Stablecoins are now well established in the crypto markets and have become an integral and essential part of it. What’s even more interesting is that with the new US administration, the first legislative from the crypto industry was the act on stablecoins. The path is now clear for creating legal and compliant stablecoins. The act was put in place a month ago. Let’s check how the stablecoins are doing with this new regulatory clarity.

In the last few years, the stablecoins market cap seems to be more concentrated around Tether USDT and Circles USDC. In the past we had Binance USD – BUSD, then the now collapsed Terra UST, DAI was also relatively bigger than it is now and rebranded as USDS. Some new stablecoins appeared but those are still with relatively small market cap.

Apart from the fiat backed stablecoins (USDT, USDC, ….) that are keeping dollars in the banks or equivalent like T-bills, there are tokens like DAI, HBD that are backed by other crypto as collateral, and/or using conversion on chain operations to maintain the peg.

Here we will be looking at: - Tether [USDT] - USD Coin [USDC] - USDS / Dai - Ethena USD [USDe] - First Digital Dollar [fdUSD] - USD1

There are a few more out there like, the Paypal token pyUSD, FRAX, etc, but we will focus on the above as the biggest ones in market cap.

Tether [USDT]

Tether is the oldest stablecoin in crypto. It has been around since 2015. Allegedly it is founded by the Bitfinex exchange. There was a lot of controversy around this coin in the past, including court cases. The main issue that has been raised has been is each coin backed by one dollar in the bank. Tether is an offshore company with a location outside of the US jurisdiction. With the new stablecoin act in the US Tether is set to become onshore company within the next three years.

Tether has survived multiple crashes and run on the banks in the last years, and it has proven itself to work as intended in the mist of the biggest chaos in the crypto industry.

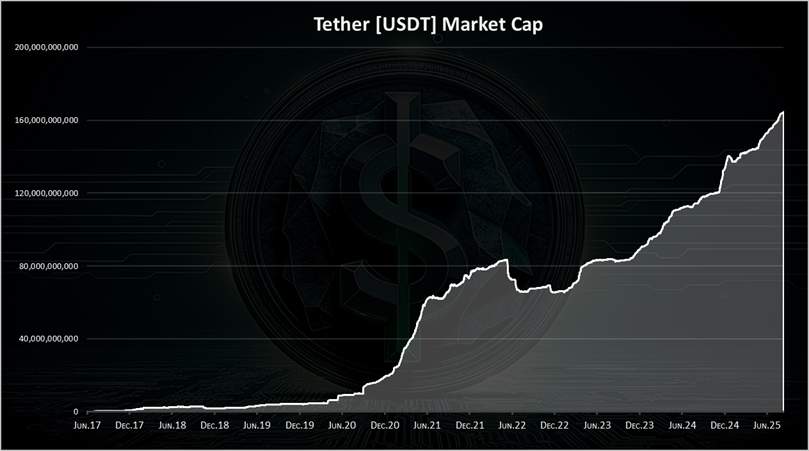

Here is the market cap for Tether.

As mentioned, Tether started operating back in 2015, but it gained some significant market cap for the first time in 2017. A real bull run and a massive increase in the market cap happened in 2021 when its market cap went from under 10B to more than 83B. Then in 2022 there was the crypto crash and the Tether market cap contracted from 83B to 65B. In 2023 it started growing again and continued to grow since then.

Quite the growth for Tether, even accelerating in the last period and it is now at 165B In 2024 alone Tether added 50B in its market cap. From 90B at the beginning of the year to 140B at the end. Another 25B in the first half of 2025. An amazing achievement for Tether market cap. At this value, Tether and the treasury bills it holds Tether is now in the top 10 US debt buyers, the size of a middle to big country. It’s almost unbelievable when you think about it. A company with less than 100 employees is a significant buyer of US debt. This raises a lot of questions, but that is a totally different debate. Also Tether made the most profit per employee in the world in 2024. Close to 20B.

