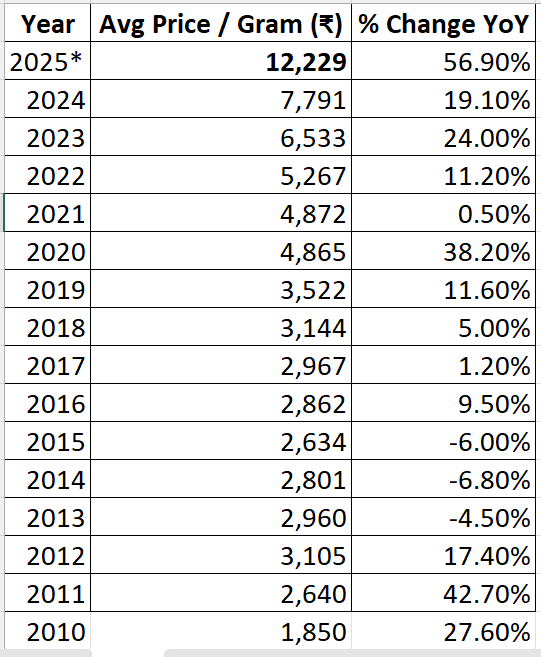

“Suno naa. I want an Ear-Ring. I am tired of this one, it's so old-fashioned and makes me look older,” she asked me. “Darling, I think anti-ageing cream is a much cheaper option.” I jokingly replied and braced for the impact. “Arey kabhi to serious raho.. “ [Eng. Translation. - Please be serious.] “Ok, dei. How much did you save?” “Oye!! I am expecting a gift from you this Diwali. Not a single paise from me.” “Bhool jao, have you seen the gold price lately?” I asked her if she is following the market. I smirked. “Shaadi ke baad, the only market you took me to was Sabzi Market.” She cracked a strong counter. I opened Chrome and checked the price. “Hmm. I think there is an error. On the website. It says 12K per gram.” I was shocked at the price. “Check another website.” She replied, sounding a little concerned “Hmm, her it's lower.” “How much?” “INR 11826 per gram,” I replied just to check her reaction. She wasn't happy with the news.

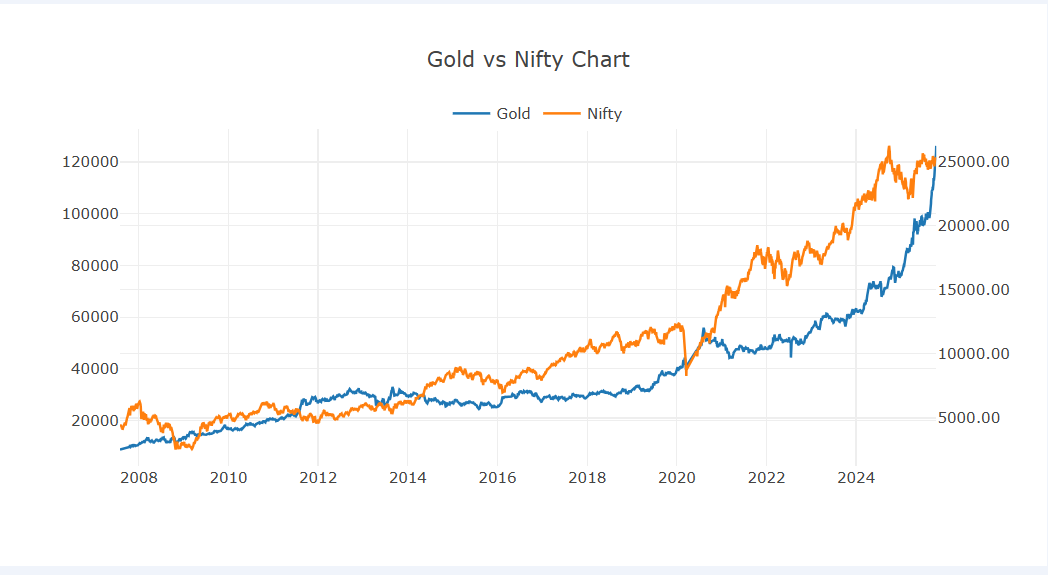

Historically speaking, the Gold price has been on a steep climb in the last few years. And I think geopolitics is to blame for this. Not entirely, though. Many wars have fueled the price hike. Gold happens to be the safe-haven asset. The recent hits on the Indian stock market have created a shift towards gold. In fact, one can see how the Gold and stock markets are inversely related. Whenever the Market is trending UP, the Gold takes a rest, and when the Market enters a bearish trend, the Gold goes up.

[A Page from my studies]

[A Page from my studies]

Now the question is how to buy the gold? If your answer is in the form of jewellery, It's not wrong, but Jewellery is not the only source of gold purchase. While the benefit of holding physical gold is that you are incharge of the safekeeping and being sole member of the asset, you cut out the dependencies from others. You can do whatever you want with the Gold (Please dont eat gold though, it's inert and doesnt get absorbed by the body. I had to mention this because Inuke was planning on eating gold, thinking that if he ate enough of it he would become.. never mind.) But with physical gold comes the problem of handling, as people misplace/lose jewellery all the time. And that's not good. And second thing is I hate the fact that once the Gold coin is melted and crafted into a Jewellery piece, there are additional charges like making, wastage etc.. But when you are redeeming the gold the jeweller would still deduct these charges. However, holding coins, bars, dust, etc., usually has very low to nil charges. Although I dont think my wife would appreciate gold dust on her nose instead of the flower nose pin she proudly flaunts.

The other methods involve a trading platform where you can hold gold as Exchange Traded Funds (ETFs), Sovereign Gold Bonds (SGBs) and Digital Gold. These are instruments that derive their prices from the gold market against USD. Now, each one has its pros and cons, but I am a little more inclined towards the SGBs. As they tend to pay 2.5% interest on the holding, But these things come with the lock-in period of 5Years. So there is that.

The point I am trying to make is that Gold is an asset that many of us ignore. In my opinion, the SGB and EFTs are good investments as they offer interest and price appreciation against physical gold. But one can argue that a gold chain around the neck looks more beautiful than the receipt of the SGB purchase.

So choose your Gold wisely.

Hi Folks

Hi Folks

Thanks for reading this blog, I would love you hear your opinion about investing in Gold. After all, it's a global currency. Also, Dhanteras is coming up this Saturday. Considered to be a really auspicious day for the Gold purchase. Oh!! Maybe that's why the market is pumping the price of gold, just to cash in on the sentiments of people. JK.. I am no expert in the market or investment. I am just blurting out my thoughts here. And as always, a Big thank you to IndiaUnited and the BeAwesome community.