In recent weeks, I have been able to enjoy a few days off work and spend some extra time with family and friends. I think I mentioned this recently, but these have been particularly tough months (in a good way, at least).

One of the pending issues I need to address NOW is how to deal with the next rewards cycle for PWR.

As you will know if you have been following the project recently, there have been some substantial changes in the way the project is run. If you're not up to date, I recommend taking a look at the official documentation (which is there for that purpose, after all).

If you have any questions, feel free to ask. You can do so here via a comment, on Discord, or privately if you prefer. My DMs are open.

Let's get down to business.

Background

Over the past year, the PWR-SWAP.HIVE pool has distributed PWR and HIVE at a 1:1 ratio at a robust 20-30% APR.

I am generally satisfied with how it has worked, but I feel I must be careful about the possibility of over-allocating rewards to the pool. The line between “balanced and attractive” and “unsustainable and too good to be true” is too thin.

There comes a point when I feel that you are no longer attracting “good” liquidity and are simply overpaying predatory LPs who will disappear as soon as the excessive returns do.

In my case with PWR, I've noticed that this point is around APRs of 30-40%.

Furthermore, the fact that the project is so small and that we are really just a handful of holders doesn't help.

I've given this a lot of thought. And the final conclusion I've come to is that someone has to pay for the party.

There's no such thing as a free lunch.

It is possible to dress up APRs and “apparent” results in the short term, but in the long term you cannot avoid the math.

And that's why I'm going to take a more conservative approach.

10.000 HIVE ready for distribution.

This third cycle of rewards will be 100% in HIVE.

This HIVE is already waiting in the savings balance from @pwr-ventures:

This means the pool PWR-SWAP.HIVE will pay a daily drip of HIVE liquid rewards for holding both assets into the LP.

I'm also introducing incentives for long-term LP's (feature provided by Hive Engine).

- 1% Daily bonus for 90 days.

This means that an LP who maintains their position for at least 3 months will receive 90% more rewards than a user who just joined the pool today. Doing flat numbers:

- Base APR will be around 10-12%

- Max APR will be around 18-20%

This will obviously be very changing, and perhaps a little more HIVE needs to be added to the reward pool later, but this is a good start.

It also has a number of highly desirable effects that I want to explore.

- Stable and predictible rewards

- Protects PWR price in case it drops (APR goes up if PWR is down Vs HIVE)

- If HIVE moons, APR moons (HIVE at 1$ and APR goes from 20% -> 100%, pushing PWR up).

Only "downside" is that If HIVE goes down, also does the APR. But this has nothing to do with PWR itself. But I might consider buying up some HIVE if this scenario happens.

More!

Another cool thing with "HIVE-only" rewards we go back to a single emission source for PWR: Only Delegations.

Delegations again are tied to Hive Power, which adds more stability overall.

Just to give some context, staking + pool rewards at one point added up to ~8K PWR in inflation per year. This was equivalent to ~7% inflation added to emissions from delegations (another ~10%).

Currently with 250K Hive Power in delegations yielding a 15% APR, and PWR at ~3 HIVE, PWR inflation is about ~11K PWR/year or ~9% inflation.

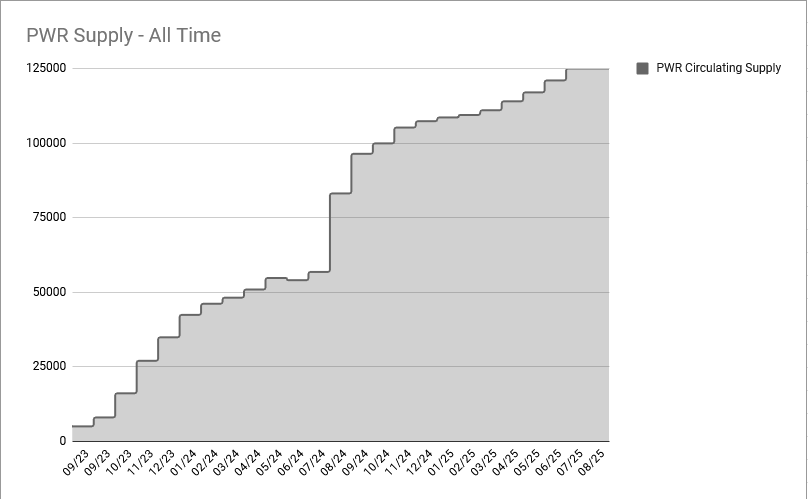

However, I bought back thousands of PWR back from the market from the @pwr-ventures account and sent it back to the @pwr-issuer account, which now holds over 8K PWR.

This means the project has ~8 months worth of inflation in reserve. The circulating supply will stay at 125K PWR for quite some time.

This also means that there may be room to increase the APR of the delegations even further, but it is still too early to talk about it. 15% is generous.

Staking rewards

Was about to end the post and I realized that I haven't written a word about the current staking rewards.

I was also waiting to start with the LP before doing anything.

But just to make a small comment. Staking is much “safer” than being in the LP, so it seems logical to me that it has a much lower return.

I'm not racking my brains too much, but if the LP pays 10% APR, you should assume that staking alone will pay half that or less (2-4% APR).

And for a token like PWR, it is “unproductive” in the sense that it should be perceived as a small bonus.

I prefer a token that appreciates in value over a token that appreciates less (or not at all) but pays a high dividend.

That's how I see i for now. Not my prio, not in a rush.

Resume

PWR Stronk and about to start it's third year! Enjoy your weekend!

- Delegate your Hive Power to @empo.voter to receive a 15% APR paid daily in PWR tokens.

- Join the PWR Discord for doubts

You're not voting for my witness yet and love what I do? Don't ask me more: