Hey All,

As we all know that gold and silver prices are making their all time records. Every now and then, we hear news that gold and silver prices have increased significantly. Obviously this has to do with the demand and supply along with growing investor interest in precious metals as safe-haven assets and everyone wants to have some share of gold or silver in their portfolio as a symbol of security and long-term value. I’m no different and I will like to take advantage here and hence was looking out for the best options to invest in gold and silver without having to buy them physically. As an example in India alone, 24K gold: On 1 October 2025 the rate was ~ ₹1,17,500 per 10 grams and by 27 October 2025 it rose to ~ ₹1,25,500 per 10 g which is an increase of approximately 7% just in matter of 25 days or so. Who wouldn’t want to invest here and take profits whenever the opportunity strikes? That’s where Gold & Silver ETFs (Exchange-Traded Funds) come into play that is offering investors an easy and efficient way to participate in the precious metals market without physically owning them.

Started Investing in GOLD & SILVER ETF - My Strategy Ahead...

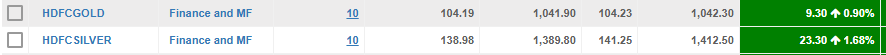

My thought process behind investing in ETFs is simple. I don’t want to buy physical gold or silver as communicated above, yet I want to make sure I can take advantage of every dip by purchasing Gold and Silver ETFs. This approach keeps my investment flexible, convenient, and aligned with market movements. As an example I started this execise to buying these funds last friday and you can clearly see I invested close to Rs.1K+ that is approximately $12+ and I got 10 units for both the ETFs.

Right now I am already making some profits here and its just been a day or so. The strategy ahead is to keep accumulating during major dips. My goal is to eventually build a position equivalent to 10 grams of gold and 1 kilogram of silver in value through ETFs. It’s a steady, long-term approach to gradually grow my exposure to precious metals without the hassle of physical ownership. What will happen here is that I’ll be able to get the best possible buying prices during market dips, while also maintaining consistent exposure to gold and silver through ETFs. This way, I benefit from both value accumulation and long-term growth potential. And finally when I have made enoguh profits I did like to convert them into a physical asset gold and silver and keep the strategy going the same way so for long-term wealth building. That is how, I am planing my investment in GOLD & SILVER ETF... Let me know your views and expereince if you have with investing in these ETFs.. Happy Investing... Cheers

Image Source:: self created via pro canva license, sharekhan

Best Regards Paras