I believe we can all agree that the Inleo team and the other team in the Leofinance ecosystem that tries to follow into the footsteps of Microstrategy, are doing things worth taking a look at. Not everyone will agree with them as they have often engaged in activities that polarized various groups on Hive (I didn't and don't agree with everything they do either), but noteworthy they are, even for those who don't agree, in my opinion.

What Leostrategy is building will have a hard test during the coming bear market, whenever that may come. And that, in my opinion, must be said. Strategy₿ has bitcoin as a collateral. Leostrategy, while being small and affording to implement various techniques to make income which at its size Strategy₿ ignores or may not be easy to implement for the bitcoin network and its addressable market, we need to be well aware of the fact that LEO is not BTC. And will likely take a bigger hit than BTC in the bear market.

The counterargument is that Leostrategy will just buy more LEO if the price drops, and so it will have more collateral. Yes, but we cannot discard the market psychology from the equation. Voices we have seen regarding SURGE not being floored at $1 after the presale (despite that not being what was sold), will exacerbate during a bear market, as will people panicking and selling off. And I'm not talking only about SURGE, that may be one of the products which could do well in the bear market. But the volatile ones may suffer if people panic. And they will, they always do.

That's why I am very curious how Leostrategy makes it through the next bear market. If they do fine, they already win something: a badge of honor for a project that survives a bear market in crypto.

Leostrategy also created its first RWA - TTSLA. Since it is both in Hive-Engine and Base, I guess we may consider this is the first RWA from the Hive ecosystem? I'll probably test that out, but personally I won't go big into such a concept before I see the mechanism of holding the peg loosely working over time as the two assets fluctuate independently.

Now to the question in the title...

Why I Chose SURGE:LEO on Hive-Engine over SURGE:USDC on Base?

Over time, as LEO price shot up I sold batches of them on Hive-Engine. The bad thing is that LEO didn't really shot up in terms of USD lately (above 15c), but rather HIVE was pushed down.

Of the sold LEO, I used part of it to buy SURGE. Including after the presale was over, since the discount was still quite nice.

After doing some research, I realized SURGE pays HBD yield whether you keep it liquid or in a LP. In the second variant, you also earn LP fees but you expose yourself to impermanent loss.

There are two SURGE LPs. One on Hive-Engine, paired with LEO and one on Base via Uniswap v4 paired with USDC.

There are different types of LPs, that cater to different people or purposes. The one on Base is paired with a stable coin, so you will have a lower IL. The APR is higher and if someone sets up concentrated liquidity right, can be even higher.

That's the kind of pool you want to go in if: * you want a higher yield (right now, you but that can change) * have USDC lying around * are familiar or want to make the step toward Base * you want to preserve your amount of SURGE, more or less * you want a set-it-and-forget-it kind of thing

The LP on Hive-Engine is paired with a volatile token and subject to IL, but it can have its own advantages: * if you have both SURGE and LEO on Hive-Engine, and you don't have USDC on Base * to grow the USD value of the position if LEO goes up in USD terms * if you want to DCA out of LEO into SURGE, in various scenarios * if you prefer Hive-Engine over Base * if you prefer no fees

As I said from the title, I've chosen the SURGE:LEO one on Hive-Engine, after a few days of thinking about it.

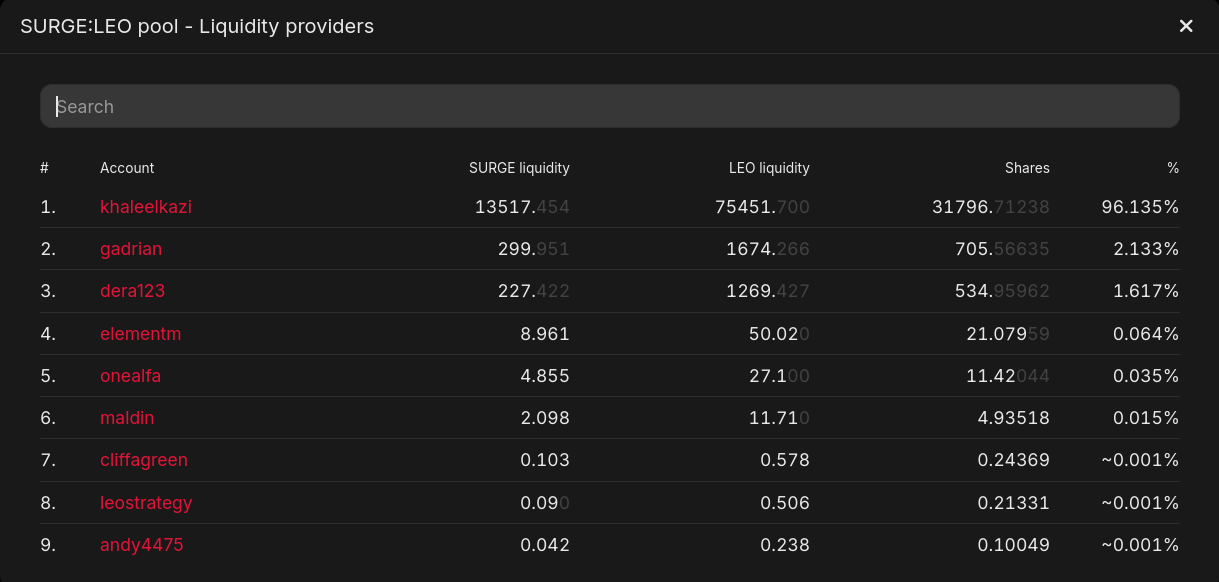

Practically, besides Khal who probably kicked off the LP with the initial liquidity, only two real LPs are in this pool, and I am one of them. And Khal has 96% of the liquidity, so we don't have an impact, by comparison.

So... why I finally decided to choose this pool and not the Base one?

Well, I went on two scenarios, but both of them considering the bull market is still on.

The price of SURGE is irrelevant, since it would be the same in both LPs. Then, it matters the other token.

First, if LEO price in USD goes up, the position grows in USD value, which is fine for the coming bear market.

Second, if LEO price in HIVE goes up (but it is perfectly possible to see a reverse in trend), then we have a slow DCA-out of LEO into SURGE due to impermanent loss. As that happens, even without withdrawing liquidity, you get a higher yield on SURGE, since you'll have more SURGE in the pool, as it balances. Obviously, the DCA isn't effective unless I withdraw liquidity. The reverse is that if the LEO price in HIVE goes down then if the price of LEO in USD holds or grows slower than HIVE, it is expected the price of SURGE in HIVE would drop the same or even more, if we consider it relatively stable. That means the LP would still be squeezed toward DCAing out LEO, or at least not go the other way. There are other options—like the price of SURGE to go up in HIVE and the price of LEO to go down, while in the bull market—, but less likely (other than the 25% discount of SURGE which we don't know when it will be recuperated or short-term reversals).

Obviously, if someone chooses the HE diesel pool to grow the position in dollar terms or the HBD yield, while DCAing out LEO, the position needs to be closed at the end of the bull market or close to it. Otherwise, the whole process reverses. The pool on Base doesn't have those "worries". You can set it and forget it and watch as USDC yield is paid regularly, unless you use concentrated liquidity pools, in which case you probably need to adjust every once in a while the position.

Posted Using INLEO