USD Coin [USDC]

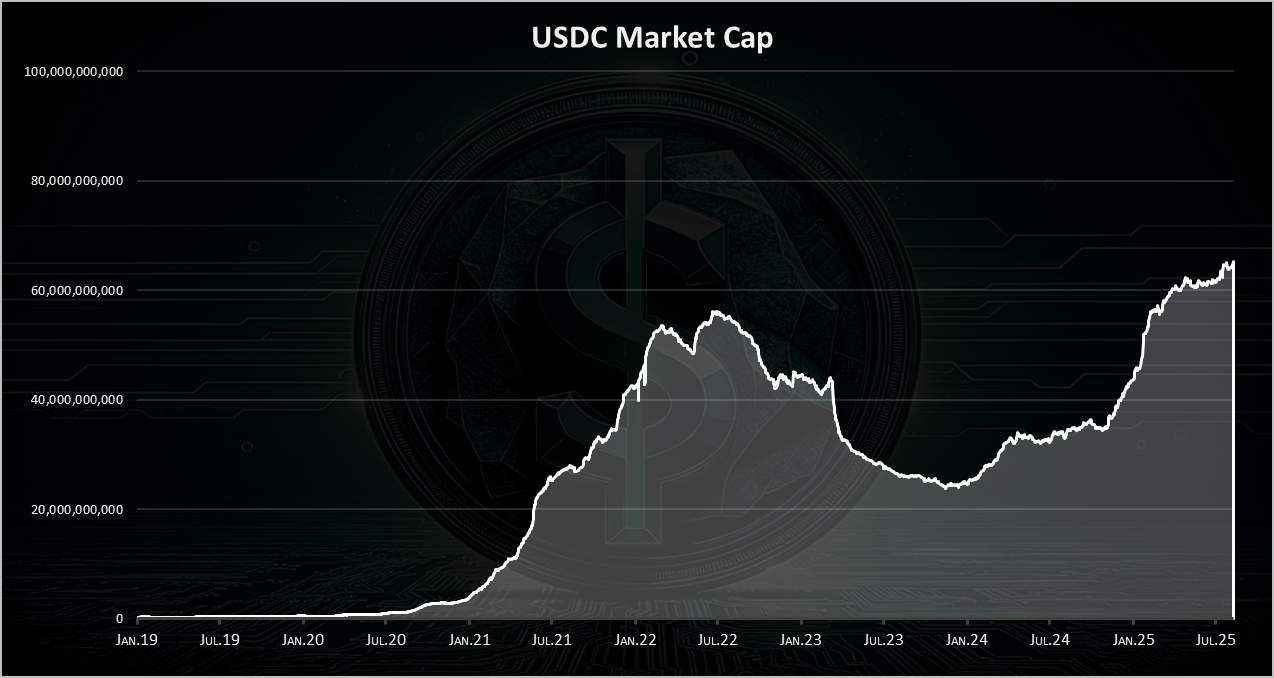

USDC is a common project between Circle and Coinbase. It is a US based company. Here is the chart.

USDC was founded back in 2018 and it gained real momentum in 2021, when it reached 58B. A drop followed afterwards in 2022, and even bigger drop in the first half of 2023 due to a bank crisis in the US. In March 2023, one of the banks where USDC had a share of its reserves in USD collapsed, causing the market to panic and pushing down the peg of USDC as low as 88 cents. This was short lived and the USDC peg recovered in a day or two, and later it even managed to get access to its funds in the collapsed bank. But the damage was done, and a lot of funds exited from USDC.

In 2024 the USDC market cap started growing again and it is now close to 60B, finally reaching its previous ATH. In 2025 the numbers increased, but just a bit, reaching 65B in market cap.

