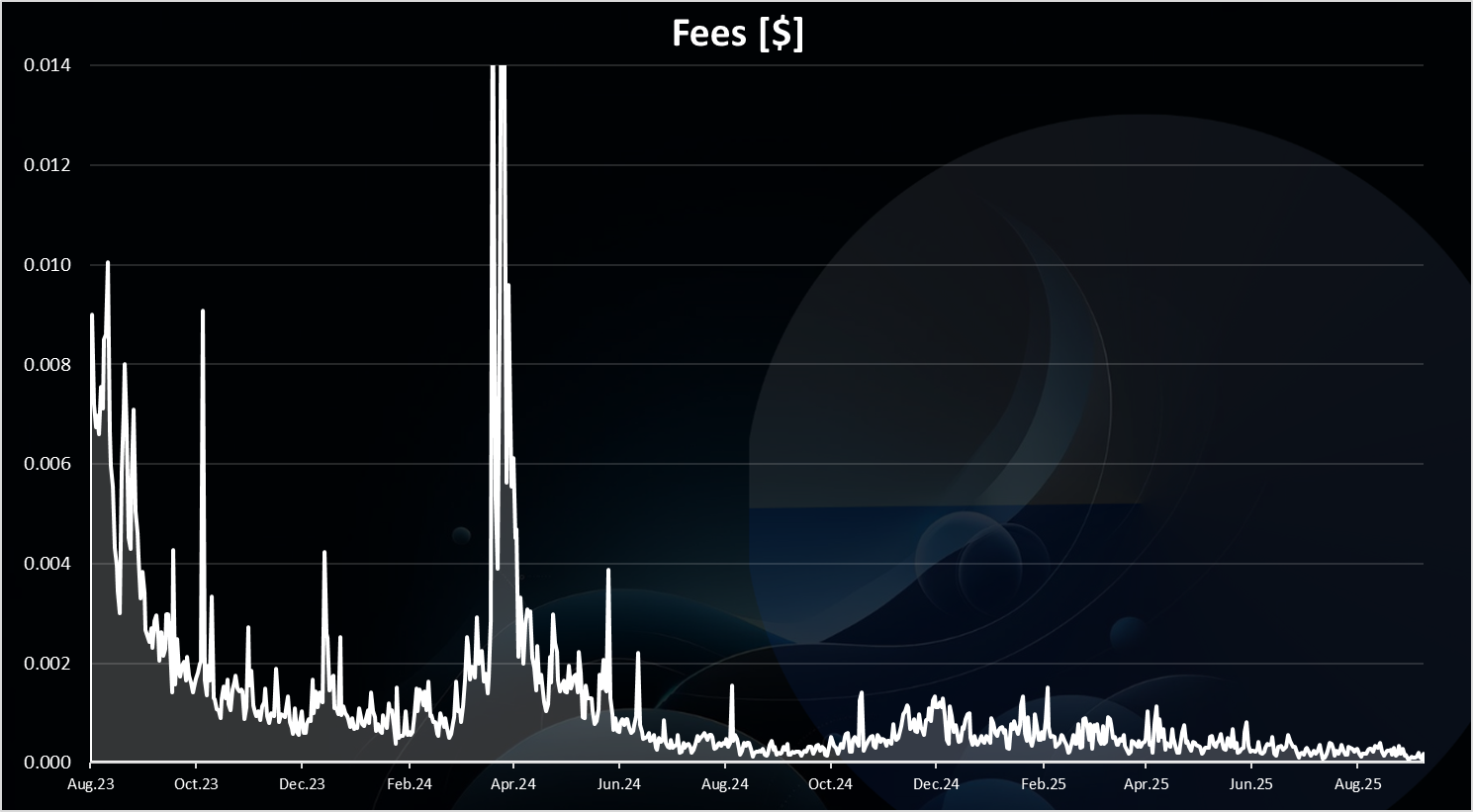

Fees

Base is basically promoting itself as a low cost option to Ethereum, but also an easy gateway from the Coinbase exchange. Recently they have even made USDC transactions feeless.

Here is the chart.

The above are the fees per transactions in $.

As we can see, at first there was a lot of volatility with the fees going up and down but staying relatively low. In the recent period the fees are basically below one cent or in the range of 0.001 to 0.0001 USD. This is no doubt a very small fees. But even with this small fees the Base chain generate daily revenues somewhere between 100k to 700k USD.

