Hey All,

Everyone is striving for money. There is a 9 to 5 job that gets you money, there is rental income and other different ways through which one can make money. Most importantly not to get forget we have CRYPTO as well that we can consider helping us all make money. After all, it’s all about making money. Do you agree with me?

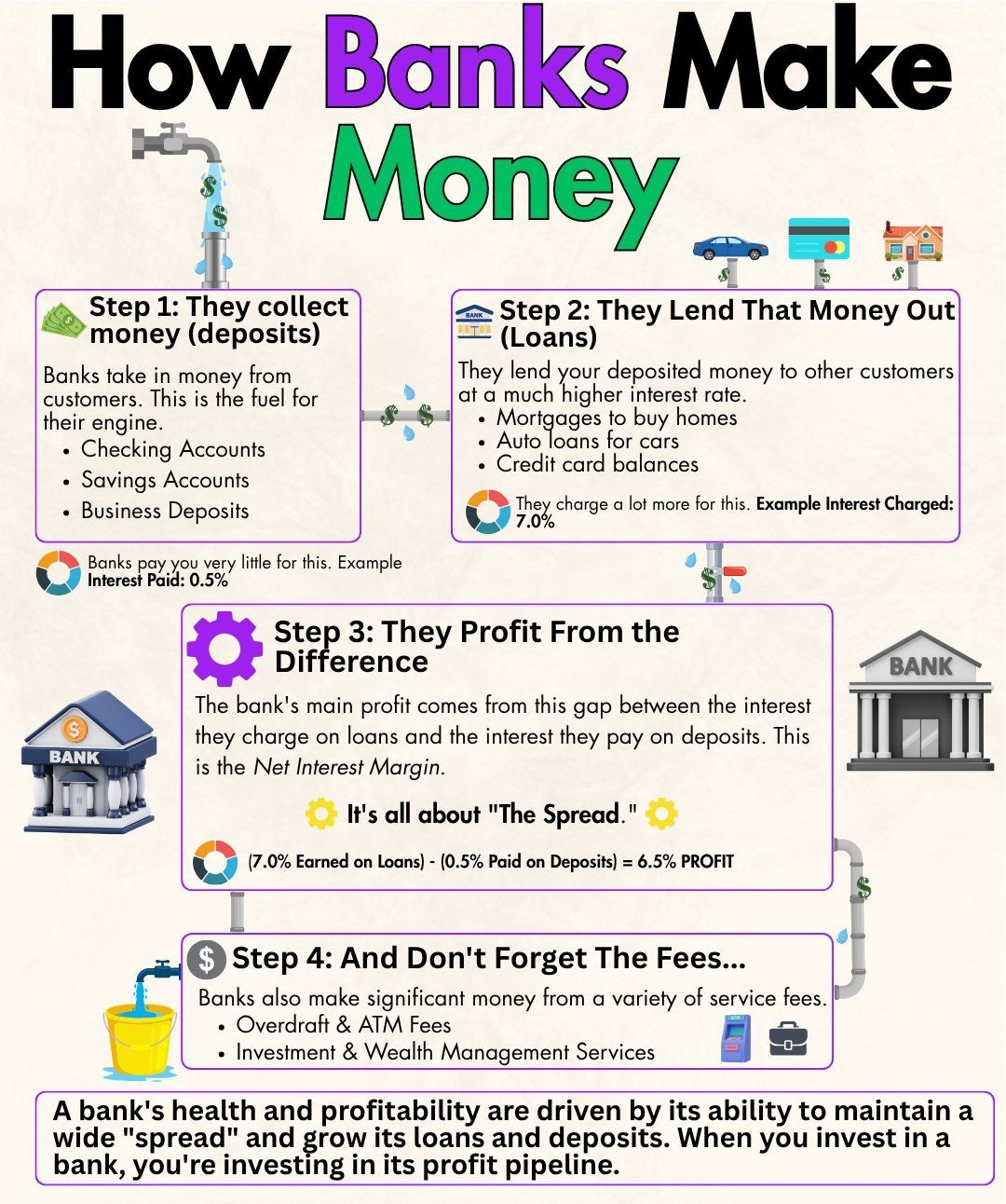

The above image caught my attention in one my X feed and as you can see it breaks down into different steps as to how banks are making money. In this post we are going to explore the same.

Step 1: Collecting Money as deposits

Banks take in money from customers. This is the fuel for their engine. • Savings Accounts • Current Accounts • Business Deposits

For all these type of deposits banks pays a very little interest, until the deposited money is loceked for a certain period of time.

Step 2 - Lending Money Out as Loans

Lending money out as different types of laon is another source that banks makes money. In simple words the bank lends our deposited money to other customers at a much higher interest rate. Here are some type of loans not going into much details.

• Mortgages to buy homes • Auto loans for cars • Credit card balances

As an example bank charges a lot more for these type of loans. Example Interest Charged for home loan is more than 8.0% here in India.

Step 3: Banks Profit From the Difference

The bank’s main profit comes from this gap between the interest they charge on loans and the interest they pay on deposits. This is called the Net Interest Margin. It’s all about - The Spread. As an example - Home loan is given out to the customers at 8% where as the bank pay an interest in deposits lets say 3% the net profit here is 8 - 3 = 5% net PROFIT... without doing anything.

Step 4: Yes, Finally Don’t Forget The Fees...

There is nothing for FREE here. There is a banking or other types of fees that needs to be paid to the bank. For Home Loan there is a home loan processing fees. Therefore Banks also make significant money from a variety of service fees which are and is not limited to the ones listed.

• Overdraft & ATM Fees • Investment & Wealth Management Services

These were some of the high-level steps that illustrate how banks make money. I know we cannot forget the various expenses that banks incur, but even after accounting for those costs, their core profitability still relies heavily on the interest spread and service fees. A bank’s health and profitability are driven by its ability to maintain a wide “spread” and grow its loans and deposits. When you invest in a bank, you’re investing in its profit pipeline. Excited about the banking money-making machine and want to be a part of it? The best way is to invest in well-known bank stocks. Here in India, we have some major players such as HDFC Bank, ICICI Bank, SBI etc.. A disclaimer I have invested in the HDFC bank and do #hodl a good amount of HDFC bank shares... Happy Investing.. cheers

Image Source:: The Deal Trader

Best Regards Paras