https://x.com/THORChain/status/1886110777939292225

https://x.com/edict3d/status/1886501225471909954

Yo!!!!!!!!!!!!!!!!!!!!1

Looks like I'm not going to lose my 0.25 BTC after all... although I may be trapped within the confines of this new shitcoin for an indefinite length of time.

As I have reported on a few times now Thorchain is insolvent due to shorting BTC and ETH and longing RUNE in the zero-liquidation lending scheme. Personally I thought this would create a flywheel that lasted well into the bull market. That didn't happen. RUNE did not outperform BTC or ETH and the debt spiraled out of control in record time.

Many have tried to compare this situation with the Luna collapse, but this is not appropriate for several reasons:

- Luna didn't freeze their bad debt until after crashing to zero. In fact Thorchain debt ratio is still below 40%, and even Hive's ratio can cap at 30%.

- Total debt owed is much less (~$200M)

- Thorchain is a smart community and Do Kwon was a single dummy.

- BTC/ETH are way more correlated to RUNE than LUNA was to USD.

- It's a bull market year not a bear market year.

My BTC and everyone else's BTC/ETH is trapped within a frozen insolvent bank vault. However, a proposal has passed that will change that.

https://gitlab.com/-/snippets/4801556

TLDR!

- For every dollar owed to the user they can claim 1 TCY.

- TCY will scalp 10% of the network's trading fees.

- Users will be able to buy and sell TCY on the open market.

https://x.com/RealYielder/status/1886284800233013684

all the sudden they are aligned...

The Thorchain network is using this opportunity to get all users on the network to be in sync when it comes to the financial incentives. In previous iterations there were splinters of users who didn't care if Thorchain was getting volume and revenue. They were going to get paid either way. Now a push is being made to get everyone on the same page. More revenue will end up benefiting everyone on the platform under the new tweaks in place.

This is a very interesting bankruptcy protocol because it may actually work out pretty well in the end... especially considering this is the beginning of 2025 and the four year cycle tells us we still have a year's worth of bull market runway.

https://x.com/aaluxxmyth/status/1886175265803387389?s=46&t=f3qY2xxYIegwgxWlYwko8g

This proposal is going to fix a lot of problems with Thorchain, not just the savers and lending programs. They are even talking about removing the block reward and existing solely on trading fees. All the fat is being trimmed on this update.

The timing is impeccable

Imagine if this new token rolls out in like 3 months. It's quite possible (and even likely) that we are in the middle of an alt-market by then, in which case an asset like this would be much better received. Time will tell.

Having the pool start at $0.10 (as low as 1-2 year payback) ensures that TCY is not immediately sold for RUNE en masse to dump.

Starting price of $0.10

TCY needs to reach $1 before everyone is considered to be fully paid back. However, it will only start at 10 cents to make sure no one can dump right at the start and exit before the process has even started. This LP will be seeded with $5M from the treasury in a non-profit fashion. This means that any user that really wants to exit immediately will have the option to do so... but they'll only get back 10 cents for every dollar they were owed.

The idea here being is that there will be at least some users on the outside who are going to want this token... because it's going to earn 10% of TC's yield forever. The treasury is also considering doing buybacks on the token to buy back the debt and reclaim some of that yield back to the network.

What are the numbers?

Well the 2024 figure I've seen thrown around was something like $30M in fees last year. TCY would get $3M of that. $3M/$200M = 1.5%... so many are saying this could take up to 50 years to payback. Of course assuming that the network isn't going to grow is a mistake. Also this figure starts at x10 because the token price is being haircut by 90% at the start. Essentially the lower the token price of TCY the higher the yield will be. And the higher network revenue is the higher the yield will be. And a higher RUNE price will also boost the value of TCY as this is the only pairing... So it does have interesting free-market mechanics right at the ground floor.

In fact if the yield was 1.5% with a revenue of $30M... this sounds bad but it actually implies a token price of $1... which means everyone has already been made whole and the entire system worked perfectly. It's very possible a token like this can have much higher speculation than actual fundamental yield to justify the current price, again... especially in a bull market. If this were 2026 the situation would be pretty bleak IMO, but it's not. Just another difference between this situation and LUNA.

Make a shallow ($500k) RUNE/TCY pool at $0.10 per TCY (or 2 year payback for buyers), then use $5M of treasury funds to buy $500k per week for 10 weeks.

The initial RUNE/TCY pool would be quite small, but the treasury will do buybacks every week for 10 weeks. Certainly this is more to incentivize outsiders to bailout the debtors that have been bailed in. If outside capital knows that money will be flowing into the pool on a guaranteed basis >> they will frontrun the buying.

