Degens lose everything again! Surprise!

If there's one thing we should have learned this week it's that there are a lot of "blue chip" cryptos out there that have a lot less liquidity than we realized. Of course the idea of a crypto being "blue chip" is absurd, as "blue chip" stocks actually have the liquidity required to make them more trustworthy.

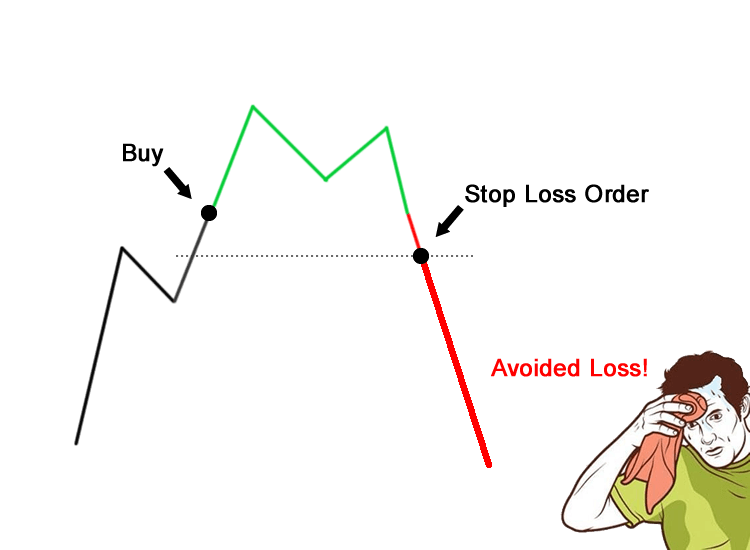

Top #100 coins like ATOM flash crashed over 99% within minutes, essentially liquidating all leverage across multiple exchanges. Of course many of these fringe instances recovered almost immediately and ended up being down a much more normal percentages like 20%. Those who buy spot are fine in this situation, while greedy leverage traders lose their entire bankroll in an instant. Luckily, we can set a stop-loss on long positions so that this doesn't happen... right? This is sound financial advice, correct?

How sound is it really though?

There's a common misconception among finance bros to always use a stop-loss. I see it constantly on social media. After all, if you're neck deep in a bet and you get it wrong, wouldn't it be best to just cut your losses and move onto the next bet? Getting reeled in to doubling down over and over (aka revenge trading) on a failed bet to "make it all back in one trade" is a great strategy for going broke. In theory, the principal of using a stop-loss is sound financial advice.

But reality is more complex than the theory.

There are a whole lot of people who actually did have stop-losses set on October 10th, and guess what happened? The market crashed so fast that their stops did not trigger in time. It was as though they never set up the stop-loss in the first place. If the liquidity isn't there to cover the stop then it's quite simply does not exist, and you become the liquidity. The exchange bails you in, takes your money, and uses that money to pay back the side that won.

Degen gamblers are the first line of defense against these Black Swan events, and the second and last line of defense is the exchange themselves. It's quite possible for an exchange to lose money on the futures market when something like this happens; especially if they were making their own markets with their own money.

Example: Comparing two nearly identical positions

Let's say we want to make a $300 bet that Bitcoin number go up. We are willing to risk $300 total, but what's the volatility? Let's say we want a liquidation point of -5%; we don't think BTC will go down another 5%. An x20 long will accomplish this. We borrow $6000 on $300 and let it ride. We aren't using a stop-loss and our total risk is $300.

Stop-loss version:

Let's say you want to make the exact same bet but the leverage is only x10. No problem. All you need is $600 collateral to borrow the same $6000 and you can set a stop-loss at -5%. That way when the stop-loss triggers you'll only lose $300 and your other $300 will be saved.

-5% x10 = -50%

Both of these positions are nearly identical, but the stop-loss on 10x is inviting more risk than the 20x. The 20x can only lose $300, but the 10x is only SUPPOSED to lose $300. You can still lose the entire $600 amount if the stop doesn't process for whatever reason. In cases such as this it's clearly safer to simply set up the bet correctly the first time without a stop loss to avoid the threat of a Black Swan coming in to ruin your day and losing everything.

And this is something that I never see anyone talking about. Everyone just blindly says "use a stop-loss" as if it's some kind of magic tool that decreases your risk. The ironic thing about that is a stop-loss will always increase your risk from a leverage perspective; all it can do is mitigate collateral losses. The chance of losing the bet becomes higher but the amount lost becomes lower.

Looking at the example above we accomplish this exact feat with the stop loss. A 10x long with $600 collateral becomes the 20x $300 long using this tool (assuming the order processes correctly). Without the stop, the 10x could have lost 10% before being liquidated, while the 20x only allows for 5%.

Buying the pump with stop-loss orders

A much more advanced and unconventional tactic is using stop-loss orders to trigger a buy when our bearish prediction gets invalidated. This is arguably something I could have done on my last bet to great effect.

October 9th Chart

Five days ago the chart looked like this which is a crazy bullish flag right on top of the trendline. Casually hanging out at all time highs with zero euphoria was looking like a decent entry point. I wanted to get in right at this spot while buying the bottom of the flag. I could have just as easily bet bearish here instead and then flipped the position once the flag was confirmed. Sure, I'd miss the move from $121k to $125k, but that's a relatively small percentage considering current bull market targets. I could have set a stop-loss trigger to buy at $125k and then positioned another short hedge to catch the opposite move in case of a breakdown... and breakdown we certainly did.

But this position is still open and I'm only down a couple hundred dollars... which feels like a win when I see a dozen degens reporting that they just "lost everything" once again. Who in their right mind puts their entire net worth leveraged on an exchange and then pretends like, "It could happen to anyone!!!" It can't thought. It can't happen to me and I hope I can't happen to anyone that reads this post. Most of our money shouldn't be on the exchange in the first place... which ironically is one of the best reasons to use leverage in the first place (trading by proxy and heavily mitigating counterparty risk).

Conclusion

A position without a stop-loss is always intrinsically safer if the current level of risk is already within acceptable limits. Triggers such as stop-loss orders never have a 100% chance of working, but people who trade crypto get complacent and assume it will always execute because the previous 99 orders worked flawlessly. It only needs to fail once before we learn this lesson the hard way.