Hello Hive and Leo Fam!

Hope life is treating you well wherever you are in this part of the world.

I continue to invest in IPOs because it is one of the forms of investment that are completed in a short period. It's all getting closed in a week, and generally, I do not hold the stocks I am allocated through the IPO, which is a process called an initial public offering. An IPO is a process through which a company opens its offering for the public before it goes listed on the stock market, so some people get the opportunity to buy stocks before the market listing.

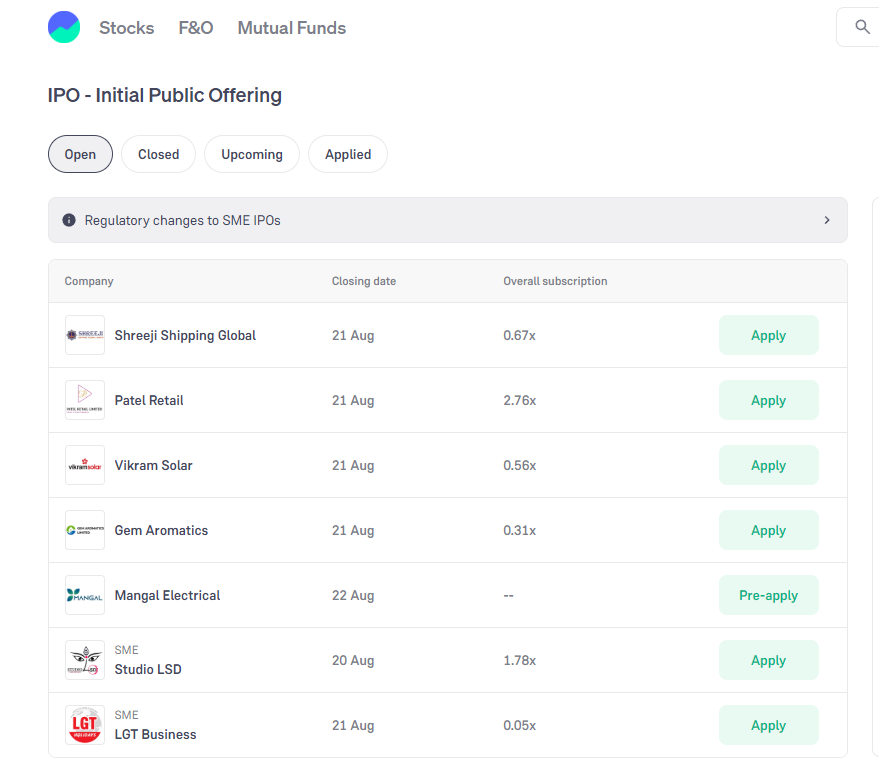

Generally, this price is lower than the market price, and that is when we get the opportunity to make some profits, which generally happens in a week's time because the duration for IPO is about a few days, and after a couple of days, it gets listed in the Stock Exchange. This year we are getting a lot of IPO, and even in this, there are seven IPO that will be closing, whereas if you are getting good attention in the market. The IPO Companies I'm listing down with the closing date of 20th or 21st August, which is just one or two.

I am going to invest in some of the IPOs today or tomorrow. Still, I'm waiting to see the overall subscription because if any IPO is highly oversubscribed, then the possibility of price appreciation is higher. I'm talking about the listing price because that's what can be a great parameter for the profit booking. If I get a stock at a lower price and it gets listed in the market I have at a higher price, then it is a profit for me. When any IPO is oversubscribed with heavy numbers, then the possibility of market listing at a higher price is inevitable, which happens most of the time.

I try to invest in an IPO on the last day of closing because by that time I get a clearer picture about the overall subscription and I do not companies that are not oversubscribed. It's all about market hype, so when there is more hype about any company that is getting listed in the stock market, it is good. Vikram Solar looks good to me in this list for now, and I will try to keep track of its subscription.

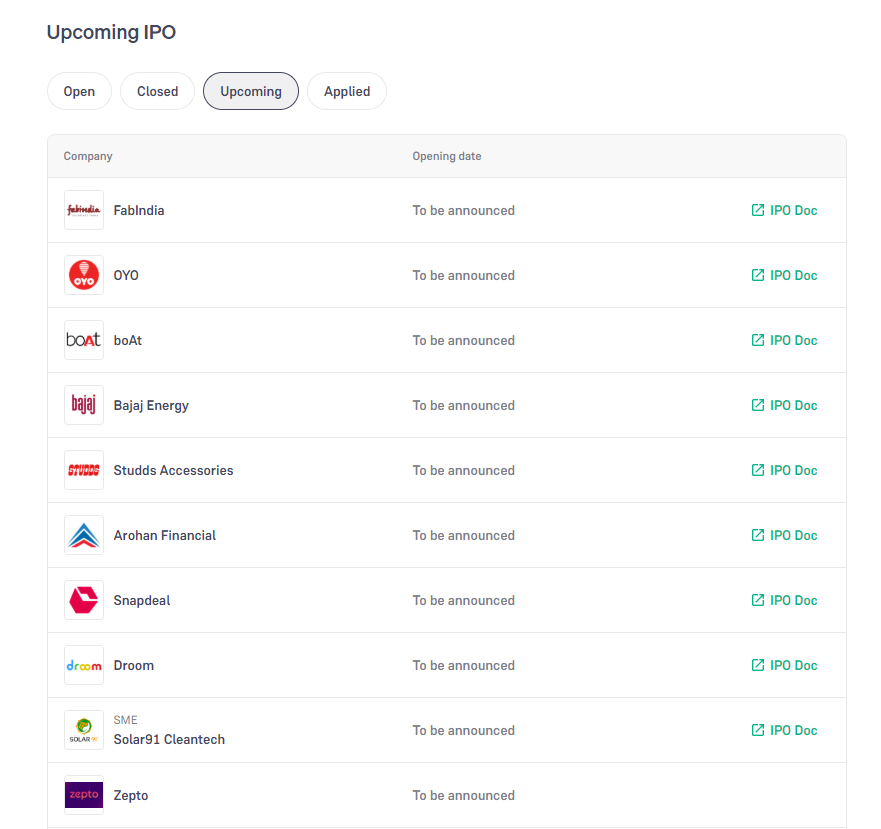

Some other companies have also announced that they will go for IPO this year, most probably, but the date has not been shared yet. These are some good companies that I hope to bring better profits in the market, and I'm eyeing those to see when they are going to announce their IPO listing. I do the complete fundamental analysis before investing in any company and invest only when their balance sheet looks good for the last three years, along with other components like their profit margin and asset holdings. If it is all in the growing order, I can go ahead and invest in those stocks.

✨✧✦✧✨✧✦✧✨✧✦✧✨✨✧✦✧✨✧✦✧✨✧✦✧✨✨✧✦✧✨✧✦✧✨✧✦✧✨✨✧✦✧✨

The stock market is a place where I do multiple things, for example, doing SIP on some stocks and mutual funds. I invest in IPO when any company looks good because not every company is going to perform well. Even in the stock market, I keep on diversifying my investment in different sectors because I just don't like to invest in one sector, and it's all. After all, you never know what might go wrong in the market that might hit the investment negatively. Thank you!

✨✧✦✧✨✧✦✧✨✧✦✧✨✨✧✦✧✨✧✦✧✨✧✦✧✨✨✧✦✧✨✧✦✧✨✧✦✧✨✨✧✦✧✨

Images courtesy- https://groww.in website

Posted Using INLEO