https://www.youtube.com/watch?v=pGhwBFYtn1s&list=RDpGhwBFYtn1s&start_radio=1

Welcome to Uptober.

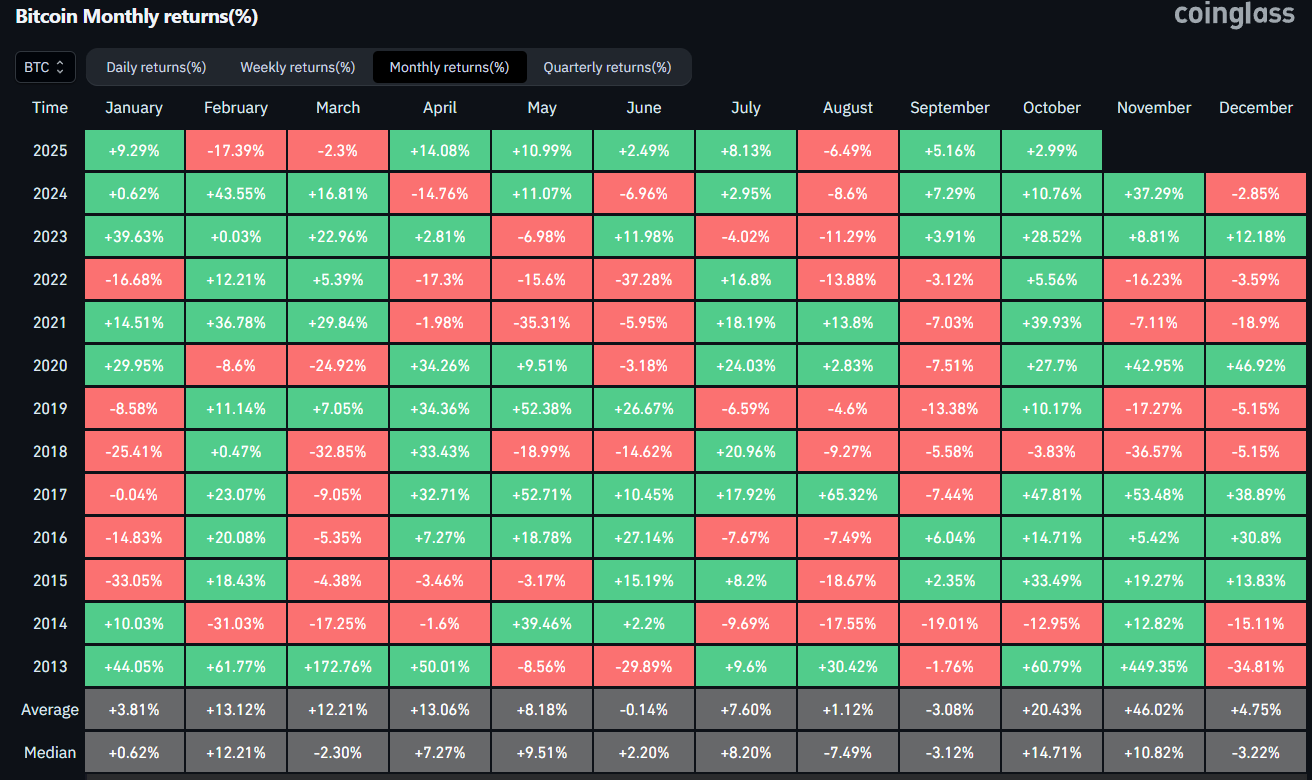

After all that bellyaching and doom and gloom nonsense over the last month we end September 5% in the GREEN, which is something that almost never happens.

Checking the actual analysis we see that Bitcoin has actually been slightly green in September for the last 3 years running, which is impressive considering we had 6 red years before that. Either way we can see that big moves in September just don't really happen. Whether we pump or dump in September it's almost always going to be a safe bet to leverage up and bet on a return of the price.

Now we approach Uptober.

As we can see Uptober has been green every single year except for the bear market years of 2014 and 2018. 2022 being green was a bit of a fluke but I'll take it. My guess is that this month will be a big turn around for the main chain, both in terms of price but more importantly in terms of sentiment. The doomers are going to disappear and pretend like they weren't doomsaying this entire time. Already I've seen multiple accounts claiming we'd hit $100k in September delete their posts as if everyone was just going to forget and not screenshot ridicule them over such dishonorable behavior. If your speculation is wrong, ignoring it and pretending that never happened isn't exactly conducive to learning from one's mistakes.

https://x.com/edict3d/status/1973031348723220738

So what did I get wrong?

I keep my speculation linked in an endless chain of reposts to keep myself honest. We can see here that I closed my shorts below $110k, which turned out to be the best possible move I could have made in the short term. Unfortunately I got a little "greedy" and didn't flip long until the recovery. I was pretty convinced we'd get another "rule of three" dip down to $105k. Never happened, and that's fine. If Q4 works out anything like previous cycles we'll be doing very well.

Current chart

I'm actually shocked that the lines I drew over six months ago continue to be relevant. It's like the chart has just drawn itself, as there's really very little work to do other than try to interpret what we're looking at here. Certainly trading below the current trendline isn't the best outcome, but if Uptober keeps doing Uptober things we should break that "resistance" any day now. One rejection should be expected. No rejections would be surprising but you never know how much momentum we're carrying into Q4.

MA(25) and MA(100)

The default moving averages of many exchanges (including Binance) are still hugging each other tight since September 10th. This is absolutely unheard of and I've never seen anything like it. Getting a short moving average to track a long one for more than even a week is a very rare thing to happen. It's been three weeks.

So how would I interpret something like that? Does it mean anything? I think it does, and I think it means we are currently in very stable territory right now. There's very little risk to the downside with a decent chance of huge upside over the coming months.

The difference in price between the MA(25), MA(50), and MA(100) is significantly less than half a percent. That's unheard of. Again, never seen anything like it. But I do know that when the averages are tight we usually see explosive movement to the upside within short order.

Conclusion

Talk is cheap but the results are speaking for themselves. I've made several good calls on my TA recently and I'm pretty confident I can eek out a few more wins by the end of the year. Q4 is here; rejoice! Finally.