As Covid-19 continues to ruin economies, one of the biggest measures of confidence in spending is expected to drop even further in Q4 2020 in the U.K. After crashing an initial 33% in Q2, the British advertising sector expect to drop another 10% in the upcoming fourth quarter, which is usually the most big budget and spend period of the year thanks to the Holidays season.

This year, driven by poor economy and also the mindset of people, the otherwise lucrative quarter, lacks confidence in continued spending as people tighten the belt with possible new lockdowns upcoming. The £725m ($942.3m) drop for Q4 is expected to be the biggest since the British advertising industry started recording figures in 1982.

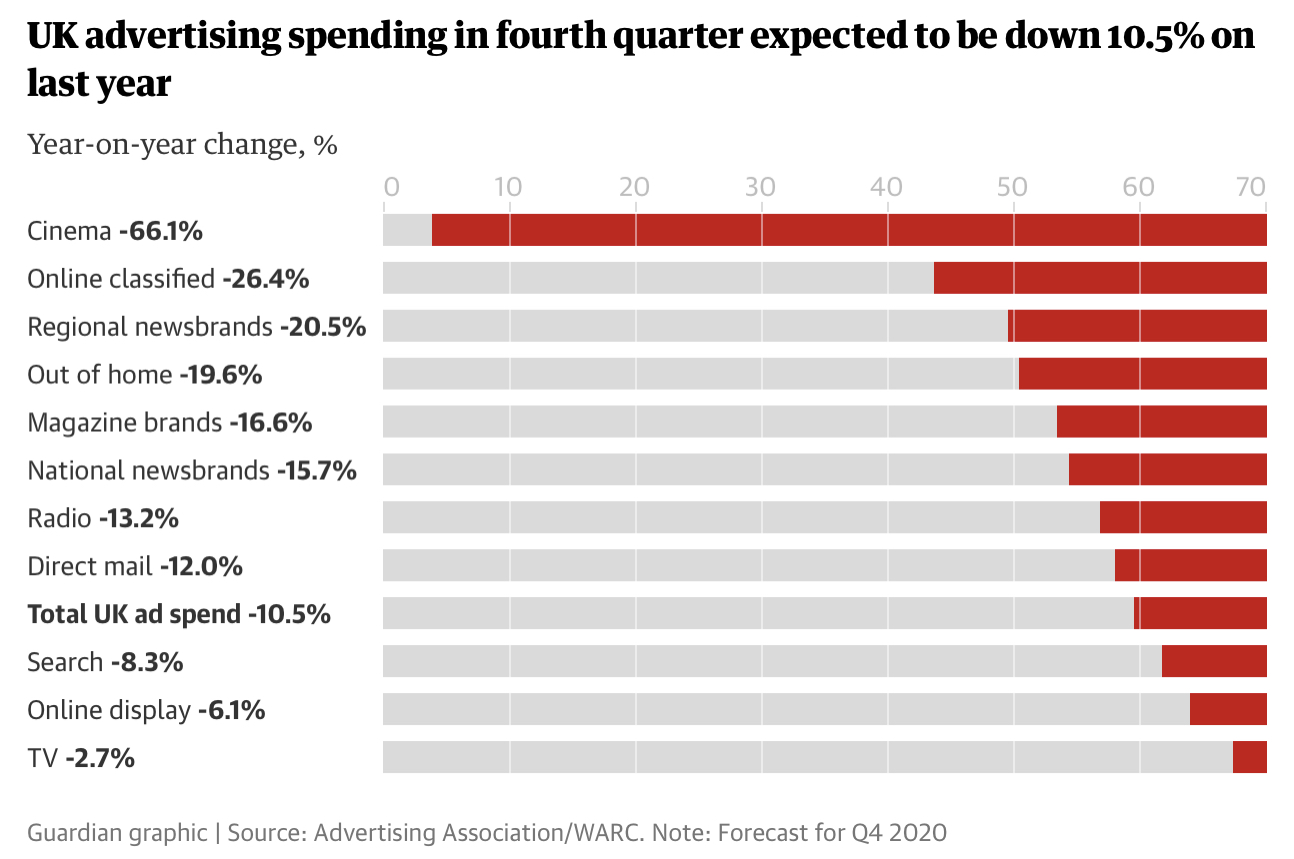

The sector expected to suffer most is the movie industry, with cinemas suffering due to lack of blockbuster releases.

Further dramatic decline is expected in the print sector, which has suffered for years already leading to closure of many print outlets. Print news and magazines are expected to see declines of more than 15% compared to Q4 2019, rising to more than 20% on regional level.the radio industry also is predicted to suffer a drop of more than 13% in revenue, further potentially altering the media landscape as the internet, and streaming (podcasts), find always more foothold in the consumption of news.

Unsurprisingly the “out of home” advertising sector, which includes billboards and posters in public locations is also expected to be almost 20% lower, an obvious outcome of lower footfall as people tend to stay home more and additional (regional) lockdowns are expected.

TV advertising and online display advertising will escape the worst though, with a predicted drop of less than 3% for the former and around 6% for the latter. Internet advertising continues to be the sector though, expected to represent 53% of the Q4 and spend in the U.K., more than two and half timeslarger than the TV advertising spend at £3.57bn ($4.64bn) vs. £1.35bn ($1.75bn).

While most of online display ads will continue to be spent mostly on Google and Facebook, increasing lower advertising revenue for larger media platforms may result in more platforms trying out their own advertising solution as the Dutch public broadcaster NPO has successfully done since early 2020, with increasing ad revenue compared to previous third-party options.

As Covid-19 continues to change “the normal” and human behavior, it will be interesting to observe whether — especially online — advertising will change and we will see new power brokers emerge or platforms of all sizes will go stand-alone and create their own advertising solutions in order to maximize revenue without middleman.

Much of the insecurity in the expected and spend decline is Covid-10 related, as well as due to the still not clear Brexit situation in the UK. But continued advertising revenue declines for the print media and also radio broadcasting are starting to reach critical levels for always more publishers and broadcasters, especially on regional level and the pandemic may result in more closures and job losses in journalism.

The advertising industry, shrewd as it is, will continue to exist and excel but there’s a clear shift happening and the victims will be the traditional media which still rely on print revenue as the internet continues to become the dominant player in our lives and spending patterns.

It may even lead to less “creepy” ads.

Credits: Graphic via the Guardian Posted Using LeoFinance