USDT vs USDC

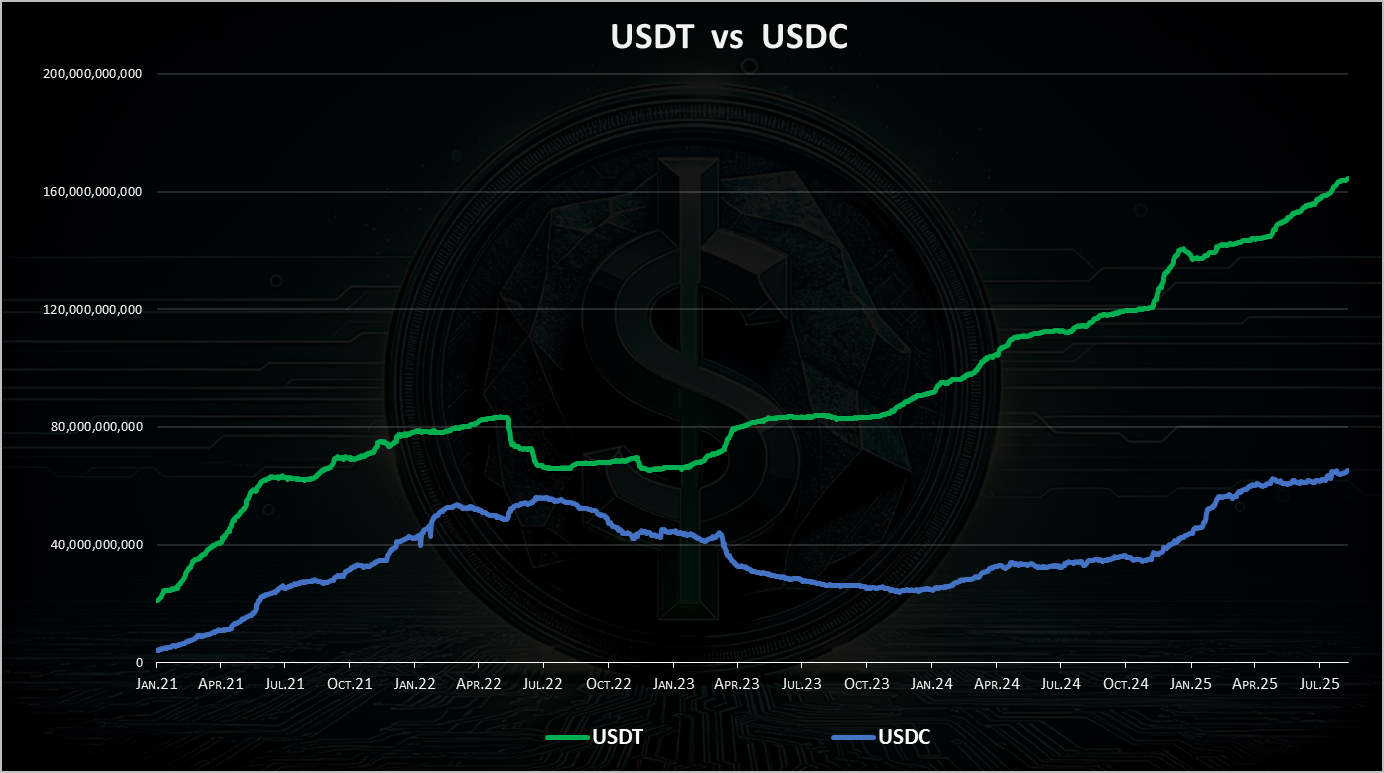

When we plot the market cap of the two biggest stablecoins we get this.

After the growth of both of these coins back in 2021, in 2022 and 2023 the market cap of these two has been inversely correlated. Whenever Tether lost market cap, USDC gained. In the last year 2024 for the first time in a while both coins started growing again, although we can notice that Tether is growing faster than USDC. The growth continues in 2025 despite the drop in the crypto prices. Tether is now in massive lead in the first spot, outpacing the closest competitor by a lot.

