This is a late post from pretty much all points of view. But don't they say "better late than never"? I'm not sure this is correct every time, but sometimes it has some ground.

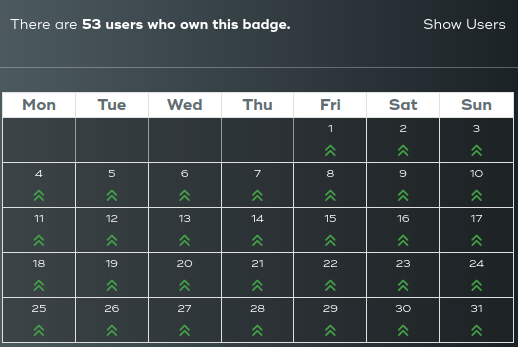

Yesterday was Hive Power Up Day... I powered up a little HIVE, as always. I also managed to power up every day last month, something that I didn't manage the month before:

Speaking of powering up, I saw a comment one of these days mentioning powering down as a bad thing for Hive and that many people are doing it nowadays. Since I am someone who unstakes coins or tokens when I believe it's suitable, I don't have a problem with that, unless it becomes a significant problem for governance, but even then, a resilient project will deal with that. It matters more if you still plan to be involved long term or not. It also matters more where the protocol, platform, or project is going.

In a comment to my previous post, @ph1102 mentioned that only a handful of "ships" might get "risen" during this end of a bull market, and that we will see sporadic pumps of specific tokens.

I seem to be in a slow-motion mode when it comes to interacting nowadays, but while this might be possible, I remember a mistake I kept doing during my first real cycle in crypto: to attempt to ride different waves by jumping from one to another. And by that, I don't mean rotating from BTC to alts and then smaller alts, which was normal back then (but I didn't know), but simply sell tokens that appeared to under-perform for others that were pumping. That way, I missed the pump on the tokens that pumped because I obviously came in late after they already began moving vertically, and missed the pumps on the tokens I sold, which usually came at a different time.

I still believe this is a mistake to avoid, even this cycle, because you may end up being exit liquidity, and it will hurt. Both financially, and your feelings. Sure, maybe you get lucky and make a serious profit. I guess if you like gambling, that might be one of those "high risk, high reward" things. At my age, I am less and less inclined to gamble, in any form that might take.

You want a recent example? At the beginning of the months I take a look of my crypto holdings, which is a pretty laborious work, you'll see why. Among them, a couple hundred PRE tokens earned for using the Presearch search engine. They are worth almost nothing and can't even claim them until I get to 1000 PRE, which at my rate of using Presearch might still take a few years, lol. But... I use search engines anyways, and they are privacy-oriented.

Why am I telling you about it? When I checked its price I noticed it was higher than "usual". So... I checked its chart. Here it is:

You see a period of accumulation since early August, followed by steady but relatively calm price rise since Aug 22 (all likely prompted by this*), and then the P&D at the end.

When do you think they attracted the most attention? On the vertical movement, I assume. How many bought and how many sold then? Well, to sell, you needed to previously hold some. And to make the decision to sell and act on it. If you didn't, you would be on the way down, still holding hoping for a reversal, or "catching falling knives" to increase your holdings thinking you are buying the dip.

Of course, this is just an example. Personally, I wouldn't advise people to buy PRE. I only earn them and never occurred to me to buy them.

Speaking of the market... Interesting what is happening today. Bull trap or a rather late reaction to this?

) What would it take for Hive to have more companies use it for their communications instead of Medium?*