Hey everyone, I hope you are all doing well and you have a week full of positive experiences! In my new post I decided to share something about the global financial system and am happy if you can learn new things.

The global financial markets are a complex issue and if there are no specific mechanisms that are responsible for stability, there would quickly be chaos and this is where the Basel accords come into play. When banks have fallen into crisis, this often has something to do with liquidity and a key point to avoid crises are the Basel accords which aim to ensure general stability within the international financial markets. They are not international laws in this regard, but a form of standards that are first decided but later have to be adapted at the national level and for this the respective country is responsible for implementing these regulations into reality. The core of the agreements is easy to understand and the goal should be to motivate the banks to hold sufficient equity capital to be prepared for possible crises and for this purpose four rules have been created so far which were partly the result of past crises within the financial world and should prevent crises preventively.

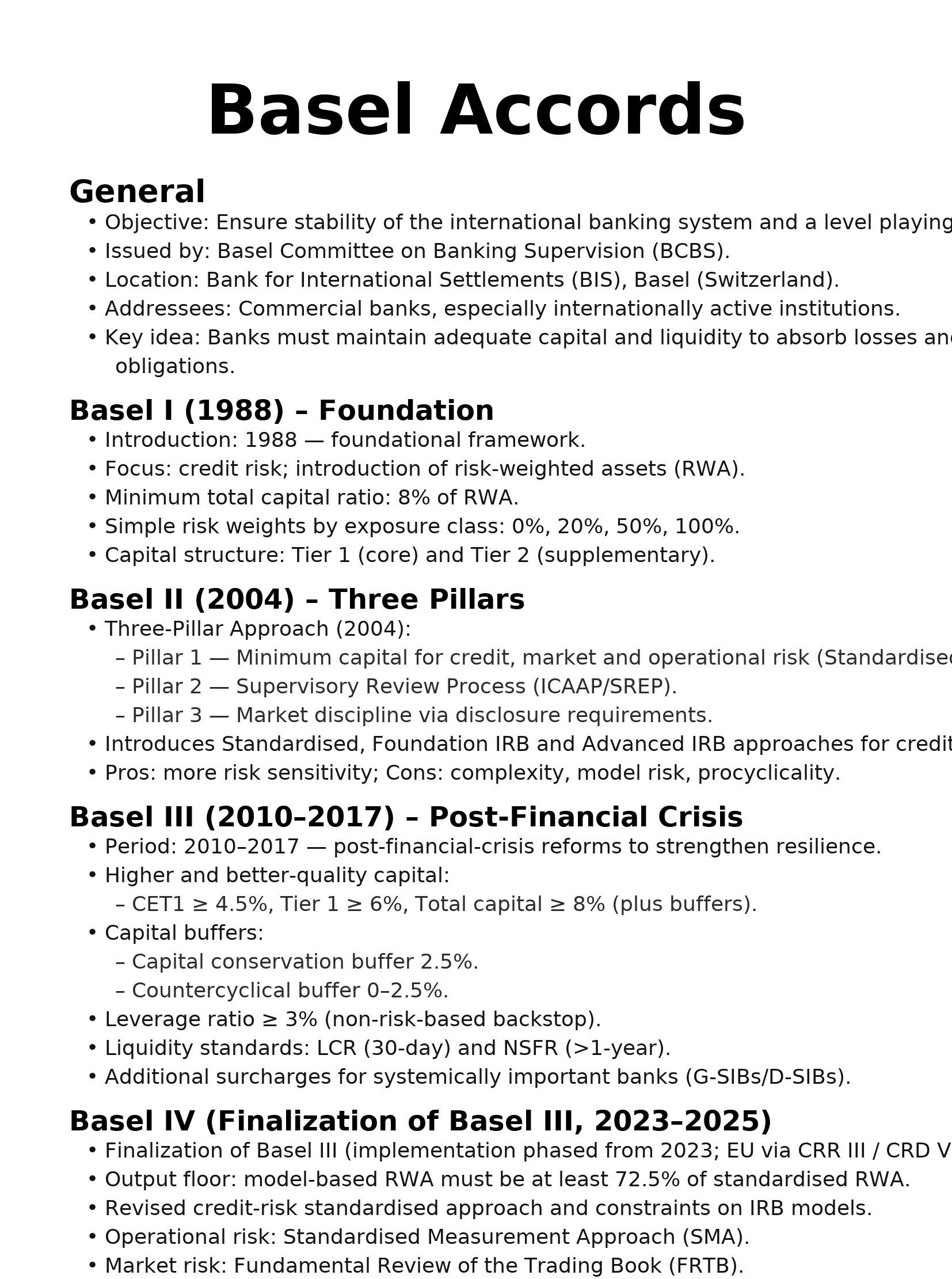

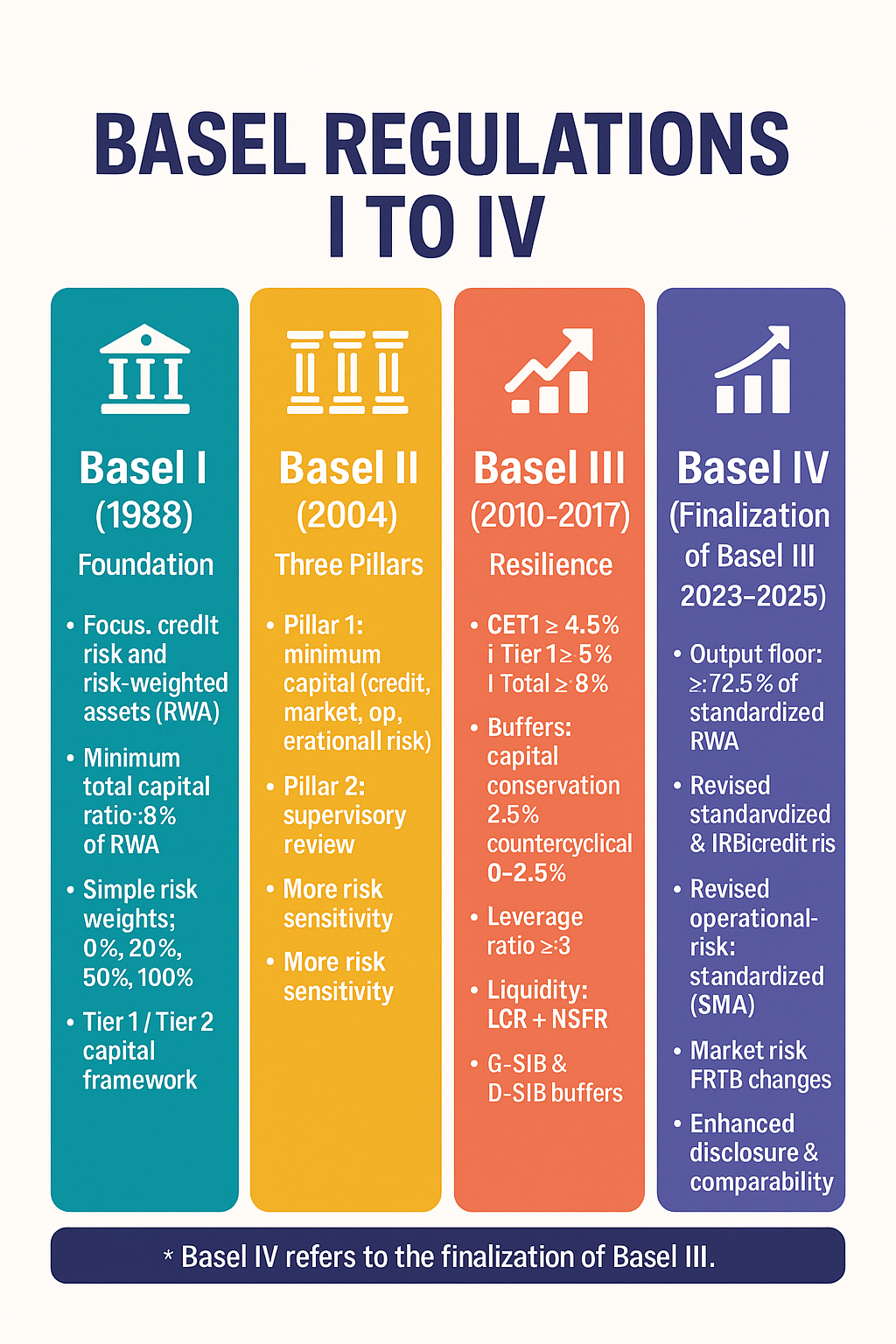

The creator of these rules is the bank for international settlement which has its headquarters in the old city of Basel and the so-called Basel Committee is internally responsible for this, which is also known under the name BCBS, and the most important recipients are large banks, which are mostly active on an international level. Within the banking world, they are historical pillars when it comes to ensuring stability and the origins reach already a few decades back where the basis of the rules was created in 1988 and so Basel I was born which should motivate international banks to create the first common standards which should include both equity and the assessment of risks. Even if it worked roughly, there were numerous criticisms inside the financial world, which was simply because