Edit: I'm dumb, I forgot about the haircut. This post can be ignored. With haircut factored in it's unlikely to be profitable I suspect.

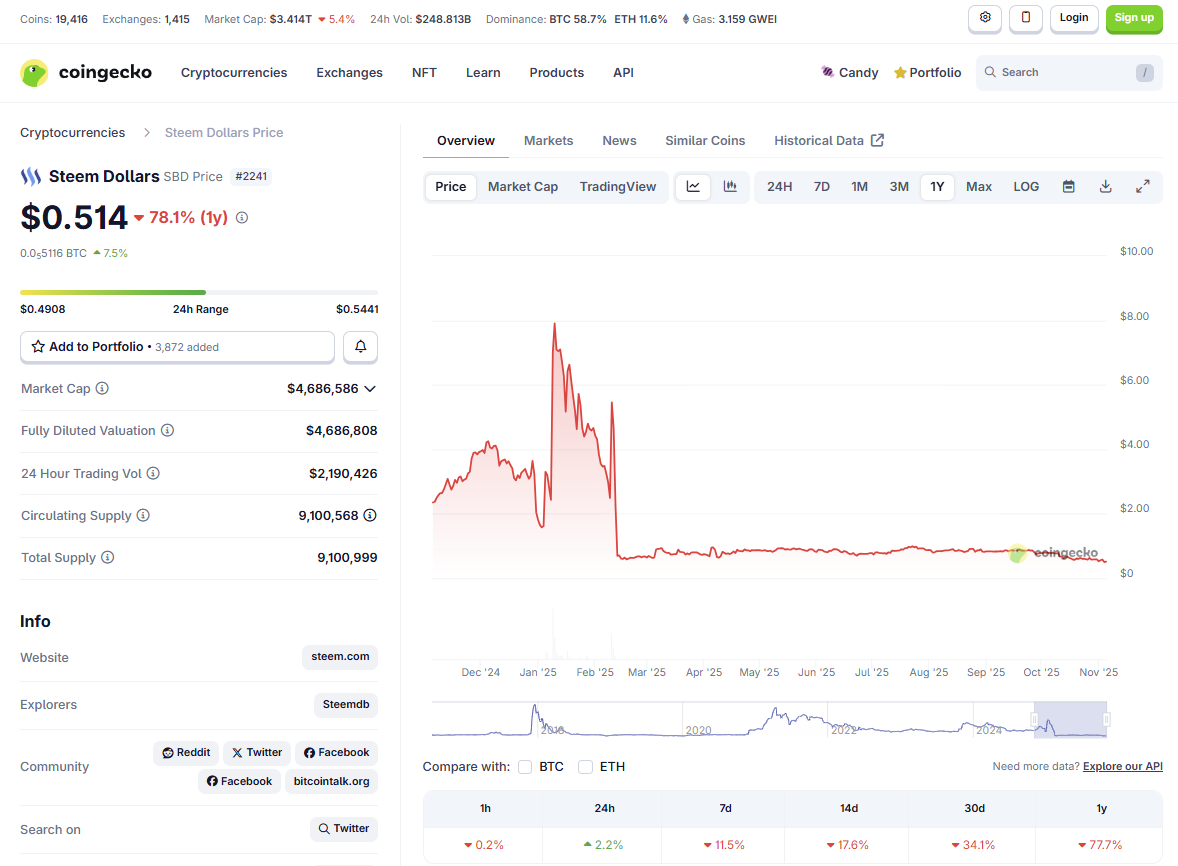

Steem Dollars have been consistently depegged to the downside since early 2025.

Now, while Steem has a substantially lower debt burden than Hive, in principle this depegging should be highly problematic for Steem inflation.

Rational actors can 1. Purchase Steem Dollars at prices substantially below $1. 2. Convert to Steem, locking for 3 days. 3. Sell approx. $1 worth of Steem on the internal market, minus some slippage and risk factor.

Every time this happens, the real supply of Steem increases while reducing the supply of SBD. This should increase inflation, putting price pressure on Steem and eventually bringing the debt ratio down enough so that Steem posts start issuing SBD again.

Eventually either the SBD peg should be fixed at approx $1, or the supply of both SBD and Steem should just gradually increase at higher and higher rates.

I don't know where to get reliable stats on Steem any more to confirm if this is or is not happening, but does anyone have any insight into what is going on there? Have the rules been changed to prevent or mitigate this issue?