Ethena USD [USDe]

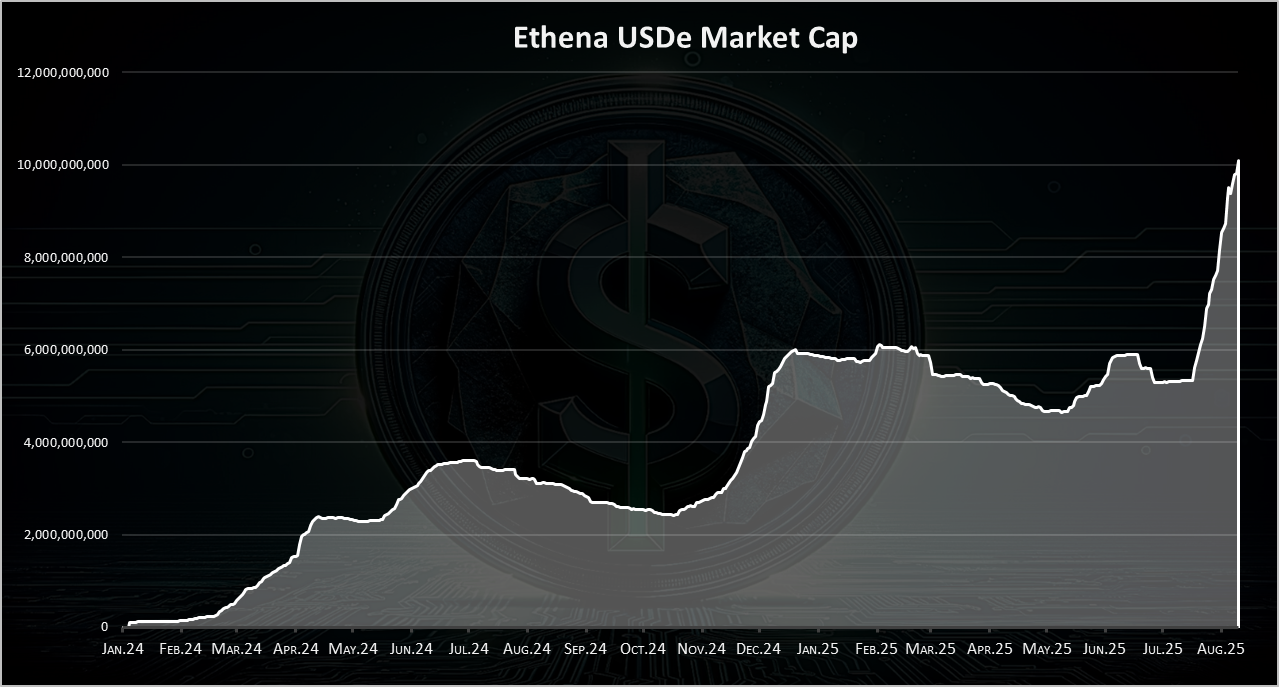

Ethena is a type of synthetic dollar that is dollar backed by a “delta-neutral” position that goes long spot stETH (and BTC) and simultaneously short an equivalent ETH-PERP (and BTC-PERP) position. The net effect is that both positions offset one another and therefore USDe is theoretically able to maintain its 1:1 peg.

Ethena is the new kid on the block and has been growing significantly in 2024 but spiked a lot in the last month going from 5B to 10B where it is now. With this jump in market cap, USDE is now in the third spot when it comes to stablecoins. It has a governance token as well ENA, that has performed great in the last month as well.