Something tells me that this token will not stay 10 cents for very long, but it also probably won't get to $1 very quickly either unless a lot of outside capital is interested in this trade. It's also unclear how many debtors will actually be happy with their TCY and just hold onto it instead of exiting the platform. Even I'm not sure about what I will do when my tokens are liquid.

So where did this solution come from?

Justification The $MAYA token works exactly like this

The liquidity token of MAYA is CACAO, but MAYA also has a MAYA token that works exactly like TCY will work. 10% of yields on MAYA go to the MAYA token, and this token is quite popular. Hopefully TCY will be just as successful even though it's being used as a mechanism to repay bad debt.

In other news:

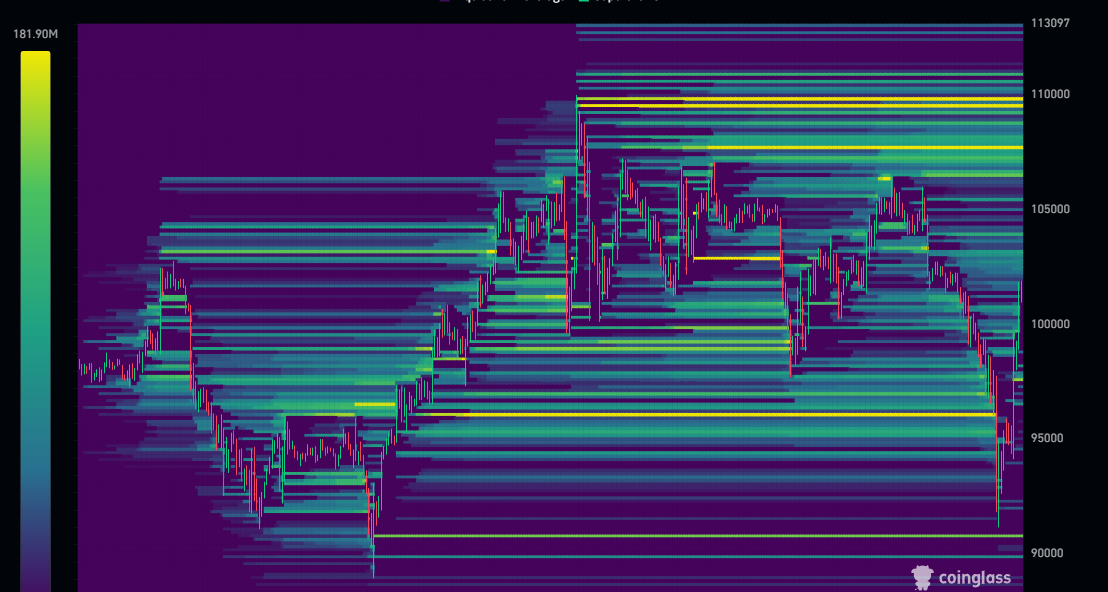

Eh is crypto making a comeback here?

Bitcoin has reclaimed $100k+ but the funding rate is still negative. We may have just signaled the end of this crab market with one last squeeze. Longs are getting paid by the shorts. This is very rare and almost always leads to bullish price action.

https://x.com/SimonDixonTwitt/status/1886512495067848924

Sovereign wealth fund

All the Bitcoiners are like see he's gonna buy Bitcoin. Meanwhile he talks about buying TikTok. It's very unclear.

https://x.com/BernieFrogger/status/1886519501337817466

Well that's fun

According to this chart we are smack dab in a pattern of getting squeezed right before the altmarket starts. Could that have been the squeeze before we visit the moon-castle? Hopefully!

Binance & Wintermute manipulation?

In addition to trade-war fears many are accusing Binance of manipulating the market yesterday in conjunction with a market maker named Wintermute. Evidence for this happening is not exactly ironclad but there are some suspect transfers back and forth.

https://x.com/jackmallers/status/1886505807212405169

Is Trump fabricating a crisis to force lower rates?

Ol Jacky boy seems to think so. This is a pretty in-depth take on the whole tariff situation. Not sure if it's accurate but it's somewhat interesting.

Conclusion

It's nice to know I'm going to get my money back from Thorchain... even if I do get trapped in a shitcoin that could crash to zero. I don't think that will happen as the way this thing is setup seems pretty decent. Because the bulk of this proposal's code already exists on Maya it's not going to take very long to put this thing into effect. Could take several weeks or several months. Either way is fine with me.