Hi again, if you're here. Today we have some advantages as we have the monthly candle closed this week, so we can have a look at the monthly chart and see what's happened last month. We know already, but the chart is a different thing.

We had the monthly candle close on Friday and as expected, we got a bearish candle, with a long downside wick. The crash happened three weeks ago swept the previous all time low and created a new one at the shocking level of $0.0327. The good thing is $HIVE price bounced back up and at the time of writing it is trading at $0.1288, which is slightly above the monthly open, which is $0.1237.

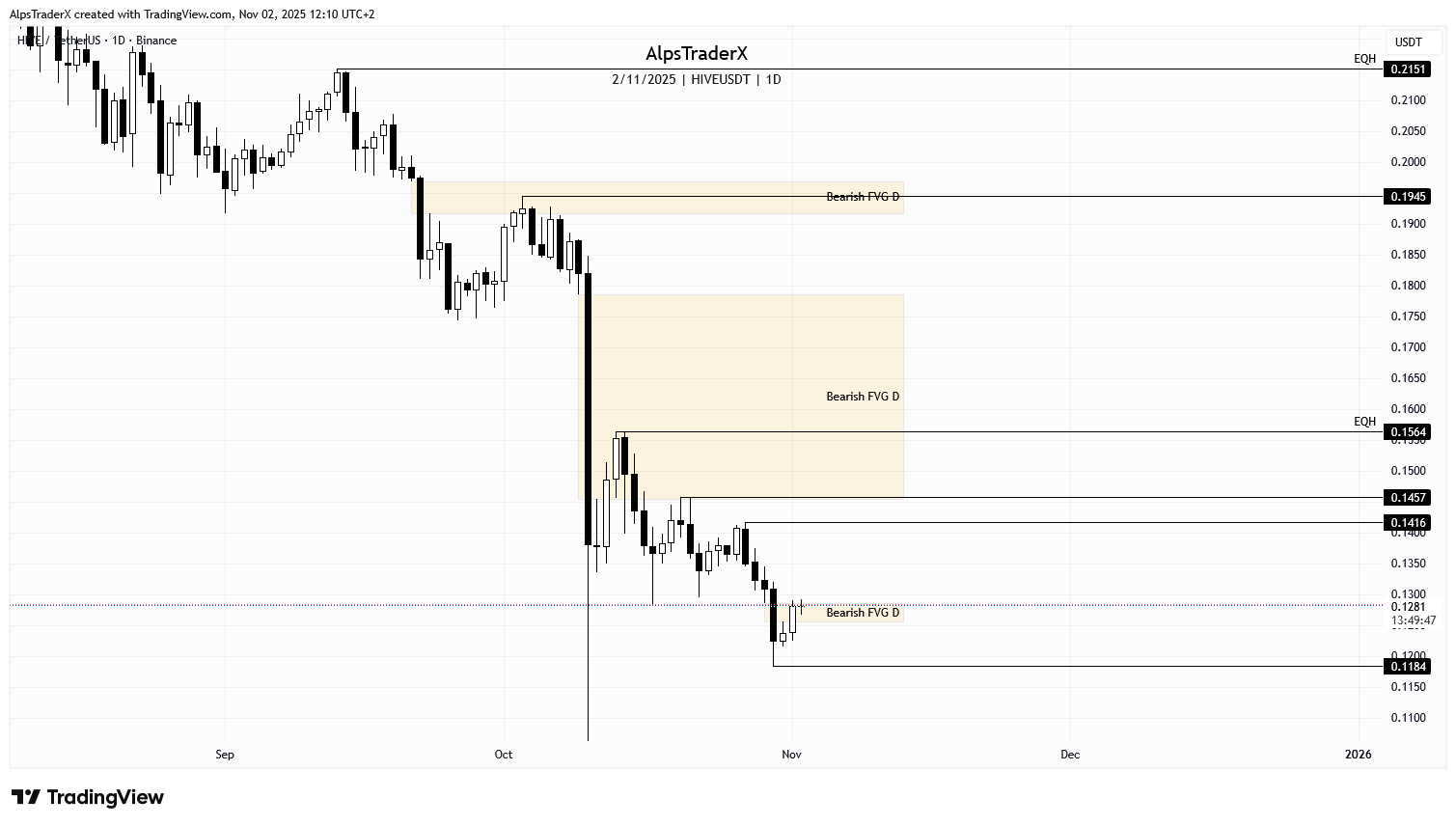

We have a bearish price action on the weekly time frame chart (what a surprise :P), so there's not much to say here. In case of more weakness, all time low is next, at $0.0327. If we get a bounce, then the bearish FVG, marked with yellow is the next liquidity pool to the upside, which is going to act as resistance. Close above it, hold, and the other slim FVG is next. There's a long way till $0.2151, but I'd love to see price get there and sweep that high.