USDS / DAI

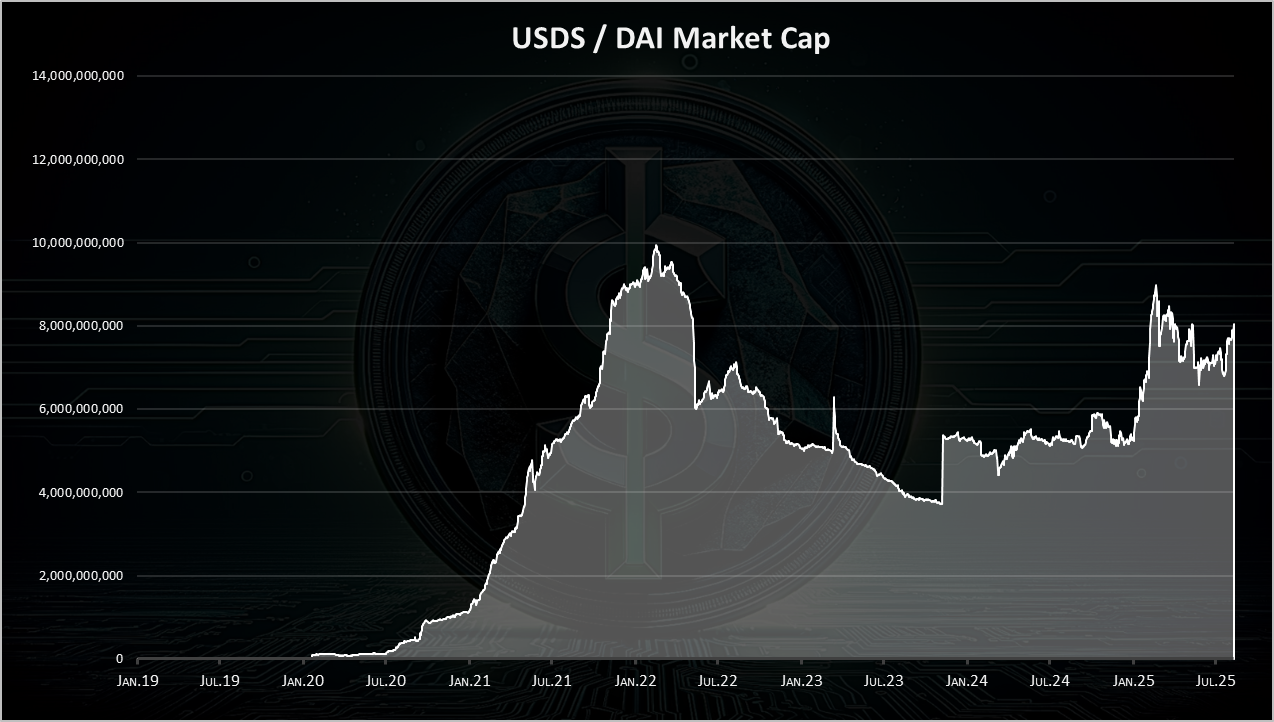

USDS or formerly DAI is the decentralized version for stablecoin. It runs as a smart contract on Ethereum. Everyone can use the MakerDAO protocol, deposit collateral and generate stablecoin as a loan.

USDS / DAI works as overcollateralized stablecoin, where users put in crypto assets to mint USDS / DAI. DAI was established back in 2019, it grew through 2021 a lot reaching 10B market cap, and it has been in decline since then up November 2023. We can see the big spike at the end of the chart. That is an increase in the market cap of DAI from 3.5B to 5B in just a few days. The biggest increase was on November 8, when there was 1.5B USDS / DAI minted in a day. Another growth happened in the beginning of 2025, and sort of sideways since then. With all the changes that were done it is now a bit unclear what is DAI, what is USDS and there is even one more version called sUSDS.

Not sure what exactly is happening with USDS / DAI there seems to be a tendency to back it with treasury bills. My wild guess is that the regulators are not in favor of a stablecoin where the collateral is crypto. They probably prefer the US debt to act as collateral.

USD1, fdUSD, pyUSD and TUSD

USD1 is the new kid on the block started back in April 2025. It is related to the Trump family. The fdUSD has grown especially in the last period and has reached more than 3B since August 2023 till now. TUSD is now at 400M and has declined since its peak of 3B. The Paypal stablecoin pyUSD has also entered the game and it is now close to 1B.