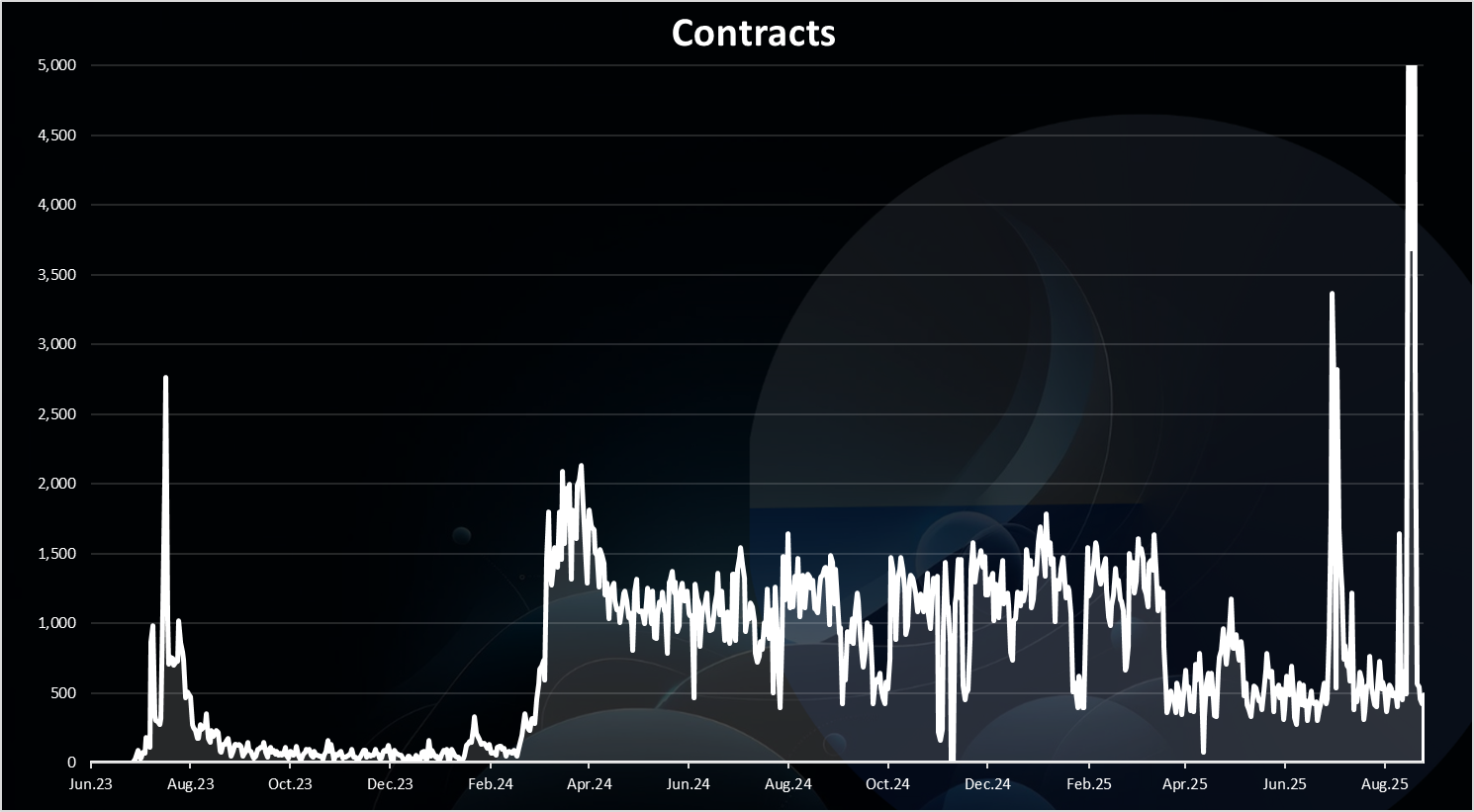

Contracts

Base as Ethereum is a smart contract platform so here is the chart for verified contracts per day.

A spike at first up to 2k daily contracts, then a drop to few per days, and an increase again in March 2024 to 1.5k where it stayed for a year. A drop in 2025 to around 500 where it has been now, with occasional spikes.

Overall, a lot of the metrics on the Base chain are up, with some spikes in between. TVL is up, wallets are up, DAUs and transactions also up, with some drops in between.

All the best @dalz