Crypto experienced the biggest liquidation event in history yesterday evening and over the night. It is still unclear how much leveraged positions were liquidated in dollars, but some numbers say 16 billion, others over 19 billion (and counting).

To have a level of comparison, during the FTX collapse, 1.6bn USD were liquidated, and in the early phases of imposing Covid lockdowns (probably for the most part on March 20th, 2020), the liquidations accounted for 1.2bn USD.

The majority of positions being liquidated over the night were long, when the market crashed suddenly (BTC reached on some exchanges a level of 102k, from reports; alts got hit even harder), but also shorts got liquidated as the market started to recover sharply and they were caught off guard as well.

That shows, once more, how easily can money be lost with leverage. Yes, the reverse is true as well, but if you lose everything (as many do because they don't have the required discipline and knowledge), it is much harder to recover after such a loss. I feel sorry for everyone who lost on leverage the last couple of hours. Even though I understand how to use leverage in various scenarios, I prefer not to do it unless it's a hedge, and I haven't done something like that in a long time. That gives me the peace of mind that I won't get margin calls in the middle of the night or something like that, and I'd have to quickly react and have the dry powder to be able to manage to do it on the short notice.

It's practically why we see a domino effect in crypto (or anywhere else where derivatives hold the majority of the TVL) even for assets that don't have direct leverage exposure. People who have margin calls, would sell anything they have liquid and at pretty much any price in order not to be liquidated. Especially if they panic, which is usually the case. Sometimes they make good calls under the time pressure, other times they don't, but it's mostly a gamble at that point.

What happened? Why the crash?

There is always a trigger for such a major crash. All markets are jumpy, so they react first and check later. That means they sometimes react to false signals and manipulations, which doesn't mean this is one of them.

What seems to have been the trigger this time?

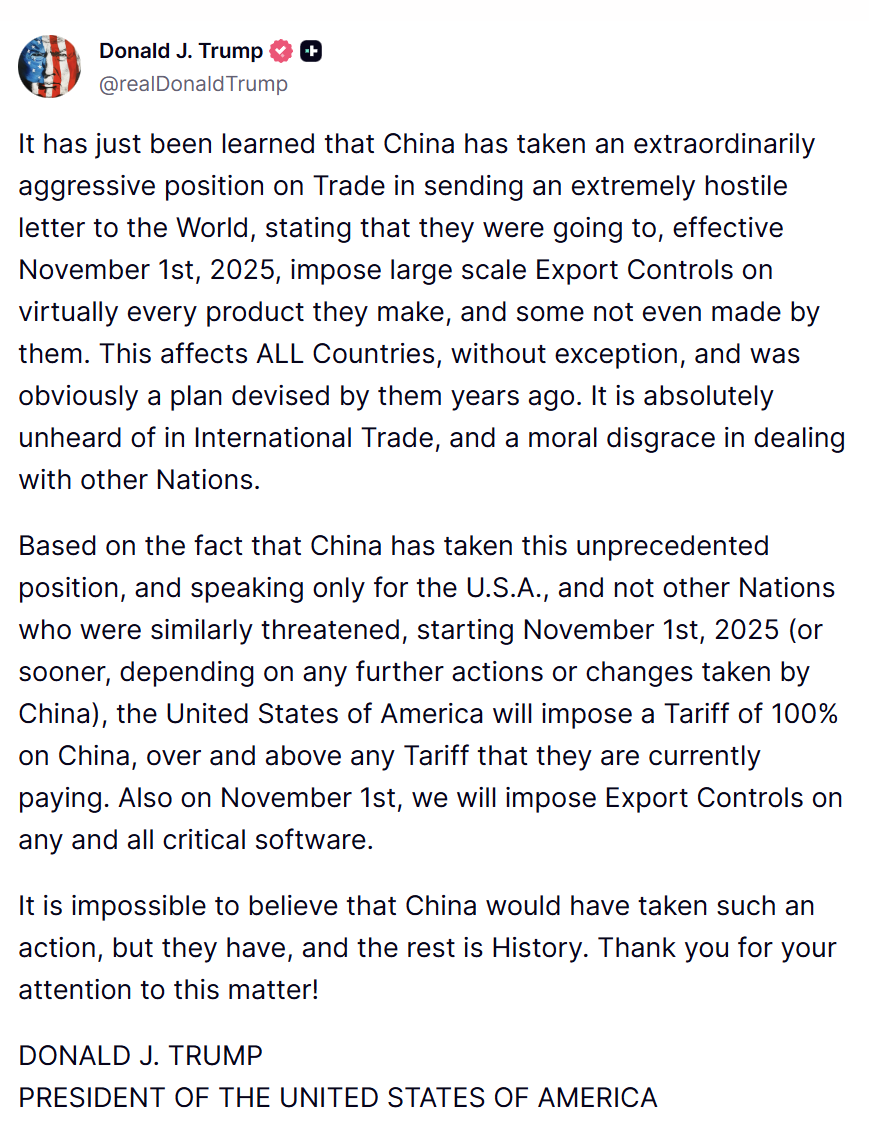

Well... This short message of Trump on Truth social:

Like always, Trump over-plays his statements, making them look better for him and worse for the other side.

At a careful look, these may be steps in a process of an escalate-to-deescalate scenario. Trump and Xi are likely to meet in person in a few weeks. China is the largest producer and exporter of rare earths, which are essential for many electronic devices, but particularly impacts the high-tech military production or AI, among others.

China started to leverage this dominant position earlier this year, by requiring export controls for 7 of the rare earths it exported. A few days ago, it added 5 more to the list, together with any China-made tech needed to extract, process, or manufacture any product containing these rare earths.

This hits particularly US military industry hard, especially since they specifically announced they would automatically deny license for any military-linked business, including AI with potential applications in the military sector...

That explains the reaction of Trump.

The question is... Are we in a escalate-to-deescalate scenario, or this will end up really bad, really soon?

It is my impression that on the short-to-medium term, the western world has been taken almost completely off guard, although things were known for many years now.

Regarding crypto... I think it was an overreaction, mostly fueled by the snowball effect of the margin calls. I would be very cautious about thinking of a long ending to the bull market though. If everything goes well (and it might or might not), we will have a pretty short and explosive finish of the bull market, which might end well before the end of Q4, if these geopolitical and even military tensions continue to build up.

Posted Using INLEO