Cumulative Stablecoins Market Cap

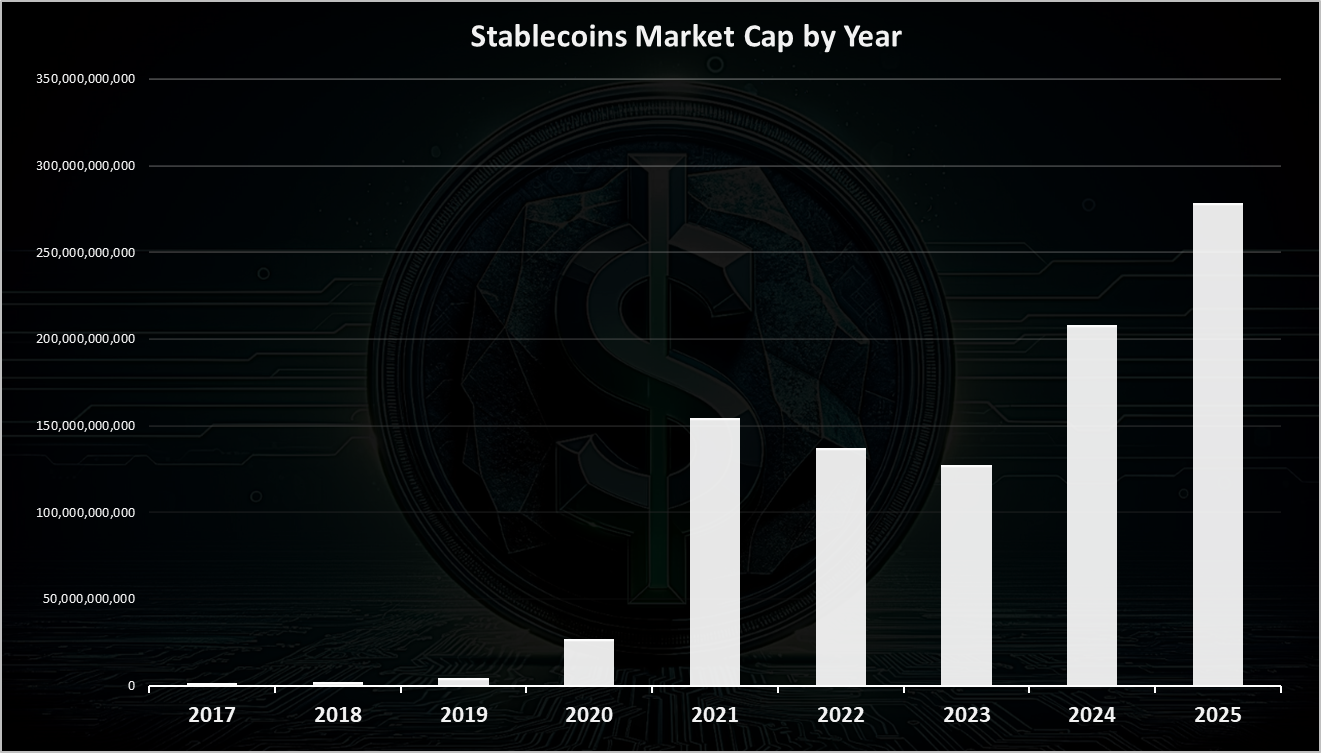

Here is the chart for the total stablecoins market cap.

This is the long term chart for the stablecoins. We can see the overall trend here that most of the stablecoins capitalization came in 2021, with Tether emerging as the first, followed by USDC and DAI. We can see the decline and fall of BUSD and the TUSD. At this moment Tether and USDC have more than 84% share of the market cap. Tether just keeps dominating trough the years.

The overall stablecoins market cap has reached a new ATH of 278B.

For context on a longer timeframe, on a yearly basis the market cap for stablecoins looks like this.

After an explosive growth in 2021, the stablecoins market cap has been dropping in 2022 and 2023 and now has been growing again in 2024 and 2025.

