Hey All,

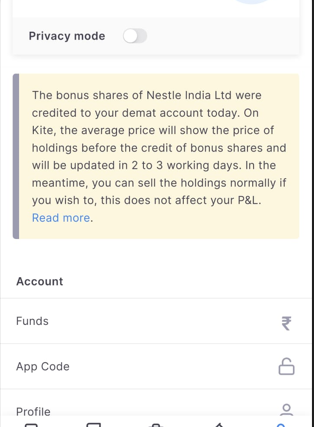

First thing first, I had some shares of Nestle India Ltd and recently came to know that the company had declared a bonus issue in a 1:1 ratio. That means for every 1 share you hold; you get 1 bonus share. But then there is a twist here which is when the Bonus shares get credited to investors account the same time the price of the share falls in that ratio. Which means if the share was trading at Rs.2K+ and there is a bonus of 1:1 this would mean that the total supply of shares would double, and the price would come down to Rs.1K+. Just an FYI August 8, was the record date for the 1:1 bonus share issue announced by Nestle India Ltd. Investors who hold shares of Nestle India as on this date were entitled to receive the additional shares. This was the notification that I got from my stockbroker application.

What I learnt new here was that the average price of holdings that it was showing was not updated with Bonus shares being credited and hence my portfolio was showing a heft loss. But then this message noted that the credit of bonus shares being adjusted to average price will happen in 2 to 3 working days. And one can still sell the shares if they want and it won’t affect their profit and loss statement. So where do I go from here with the Bonus shares credited to my dmat account now. Well, the short answer is that I plan to continue to hold the shares and rather will be round up my holding to 20 shares of Nestle India Ltd. The company overall has been doing good and at present, there’s no dividend data for FY 2024–25 yet, as the final dividend for the year is typically announced in mid-2026. So, let’s see if the company maintains its consistent payout history and possibly rewards shareholders with another healthy interim or final dividend that I can take advantage of. Ok and now before I end this post here is some research that I have on the companies and their recently announced corporate activities, which include dividends and bonus share declarations. Grab some stocks if you like and fits into your portfolio.

Corportae Actions Round-UP...

| Company | Corporate Action | Details |

|---|---|---|

| HDFC Bank | Special interim dividend & bonus issue | Special interim dividend of ₹5 per share and 1:1 bonus shares |

| Pidilite Industries | Special interim dividend & bonus issue | Special interim dividend of ₹10 per share and a 1:1 bonus issue |

| Page Industries | Interim dividend | Interim dividend of ₹150 per share |

| Aurobindo Pharma | Interim dividend | Interim dividend ₹4 per share |

| Power Finance Corporation (PFC) | Interim dividend | Interim dividend ₹3.70 per share |

| Mankind Pharma | Interim dividend | Interim dividend of ₹1 per share |

| Container Corporation of India (CONCOR) | Interim dividend | Interim dividend of ₹1.60 per share |

| Embassy Office Parks REIT | Interim dividend | Interim dividend of ₹5.80 per share |

| TIPS Music Limited | Interim dividend | Interim dividend of ₹4 per share |

| Dr. Lal PathLabs | Interim dividend | Interim dividend of ₹6 per share |

Well this should be it for today’s post on – “Stock Market 101 Series – Received 1:1 Nestle Bonus Share – CR actions Round-UP…” Happy Investing & Enjoy the dividends and the Bonus shares... cheers

Have Your Say On the - Nestle Bonus Share – CR actions Round-UP

Do you invest in India Stock Markets? What are the different criteria you look into before picking a quality stock? Do you look into the notfication provided by the Stock Broker App? Where you invested in Nestle India Ltd?. Please let me know your views in the comment section below...cheers

Image Credits:: pro canva, zerodha

Best Regards

PS:- None of the above is a FINANCIAL Advice. Please DYOR; Do your own research. I've an interest in Blockchain, Stocks & Cryptos and have been investing in many emerging projects.

Posted Using INLEO