Today, the vision of a truly decentralized stablecoin is blurred by the existence of a few giants and many small contenders.

On one side, we have USDT and Tether (163B mcap), and on the other, USDC with Circle (64B mcap). Far behind, the next contender, Ethena's USDe, has (9B mcap).

Gone are the days when DAI (4th place, 5B mcap) had a certain prominence in the stablecoin sector.

Events such as the collapse of Luna and Terra in 2022 wreaked havoc on the past bear market, squandering the dubious ideas of many as to whether “a truly decentralized stablecoin was possible.”

Today we are living in a somewhat disturbing reality:

The stablecoin sector is hijacked

All of the aforementioned stablecoins are simply hijacked.

They all fail the most basic test, which is that they are all dependent on venture capitalists, real dollars in bank accounts, audits, and the complacency that their managers won't screw up.

And mind you, that doesn't mean they don't work. They have a very significant market share and are one of the fastest-growing sectors.

People understand them “better” than hypothetical algorithmic stablecoins, for example. This is also normal. It takes a long time to adopt disruptive technologies and this is no exception.

However, that does not mean that there is no innovation. There are some interesting cases worth studying, and today I am going to talk about one of them.

HBD, or Hive Backed Dollars.

Why HBD is the best, most decentralized stablecoin you've never heard of:

First and foremost, HBD is an algorithmic stablecoin that is somewhat difficult to understand without context.

And that context is Hive and it's history.

I don't want to go into excessive detail, but suffice it to say that Hive is a blockchain (forked from Steem) launched in March 2016. HBD (SBD back in the day) was launched shortly thereafter, in July-August of that same year.

In it's early days, Hive was conceived as a decentralized blogging platform, where “likes” and “retweets” were (and still are) tokenized.

Part of the reward for being active on the chain was the governance token (HIVE) and its stablecoin version (HBD).

These rewards were linked to the natural inflation of the chain (6-10%), which has allowed both HIVE and HBD to be distributed among thousands of hands in such an organic way over the last decade.

It's the kind of distribution which made Bitcoin irreplicable. It's the kind of distribution happening today with HIVE and HBD.

Slowly, organic, almost by accident... Hive is a modest community being built from the roots.

It's the kind of thing which makes a community unique. Relationships here have been forged over many years.

Without VC's, without shady presales or deals behind the curtains, without any of the initial founders... Simply, community driven.

Let's briefly discuss the tokenomics of HBD.

HBD Tokenomics

The distribution of HIVE and HBD has been going on for almost a decade, as I mentioned earlier. But how does HBD remain stable?

It's a very simple dual mechanism at it's core.

When the price falls below $1, the blockchain allows you to “print” HIVE in exchange for HBD.

- Burn 1 HBD -> $1 in HIVE (after 3,5 days)

Essentially allowing any user to arbitrate the cents difference. The same the other way around (with the exception of a fee charged at the blockchain level).

- Burn 1 HIVE -> print 1 HIVE worth of HBD (minus a 5% fee)

As you can see both processes have their own security mechanisms in the form of fees and/or delays. These are intended to make the conversion process “slow and expensive” by design.

It's not a bug, it's a feature.

This gives the community some leeway in the event of an attack, and excess demand for HBD also puts buying pressure on HIVE (reinforcing the collateral value).

Because we must not forget that HBD is an asset and HIVE is the collateral.

Hive Collateral at Layer 1 level -> Transparent Backing for HBD

Apart from the operational limits I just mentioned, there are also structural limits.

The most important one is as follows:

- At any given time, the market cap of HBD cannot exceed 30% of Hive.

If that happens, the blockchain's promise to “honor” HBD at $1 is broken, and convertibility is broken.

- The $1 peg breaks and the blockchain begins to reduce the ratio at which it converts HBD to HIVE.

Not only that.

- Posting rewards goes from 50% HIVE + 50% HBD to 100% HIVE.

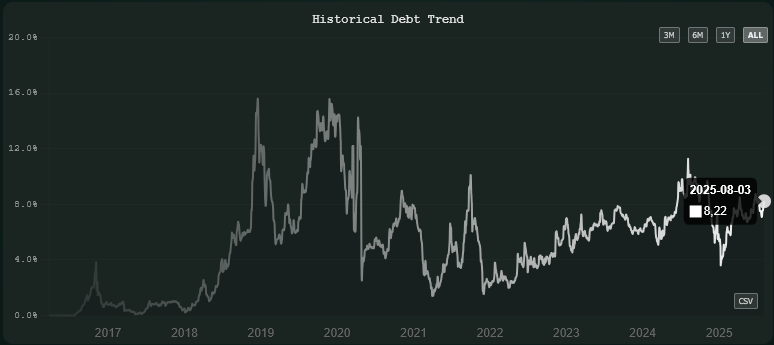

This is the ultimate resort to avoid the debt espiral which happened to other algoritmic stablecoins like Terra UST. Instead of "unlimited"; the switch goes off at 30% and the blockchain refuses to keep printing HBD.

Once the debt gets reduced to more manageable levels. The chain starts printing HBD gradually.

Currently the HBD economy is stable and healthy: it represents less than a 10% debt over Hive marketcap and would require a 70% drawdown to touch those 30% debt levels.

Unlikely levels today. Not seen since a long ago (early 2017).

Chart courtesy of hbdstats from @dalz.

Chart courtesy of hbdstats from @dalz.

HBD Savings (15%): Community driven APR

As a bonus, mention that holding HBD has another core benefit.

- It yiels a 15% APR paid monthly to your wallet.

Without smart contract risk, slashing, maintaining a node or high technical skills.

Just deposit your HBD into savings and come once a month (or every other month) to claim.

This yield is community driven, signaled by the top 20 witnesses (block producers). And is being brought to discussion every few months (since some people things it's unsustainable, while others disagree).

Key is this parameter can change as Witnesses and community agrees. So, nothing is guaranteed. In fact, many witnesses have different parameters. Consensus defines the definition of "true".

And I can guarantee you, we have some diehard cyberpunks there. I have a friend who calls fondly Hive "The cockroaches of crypto" Because it doesn't matter if they throw a nuclear bomb at us. Well just be there

Back to Savings APR; It was changed not too long ago and reduced from 20% to 15%. It's expected that as HBD economy grows, yield from savings will be reduced down to more "natural" levels.

Think about a custom "interest rates mechanism" for a blockchain. Like the FED does with the $. Witnesses and community can change the "Savings rate" to control it's own "debt".

Isn't that a brilliant mechanism? Not theorical. It works. NOW.

Another chart courtesy of hbdstats from @dalz.

Another chart courtesy of hbdstats from @dalz.

For all these reasons and more, HBD is what some consider a forgotten gem.

Ignored for the moment, but quietly growing.

Until when?

--

Resources

Hive.io Website - HBD Section on Official Website Hive Wallet - OG Wallet Keychain - Hive Browser Wallet - Metamask equivalent for Hive HiveLedger - @engrave Ledger Integration for Hive and HBD Hive Whitepaper HBDStats - @dalz tracking tool HiveDex - @mahdiyari frontend for HIVE/HBD seamless trading Hiveblocks - OG Block Explorer VSC - Future Hive and HBD L2

If you enjoyed my post, please consider voting for my Witness.