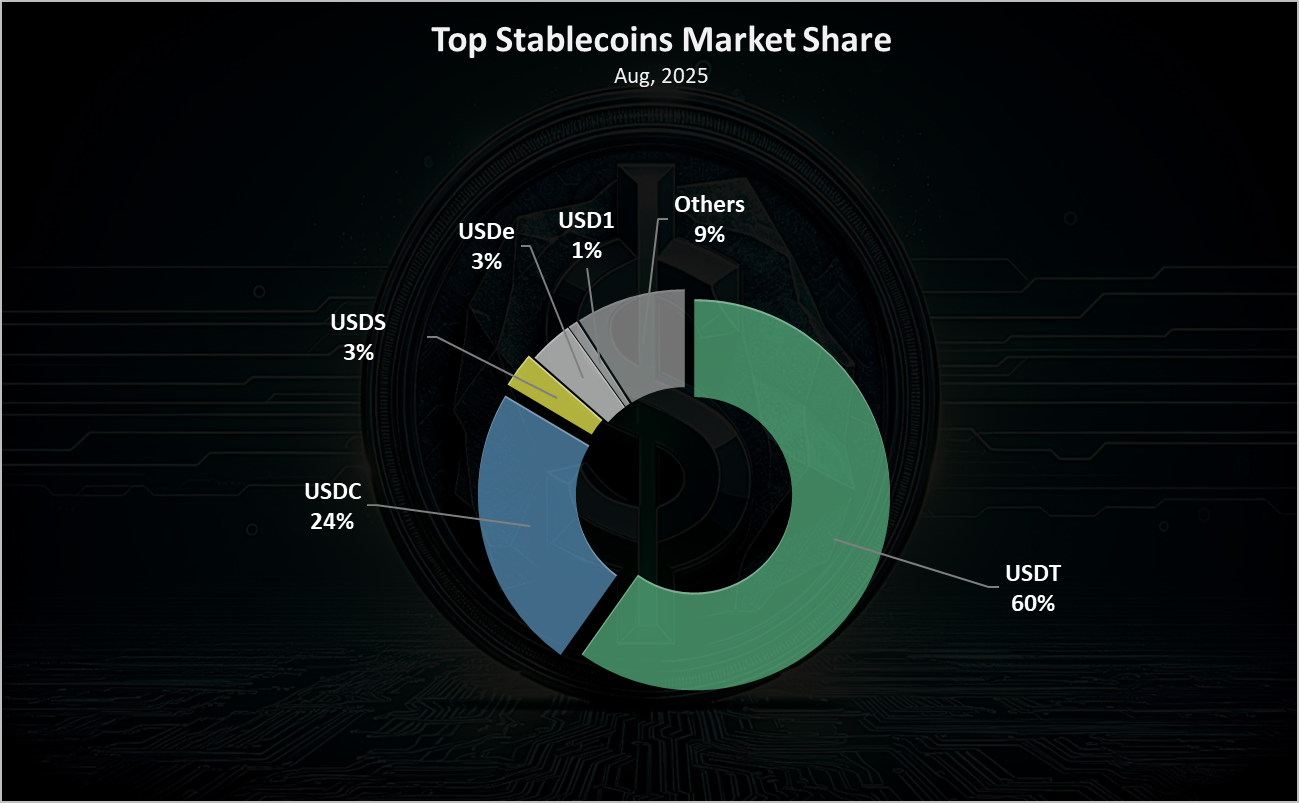

Top Stablecoins Market Share

Here is the chart for the market share of the top stablecoins.

Tether USDT is still dominant. The harsh regulation in the US on stablecoins has probably contributed to this. Things might change when there is more clarity about stablecoins issuers in the US. There seems to be change recently in this, so we will see how it goes. Tether USDT now holds 60% share in the stablecoins industry. USDC is in the second spot with 24% share followed by USDE and then USDS / DAI and USDe with 3% share.

All the best @dalz