Basel I was not precise enough and some scenarios were not taken into account and it was simply all still too superficial and the detail of these regulations was not taken into account, which led to a whirlwind within the banking system. Even if there were problems that should not be neglected, the basis was formed which should remain steadfast for over ten years and these whole agreements with Basel II became more precise, which should include an extended concept of risk assessment, but this agreement also had the consequence that it needed significantly more equity to counteract crises, which created space for new problems, but roughly led Basel II to much more transparency and numerous reforms inside the system.

Basel III was the result of a serious financial crisis or to mention it more precisely, the global crisis which had started in 2007 and here it was clear that the banks must be strengthened and the goal was to create adjustments that should make the banks even more resistant to problems and here there were some changes which the banks should make much stronger against future scenarios of this kind and it can also be said that this global financial crisis has ultimately made the banking system much more stable. Despite many innovations, Basel III was not mature enough and the successor Basel IV was a completion which led to more harmony and for this some things such as the risk assessment were revised again and these results led to more transparency within the financial world. It's interesting to see how these accords have changed over time and how there have been adjustments again and again which have resulted in the financial markets becoming stronger and stronger and here it is particularly interesting to observe how it was reacted to crises and to know how the system was improved from these scenarios of the past.

Many thanks for stopping by and I hope you could learn something new and like my post and appreciate my effort! I captured these pictures with my Sony Alpha 6000 plus 55-210 mm, iPhone 16 and created these explanations with the help of a tool.