The daily chart looks a bit better. After the bounce on the 10th, we finally got a swing low this week on Thursday, at $0.1184. At the time of writing, price is trying to close above the bearish gap and invert it. We will only know, when the candle closes, but in case we get some momentum and close above it, the next swing high is at $0.1416. It's Sunday though, so many time we've seen a Sunday pump, followed by a Monday dump, so if that happens, I'd be looking to the current swing low to be swept at $0.1184.

On a more granular scale, the h4 time frame we still have a bearish price action, but at least price managed to invert the lowest gap and it is holding above it nicely so far. I need price to print more candles, to give me higher lows, higher highs, or whatever it is in store for $HIVE, to be able to see a clear direction.

The levels to watch on this time frame are $0.1215, which is the next swing low and $0.1184 on the downside. If price manages to hold above the current gap and gain some momentum, I'm looking at $0.1345, $0.1374 and $0.1416, if there's enough momentum.

$BTC is approaching resistance, it is below the top of the lower range. I'd be cautions here. If $BTC gets rejected here, it can affect the whole market.

ETH/BTC is still ranging, has been for the last two weeks or so. As long as the current gap can hold price, there's a chance to go higher, in which case I'd look at 0.037129 and 0.038112, which is an intermediate high. If the gap is lost, revisiting 0.032261 is possible. Next week hopefully brings a move in some direction.

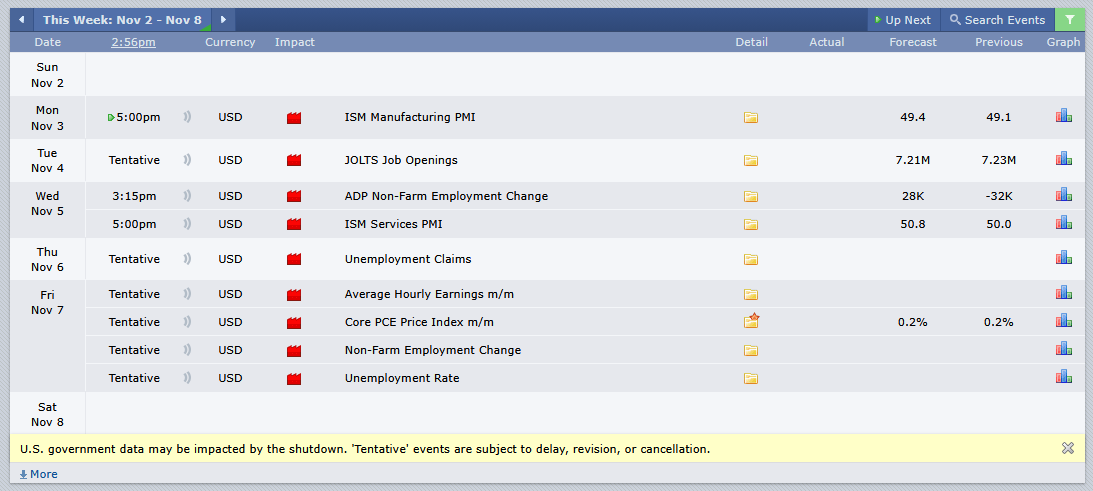

As far as the economic calendar is concerned, next week it is full, but it also says

U.S. government data may be impacted by the shutdown. 'Tentative' events are subject to delay, revision, or cancellation.

In any case, I'd be ready for some volatility.

If you're a newbie, you may want to check out these guides: - Communities Explained - Newbie Guide - Cross Posting And Reposting Explained, Using PeakD - Hive Is Not For Me - How To Pump Your Reputation Fast - Newbie Guide - Tips And Tricks & Useful Hive Tools For Newbies - More Useful Tools On Hive - Newbie Guide - Community List And Why It Is Important To Post In The Right Community - Witnesses And Proposals Explained - Newbie Guide - To Stake, Or Not To Stake - Newbie Guide - Tags And Tagging - Newbie Guide - Newbie Expectations And Reality - About Dust Vote And Hive Reward Pool, by libertycrypto27